Japan Timber Construction Market Size, Share, and COVID-19 Impact Analysis, By Timber Type (Softwood, Commercial, and Engineered Wood), By End-Use (Residential and Non-residential), and Japan Timber Construction Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsJapan Timber Construction Market Size Insights Forecasts to 2035

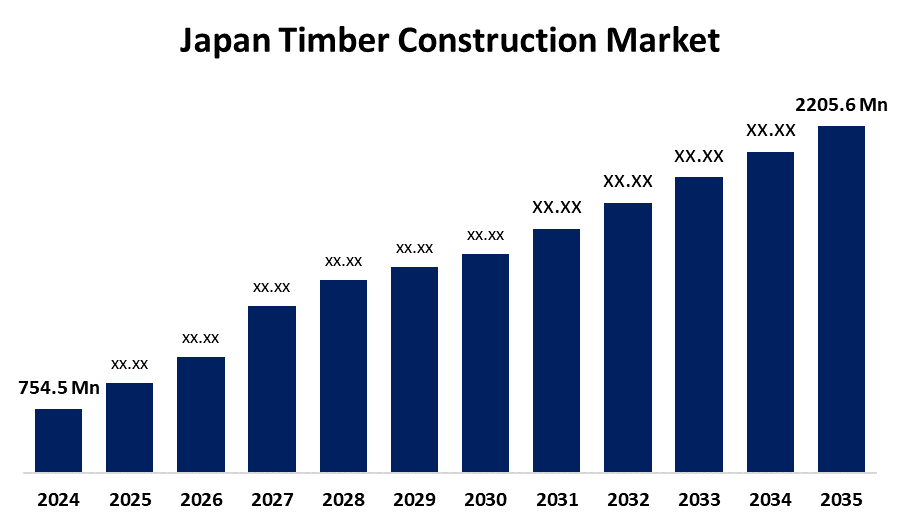

- The Japan Timber Construction Market Size Was Estimated at USD 754.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 10.24% from 2025 to 2035

- The Japan Timber Construction Market Size is Expected to Reach USD 2205.6 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Timber Construction Market Size is anticipated to Reach USD 2205.6 Million by 2035, Growing at a CAGR of 10.24% from 2025 to 2035. The timber construction market in Japan is driven by growing emphasis on sustainable building practices in Japan. Additionally, compared to steel and concrete, which are linked to higher carbon emissions, timber is becoming more and more popular as a renewable and carbon-sequestering material.

Market Overview

Timber construction refers to the use of wood as the primary structural material in building and infrastructure projects. It includes a variety of methods, including hybrid timber solutions, cross-lime timber (CLT), sticky laminate wood (glulam), solid wood frame and engineered wood system. Due to its renewable nature, adaptability, and ability to offer both structural strength and visual appeal, the construction of wood is highly valuable. One of the initial construction materials, Timber has made a return as a permanent option for traditional steel for progress in modern engineering and solid construction. Large spans, long structures, and complex patterns that were previously considered impossible for wood can now be made because CLT, laminate veneer wood (LVL), and engineered wooden content, such as glulam, also improve the underlying strength of wood. Residential houses, commercial buildings, educational institutions, and even multi-story buildings often use wood construction. Improvement in durability, acoustic performance, and fire-resistant treatment has increased its use in urban and high-rise constructions. In addition, the lumber provides natural thermal insulation, which increases the energy efficiency of a building.

Report Coverage

This research report categorizes the market for the Japan timber construction market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan timber construction market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan timber construction market.

Japan Timber Construction Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 754.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.24% |

| 2035 Value Projection: | USD 2205.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 162 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Timber Type, By End-Use and COVID-19 Impact Analysis |

| Companies covered:: | Sumitomo Forestry Co., Ltd., Takenaka Corporation, Shinohara Shoten Co.Ltd., Obayashi Corporation, Itochu Kenzai Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan timber construction market is driven by increased use of engineered wood products such as CLT and Glulam, government law encourages green manufacturing, and increasing demand for environmentally friendly and durable building solutions. The demand is fueled by the timetable of the low building, low carbon footprints, and aesthetic appeal. The expansion of the market is supported by consumer demand for moving urbanization and natural materials.

Restraining Factors

The Japan timber construction market is mostly constrained by high upfront expenses, lack of awareness in some areas, and worry about pest resistance, moisture and fire safety. The construction of wood can be widely adopted by the lack of regulatory restrictions in high growth projects and lack of experienced personnel for modern wooden technology.

Market Segmentation

The Japan timber construction market share is classified into timber type and end-use.

- The softwood segment held the highest revenue share in 2024 and is expected to grow at a rapid CAGR during the forecast period.

The Japan timber construction market is segmented by timber type into softwood, commercial, and engineered wood. Among these, the softwood segment held the highest revenue share in 2024 and is expected to grow at a rapid CAGR during the forecast period. This is due to mild and simple, softwoods such as spruce, pine, and FIR are often used in both residential and non-residential construction. To meet the growing environmental and regulatory requirements, softwood wood is usually obtained from forests that are continuously managed.

- The non-residential is expected to grow at the fastest CAGR over the forecast period.

The Japan timber construction market is segmented by end-use into residential and non-residential. Among these, the non-residential is expected to grow at the fastest CAGR over the forecast period. This is due to increasing needs for environmentally efficient and architectural building solutions in public infrastructure, commercial, and educational projects. Office, schools, hotels, and community centers are adopting wood due to its aesthetic appeal, low construction time, and better environmental performance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan timber construction market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sumitomo Forestry Co., Ltd.

- Takenaka Corporation

- Shinohara Shoten Co.Ltd.

- Obayashi Corporation

- Itochu Kenzai Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan timber construction market based on the below-mentioned segments:

Japan Timber Construction Market, By Timber Type

- Softwood

- Commercial

- Engineered Wood

Japan Timber Construction Market, By End-Use

- Residential

- Non-Residential

Frequently Asked Questions (FAQ)

-

Q: What is the market size of the Japan Timber Construction Market in 2024?A: The market size was valued at USD 754.5 million in 2024.

-

Q: What is the expected market size by 2035?A: It is projected to reach USD 2205.6 million by 2035.

-

Q: What is the CAGR of the Japan Timber Construction Market during 2025–2035?A: The market is expected to grow at a CAGR of 10.24%.

-

Q: What factors are driving the Japan timber construction market?A: Key drivers include the increased use of engineered wood (CLT, Glulam), government support for green building laws, and rising demand for eco-friendly, durable building materials.

-

Q: What are the restraining factors in the Japan timber construction market?A: Major restraints are high upfront costs, fire and pest safety concerns, limited awareness, and a shortage of skilled professionals in modern timber technologies.

-

Q: Why is softwood leading in timber construction in Japan?A: Because spruce, pine, and fir are widely available, lightweight, cost-effective, and sourced from sustainably managed forests.

-

Q: Which end-use is growing fastest?A: The non-residential segment is growing at the fastest CAGR due to demand in offices, schools, hotels, and community projects.

-

Q: Who are the key players in the Japan timber construction market?A: Key companies include Sumitomo Forestry, Takenaka Corporation, Shinohara Shoten, Obayashi Corporation, and Itochu Kenzai.

-

Q: Which target audiences are most relevant for this market?A: The market targets construction firms, investors, government bodies, research organizations, and end-users in residential and non-residential sectors.

Need help to buy this report?