Global Laboratory Titration Devices Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Automatic Titrators, Manual Titrators, and Semi-Automatic Titrators), By Application (Pharmaceuticals, Food & Beverages, Environmental Testing, Chemical Analysis, Academic Research, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Machinery & EquipmentGlobal Laboratory Titration Devices Market Insights Forecasts to 2035

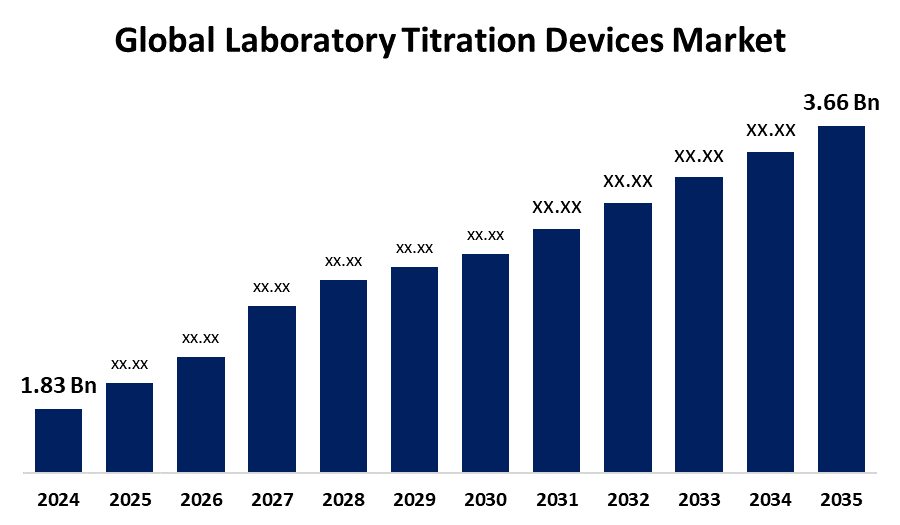

- The Global Laboratory Titration Devices Market Size Was Estimated at USD 1.83 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.5% from 2025 to 2035

- The Worldwide Laboratory Titration Devices Market Size is Expected to Reach USD 3.66 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Laboratory Titration Devices Market Size was worth around USD 1.83 Billion in 2024 and is projected to grow from USD 1.95 Billion in 2025 to around USD 3.66 Billion by 2035 at a compound annual growth rate (CAGR) of 6.5% during the forecast period (2025–2035). The expansion of the global laboratory titration devices market is propelled by product quality and regulatory compliance. Sectors like medicines, food and beverage, and environmental testing require more accurate analytical tools. The creation of next generation titrators, which offer improved accuracy, efficiency, and integration with digital technologies like AI and IoT, is the result of advancements in laboratory automation.

Global Laboratory Titration Devices Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1.83 Billion

- 2035 Projected Market Size: USD 3.66 Billion

- CAGR (2025-2035): 6.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market Overview

Laboratory titration devices are specialized tools used in analytical chemistry that add a solution with a known concentration until the reaction reaches its endpoint in order to determine the concentration of an unknown solution. The increase in demand for automated lab titration equipment, as well as the increasing use of titration systems in research, pharmaceuticals, and chemical laboratories, is driving the market. In addition, the increased use of lab titration in research, chemical laboratories, and pharmaceuticals will further boost demand for lab systems and drive market growth. For example, the PASCO article published in June 2023 explains that titration is a widely used process used to determine the concentration of various chemical components in water, soil, and air samples. For example, in titration measuring acidity and alkalinity of water, researchers can determine contamination levels such as acid rain and industrial discharges. In addition to that, the demand for lab titration systems will increase due to development of research & development activities and the establishment of research laboratories, encouraging growth within the market. For example, Higher Education Research and Development's report released in May 2023 illustrates that approximately USD 12.8 billion was funded by US universities on new research facilities in 2022 and 2023, including laboratory equipment such as titration systems. It is projected that these investments will increase the need for titration devices, which are crucial for medication development, as well as the demand for laboratory equipment such as titration systems.

The Indian Council of Medical Research has increased funding for laboratory infrastructure, which has facilitated the expansion of clinical trials and the generics manufacturing industry, and raised need for advanced titration equipment. Additionally, the government has put in place programs like the Production Linked Incentive Scheme for Medical Devices, which encourages the local production of medical equipment, including titration devices, by providing manufacturers with financial incentives.

Key Market Insights

- North America is expected to account for the largest share in the laboratory titration devices market during the forecast period.

- In terms of product, the automatic titrators segment is projected to lead the laboratory titration devices market throughout the forecast period

- In terms of application, the pharmaceuticals segment captured the largest portion of the market

Laboratory Titration Devices Market Trends

- Advancements in Automation and Digital Integration

- Rising Demand for Multi Parameter Analysis

- Focus on Sustainability and Green Chemistry

- Growth in Emerging Markets

- Integration of Artificial Intelligence and Machine Learning

Report Coverage

This research report categorizes the laboratory titration devices market based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the laboratory titration devices market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the laboratory titration devices market.

Global Laboratory Titration Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.83 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.5 % |

| 2035 Value Projection: | USD 3.66 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Product Type, By Application, By Region |

| Companies covered:: | Mettler Toledo International Inc., Metrohm AG, Thermo Fisher Scientific Inc., Hanna Instruments, Inc., Xylem Inc., Hach Company, Eppendorf AG, Brand GmbH, Sartorius AG, DKK TOA Corporation, KEM Kyoto Electronics Manufacturing Co., Ltd., GR Scientific Ltd., SI Analytics GmbH, Hiranuma Sangyo Co., Ltd., Mitsubishi Chemical Corporation, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving factors

The laboratory titration devices market is driven as in labs, the demand for automated titration machines will likely continue to be driven by speed, accuracy, and less operator engagement. The 2023 US FDA recalls indicated that over 60% of all drug recalls were related to quality control issues, and it is expected to drive stricter global methods for industrial, food testing, and pharmaceutical applications, which demonstrate traceability and audit trails for the user. A further benefit is anticipated for titrators that increase data integrity and efficiency with their connectivity to laboratory information management systems. The market for karl fischer and coulometric titrators is expected to increase due to higher sensitivity applications for petrochemicals and moisture testing.

Restraining Factor

One of the main factors restraining the laboratory titration devices market is that the more advanced automated titration machines will likely deter adoption with smaller laboratories because of a higher initial capital expenditure and feasibility in facilities that already have limited budgets. There is the possibility that advanced titration machines will deter adoption in regions of limited training, skills, and infrastructure.

Market Segmentation

The global laboratory titration devices market is divided into product type and application.

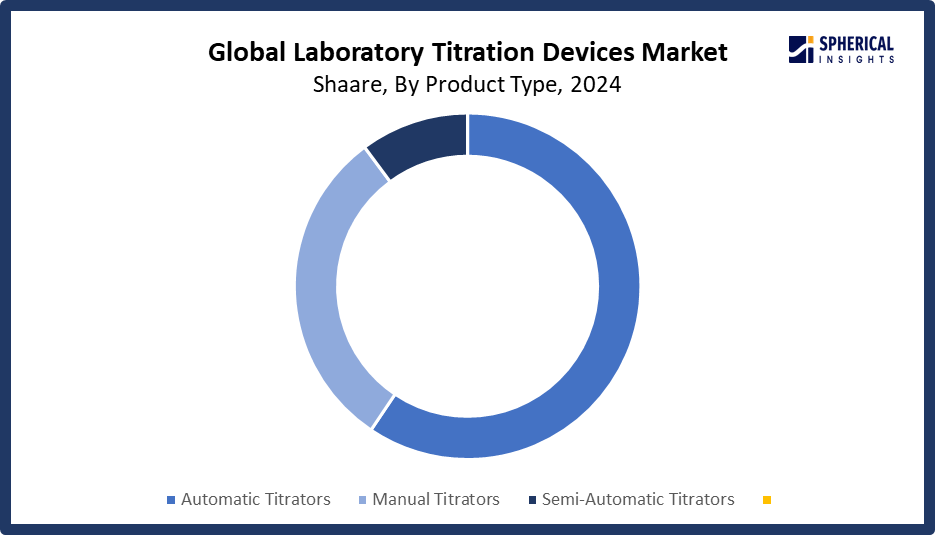

Global Laboratory Titration Devices Market, By Product Type:

- The automatic titrators segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on product type, the global laboratory titration devices market is segmented into automatic titrators, manual titrators, and semi-automatic titrators. Among these, the automatic titrators segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven due to their high precision and efficiency, as well as their capability to perform complex titration processes with minimal human input. These devices are critical in high throughput laboratories as they are designed with sophisticated features, such as data logging, endpoint detection, and automated reagent dispensing. The growth of automatic titrators is related to the increasing desire to automate processes in laboratories thereby increasing efficiency and reducing human error.

Get more details on this report -

The manual titrators segment in the laboratory titration devices market is expected to grow at the fastest CAGR over the forecast period, due to affordability, ease of use, and simplicity. These devices are mostly used in small-scale laboratories and university research. Manual titrators are often better suited for basic research applications and teaching contexts because they afford more flexibility and control over the titration process.

Global Laboratory Titration Devices Market, By Application:

- The pharmaceuticals segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on application, the global laboratory titration devices market is segmented into pharmaceuticals, food & beverages, environmental testing, chemical analysis, academic research, and others. Among these, the pharmaceuticals segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to the increased demand for precise and reliable analytical methods in drug discovery, quality compliance, and regulatory compliance. Titration instrument’s role is critical to pharmaceutical companies because they assess concentrations of active ingredients, impurities, and other chemical parameters to confirm the quality and safety of pharmaceutical products.

The food & beverages segment in the laboratory titration devices market is expected to grow at the fastest CAGR over the forecast period, due to the increasing degree of quality control and safety requirements in food manufacturing and processing. Titration instruments are used as food analytical methods to determine the degree of acidity, alkalinity, or concentration of food additives however, to adhere to food safety laws and ensure quality.

Regional Segment Analysis of the Global Laboratory Titration Devices Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Laboratory Titration Devices Market Trends

Get more details on this report -

North America is expected to hold the largest share of the global laboratory titration devices market over the forecast period.

The North American region's supremacy attributed to its many pharmaceutical and biotechnology companies, advanced research laboratories, and strict regulations. Market demand for titration instruments in this region is being supported by rising investments in research and development expenditures and growing demand for high precision analytical tools. The North American market's growth is driven by its advanced healthcare system and focus on innovation, research, and integrity in quality control practices.

Asia Pacific Laboratory Titration Devices Market Trends

Asia Pacific is expected to grow at the fastest CAGR in the laboratory titration devices market during the forecast period. In the Asia Pacific market, the rise is due to the rapid industrialization, increase in healthcare facilities investment, and growing concerns over environmental issues. The leading countries driving the market growth in this area include China, India, and Japan. The demand for titration devices in the Asia Pacific region is propelled by the growth of the pharmaceutical, chemical, and food and beverage sectors, as well as an increased focus on quality assurance and regulatory compliance. In addition, the growth of the market is driven by increased investments in university research and increased awareness of environmental protection.

Europe Laboratory Titration Devices Market Trends

Europe is driven by its wide-ranging regulations, advanced research laboratories, and heavy reliance on research and development. The market is primarily driven by the European chemical and pharmaceutical industries, which are heavily reliant on accurate titration techniques for research, government regulations and standards, and quality control. Growing regulatory concerns with sustainability and the environmental aspect have led to the growing concern for titration instruments in environmental testing laboratories. As well as new investments resulting from the continuous improvements in the titration instruments themselves, support the steady market growth in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global laboratory titration devices, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The Laboratory Titration Devices Market Include

- Mettler Toledo International Inc.

- Metrohm AG

- Thermo Fisher Scientific Inc.

- Hanna Instruments, Inc.

- Xylem Inc.

- Hach Company

- Eppendorf AG

- Brand GmbH

- Sartorius AG

- DKK TOA Corporation

- KEM Kyoto Electronics Manufacturing Co., Ltd.

- GR Scientific Ltd.

- SI Analytics GmbH

- Hiranuma Sangyo Co., Ltd.

- Mitsubishi Chemical Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In August 2024, METTLER TOLEDO introduced its latest product innovation the EVA Volumetric Karl Fischer titrator. This cutting-edge titrator is engineered to provide precise efficiency, versatile applications, seamless workflows, and optimal safety in water content determination.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the laboratory titration devices market based on the following segments:

Global Laboratory Titration Devices Market, By Product Type

- Automatic Titrators

- Manual Titrators

- Semi-Automatic Titrators

Global Laboratory Titration Devices Market, By Application

- Pharmaceuticals

- Food & Beverages

- Environmental Testing

- Chemical Analysis

- Academic Research

- Others

Global Laboratory Titration Devices Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the laboratory titration devices market over the forecast period?The global laboratory titration devices market is projected to expand at a CAGR of 6.5% during the forecast period.

-

2. What is the market size of the laboratory titration devices market?The global laboratory titration devices market size is expected to grow from USD 1.83 billion in 2024 to USD 3.66 billion by 2035, at a CAGR 6.5% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the laboratory titration devices market?North America is anticipated to hold the largest share of the laboratory titration devices market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global laboratory titration devices market?Mettler Toledo International Inc., Metrohm AG, Thermo Fisher Scientific Inc., Hanna Instruments, Inc., Xylem Inc., Hach Company, Eppendorf AG, Brand GmbH, Hirschmann, Sartorius AG, DKK TOA Corporation, KEM Kyoto Electronics Manufacturing Co., Ltd., GR Scientific Ltd., SI Analytics GmbH, Hiranuma Sangyo Co., Ltd., Mitsubishi Chemical Corporation, and Others.

-

5. What factors are driving the growth of the laboratory titration devices market?The laboratory titration devices market's growth is driven by Advanced titration systems are expensive up front, which prevents small labs and institutions from adopting them. Personnel with the necessary skills to operate and maintain such devices are in short supply. Another obstacle is the incompatibility of older lab systems and the disparities in international regulatory standards.

-

6. What are the market trends in the laboratory titration devices market?Advancements in Automation and Digital Integration, Rising Demand for Multi Parameter Analysis, Focus on Sustainability and Green Chemistry, Growth in Emerging Markets, and Integration of Artificial Intelligence and Machine Learning.

-

7. What are the main challenges restricting wider adoption of the laboratory titration devices market?The laboratory titration devices market faces challenges, including high growing need for high-precision analytical testing in environmental, food and beverage, and pharmaceutical laboratories.

Need help to buy this report?