Japan Waste sorting equipment Market Size, Share, and COVID-19 Impact Analysis, By Waste Type (Plastic Waste, Paper & Cardboard, Metal Waste, Organic Waste, Glass, and Others), By Operation Mode (Automatic, Manual, and Semi-Automatic), By Application (Municipal and Industrial), and Japan Waste sorting equipment Market Insights, Industry Trend, Forecasts to 2035

Industry: Machinery & EquipmentJapan Waste Sorting Equipment Market Insights Forecasts to 2035

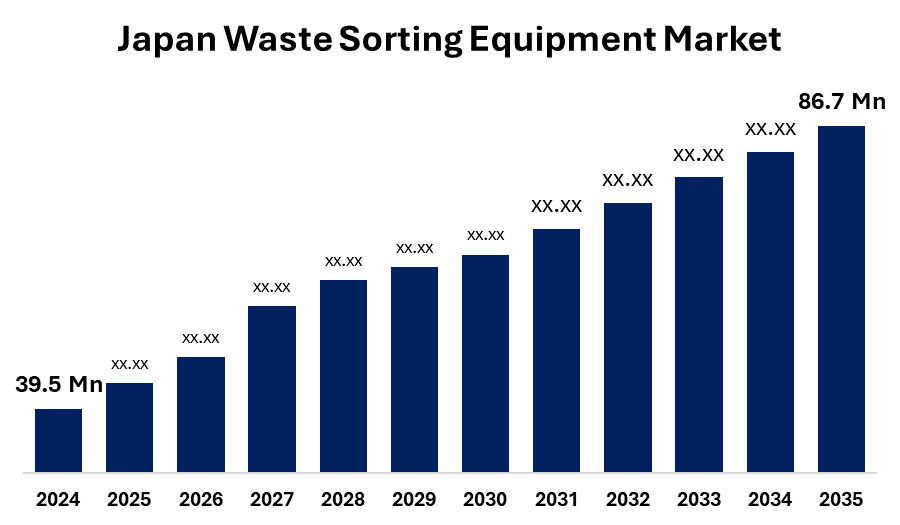

- The Japan Waste Sorting Equipment Market Size Was Estimated at USD 39.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.77% from 2025 to 2035

- The Japan Waste Sorting Equipment Market Size is Expected to Reach USD 86.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Waste Sorting Equipment Market Size is anticipated to reach USD 86.7 Million by 2035, growing at a CAGR of 4.76% from 2025 to 2035. The waste sorting equipment market in Japan is driven by growing environmental concerns and stricter government regulations focused on sustainable waste management.

Market Overview

Waste sorting equipment includes a wide range of equipment and technologies aimed at separating and classifying waste into groups such as glass, organic materials, metals, plastic, paper, and dangerous items. Sophisticated robotics with conveyors, shredders, optical sorters, magnetic sorters, air classifiers, and AI and IOT integration are some examples of these systems. The main objective is to increase recycling effectiveness, reduce load on landfills, recover valuable resources, and guarantee adherence to environmental laws. The sorting processes are becoming more and more automatic with the use of technological progress, including sensor-based systems, near-infrared (NIR) optical sorters, and robotic weapons run by Artificial Intelligence. These technologies increase the recovery rate of high-value recycling, including PET bottles, aluminum, and electronic debris, reduce the need for human labor, and improve pruning accuracy. Conveyors, Shredders, Optical Sorters, Air Classifier, Magnetic and AD Current Separators, and fast robotics and Artificial Intelligence (AI) -Power systems are some of the various techniques used in waste filtered devices in Japan. To separate plastic, metal, paper, organic matter, and dangerous materials, these solutions are used in private waste management firms, industrial recycling facilities and municipal facilities.

Report Coverage

This research report categorizes the market for the Japan waste sorting equipment market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan waste sorting equipment market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan waste sorting equipment market.

Japan Waste Sorting Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 86.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.77% |

| 2035 Value Projection: | USD 86.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Waste Type, By Operation Mode, By Application |

| Companies covered:: | Satake Corporation, Kawasaki Heavy Industries, Ltd., Hitachi Zosen Inova Japan, Mitsubishi Heavy Industries Environmental & Chemical Engineering, JFE Engineering Corporation, Kubota Corporation, Ebara Corporation, Kubota Corporation, FASOTEC, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Strict government recycling rules and active civil participation in garbage isolation. Adoption of adoption is quicker by increasing urbanization, an increase in the volume of industrial and municipal waste, and effective recycling technology. In industries, technological progress such as Artificial Intelligence (AI), robots, and IOT integration improves accuracy, productivity, and resource collection.

Restraining Factors

The waste sorting equipment market is mostly constrained by high installation and maintenance costs, the requirement for special training, and the requirement for trained labor. Delayed uniformity in municipalities and technical difficulties in the processing of mixed or polluted waste limited the market for waste sorting equipment in Japan.

Market Segmentation

The Japan waste sorting equipment market share is classified into waste type, operation mode, and application.

- The plastic waste segment held a significant market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The Japan waste sorting equipment market is segmented by waste type into plastic waste, paper & cardboard, metal waste, organic waste, glass, and others. Among these, the plastic waste segment held a significant market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. Governments and companies have adopted a better sorting system to increase recycling efficiency due to the use of plastic, especially single-use items, and growing environmental concerns.

- The automatic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan waste sorting equipment market is segmented by operation mode into automatic, manual, and semi-automatic. Among these, the automatic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to great accuracy, efficiency and ability to manage large amounts of waste with little help from humans. Waste management features and municipalities prefer automated systems as they provide better material recovery rates and making them the preferred choice for large-scale waste management facilities and municipalities.

- The industrial segment is anticipated to grow at the fastest CAGR during the projected timeframe.

The Japan waste sorting equipment market is segmented by application into municipal and industrial. Among these, the industrial segment is anticipated to grow at the fastest CAGR during the projected timeframe. This is due to demand for environmentally friendly waste management in increasing industrialization and processing, manufacturing and chemical fields. The use of advanced sorting machinery is being fueled due to increasing regulatory pressure to handle dangerous and non-dominant industrial waste properly.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan waste sorting equipment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Satake Corporation

- Kawasaki Heavy Industries, Ltd.

- Hitachi Zosen Inova Japan

- Mitsubishi Heavy Industries Environmental & Chemical Engineering

- JFE Engineering Corporation

- Kubota Corporation

- Ebara Corporation

- Kubota Corporation

- FASOTEC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan waste sorting equipment market based on the below-mentioned segments:

Japan Waste Sorting Equipment Market, By Waste Type

- Plastic Waste

- Paper & Cardboard

- Metal Waste

- Organic Waste

- Glass

- Others

Japan Waste Sorting Equipment Market, By Operation Mode

- Automatic

- Manual

- Semi-Automatic

Japan Waste Sorting Equipment Market, By Application

- Municipal

- Industrial

Frequently Asked Questions (FAQ)

-

Q: What is the market size of the Japan Waste Sorting Equipment Market in 2024?A: The Japan Waste Sorting Equipment Market was valued at USD 39.5 million in 2024.

-

Q: What is the forecasted market size by 2035?A: The market is projected to reach USD 86.7 million by 2035.

-

Q: What is the growth rate (CAGR) of the market?A: The market is expected to grow at a CAGR of 6.77% during 2025–2035.

-

Q: What are the major waste types covered in this market?A: The market is segmented into Plastic Waste, Paper & Cardboard, Metal Waste, Organic Waste, Glass, and Others.

-

Q: Which waste type held the largest market share in 2024?A: Plastic waste held a significant market share in 2024 due to rising plastic consumption and strict regulations on single-use plastics.

-

Q: What are the key operation modes of waste sorting equipment?A: The equipment is categorized as Automatic, Manual, and Semi-Automatic.

-

Q: What are the main driving factors for market growth?A: Strict government recycling regulations, strong public participation, rapid urbanization, rising waste volumes, and technological advancements such as AI, robotics, and IoT integration.

-

Q: What are the main restraining factors?A: High installation and maintenance costs, need for specialized training, lack of skilled labor, and challenges in processing contaminated or mixed waste.

-

Q: Who are the key companies operating in the Japan waste sorting equipment market?A: Notable companies include Satake Corporation, Kawasaki Heavy Industries, Hitachi Zosen Inova Japan, Mitsubishi Heavy Industries Environmental & Chemical Engineering, JFE Engineering, Kubota, Ebara, and FASOTEC.

Need help to buy this report?