Global Lead Acid Battery Market Size, Share, and COVID-19 Impact Analysis, By Construction Method (VRLA Lead Acid Battery, Flooded Lead Acid Battery), By Type (SLI, Stationary, Motive), By Application (UPS, Electric Bikes, Telecom, Transport Vehicles, Automotive, Others), By End-User (Transportation, Industrial, Utilities, Commercial & Residential), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Energy & PowerGlobal Lead Acid Battery Market Insights Forecasts to 2033

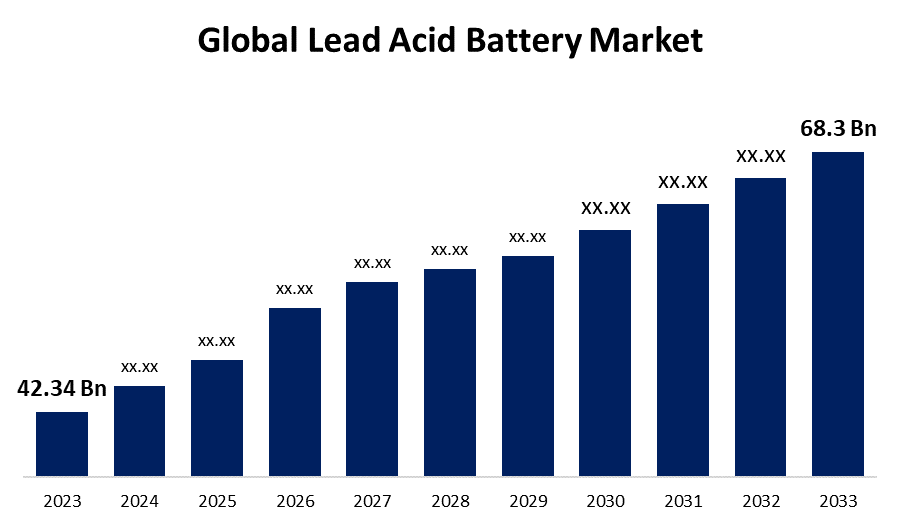

- The Global Lead Acid Battery Market Size was Valued at USD 42.34 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.9% from 2023 to 2033.

- The Worldwide Lead Acid Battery Market Size is Expected to Reach USD 68.3 Billion by 2033.

- North America Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Lead Acid Battery Market Size is Anticipated to Exceed USD 68.3 Billion by 2033, Growing at a CAGR of 4.9% from 2023 to 2033.

Market Overview

Lead-acid batteries are a type of rechargeable battery that uses lead dioxide as the positive electrode, lead as the negative electrode and sulfuric acid as the electrolyte. These batteries have been widely used for years in various applications due to their reliability, low cost, and ability to deliver high surge currents. The rise of interest in energy-efficient products and services globally can be attributable to market growth. Over the past few years, as an increasing number of cars have become hybrid and electric the requirement for lead-acid batteries has continuously grown. Shortly, it is anticipated that the transportation sector's progress and increasing interest in uses for energy storage will fuel demand among industries. The industry's desire to supply UPS has increased due to increasing demand across several industries, especially the banking sector, petroleum and natural gas, health services, and chemicals. However, if compared to lithium-ion batteries the percentage of lead-acid batteries is higher in recycling and processing than lithium-ion batteries. Lead-acid batteries have mainly two forms: motive and stationary. The equipment being powered by stationary lead-acid batteries requires a backup power source, such as a UPS or an inverter, to deliver the required backup power. Devices like security systems and lights for emergencies use SLA batteries with smaller capacities. Basic lead acid batteries and advanced lead acid batteries are made using the Flooded and Valve Regulated Lead Acid (VRLA) methods, among other technologies.

Report Coverage

This research report categorizes the market for the global lead acid battery market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global lead acid battery market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global lead acid battery market.

Global Lead Acid Battery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 42.34 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.9% |

| 2033 Value Projection: | USD 68.3 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 193 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Construction, By Type, By Application, By End-User, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | GS Yuasa, Luminous Power Technologies Pvt. Ltd., FIAMM, HBL Power Systems Ltd., Amara Raja Batteries Ltd., Su-Kam Power Systems Ltd., Furukawa Electric Co., Ltd., Hitachi Chemical Company, Ltd., Narada Power Source Co. Ltd., SiteTel Sweden AB, Clarios, C&D Technologies Inc., Leoch International Technology Ltd., Yokohama Batteries Sdn. Bhd., Enersys, Exide Industries Ltd. and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Lead acid batteries offer multiple features over other forms of batteries, which include being affordable, having a high current carrying capacity, being resistant to charging excessively, and being in a variety of dimensions and features. Lead acid batteries can be recycled, and in some nations, the recycling rate for lead acid batteries reaches 90%. In addition to preserving resources and lowering pollution, this also reduces the cost of batteries. The broad range of uses and all those perks are propelling the lead acid battery market globally. For those involved in the lead acid battery market, the increasing need for electric bikes in the field of transportation in developed as well as developing nations is expected to present several potential consumers. The global lead acid battery market is supported by manufacturers of motorcycles, passenger automobiles, trucks, buses, and a commercial transporter using more lead acid batteries. Moreover, the primary factors driving the lead acid battery market are the growing popularity of electric bicycles due to their reduced cost of repair and replacement and decreased dependency on traditional fuel sources.

Restraining Factors

Lead-acid batteries generally have a shorter lifespan compared to other battery types. They tend to degrade over time due to factors like sulfation and corrosion, which reduces their efficiency and reliability. In addition to these, the cost of lithium-ion batteries has limited the demand for lead-acid batteries. However, lead-acid batteries typically have longer charged times compared to lithium-ion batteries. This slower charging rate can be a limitation in applications where rapid charging is necessary, such as electric vehicles and grid storage systems in this way market for lead-acid batteries gets hampered.

Market Segmentation

The global lead acid battery market share is classified into construction method, type, application, and end-user

- The flooded lead acid batteries segment is expected to grow at fastest pace in the global lead acid battery market during the forecast period.

Based on the construction method, the global lead acid battery market is divided into VRLA lead acid batteries and flooded lead acid batteries. The flooded lead acid battery segment is expected to grow at the fastest pace in the lead acid battery market during the forecast period. The flooded lead acid batteries have advantages like high backup power and the ability to perform when partially charged therefore, it is used widely. In addition, these flooded batteries are economical and require low maintenance. They are used in backup power, utility, telecom, and in backup power supplies. Therefore, there is increased demand for flooded batteries in the residential and commercial sectors which ultimately propel the market growth for lead-acid batteries in the forecast period.

- The SLI segment is expected to hold the largest share of the global lead acid battery market during the forecast period.

Based on type, the global lead acid battery market is divided into SLI, stationary, and motive. Among these, the SLI segment is expected to hold the largest share of the lead acid battery market during the forecast period. SLI battery segment has dominated the industry SLI batteries perform a constant process of charging and discharging while the car is functioning because they are designed specifically for automobiles and remain connected to the vehicle's charging system. The increasing need for OEMs and aftermarkets has supported the automotive industry's grow. One of the primary drivers of the SLI battery market's development is the need for these batteries to provide good performance, long shelf life, and cost-effectiveness while powering internal combustion engines, lighting, motors, and ignition systems.

- The automotive segment is expected to grow at greatest pace in the global lead acid battery market during the forecast period.

Based on the application, the global lead acid battery market is divided into UPS, electric bikes, telecom, transport vehicles, automotive, and others. The automotive segment is expected to grow at the greatest pace in the lead acid battery market during the forecast period. The automotive industry is growing globally as a result of lead acid batteries being used highly in the automotive industry. These batteries are widely used in traditional internal combustion engine vehicles for starting, lighting, and ignition (SLI) systems. They provide the initial burst of energy required to start the engine and power vehicle accessories when the engine is not running.

- The transportation segment is expected to grow at greatest pace in the global lead acid battery market during the forecast period.

Based on the end-user, the global lead acid battery market is divided into transportation, industrial, utilities, commercial & residential. The transportation segment is expected to grow at the greatest pace in the lead acid battery market during the forecast period. The rising investment in electric and hybrid vehicles is expected to drive up the demand for transportation services. This surge in demand is likely to lead to an increased need for lead-acid batteries in the transportation sector, as these vehicles are equipped with high-performance and energy-efficient power systems.

Regional Segment Analysis of the Global Lead Acid Battery Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

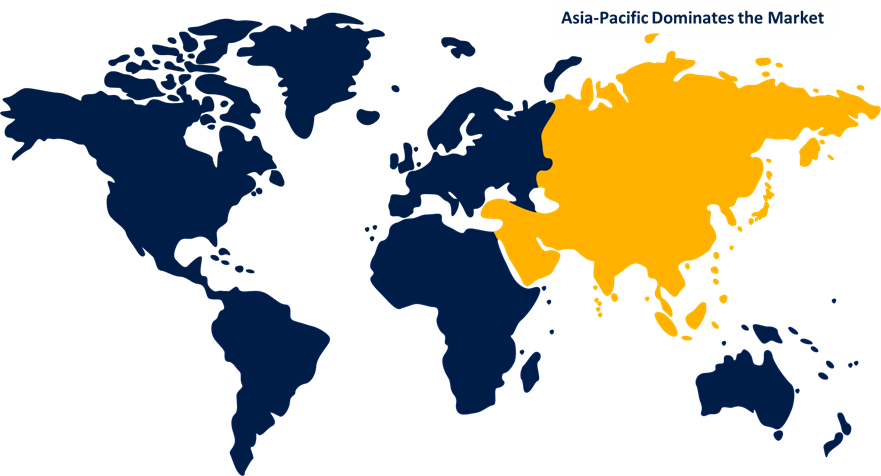

Asia Pacific is anticipated to hold the largest share of the global lead acid battery market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global lead acid battery market over the predicted timeframe. Population growth, rapid industrialization, automobile production, and sales are the potential key factors of the Asia Pacific region’s growth. In addition, the sales of lead acid batteries are driven by the automotive sector due to huge demand for passenger cars, acceptance of electric vehicles, and rising awareness in the Asia Pacific region supports the market growth across the region. The largest and most dominant player that manufactures lead acid batteries is China. Moreover, China has access to international markets with constantly growing collaborations. Lead-acid battery consumption, production, and exports are currently all dominated by China. The region has become known for its capability to produce anything in huge quantities, from equipment used in industrial facilities to everyday items. The need for cheap battery storage solutions has arisen due to increasing demands for peak shaving, backup power, grid stability, and integration of renewable energy with the main grid. The lead acid battery market in the area is driven by this. Additionally, it is projected that until 2030, the demand for lead acid batteries will be supported by advantageous government rules intended to attract capital from public-private partnerships and foreign direct investments (FDI).

North America is expected to grow at the fastest pace in the global lead acid battery market during the forecast period. Therefore, lead acid batteries become cheaper and easily accessible to end users, which pushes the market to expand across the region. Moreover, it is illegal in the United States to dispose of any kind of battery in the trash. Usually, batteries that are depleted are brought to a facility approved for recycling. Since most new batteries are made using raw materials derived from recycled items, this lowers production costs. As a result, lead acid batteries become more affordable and readily available to consumers, driving growth in the market throughout the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global lead acid battery along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GS Yuasa

- Luminous Power Technologies Pvt. Ltd.

- FIAMM

- HBL Power Systems Ltd.

- Amara Raja Batteries Ltd.

- Su-Kam Power Systems Ltd.

- Furukawa Electric Co., Ltd.

- Hitachi Chemical Company, Ltd.

- Narada Power Source Co. Ltd.

- SiteTel Sweden AB

- Clarios

- C&D Technologies Inc.

- Leoch International Technology Ltd.

- Yokohama Batteries Sdn. Bhd.

- Enersys

- Exide Industries Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2023, C&D Technologies launched the Pure Lead Max VRLA battery specifically for data centers to lower overall costs. It comes with an excellent eight-year warranty and uses special pure-lead technology and catalyst design for longer life. This battery also helps the environment by using recycled materials and cuts maintenance costs by up to 38%, plus it takes up less space. Its design is focused on lasting longer and performing better.

- In March 2022, Exide Industries, the top lead-acid battery manufacturer in India, revealed its intention to establish a big manufacturing plant in partnership with SVOLT Energy Technology Co. Ltd (SVOLT), a battery company from China. This plant will specifically focus on producing lithium-ion cells on a large scale. The agreement enables Exide to utilize SVOLT's resources to promote lithium-ion cell production in India.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global lead acid battery market based on the below-mentioned segments:

Global Lead Acid Battery Market, By Construction method

- VRLA lead acid battery

- Flooded Lead Acid Battery

Global Lead Acid Battery Market, By Type

- SLI

- Stationary

- Motive

Global Lead Acid Battery Market, By Application

- UPS

- Electric Bikes

- Telecom

- Transport Vehicles

- Automotive

- Others

Global Lead Acid Battery Market, By End-User

- Transportation

- Industrial

- Utilities

- Commercial & Residential

Global Lead Acid Battery Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which region holds the largest share of the global lead acid battery market?Asia Pacific is anticipated to hold the largest share of the global lead acid battery market over the predicted timeframe.

-

2. What is the market growth rate of the global lead acid battery market?The market size is growing at a CAGR of 4.9% from 2023 to 2033.

-

3. What is the market size of the global lead acid battery market?The global lead acid battery market is expected to grow from USD 42.34 Billion in 2023 to USD 68.3 Billion by 2033, during the forecast period 2023-2033.

-

4. Which are the key companies that are currently operating within global lead acid battery market?GS Yuasa, Luminous Power Technologies Pvt. Ltd., FIAMM, HBL Power Systems Ltd., Amara Raja Batteries Ltd., Su-Kam Power Systems Ltd., Furukawa Electric Co., Ltd., Hitachi Chemical Company, Ltd., Narada Power Source Co. Ltd., SiteTel Sweden AB, Clarios, C&D Technologies Inc., Leoch International Technology Ltd., Yokohama Batteries Sdn. Bhd., Enersys, Exide Industries Ltd., Others

Need help to buy this report?