Global Lacquers Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Nitrocellulose Lacquer, Acrylic Lacquer, Catalyzed Lacquer, Water-based Lacquer, and Others), By Application (Wood Finishing, Automotive, Musical Instruments, Furniture, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Specialty & Fine ChemicalsGlobal Lacquer Market Insights Forecasts To 2035

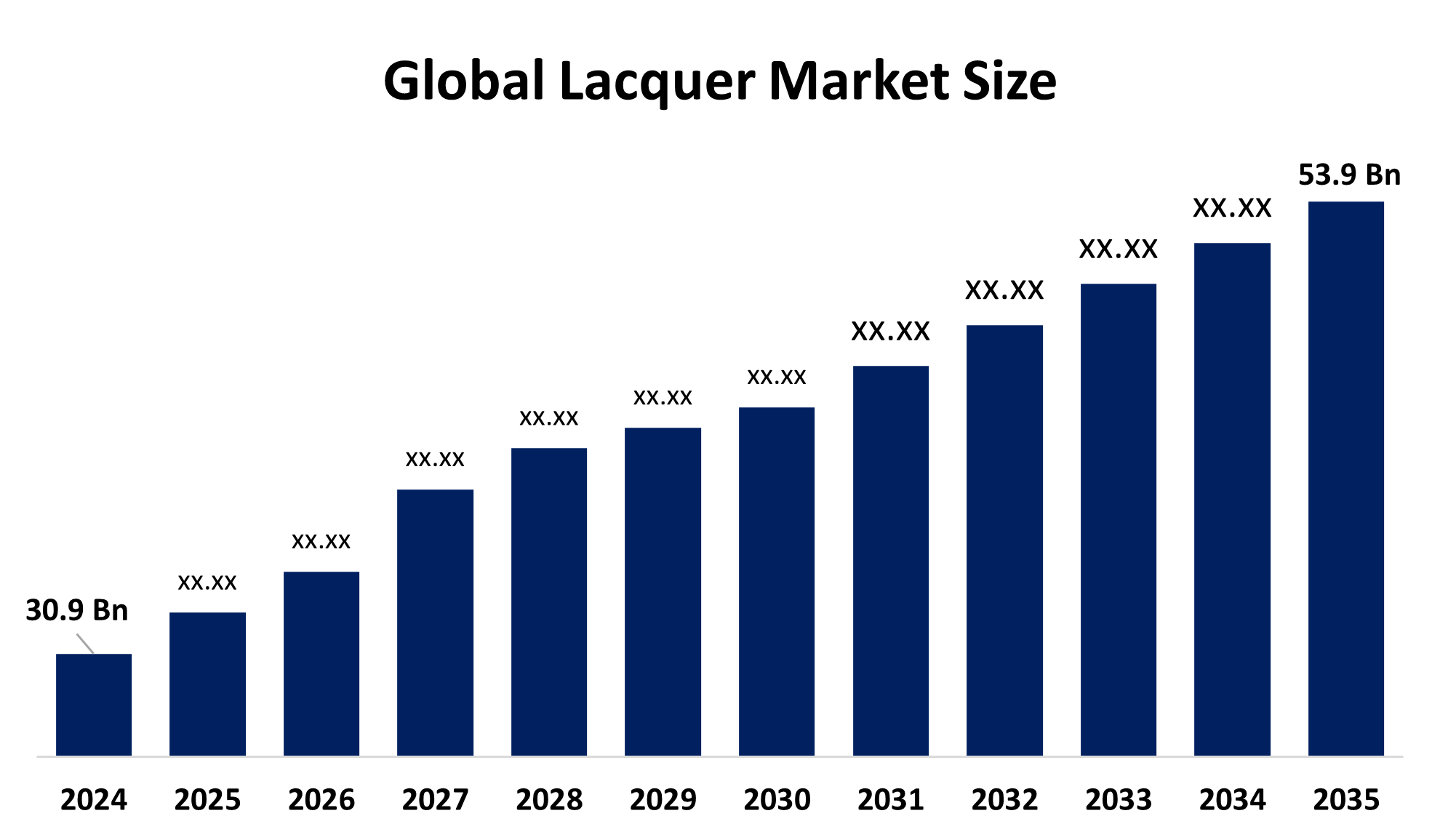

- The Global Lacquer Market Size Was Estimated at USD 30.9 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.19% from 2025 to 2035

- The Worldwide Lacquer Market Size is Expected to Reach USD 53.9 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Lacquer Market Size was worth around USD 30.9 Billion in 2024 and is Projected To Grow from USD 32.5 billion in 2025 to around USD 53.9 billion by 2035 at a compound annual growth rate (CAGR) of 5.19% during the forecast period (2025–2035). The expansion of the global lacquer market is propelled due to increased demand from the construction, automotive, and furniture industries, tighter environmental regulations that are driving the transition to water based and low VOC lacquers, and technological advancements, i.e, faster drying, improved scratch resistance, nanotechnology, etc., that enhance performance and broaden application areas.

Global Lacquer Market Forecast and Revenue Outlook

- 2024 Market Size: USD 30.9 Billion

- 2035 Projected Market Size: USD 53.9 Billion

- CAGR (2025-2035): 5.19%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Market Overview

Lacquer is a natural or synthetic liquid coating that can be applied to wood, metal, and other surfaces it dries to form a hard, glossy, protective covering The increasing demand for high quality finishes, especially in the furniture and woodworking industries, drives the market Lacquer, a hard, glosty, and protective topcoat, is increasing in demand as consumers become increasingly attracted to items that ure both aesthetically pleasing and have long lasting durability Consumers are also making lacquer products increasingly in demand because of the excessive growth in home design trends and home renovation, specifically for residential applications This growth trend is expected to support growth during the forecast period. The surging demand for sustainable and ecofriendly products is another

sigruficant opportunity within the lacquer market. As result of the increasing legal standards-on Volatile Organic Compounds and increasing concerns for eco friendliness, ecofriendly products like water-based lacquers are rapidly increasing in denmand. Time and investment in manufacturing eco friendly products that meet both legal requirements and consumers interests in ecofriendly products may permit relevant manufacturers a competitive advantage. While this trend is picking up pace in developing nations, it is noticeably much more powerful in regions with stricter environmental regulations, like North America and Europe

Governments are increasingly using financial incentive programs and regulatory pressure to assist the lacquer and larger coatings industry For instanice, a Production Linked Incentive scheme of approximately 10,000 crore, approximately USD billion, is being developed in India for the chemicals and petrochemicals industry to encourage domestic production of sperialized chemicals, such as those used in lacquers and varnishes Instant made a significant investment of INR 5,894 crore, about USD 700-800 million, depending on exchange rates, for a plant at Gujarat Refinery that produces butyl acrylate, acrylic acid, and other products. These are co precursors and raw ingredients for larquers, coatings, and related compounds

Key Market Insights

- Asia Pacific is expected to account for the largest share in the lacquer market during the forecast period.

- In terms of product type, the nitrocellulose lacquer segment is projected to lead the lacquer market throughout the forecast period

- In terms of application, the wood finishing segment captured the largest portion of the market

Lacquer Market Trends

- Growing Preference for Eco Friendly and Low VOC Formulations

- Technological Innovation

- Growth in Emerging Markets & Urbanization

- Digitalization & Automation in Production & Application

- Customization & Aesthetic Differentiation

Report Coverage

This research report categorizes the lacquer market based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the lacquer market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the lacquers market.

Driving factors

The lacquer market is driven by robust growth in significant end use sectors, increasing customer demand for attractive and durable finishes, and continuous advancements in formulation technologies. Collectively, these trends provide a favourable market environment that fosters innovation and expands lacquer product applications globally. Urbanization, particularly in developing countries, also increases demand for lacquers in furniture and architectural applications.

Restraining Factor

One of the main factors restraining the lacquer market is the fluctuating prices and supply of raw materials, which immediately impact production costs and profit margins. In addition, the legislation surrounding VOC, which can complicate production methods and necessitate expensive R&D to develop compliant low VOC formulations.

Market Segmentation

The global lacquer market is divided into product type and application.

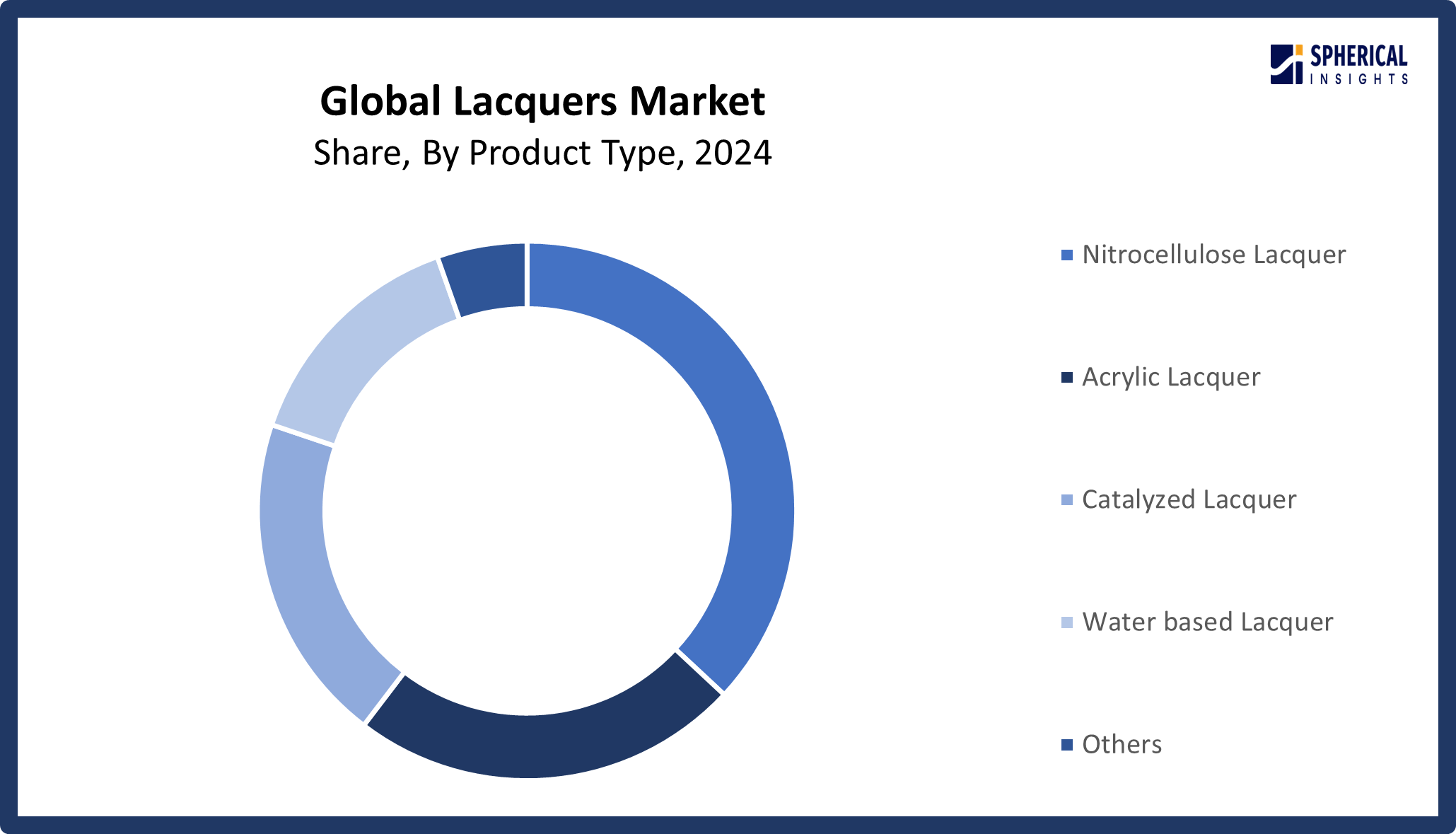

Global Lacquers Market, By Product Type:

- The nitrocellulose lacquer segment dominated the market in 2024, accounting for approximately 7.56% and is projected to grow at a substantial CAGR during the forecast period.

Based on product type, the global lacquers market is segmented into nitrocellulose lacquer, acrylic lacquer, catalyzed lacquer, water-based lacquer, and others. Among these, the nitrocellulose lacquer segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven by its quick drying and easy application. This lacquer is commonly used in the furniture and woodworking industries that favor a high gloss, quick drying finish. High end furniture and musical instruments also use it because it is very easy to buff to a high gloss.

Get more details on this report -

The acrylic lacquer segment in the lacquers market is expected to grow at the fastest CAGR over the forecast period, because it is known for its resistance to UV rays and gradual fading. This makes it an excellent choice for automotive applications that must have durable finishes. The growth of the automotive marketplace, particularly in emerging markets, has driven demand for acrylic lacquers.

Global Lacquers Market, By Application:

- The wood finishing segment accounted for the largest share in 2024, accounting for approximately 3.71% and is anticipated to grow at a significant CAGR during the forecast period.

Based on application, the global lacquers market is segmented into wood finishing, automotive, musical instruments, furniture, and others. Among these, the wood finishing segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to the growing use of lacquer to protect and enhance the beauty of wooden surfaces. The rise in house remodeling and increased demand for high end wood finishes are the driving factors. Both end users and professionals appreciate lacquer for its ability to add a layer of protection and gloss to enhance the aesthetics of wood flooring, furniture, and decorative items.

The automotive segment in the Lacquers market is expected to grow at the fastest CAGR over the forecast period. The automotive application segment is also seeing significant growth due to the rising global production and sales of cars. Lacquer is a preferred coating in the automotive sector for painting and polishing vehicle surfaces, as it provides a protective coating with a durable, high gloss finish that enhances a vehicle's aesthetic appeal.

Regional Segment Analysis of the Global Lacquer Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific Lacquers Market Trends

Asia Pacific is expected to hold the largest share of the global Lacquers market over the forecast period.

The Asia Pacific region's supremacy due to fast industrialization, urbanization, and rising economies in countries like China, India, and Japan. The lacquer segment is witnessing a strong demand because of the booming furniture, automobile, and construction industries in the region. The demand for lacquer is supported by higher consumer spending on home improvement and automotive products, along with rising investment in infrastructure construction. There are many manufacturers in the Asia Pacific, and raw material sources are also inexpensive, facilitating further market expansion.

North America Lacquers Market Trends

North America is expected to grow at the fastest CAGR in the lacquers market during the forecast period. In the North America market, the rise is rising due to the widespread use of cutting-edge lacquer technology and the existence of important manufacturers. North America held almost a quarter of the world market in 2023. The market for lacquer products is mostly driven by the region's established furniture and automobile sectors. The market expansion in this area is also being driven by the rising popularity of house remodeling and the growing desire of consumers for premium finishes. Additionally, producers are being compelled by strict environmental restrictions to create low VOC and ecofriendly lacquer formulations, which are becoming more and more popular with consumers.

Europe Lacquers Market Trends

Europe is another important market for lacquer products, and environmental compliance and sustainability are highly valued there. Advanced lacquer formulas are in high demand due to the region's thriving furniture and automotive industries, as well as the growing emphasis on eco friendly products. Adoption of water based and low VOC lacquers is being aided by stricter VOC emission laws and increased consumer awareness of environmental issues. Countries that contribute significantly to the lacquer market in this region include the UK, France, and Germany.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global lacquers market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players in The Lacquers Market Include

- Akzo Nobel N.V.

- PPG Industries, Inc.

- Sherwin Williams Company

- Nippon Paint Holdings Co., Ltd.

- Axalta Coating Systems Ltd.

- BASF SE

- Kansai Paint Co., Ltd.

- RPM International Inc.

- Jotun Group

- Asian Paints Limited

- Masco Corporation

- Hempel A/S

- DAW SE

- Tikkurila Oyj

- Berger Paints India Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2025, Adler launched a furniture lacquer called Bluefin Unistar Zero, which is completely solvent-free and VOC free. It maintains good filling power, transparency, and improved protection against yellowing, scratches, and stains while also improving block resistance.

- In May 2025, PPG Industries introduced Enviroluxe Plus, a powder coating line incorporating recycled plastics, aligning with the company's circular economy goals.

- In February 2024, Akzo Nobel launched RUBBOL WF 3350, a bio-based wood coating, and initiated collaborations with Arkema and Omya to incorporate circular raw materials into its product lines.

- in July 2024, A collaboration between Dutch company Lamoral Coatings and india's Neochem Technologies, focused on specialty chemicals and super-durable coatings, likely aimed at improving environmentally friendly lacquer finishes.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the lacquers market based on the following segments:

Global Lacquers Market, By Product Type

- Nitrocellulose Lacquer

- Acrylic Lacquer

- Catalyzed Lacquer

- Water based Lacquer

- Others

Global Lacquers Market, By Application

- Wood Finishing

- Automotive

- Musical Instruments

- Furniture

- Others

Global Lacquers Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Lacquers market over the forecast period?The global Lacquers market is projected to expand at a CAGR of 5.19% during the forecast period.

-

2. What is the market size of the Lacquers market?The global Lacquers market size is expected to grow from USD 30.9 billion in 2024 to USD 53.9 billion by 2035, at a CAGR 5.19% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Lacquer market?Asia Pacific is anticipated to hold the largest share of the Lacquers market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global Lacquer market?Akzo Nobel N.V., PPG Industries, Inc., Sherwin Williams Company, Nippon Paint Holdings Co., Ltd., Axalta Coating Systems Ltd., BASF SE, Kansai Paint Co., Ltd., RPM International Inc., Jotun Group, Asian Paints Limited, Masco Corporation, Hempel A/S, DAW SE, Tikkurila Oyj, Berger Paints India Limited, and Others.

-

5. What factors are driving the growth of the Lacquer market?The Lacquers market's growth is driven by growing demand for long lasting, glossy finishes from the automotive, furniture, and construction industries, tighter environmental regulations forcing a switch to low VOC, water, and bio-based formulations urbanization and rising disposable incomes in emerging markets and advancements in technology such as UV cure and nanotech that enhance performance.

-

6. What are market trends in the Lacquers market?Cutting edge tools and technologies, including growing preference for ecofriendly and low VOC formulations, technological innovation, growth in emerging markets & urbanization, digitalization & automation in production & application, and customization & aesthetic differentiation, are being used in the Lacquers market.

-

7. What are the main challenges restricting wider adoption of the Lacquer market?The Lacquers market faces challenges, including high VOC, and solvent based coatings are restricted by strict environmental rules, necessitating costly reformulations. Alternatives that are bio or water based frequently cost more and perform worse.

Need help to buy this report?