Global Knee Replacement Prosthesis Market Size, Share, and COVID-19 Impact Analysis, By Type (Tibial Component, Femoral Component, and Patella Component), By Application (Osteoarthritis, Sports Injuries, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Knee Replacement Prosthesis Market Insights Forecasts to 2035

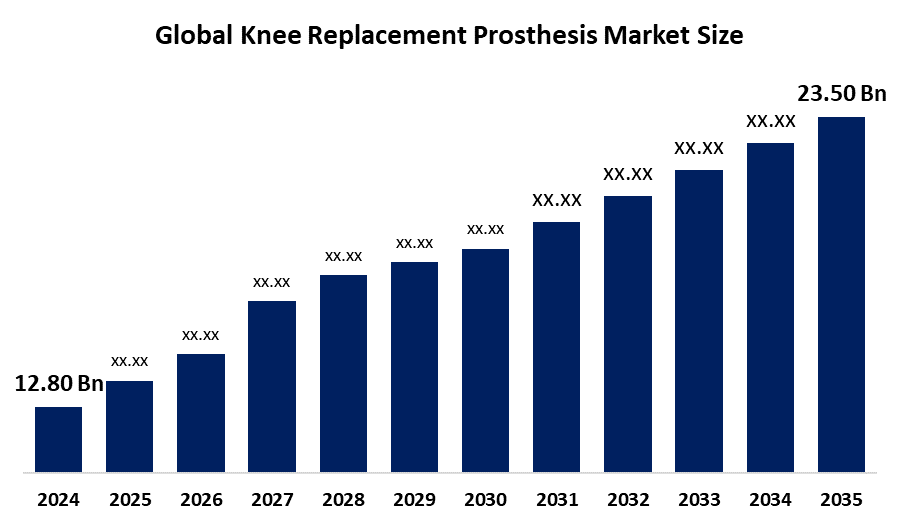

- The Global Knee Replacement Prosthesis Market Size Was Estimated at USD 12.80 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.68% from 2025 to 2035

- The Worldwide Knee Replacement Prosthesis Market Size is Expected to Reach USD 23.50 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global Knee Replacement Prosthesis market size was worth around USD 12.80 Billion in 2024 and is predicted to grow to around USD 23.50 Billion by 2035 with a compound annual growth rate (CAGR) of 5.68% from 2025 and 2035. The market for Knee Replacement Prosthesis has a number of opportunities to grow due to the emergence of smart knee implant technology and the incorporation of sensor technology for improved post-operative recovery, along with an increasing R&D activities and global health initiatives.

Market Overview

The Global Knee Replacement Prosthesis Market Size refers to the industry for the artificial joints used in knee replacement surgeries. Knee replacement, or knee arthroplasty, is a surgical procedure to replace the weight-bearing surfaces of the knee joint to relieve pain and disability, most commonly offered when joint pain is not diminished by conservative measures. Further, it may also be performed for other knee conditions, like rheumatoid arthritis. The prosthesis consists of two parts, in which one part is attached to the end of the thigh bone and the other part is attached to the shin bone, using a bone cement or screws.

Innovation and market expansion are anticipated as a result of major players' growing technological advancements and strategic partnerships for expanding their product portfolio. For instance, in June 2024, Zimmer Biomet Holdings, Inc., a global medical technology company, announced a limited distribution agreement with THINK Surgical, Inc. regarding its wireless, handheld, TMINI Miniature robotic system for total knee arthroplasty. The increasing innovation in knee implant materials and the emergence of technology, including 3D printing, smart implants, and nanomaterials, are driving a huge surge in the global knee replacement prosthesis market.

Report Coverage

This research report categorizes the knee replacement prosthesis market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the knee replacement prosthesis market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the knee replacement prosthesis market.

Global Knee Replacement Prosthesis Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12.80 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.68% |

| 2035 Value Projection: | USD 23.50 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Johnson & Johnson B. Braun Melsungen AG Exactech, Inc. Stryker Corporation ConforMIS Smith+Nephew Medacta International JRI Orthopaedics Ltd. United Orthopedic Corporation Zimmer Biomet MicroPort Scientific Corporation Corin Group Arthrex, Inc. and Others, key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Knee Replacement Prosthesis Market Size is driven by the growing prevalence of osteoarthritis. For instance, according to a WHO report in July 2023, it was estimated that 528 million people worldwide were living with osteoarthritis in the year 2019, and about 73% of people living with osteoarthritis are older than 55 years, and 60% are female. An increasing prevalence of total knee arthroplasty in the elderly population is contributing to propel the knee replacement prosthesis market. It was estimated that approximately 790,000 surgeries are performed in the U.S. each year, and are expected to grow with increased population age, obesity rates. Additionally, advancements in prosthesis technology are bolstering the market growth of knee replacement prosthesis.

Restraining Factors

The Knee Replacement Prosthesis Market Size is restricted by the increased cost of orthopedic procedures, limited healthcare spending, and the lack of skilled surgeons. Further, the strict regulations and lengthy approval process of innovative solutions are challenging the market growth.

Market Segmentation

The knee replacement prosthesis market share is classified into type and application.

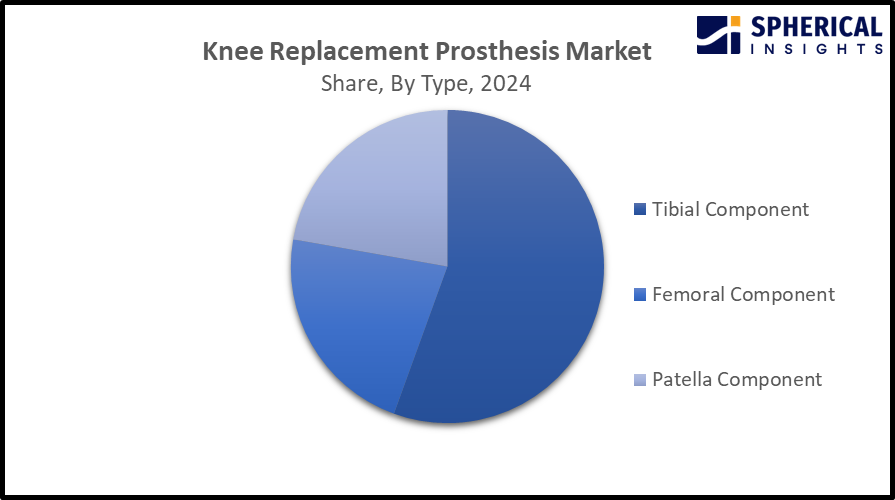

- The tibial component segment dominated the knee replacement prosthesis market in 2024, accounting for a 55.5% share and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the knee replacement prosthesis market is divided into tibial component, femoral component, and patella component. Among these, the tibial component segment dominated the knee replacement prosthesis market in 2024, accounting for a 55.5% share and is projected to grow at a substantial CAGR during the forecast period. Tibial components in revision procedures on total knee prostheses involve cemented (tray and stem) and hybrid (cemented tray and uncemented, nonporous canal-filling stem). The advantages of tibial components, including joint fixation, preventing implant loosening, and improving patients' mobility, are responsible for driving the segmental market growth.

Get more details on this report -

- The osteoarthritis segment accounted for the largest revenue share of over 70% in 2024 and is anticipated to grow at a significant CAGR of 5-7% during the forecast period.

Based on the application, the knee replacement prosthesis market is divided into osteoarthritis, sports injuries, and others. Among these, the osteoarthritis segment accounted for the largest revenue share of over 70% in 2024 and is anticipated to grow at a significant CAGR of 5-7% during the forecast period. Prostheses aid in replacing joints that are very damaged by osteoarthritis with joints in synthetic materials. For instance, in April 2025, the U.S. FDA approved the first implantable shock absorber for people with early-stage knee osteoarthritis. The increasing prevalence of knee osteoarthritis, along with an increasing innovation & design of knee implants and robot-assisted knee surgeries, is responsible for driving the market demand.

Regional Segment Analysis of the Knee Replacement Prosthesis Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the knee replacement prosthesis market over the predicted timeframe.

North America is anticipated to hold the largest share of around 45.40%-50.80% in the knee replacement prosthesis market over the predicted timeframe. The market ecosystem in North America is strong, with the presence of cutting-edge startups. For instance, in May 2025, an Imperial startup raised £2.5m to take innovative joint replacements to the US. The market for knee replacement prosthesis has been driven by the region's increasing healthcare expenditure and integration of AI and ML in R&D for making better and affordable knee implants. The United States is leading the North America knee replacement prosthesis market, with a significant share of 39.9-93.6% in 2024, driven by the company's increasing investment, presence of advanced healthcare infrastructure, and skilled workforce.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR of around 5.7-6.4% in the knee replacement prosthesis market during the forecast period. The Asia Pacific area has a thriving market for knee replacement prosthesis due to the region’s increasing elderly population and osteoarthritis prevalence, along with an increasing awareness of joint replacement procedures. Further, the growing innovative solutions in knee replacement care are contributing to propel market growth. For instance, in May 2025, Dr K.C. Mehta joined Marengo CIMS Hospital to advance orthopaedic innovation and developed his proprietary knee joint design and holds ten international patents. China is dominating the Asia Pacific region, with a 35% revenue share in the year 2024, owing to the increasing advancement in surgical techniques and government emphasis on improving healthcare services.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the knee replacement prosthesis market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Johnson & Johnson

- B. Braun Melsungen AG

- Exactech, Inc.

- Stryker Corporation

- ConforMIS

- Smith Nephew

- Medacta International

- JRI Orthopaedics Ltd.

- United Orthopedic Corporation

- Zimmer Biomet

- MicroPort Scientific Corporation

- Corin Group

- Arthrex, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Hospital for Special Surgery (HSS), the world’s leading academic medical centre focused on musculoskeletal health, announced the results of a retrospective study analyzing the results of the “Quiet Knee” protocol after total knee arthroplasty (TKA), also known as knee replacement surgery.

- In April 2025, OSSTEC, a London-based start-up changing the face of joint replacement implants with a novel 3D printing technology, raised 2.5 million GBP in funding.

- In March 2025, Medtech company Eventum Orthopaedics, focused on improving knee replacement surgery, has raised a further £3.8 million from NPIF II, Mercia Equity Finance. managed by Mercia Ventures as part of the Northern Powerhouse Investment Fund II (NPIF II), Mercia’s EIS funds and private investors, including leading surgeons.

- In March 2025, Smith-Nephew, the global medical technology company, announced it would feature the latest advancements in orthopaedic reconstruction at the American Academy of Orthopaedic Surgeons Annual Meeting in San Diego.

- In January 2025, BionicM announced the launch of its U.S. subsidiary, BionicM USA, located in the Virginia area near Washington, D.C. The strategic move reinforces the company’s commitment to delivering advanced powered microprocessor knee solutions to the world's largest prosthetics market.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Knee Replacement Prosthesis market based on the below-mentioned segments:

Global Knee Replacement Prosthesis Market, By Type

- Tibial Component

- Femoral Component

- Patella Component

Global Knee Replacement Prosthesis Market, By Application

- Osteoarthritis

- Sports Injuries

- Others

Global Knee Replacement Prosthesis Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the knee replacement prosthesis market?The global knee replacement prosthesis market size is expected to grow from USD 12.80 Billion in 2024 to USD 23.50 Billion by 2035, at a CAGR of 5.68% during the forecast period 2025-2035.

-

2.Which region holds the largest share of the knee replacement prosthesis market?North America is anticipated to hold the largest share of the knee replacement prosthesis market over the predicted timeframe.

-

3.What is the forecasted CAGR of the Global Knee replacement prosthesis Market from 2024 to 2035?The market is expected to grow at a CAGR of around 5.68% during the period 2024–2035.

-

4.Who are the top companies operating in the Global Knee replacement prosthesis Market?Key players include Johnson & Johnson, B. Braun Melsungen AG, Exactech, Inc., Stryker Corporation, ConforMIS, Smith+Nephew, Medacta International, JRI Orthopaedics Ltd., United Orthopedic Corporation, Zimmer Biomet, MicroPort Scientific Corporation, Corin Group, and Arthrex, Inc.

-

5.Can you provide company profiles for the leading knee replacement prosthesis manufacturers?Yes. For example, Johnson & Johnson is an American multinational pharmaceutical, biotechnology, and medical technologies corporation headquartered in New Brunswick, New Jersey, and publicly traded on the New York Stock Exchange. B. Braun Melsungen AG is a German medical and pharmaceutical device company which currently has more than 63,000 employees globally, and offices and production facilities in more than 60 countries.

-

6.What are the main drivers of growth in the knee replacement prosthesis market?The growing prevalence of osteoarthritis, increasing elderly population, and technological advancements are major market growth drivers of the knee replacement prosthesis market.

-

7.What challenges are limiting the knee replacement prosthesis market?An increased cost of orthopedic procedures, limited healthcare infrastructure, and strict regulations remain key restraints in the knee replacement prosthesis market.

Need help to buy this report?