Global L-Lysine Hydrochloride Market Size, Share, and COVID-19 Impact Analysis, By Source (Fruits, Vegetables, Dairy products, Meat, and Others), By Application (Processed Food Products, Beverages, Animal Feed, Pharmaceuticals, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal L-Lysine Hydrochloride Market Size Insights Forecasts to 2035

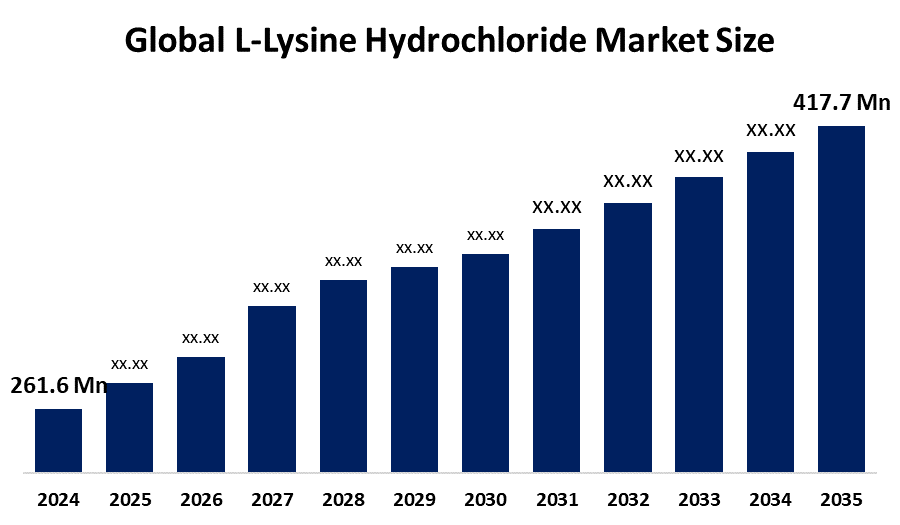

- The Global L-Lysine Hydrochloride Market Size Was Estimated at USD 261.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.35 % from 2025 to 2035

- The Worldwide L-Lysine Hydrochloride Market Size is Expected to Reach USD 417.7 Million by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global L-lysine Hydrochloride Market Size was valued at around USD 261.6 Million in 2024 and is predicted to Grow to around USD 417.7 Million by 2035 with a compound annual growth rate (CAGR) of 4.35 % from 2025 to 2035. The L-lysine hydrochloride market offers opportunities through rising demand in animal nutrition, pharmaceutical formulations, food fortification, and expanding applications driven by global protein consumption growth.

Market Overview

The global industry engaged in the manufacturing, distribution, and marketing of L-Lysine Hydrochloride, the hydrochloride salt version of the essential amino acid L-Lysine, is referred to as the L-Lysine hydrochloride (or L-Lysine HCl) market. This chemical is an important dietary supplement that is mostly produced by microbial fermentation methods. L-lysine hydrochloride is mainly used as a nutritional supplement in animal feed to promote healthy growth in cattle and poultry, increase feed efficiency, and boost protein synthesis. To treat lysine inadequacies in human nutrition, it is also used in food fortification, nutritional supplements, and pharmaceutical formulations. L-Lysine hydrochloride initiatives were launched in early 2026, supported by China’s animal nutrition incentives, the USDA’s BioPreferred program, and India’s National Livestock Mission to enhance productivity and sustainability. A number of important variables related to global agricultural, industrial, and nutritional trends are driving the growth of the L-lysine hydrochloride market. The expansion of the cattle and poultry sectors is mostly due to the growing demand for premium animal protein.

Report Coverage

This research report categorizes the L-lysine hydrochloride market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the L-lysine hydrochloride market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the L-lysine hydrochloride market.

Global L-Lysine Hydrochloride Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 261.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.35% |

| 2035 Value Projection: | USD 417.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 154 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Source, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Ajinomoto Co Inc. CJ CheilJedang Corporation. Evonik Industries AG, Global Bio-Chem Technology Group Company Limited, Huazhong Pharmaceutical Co., Ltd., Kyowa Hakko Bio Co., Ltd. Meihua Holdings Group Co., Ltd., Ningxia Eppen Biotech Co, Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

L-lysine hydrochloride, an important amino acid, is frequently added to animal feed to support intensive farming practices by improving growth performance, feed efficiency, and overall animal health. Research is now primarily motivated by the science of balanced nutrition and amino acid supplementation for both human and animal diets. Fermentation and biotechnology developments, which have improved production efficiency, reduced costs, and improved product quality, have contributed to market expansion. The demand for L-lysine hydrochloride is rising due to the growth of the pharmaceutical industry and growing R&D.

Restraining Factors

The market for L-lysine hydrochloride is constrained by a number of factors, including fluctuating raw material prices, high production costs, strict regulations, manufacturing-related environmental issues, and growing competition from feed additives and alternative amino acids.

Market Segmentation

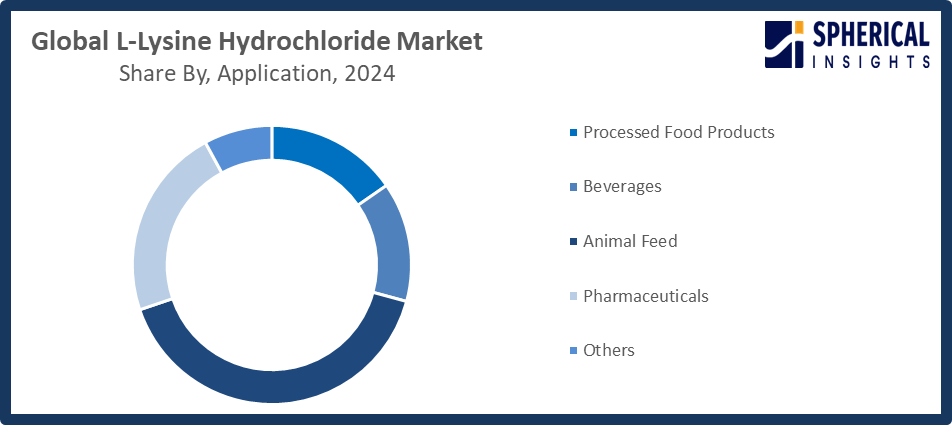

The L-lysine hydrochloride market share is classified into source and application.

- The meat segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the source, the L-lysine hydrochloride market is divided into fruits, vegetables, dairy products, meat, and others. Among these, the meat segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. L-lysine hydrochloride is found in meat due to its rich amino acid composition and great biological value. Meat provides all essential amino acids for its extraction, just like all other essential amino acids. Humans prefer L-lysine from animal sources since it is essential for protein synthesis and overall health.

- The animal feed segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the L-lysine hydrochloride market is divided into processed food products, beverages, animal feed, pharmaceuticals, and others. Among these, the animal feed segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The amino acid's vital role in boosting protein synthesis, encouraging healthy growth, and increasing feed efficiency in cattle, poultry, and aquaculture is the main driver of animal feed. Adoption has been accelerated by the rising demand for meat and animal-based protein products worldwide, especially in areas with intensive farming methods.

Get more details on this report -

Regional Segment Analysis of the L-Lysine Hydrochloride Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the L-lysine hydrochloride market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the L-Lysine hydrochloride market over the predicted timeframe. Asia Pacific region drive the market through their extensive growth while customers seek affordable feed supplements. China, India, Vietnam, and Indonesia function as key market drivers because their animal populations and rising meat demand create new market opportunities. China operates as the world leader in L-Lysine Hydrochloride production and consumption because of its fermentation facilities, production capabilities and government support for animal feed nutrition and efficiency. The Chinese government's position receives substantial support from its Ministry of Agriculture and Rural Affairs which promotes amino acid feed additives for better protein nutrition through reduced soybean meal consumption.

North America is expected to grow at a rapid CAGR in the L-lysine hydrochloride market during the forecast period. The region has advanced livestock and poultry and aquaculture industries that use amino acid supplements to boost production, decrease feed expenses, and achieve high nutritional requirements. Government support indirectly aids via USDA Bio Preferred programs, which promote bio-based additives and sustainable agriculture policies that support efficient nutrient usage. The early 2026 period did not see any new lysine products launched, but the industry continues to offer animal health and nutrition benefits through its wider incentive programs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the L-lysine hydrochloride market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ajinomoto Co., Inc.

- CJ CheilJedang Corporation

- Evonik Industries AG

- Global Bio-Chem Technology Group Company Limited

- Huazhong Pharmaceutical Co., Ltd.

- Kyowa Hakko Bio Co., Ltd.

- Meihua Holdings Group Co., Ltd.

- Ningxia Eppen Biotech Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2024, Evonik Industries AG launched Biolys, an L-Lysine Hydrochloride product, revealing its carbon footprint at EuroTier, supporting sustainable animal feed and reducing environmental impact in protein production.

- In September 2024, Ajinomoto Co., Inc. and Danone launched a global partnership using AjiPro-L, an L-Lysine Hydrochloride formulation, reducing dairy feed emissions and enhancing sustainable nutrient absorption in cows.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the L-lysine hydrochloride market based on the below-mentioned segments:

Global L-Lysine Hydrochloride Market, By Source

- Fruits

- Vegetables

- Dairy Products

- Meat

- Others

Global L-Lysine Hydrochloride Market, By Application

- Processed Food Products

- Beverages

- Animal Feed

- Pharmaceuticals

- Others

Global L-Lysine Hydrochloride Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the L-lysine hydrochloride market over the forecast period?The global L-lysine hydrochloride market is projected to expand at a CAGR of 4.35% during the forecast period.

-

2. What is the market size of the L-lysine hydrochloride market?The global L-lysine hydrochloride market size is expected to grow from USD 261.6 million in 2024 to USD 417.7 million by 2035, at a CAGR of 4.35 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the L-lysine hydrochloride market?Asia Pacific is anticipated to hold the largest share of the L-lysine hydrochloride market over the predicted timeframe.

-

4. Who are the top companies operating in the global L-lysine hydrochloride market?Ajinomoto Co., Inc., CJ CheilJedang Corporation, Evonik Industries AG, Global Bio‑Chem Technology Group Company Limited, Huazhong Pharmaceutical Co., Ltd., Kyowa Hakko Bio Co., Ltd., Meihua Holdings Group Co., Ltd., Ningxia Eppen Biotech Co., Ltd., Shengda Bioengineering Co., Ltd., and Others.

-

5. What factors are driving the growth of the L-lysine hydrochloride market?Rising demand for animal protein, growing livestock and poultry industries, increasing use in dietary supplements and food fortification, technological advancements in production, and supportive government policies drive the L-Lysine Hydrochloride market growth.

-

6. What are the market trends in the L-lysine hydrochloride market?Trends include growing adoption in animal feed, expansion in nutraceutical and pharmaceutical applications, bio-based production methods, increased focus on sustainable farming, and strategic partnerships among key market players.

-

7. What are the main challenges restricting the wider adoption of the L-lysine hydrochloride market?High production costs, raw material price volatility, stringent regulatory standards, environmental concerns from manufacturing, and competition from alternative amino acids limit the wider adoption of L-lysine hydrochloride globally.

Need help to buy this report?