Global Lamination Adhesives Market Size, By Technology (Solvent-Borne, Water-Borne, Solvent-Less, Other Types), By End-use (Packaging, Industrial), By Region, And Segment Forecasts, By Geographic Scope And Forecast

Industry: Chemicals & MaterialsGlobal Lamination Adhesives Market Insights Forecasts to 2032

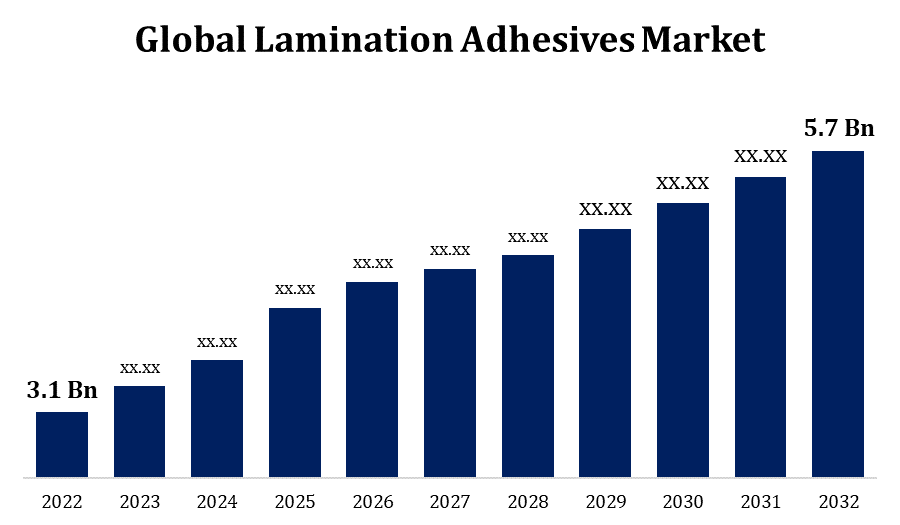

- The Global Lamination Adhesives Market Size was valued at USD 3.1 Billion in 2022.

- The Market is Growing at a CAGR of 8.3% from 2022 to 2032

- The Worldwide Lamination Adhesives Market Size is expected to reach USD 5.7 Billion by 2032

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Lamination Adhesives Market Size is expected to reach USD 5.7 Billion by 2032, at a CAGR of 8.3% during the forecast period 2022 to 2032.

The growing packaging sector, rising need for flexible packaging, and technological developments are driving the Laminating Adhesives Market. The trend towards environmentally friendly and sustainable adhesives is also playing a role. Companies are becoming inventive, creating adhesives that not only hold things together but also help to reduce environmental effect. The manufacture and distribution of adhesives specifically intended for laminating or glueing different materials together comprise the lamination adhesives market. This method is frequently utilised in industries such as packaging, automotive, and electronics, where the ability to combine layers of materials is critical. Lamination adhesives are critical in providing a strong and long-lasting adhesion between various substrates such as plastics, metals, and foils.

Lamination Adhesives Market Value Chain Analysis

These basic materials are processed by adhesive producers into laminating adhesives. This stage includes extensive testing to ensure that the adhesive meets quality criteria as well as application requirements. The adhesives are packed and shipped to various end-users after they have been created. This step entails logistics and transportation in order to get the products to their final destinations. Lamination adhesives are used in the manufacturing processes of industries such as packaging, automotive, electronics, and others. End customers employ lamination adhesives to glue or laminate various materials together. Laminating layers of plastic, metal, or other substrates could be involved. Finally, end consumers generate final goods. In the packaging sector, for example, the final product could be a flexible, multi-layered packing material.

Lamination Adhesives Market Opportunity Analysis

The development of new and advanced laminating adhesive technologies may provide opportunities. Innovations that improve bonding strength, reduce curing time, or give environmentally acceptable alternatives can provide a competitive advantage. Determine which sectors are experiencing an increase in demand for lamination adhesives. For example, the packaging business is witnessing tremendous expansion as a result of e-commerce, which is increasing demand for flexible and durable packaging materials. Environmentally friendly adhesives are becoming more popular. Developing low-impact lamination adhesives or ones made from renewable resources can be a valuable commercial potential. Consider chances for worldwide market expansion. Emerging economies with expanding manufacturing sectors may offer laminating adhesives untapped opportunities. It might be a strategic decision to tailor lamination adhesives to specific industrial needs or to offer specialised formulas for niche applications.

Global Lamination Adhesives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 3.1 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.3% |

| 2032 Value Projection: | USD 5.7 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Technology, By End-use, By Region. |

| Companies covered:: | Henkel, Dow, Coim India Pvt Ltd, Bostik, 3M, Ashland, H.B. Fuller Company, Vimasco Corporation, Scott D. Davis, Flint Group, Sun Chemical, DIC CORPORATION, Arkema, Chemline India Ltd, Vimasco Corporation, ADCO Global, Inc., Sika AG, Dymax Corporation, BASF SE and Other Key Vendors. |

| Growth Drivers: | Increasing pharmaceutical demand to drive the market |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Lamination Adhesives Market Dynamics

Increasing pharmaceutical demand to drive the market

Specialised packaging is frequently required in the pharmaceutical industry to preserve the integrity, safety, and shelf-life of drugs. Lamination adhesives are essential for bonding different layers of packing materials while also providing barrier qualities and protection against external forces. Innovative packaging options are critical to the advancement of medicine delivery systems such as transdermal patches and blister packs. By securely attaching different layers of materials, lamination adhesives can enable the manufacturing of these sophisticated drug delivery systems. The pharmaceutical sector is increasingly moving towards flexible packaging. Lamination adhesives aid in the production of lightweight, cost-effective flexible packaging materials that provide greater contamination prevention. The pharmaceutical sector is rising as global healthcare expenditure rises. This expansion raises the demand for packaging materials.

Restraints & Challenges

Raw material price volatility, such as resins and solvents, can have an impact on production costs. Balancing the requirement for cost-effective solutions while retaining quality and performance is an ongoing market challenge. The total demand for lamination adhesives can be influenced by economic changes and uncertainties. Automotive and construction industries, which rely significantly on these adhesives, may encounter slowdowns during economic downturns. The market is competitive, with numerous manufacturers providing a variety of adhesive solutions. Standing out in the market requires differentiating items, maintaining quality, and offering exceptional customer service. Disruptions in the supply chain, whether caused by natural catastrophes, geopolitical concerns, or other unforeseeable occurrences, can affect raw material availability and disrupt production. It is crucial to maintain consistent quality throughout batches.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Lamination Adhesives Market from 2023 to 2032. North America has a thriving packaging industry, fueled by the e-commerce, food and beverage, and pharmaceutical industries. The use of lamination adhesives in flexible packaging materials is becoming more popular. The region is a technical innovation hotspot. Continuous improvements in lamination adhesive technologies, such as the creation of high-performance and environmentally friendly adhesives, provide prospects for growth. Demand for eco-friendly laminating adhesives is being driven by increased awareness and attention on sustainability in packaging materials. Green alternative providers may find a rising market in North America.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. The Asia-Pacific region is rapidly industrialising, particularly in countries such as China and India. This expansion feeds demand for packaging materials, where lamination adhesives play an important role. Rising middle-class populations, urbanisation, and e-commerce tendencies all contribute to a thriving packaging business. Flexible packaging, in particular, is in great demand, offering prospects for manufacturers of lamination adhesive. Asia-Pacific's automobile sector is growing. Lamination adhesives are used in vehicle interiors, exteriors, and electronics, creating prospects for growth for adhesive manufacturers. As disposable income rises in many Asia-Pacific countries, so does demand for consumer goods, electronics, and automobile products, all of which frequently necessitate the use of lamination adhesives.

Segmentation Analysis

Insights by Technology

Water based segment accounted for the largest market share over the forecast period 2023 to 2032. Water-based adhesives typically contain less VOC than solvent-based adhesives. This increases their compliance with air quality rules, which contributes to their growth, particularly in regions with rigorous environmental criteria. Because of their decreased toxicity, water-based adhesives are often seen as safer for workers. This is especially important in businesses where worker safety is a top focus. Water-based adhesives are increasingly preferred by end users, particularly in industries such as packaging, due to their lower environmental effect. This choice is a major driver of growth in this technology industry. The packaging business, a major consumer of lamination adhesives, is expanding rapidly. Water-based adhesives, with their adaptability and sustainability, are well-positioned to meet this sector's growing need.

Insights by End Use

Packaging segment accounted for the largest market share over the forecast period 2023 to 2032. The global trend towards more convenient and lightweight packaging has resulted in an increase in demand for flexible packaging materials. Lamination adhesives are essential for bonding many layers of materials together, providing strength, flexibility, and protection. The growth of e-commerce has increased the demand for strong and safe packaging. Flexible packaging, which frequently employs lamination adhesives, is valued for its capacity to protect products during transit while also providing design flexibility. Lamination adhesives are widely used in the food and beverage industries. The demand for attractive and functional packaging, as well as the necessity for longer shelf life, has resulted in a growth in the use of laminated packaging materials. Expansion of the pharmaceutical sector, fueled by factors such as an ageing population and growing healthcare needs.

Recent Market Developments

- In August 2022, Toyo-Morton, Ltd., Japan's leading laminating adhesive maker, has created a new ECOAD series of polyurethane solvent-free laminating adhesive solutions for the food packaging and industrial industries, especially in Asia.

Competitive Landscape

Major players in the market

- Henkel

- Dow

- Coim India Pvt Ltd

- Bostik

- 3M

- Ashland

- H.B. Fuller Company

- Vimasco Corporation

- Scott D. Davis

- Flint Group

- Sun Chemical

- DIC CORPORATION

- Arkema, Chemline India Ltd

- Vimasco Corporation

- ADCO Global, Inc.

- Sika AG

- Dymax Corporation

- BASF SE

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Lamination Adhesives Market, Technology Analysis

- Solvent-Borne

- Water-Borne

- Solvent-Less

- Other Types

Lamination Adhesives Market, End Use Analysis

- Packaging

- Industrial

Lamination Adhesives Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Lamination Adhesives Market?The global Lamination Adhesives Market is expected to grow from USD 3.1 Billion in 2023 to USD 5.7 Billion by 2032, at a CAGR of 8.3% during the forecast period 2022-2032.

-

2. Who are the key market players of the Lamination Adhesives Market?Some of the key market players of market are Henkel, Dow, Coim India Pvt Ltd, Bostik, 3M, Ashland, H.B. Fuller Company, Vimasco Corporation, Scott D. Davis, Flint Group, Sun Chemical, DIC CORPORATION, Arkema, Chemline India Ltd, Vimasco Corporation, ADCO Global, Inc., Sika AG, Dymax Corporation and BASF SE.

-

3. Which segment holds the largest market share?Packaging segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Lamination Adhesives Market?North America is dominating the Lamination Adhesives Market with the highest market share.

Need help to buy this report?