Global Laundry and Dishwashing Detergent Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Liquid Detergents, Powder Detergents, Pods/Tablets, and Gel Detergents), By Application (Household and Commercial), By Distribution Channel (Supermarkets/Hypermarkets, Online Stores, Convenience Stores, Specialty Stores, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Consumer GoodsGlobal Laundry and Dishwashing Detergent Market Insights Forecasts to 2035

- The Global Laundry and Dishwashing Detergent Market Size Was Estimated at USD 124.41 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.05% from 2025 to 2035

- The Worldwide Laundry and Dishwashing Detergent Market Size is Expected to Reach USD 192.64 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the Global laundry And Dishwashing Detergent Market Size Was Worth Around USD 124.41 Billion In 2024 And Is Predicted To Grow To Around USD 192.64 Billion By 2035 With A Compound Annual Growth Rate (CAGR) of 4.05% from 2025 to 2035. The demand for laundry and dishwashing detergents is increasing due to rising hygiene awareness, expanding populations, higher disposable incomes, a shift towards convenience products (such as pods and liquid detergents) and a growing interest in environmentally friendly and sustainable alternatives. Innovations, including enzyme-based and concentrated formulas, also play a role in driving market growth.

Market Overview

The worldwide Laundry And Dishwashing Detergent industry refers to items designed for cleaning garments, cookware and home surfaces offered in forms such as powders, liquids, gels, pods and tablets. These detergents are essential for promoting cleanliness, removing stains and minimizing the presence in both domestic and commercial environments. Market growth is driven by increasing urbanization, enhanced awareness of hygiene, advancements in washing machines and the movement toward high-efficiency products. Chances keep increasing through friendly formulations, compostable packaging and high-end scent-packed or enzyme-boosted products that attract changing consumer tastes. The rising use of dishwashers in developing countries and the rise of e-commerce channels also open up growth opportunities. Major companies in the market consist of Procter & Gamble, Henkel, Unilever, Church & Dwight, Kao Corporation and Colgate Palmolive, each emphasizing innovation, sustainability and brand distinction to enhance their footprint. In the U.S., the EPA’s Safer Choice Program now endorses 150+ non-toxic, plant-based detergents. California’s 2024 ban on nonylphenol ethoxylates went nationwide, while the Biden Administration’s $55 billion water infrastructure funding improves detergent performance in hard-water areas. The enforced 10% import duties raise costs yet promote production.

Report Coverage

This research report categorizes the Laundry And Dishwashing Detergent Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the laundry and dishwashing detergent market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the laundry and dishwashing detergent market.

Driving Factors

The worldwide need for Laundry And Dishwashing Detergents is propelled by growing populations, increasing middle-class incomes, and an intensified consumer emphasis on hygiene and cleanliness. Enhanced awareness of health and sanitation following health crises consistently raises demand. Innovations in products, such as eco-plant-based concentrated formulas, attract environmentally aware buyers. Trends emphasizing convenience, including measured pods, dishwasher tablets and liquid detergents, also support market expansion. The rapid uptake of washing machines and dishwashers in emerging markets, combined with e-commerce platforms, further propels market growth. Moreover, the shift towards premium products and brand distinction, through scents and performance attributes, fuels demand.

Restraining Factors

The industry of laundry and dishwashing detergents has challenges in relation to high toxicity and ensuring safety requirements to protect against serious health risks. Production costs can be affected by fluctuations in raw materials, especially white phosphorus. There is a lack of balance between increasing demand and safety and compliance standards due to the risk of environmental pollution and serious regulations that complicate production and distribution.

Market Segmentation

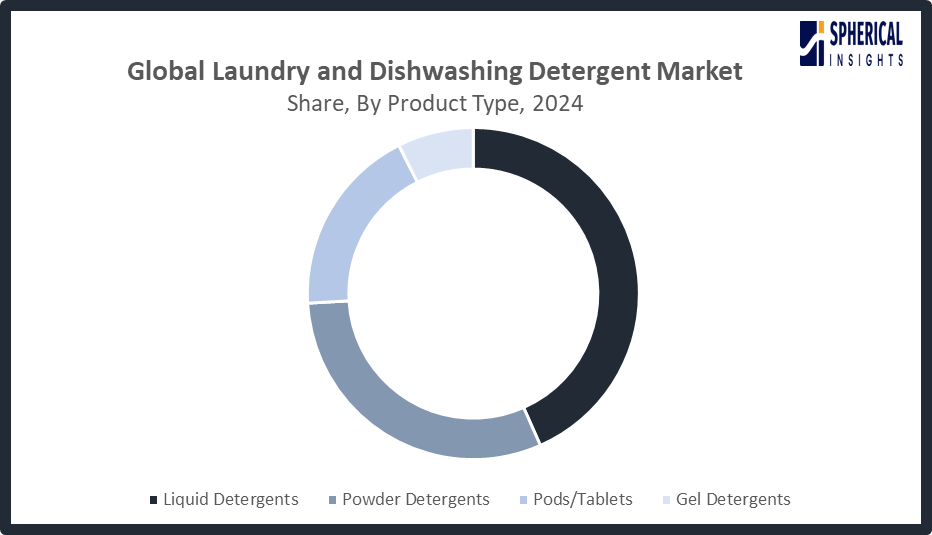

The laundry and dishwashing detergent market share is classified into product type, application, and distribution channel.

- The liquid detergents segment dominated the market in 2024, approximately 43% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the Laundry And Dishwashing Detergent Market Size is divided into liquid detergents, powder detergents, pods/tablets, and gel detergents. Among these, the liquid detergents segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Liquid detergents led the market, attributed to their convenience and efficiency in water types. They rapidly dissolve, soak into fabrics and surfaces and work effectively in areas with hard water where powders often falter. Friendly packaging options, such as refillable bottles, appeal to eco-aware buyers aiming to minimize plastic waste, enhancing their global appeal.

Get more details on this report -

- The household segment accounted for the largest share in 2024, approximately 67% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the Laundry And Dishwashing Detergent Market Size is divided into household and commercial. Among these, the household segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The market is primarily led by the household sector due to the need for everyday cleaning products in residences. In this category, buyers are showing a growing preference for quality and environmentally friendly detergents, prioritizing both effectiveness and ecological advantages. This shift is driven by increasing awareness and health concerns as households seek products that provide eco-friendly home cleaning.

- The supermarkets/hypermarkets segment accounted for the highest market revenue in 2024, approximately 57% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the Laundry And Dishwashing Detergent Market Size is divided into supermarkets/hypermarkets, online stores, convenience stores, specialty stores, and others. Among these, the supermarkets/hypermarkets segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Supermarkets and hypermarkets are a key distribution channel, providing one-stop shopping convenience. They offer a wide variety of detergent brands and types, enabling consumers to compare and choose effectively. In-store promotions and discounts further attract buyers, making these retail outlets the preferred choice for many seeking variety, value, and accessibility in laundry and dishwashing products.

Regional Segment Analysis of the Laundry and Dishwashing Detergent Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the laundry and dishwashing detergent market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the Laundry And Dishwashing Detergent Market Size over the predicted timeframe. The Asia Pacific region is projected to capture a 36% market share of the laundry and dishwashing detergent market owing to its swiftly increasing population, urbanisation and rising disposable incomes. Nations such as China and India play a role, fueled by the growth of middle-class families and heightened hygiene and cleanliness awareness. Additionally, the area is witnessing an expansion in retail channels and online shopping, improving product availability. Buyers are increasingly favoring quality and specialised detergent products. In October 2024, India launched the BIS Ecomark Rule 2024, aiming to lessen the footprint of household items, advance sustainability and foster eco-conscious production methods, thereby backing a circular economy.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the laundry and dishwashing detergent market during the forecast period. North America is expected to have a 21% market share in the laundry and dishwashing detergent sector, propelled by increasing demand for high-quality and environmentally friendly items. In the United States, the region’s market is moving towards concentrated and eco-conscious detergents influenced by environmental concerns and hectic lifestyles. Enhanced disposable incomes, sophisticated retail infrastructure and growing use of liquid and speciality detergents are additionally fueling this growth. In August 2024, the U.S. EPA revised the Safer Choice and DfE guidelines, encouraging the use of chemicals and assisting consumers in recognizing products that comply with rigorous health and environmental standards.

Europe’s laundry and dishwashing detergent market is growing due to rising demand for eco-friendly and biodegradable products. Germany leads this growth with strong sustainability awareness and strict environmental regulations. The adoption of premium and concentrated detergents, coupled with busy urban lifestyles, is boosting demand. The EU’s revised Detergent Regulation (EC) No 648/2004, aligned with the Green Deal, bans microplastics and nonylphenol ethoxylates from mid-2025, mandates digital labeling, and the 2025 Packaging Regulation requires 50% recycled content in detergent packaging by 2030.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the laundry and dishwashing detergent market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Unilever

- Reckitt Benckiser

- Henkel AG & Co. KGaA

- Procter & Gamble

- Colgate-Palmolive Company

- Kao Corporation

- S.C. Johnson & Son, Inc.

- Church & Dwight Co., Inc.

- The Clorox Company

- Godrej Consumer Products Ltd.

- Lion Corporation

- McBride PLC

- Amway Corporation

- LG Household & Health Care

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Kao Industrial (Thailand) and Charoen Pokphand Group launched Extra, an eco-friendly laundry detergent from Japan, now available nationwide at Makro, Lotus’s, and 7-Eleven. Thailand’s detergent market, valued at 21,500 billion baht, saw 4% growth from 2019-2024, with conventional detergent projected to reach 7,200 billion baht in 2025.

- In April 2025, Lion Corporation, led by Masayuki Takemori, will launch Acron Yasashisa Premium nationwide. This laundry detergent for delicate contains fabric-softening ingredients that protect clothing from damage, such as wrinkling, stretching, shrinking, fading, and pilling, and delivers a high-grade finish, especially in low water flow or zero-rinse washing settings.

- In February 2025, Dawn launched Dawn PowerSuds, its most effective liquid dish soap, designed for large loads. Based on P&G research showing dishwashing as America’s least-liked chore, the formula produces double suds that trap grease and remove residue, making dishwashing faster, easier, and more efficient with less effort.

- In April 2024, Unilever’s Dirt Is Good brand launched Wonder Wash, a 15-minute laundry detergent developed using robotics and AI for fast, effective cleaning. Responding to hybrid work patterns and increased use of malodour-retaining athleisurewear, the innovation addresses evolving laundry needs and changing home washing technologies.

- In April 2024, Procter & Gamble (P&G) launched Tide Eco-Friendly Laundry Pods, highlighting its commitment to sustainability and consumer convenience. This innovation in the laundry care segment represents a key step in P&G’s ongoing efforts to minimize environmental impact while delivering effective cleaning solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the laundry and dishwashing detergent market based on the below-mentioned segments:

Global Laundry and Dishwashing Detergent Market, By Product Type

- Liquid Detergents

- Powder Detergents

- Pods/Tablets

- Gel Detergents

Global Laundry and Dishwashing Detergent Market, By Application

- Household

- Commercial

Global Laundry and Dishwashing Detergent Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Online Stores

- Convenience Stores

- Specialty Stores

- Others

Global Laundry and Dishwashing Detergent Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the laundry and dishwashing detergent market over the forecast period?The global laundry and dishwashing detergent market is projected to expand at a CAGR of 4.05% during the forecast period.

-

2. What is the laundry and dishwashing detergent market?The laundry and dishwashing detergent market refers to the global industry for household cleaning products used to wash clothes and dishes.

-

3. What is the market size of the laundry and dishwashing detergent market?The global laundry and dishwashing detergent market size is expected to grow from USD 124.41 billion in 2024 to USD 192.64 billion by 2035, at a CAGR of 4.05% during the forecast period 2025-2035

-

4. Which region holds the largest share of the laundry and dishwashing detergent marketAsia Pacific is anticipated to hold the largest share of the laundry and dishwashing detergent market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global laundry and dishwashing detergent market?Unilever, Reckitt Benckiser, Henkel AG & Co. KGaA, Procter & Gamble, Colgate-Palmolive Company, Kao Corporation, S.C. Johnson & Son, Inc., Church & Dwight Co., Inc., The Clorox Company, Godrej Consumer Products Ltd., and Others.

-

6. What factors are driving the growth of the laundry and dishwashing detergent market?Growth in the laundry and dishwashing detergent market is driven by increasing disposable income, urbanization leading to lifestyle changes and demand for convenient products, rising hygiene awareness, and the expanding hospitality sector.

-

7. What are the market trends in the laundry and dishwashing detergent market?Key trends in the laundry and dishwashing detergent market include a shift toward liquid and eco-friendly detergents, driven by increasing consumer awareness of hygiene, health, and environmental impact.

-

8. What are the main challenges restricting wider adoption of the laundry and dishwashing detergent market?The main challenges restricting wider adoption and growth of the laundry and dishwashing detergent market are primarily related to price sensitivity, environmental regulations and concerns, and intense market competition

Need help to buy this report?