Global Lactic acid Market Size, Share, and COVID-19 Impact Analysis, By Raw Material (Sugarcane, Corn, Yeast Extract, and Others), By Application (Polylactic Acid, Food & Beverages, Pharmaceutical, Cosmetics & Personal Care, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Lactic Acid Market Insights Forecasts to 2035

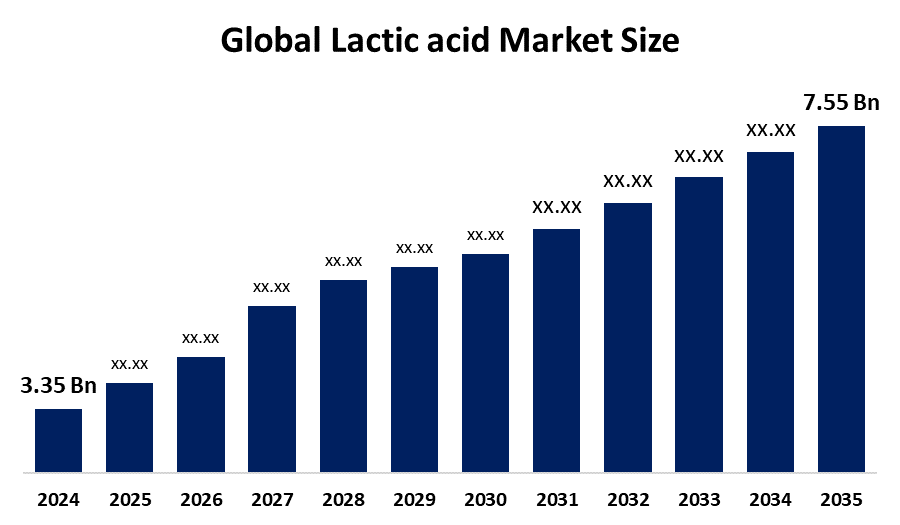

- The Global Lactic Acid Market Size Was Estimated at USD 3.35 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.67% from 2025 to 2035

- The Worldwide Lactic Acid Market Size is Expected to Reach USD 7.55 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Lactic Acid Market Size was worth around USD 3.35 Billion in 2024 and is predicted to grow to around USD 7.55 Billion by 2035 with a compound annual growth rate (CAGR) of 7.67% from 2025 and 2035. The market for lactic acid has a number of opportunities to grow due to its extensive application across various industries.

Market Overview

The global industry of lactic acid encompasses the production and sale of lactic acid, which is an organic compound used for a wide range of industrial applications. Lactic acid is an organic acid having the molecular formula C3H6O3, and is produced by both artificial synthesis and natural sources. Its applications include organic synthesis industries and various biochemical industries as a synthetic intermediate. Its rich probiotic content and health-promoting properties are driving the demand for lactic acid among health-conscious consumers, thereby propelling the market demand. For instance, Kirin Holdings, KOIWAI DAIRY PRODUCTS CO., LTD. and KYOWA HAKKO BIO CO., LTD. have jointly conducted research on LC-Plasma, which is a heat-killed lactic acid bacterium that supports the maintenance of immunity of healthy people.

Innovation and market expansion are anticipated as a result of major players' growing R&D expenditures for developing advanced and sustainable production methods. For instance, in August 2023, NTU Singapore scientists developed a sustainable and more effective technique for making lactic acid by using discarded jackfruit seeds. The increasing production efficiency of lactic acid from renewable resources, using advanced fermentation techniques, is driving a huge surge in the global lactic acid market.

Report Coverage

This research report categorizes the lactic acid market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the lactic acid market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the lactic acid market.

Global Lactic Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.35 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.67% |

| 2035 Value Projection: | USD 7.55 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Raw Material, By Application and By Region |

| Companies covered:: | BASF SE, Galactic, Corbion, NatureWorks LLC, CELLULAC, Sulzer Ltd, GODAVARI BIOREFINERIES LTD., Cargill, Incorporated, Kemin Industries, Inc., Henan Jindan Lactic Acid Technology Co. Ltd., Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The widespread application of lactic acid in various sectors like the food industry, cosmetic & pharmaceutical products, and in textiles, leather tanning, and agriculture is driving the market expansion. Further, the lactic acid usage in household cleaning is driven by its versatility, natural origin, and ability to address common cleaning issues in an eco-friendly way, which is propelling the market growth. For instance, in May 2025, Balrampur Chini unveiled eco-friendly input for making single-use products by popularising polylactic acid (PLA) under the brandBalrampur Bioyug, which would be supplied to small-scale units.

Restraining Factors

The lactic acid market is restricted by factors like raw material price volatility and a rise in commodity costs. Further, the inferiority in thermal and mechanical properties of lactic acids, as well as competition from petrochemical-based alternatives, are hampering the market growth.

Market Segmentation

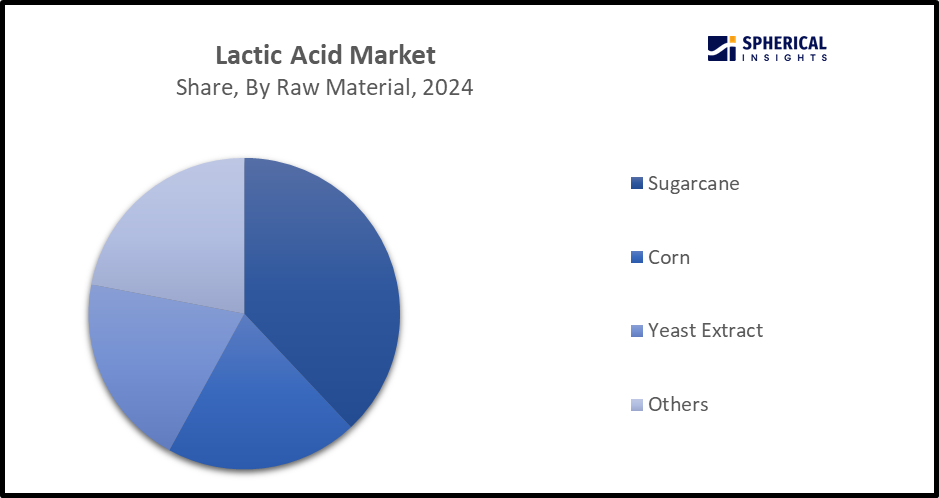

The lactic acid market share is classified into raw material and application.

- The sugarcane segment dominated the market with the largest revenue share of 38.7% in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the raw material, the lactic acid market is divided into sugarcane, corn, yeast extract, and others. Among these, the sugarcane segment dominated the market with the largest revenue share of 38.7% in 2024 and is projected to grow at a substantial CAGR during the forecast period. Lactic acid obtained from sugarcane, which is an eco-friendly process utilising renewable resources, reduces the carbon footprint associated with traditional lactic acid production methods. For instance, sugarcane molasses, which is a waste from sugar manufacturing, is used as a cheap carbon source for lactic acid production.

Get more details on this report -

- The polylactic acid segment accounted for the largest revenue share of 29.0% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the lactic acid market is divided into polylactic acid, food & beverages, pharmaceutical, cosmetics & personal care, and others. Among these, the polylactic acid segment accounted for the largest revenue share of 29.0% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Polylactic acid is popularly used as it is economically manufactured from renewable resources and used for compostable products. Government increasing emphasis on single-use plastics, demand for eco-friendly products, and advancements in high-heat & durable grade PLA are contributing to propel the market in the polylactic acid segment.

Regional Segment Analysis of the Lactic Acid Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the lactic acid market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of 45.4% revenue share in 2024 in the lactic acid market. The market ecosystem in North America is strong, due to the industry increasing emphasis on capacity expansion, regulatory & policy-driven demand, diversification of applications, innovation and R&D, and strategic alliances. The demand for lactic acid has been driven by the increasing demand for lactic acid from pharmaceutical, cosmetics, and food & beverage industries, along with the region’s advanced biotechnology, robust manufacturing base, and emphasis on sustainability. For instance, in August 2022, LG Chem and ADM launched joint ventures, announced the intended location for U.S. production of lactic acid and polylactic acid. The United States is leading the North America lactic acid market with the largest share of about 91.1% in the region, owing to the robust pharmaceutical sector and increasing PLA application in biodegradable materials.

Asia Pacific is expected to grow at a rapid CAGR of 8.7% in the lactic acid market during the forecast period. An increasing need for lactic acid in the food & beverage industry, along with the growing need for meat products and food acidulants, is propelling the market demand. Further, the increasing emphasis on strategic alliances and mergers & acquisitions is promoting the market growth. For instance, in January 2025, Hugel reaffirmed its botulinum toxin and filler-focused strategy at the 43rd annual J.P. Morgan Healthcare Conference (JPM 2025) while hinting at possible expansion to new injectables, including PLA (polylactic acid). China is estimated to hold a major share of about 54% in the Asia Pacific lactic acid market, owing to the increasing consumption of lactic acid in food preservatives and PLA increasing demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the lactic acid market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Galactic

- Corbion

- NatureWorks LLC

- CELLULAC

- Sulzer Ltd

- GODAVARI BIOREFINERIES LTD.

- Cargill, Incorporated

- Kemin Industries, Inc.

- Henan Jindan Lactic Acid Technology Co. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, TotalEnergies Corbion and Useon entered a strategic alliance aimed at accelerating the development and global adoption of EPLA (Expanded PLA) molded products, which is an innovative, sustainable foam solution crafted from Luminy PLA bioplastics.

- In May 2025, Sulzer signed a key equipment supply agreement with Emirates Biotech to provide proprietary technology for the world’s largest polylactic acid (PLA) production facility, which is under development in the United Arab Emirates.

- In February 2025, Uttar Pradesh inaugurates India's first biopolymer plant in Lakhimpur Kheri, aiming to boost eco-friendly production and generate employment.

- In April 2024, Granaio delle Idee (IGDI), an innovative international developer and provider of clean label baking ingredients, and Ginkgo Bioworks, which is building the leading platform for cell programming and biosecurity, announced a new collaboration.

- In August 2023, NTU Singapore scientists developed a sustainable method to produce lactic acid, indispensable in industrial food production, using waste jackfruit seeds.

- In October 2022, Teijin announced the launch of the Teijin Meguro Institute to strengthen the company’s development and manufacture of probiotics for use in functional foods.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the lactic acid market based on the below-mentioned segments:

Global Lactic Acid Market, By Raw Material

- Sugarcane

- Corn

- Yeast Extract

- Others

Global Lactic Acid Market, By Application

- Polylactic Acid

- Food & Beverages

- Pharmaceutical

- Cosmetics & Personal Care

- Others

Global Lactic Acid Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the lactic acid market?The global lactic acid market size is expected to grow from USD 3.35 Billion in 2024 to USD 7.55 Billion by 2035, at a CAGR of 7.67% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the lactic acid market?North America is anticipated to hold the largest share of the lactic acid market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Lactic Acid Market from 2024 to 2035?The market is expected to grow at a CAGR of around 7.67% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Lactic Acid Market?Key players include BASF SE, Galactic, Corbion, NatureWorks LLC, CELLULAC, Sulzer Ltd, GODAVARI BIOREFINERIES LTD., Cargill, Incorporated, Kemin Industries, Inc., and Henan Jindan Lactic Acid Technology Co. Ltd.

-

5. Can you provide company profiles for the leading lactic acid manufacturers?Yes. For example, BASF SE is the largest chemical producer in the world, headquartered in Ludwigshafen, Germany, and comprises subsidiaries and joint ventures in more than 80 countries, operating six integrated production sites and 390 other production sites across Europe, Asia, Australia, the Americas and Africa. Galactic is a funded company based in Brussels (Belgium), and operates as a Fermentation technology application to food, feed, healthcare and industrial biotechnology.

-

6. What are the main drivers of growth in the lactic acid market?Lactic acid widespread application and increasing health consciousness are major market growth drivers of the lactic acid market.

-

7. What challenges are limiting the lactic acid market?Volatility in raw material prices and competition from petrochemical-based alternatives remain key restraints in the lactic acid market.

Need help to buy this report?