Japan Venture Capital Investment Market Size, Share, By Sector (Technology & IT, Healthcare & Life Sciences, Consumer & Media, Energy & Others), By Funding Type (First Time Venture Funding, Follow-On Venture Funding), Japan Venture Capital Investment Market Insights, Industry Trends, Forecasts to 2035

Industry: Banking & FinancialJapan Venture Capital Investment Market Insights Forecasts to 2035

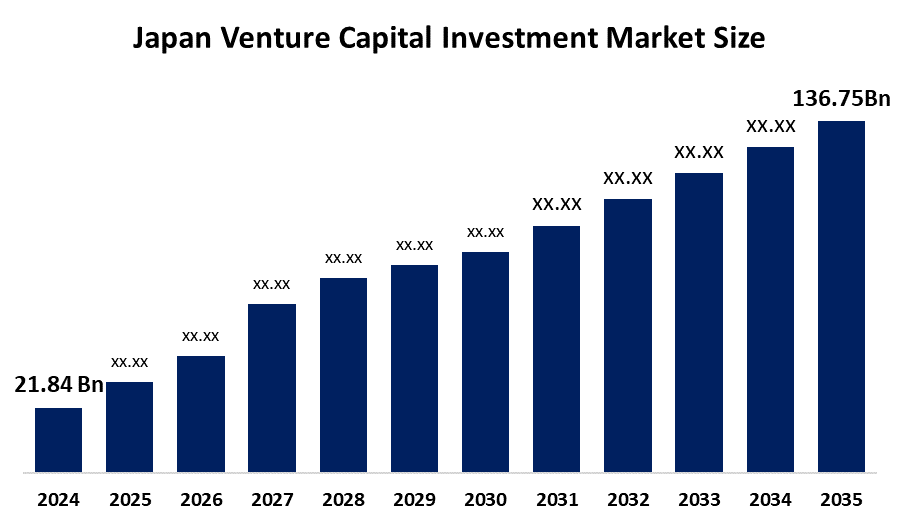

- Japan Venture Capital Investment Market Size 2024: USD 21.84 Bn

- Japan Venture Capital Investment Market Size 2035: USD 136.75 Bn

- Japan Venture Capital Investment Market CAGR 2024: 18.15%

- Japan Venture Capital Investment Market Segments: Sector and Funding Type

Get more details on this report -

The Japan venture capital investment market refers to financial investments made into high-potential startups in exchange for equity or ownership stakes. The market functions as a vital component that supports innovation development and entrepreneurship creation and business expansion throughout multiple industries including technology and healthcare and consumer products and energy. Government programs that provide startup funding and tax breaks and innovation development schemes have created an environment which supports market expansion. The combination of increased private and corporate venture activities with Japan's commitment to digital transformation and sustainable development and advanced technology implementation has created new funding opportunities which attract investors throughout the country.

Technological advancements in AI and fintech and biotech and clean energy sectors have enabled startups to develop their operations and explore new business territories. Domestic and international investors work together which boosts capital investments that help businesses grow and industries develop new markets. The market provides investors and startups with multiple opportunities to enter new disruptive technologies at their early development stages. The next decade will see market expansion which will lead to higher venture capital funding because of increased ecosystem support and regulatory backing and improved startup capacity.

Market Dynamics of the Japan Venture Capital Investment Market:

The Japan venture capital investment market is fueled by the presence of robust government initiatives that promote startups, such as financial assistance, tax benefits, and innovation support initiatives. The increased pace of digitalization, startup activity, and development in areas like AI, fintech, biotech, and clean energy are encouraging investment activity. The growth of corporate venture capital, incubators, and accelerators is also boosting the market.

The market faces restrictions because of high investment risks and limited exit options and complicated regulatory frameworks. The combination of economic instability and unpredictable market conditions leads to decreased investor interest while compliance difficulties result in funding delays. The capital deployment process experiences limitations because these factors restrict the speed and volume of actual growth.

Emerging technologies and sustainable development projects and cross-border investments present major opportunities for future development. The market will experience increased venture funding because domestic and international investors work together and startups reach higher levels of development and sector-specific innovations emerge. The market trends show that the Japanese market will experience strong growth while providing sustainable strategic returns for an extended period.

Japan Venture Capital Investment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 21.84 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 18.15% |

| 2035 Value Projection: | USD 136.75 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Sector, By Funding Type |

| Companies covered:: | JAFCO,Globis Capital Partners,Global Brain,ANRI,Coral Capital,Incubate Fund,WiL,Mitsubishi UFJ Capital,Mizuho Capital,SMBC Venture Capital,SBI Investment And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan venture capital investment market share is classified into sector and funding type.

By Sector:

The Japan venture capital investment market is divided by sector into technology & IT, healthcare & life sciences, consumer & media, and energy & others. Among these, the technology & IT segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Japan's Technology and IT sector maintains its superior performance through strong digital transformation programs and active startup development and government backing and rising IT system adoption.

By Funding Type:

The Japan venture capital investment market is divided by funding type into first-time venture funding and follow-on venture funding. Among these, the follow-on venture funding segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The Japanese startup ecosystem benefits from heightened investor trust and demonstrated startup success and the growing financial needs of businesses and ongoing government programs that fund expanding companies.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan venture capital investment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Venture Capital Investment Market:

- JAFCO

- Globis Capital Partners

- Global Brain

- ANRI

- Coral Capital

- Incubate Fund

- WiL

- Mitsubishi UFJ Capital

- Mizuho Capital

- SMBC Venture Capital

- SBI Investment

- Daiwa Corporate Investment

- Nissay Capital

- DBJ Capital

- INCJ

- Others

Recent Developments in Japan Venture Capital Investment Market:

In December 2024, The Central Japan Innovation Capital established its initial venture capital fund to provide financial assistance to startups in the Tokai area while targeting deep technology and university-based business initiatives to develop the regional startup ecosystem.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan venture capital investment market based on the below-mentioned segments:

Japan Venture Capital Investment Market, By Sector

- Technology & IT

- Healthcare & Life Sciences

- Consumer & Media

- Energy & Others

Japan Venture Capital Investment Market, By Funding Type

- First Time Venture Funding

- Follow-On Venture Funding

Frequently Asked Questions (FAQ)

-

Q: What is the Japan venture capital investment market size?A: Japan venture capital investment market is expected to grow from USD 21.84 billion in 2024 to USD 136.75 billion by 2035, growing at a CAGR of 18.15% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by strong government support for startups, increasing digital transformation and entrepreneurship, advancements in AI, fintech, biotech, and clean energy, rising corporate venture activities, and the expansion of startup incubators and accelerators.

-

Q: What factors restrain the Japan venture capital investment market?A: Constraints include high investment risks, limited exit opportunities, complex regulatory frameworks, economic volatility, and compliance challenges, all of which may slow capital deployment and reduce investor appetite.

-

Q: How is the market segmented by sector?A: The market is segmented into Technology & IT, Healthcare & Life Sciences, Consumer & Media, and Energy & Others. Among these, the Technology & IT segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

-

Q: How is the market segmented by funding type?A: The market is segmented into First-Time Venture Funding and Follow-On Venture Funding. Among these, the Follow-On Venture Funding segment dominated the share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

-

Q: Who are the key players in the Japan venture capital investment market?A: Key companies include JAFCO, Globis Capital Partners, Global Brain, ANRI, Coral Capital, Incubate Fund, WiL, Mitsubishi UFJ Capital, Mizuho Capital, SMBC Venture Capital, SBI Investment, Daiwa Corporate Investment, Nissay Capital, DBJ Capital, INCJ, and others

Need help to buy this report?