Japan Thermoplastic Vulcanizates Market Size, Share, By Grade (Natural, Standard Black, Pre-Colored, and Others), By Application (Automotive, Construction & Architecture, Consumer goods, Electric & Electronics, Medical & Healthcare, and Others), Japan Thermoplastic Vulcanizates Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Thermoplastic Vulcanizates Market Size Insights Forecasts to 2035

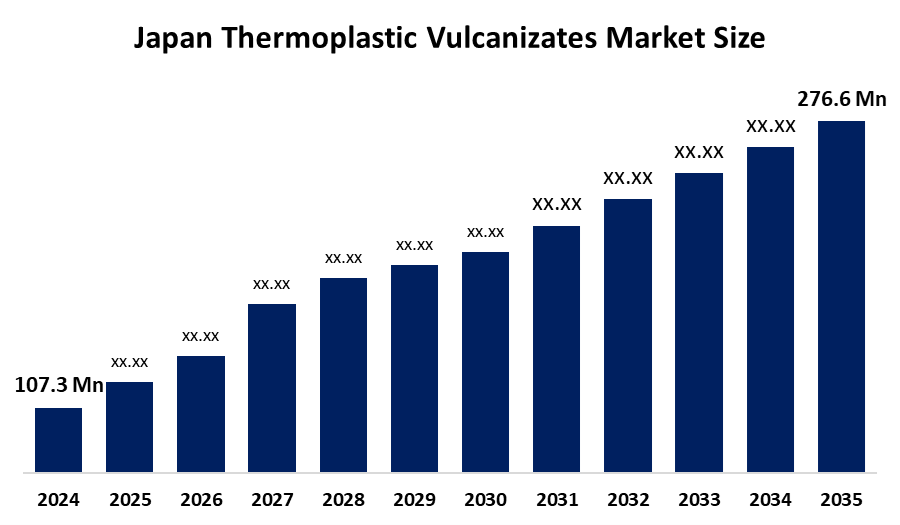

- Japan Thermoplastic Vulcanizates Market Size 2024: USD 107.3 Mn

- Japan Thermoplastic Vulcanizates Market Size 2035: USD 276.6 Mn

- Japan Thermoplastic Vulcanizates Market Size CAGR 2024: 8.99%

- Japan Thermoplastic Vulcanizates Market Size Segments: Grade and Application.

Get more details on this report -

Japan's Thermoplastic Vulcanizates (TPV) Market Size is the portion of the polymer market, which utilises polymers to manufacture elastomeric products, that incorporates the elastic properties of vulcanised rubber and the benefits of thermoplastic processing and recyclability. Thermoplastic vulcanizate products are generated via dynamic vulcanisation, where very fine rubber particles are put into a thermoplastic matrix. TPVs provide very high resistance to chemical and weather damage, good durability, and can be easily moulded into shapes. The automotive sealing industry, hoses, gaskets, interior trim, and under-hood components are typical applications for TPV products in Japan, as Japan has a strong automotive and manufacturing base.

The Japanese government has been instrumental in creating a favourable environment for tpv products through various government initiatives focusing on sustainability, energy efficiency, and advanced manufacturing practices. For example, the Ministry of Economy, Trade, and Industry (METI) is actively promoting the use of lightweight and recyclable materials to help reduce carbon emissions in the automotive sector. In addition, various Government-supported initiatives promoting smart manufacturing, material innovations, and carbon neutrality by 2050 will indirectly create increased demand for high-performing and eco-friendly thermoplastic vulcanizate products.

The technological advancements of thermoplastic vulcanizates in Japan involve the introduction of high-performance, speciality thermoplastic vulcanizates that are engineered with greater levels of heat and oil resistance as well as low-temperature flexibility. In addition to improving versatility, the development of new methods of polymer blending and dynamic vulcanisation has resulted in greater consistency and mechanical strength of these materials. Many Japanese manufacturers are now concentrating their efforts on producing TPV from eco-friendly, bio-based, and recycled resins to achieve their company's commitment to becoming more sustainable and environmentally responsible. The continued advancement of next-generation automotive, electronics, and industrial markets is further contributing to the expansion of the thermoplastic vulcanizates market in Japan.

Japan Thermoplastic Vulcanizates Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 107.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.99% |

| 2035 Value Projection: | 276.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Grade, By Applicaton |

| Companies covered:: | Mitsui Chemicals, Inc., Sumitomo Chemical Co., Ltd., JSR Corporation, Kuraray Co., Ltd., Toray Industries, Inc., Asahi Kasei Corporation, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Thermoplastic Vulcanizates Market Size:

The Japanese thermoplastic vulcanizates market is driven by a strong demand from the automotive sector, where thermoplastic vulcanizates are increasingly used to reduce vehicle weight and improve fuel efficiency, and are needed to help companies to comply with the strict emission requirements coming from various countries. Electric vehicles (EVs) further increase the need for thermoplastic vulcanizates due to their ability to be flexible, durable, and recyclable in comparison to the traditional flexible foams and plastics used in the production of vehicles. The thermoplastic vulcanizates market has grown because of the increasing number of thermoplastic vulcanizates manufactured for use in various consumer products, electronic and medical applications, as well as Japan's emphasis on using sustainable and recyclable materials.

There are barriers to the wider adoption of thermoplastic vulcanizates, as the high cost of raw materials like rubber and speciality polymers limits the number of companies that produce thermoplastic vulcanizates. Thermoplastic vulcanizates must compete with other elastomer products, such as silicone rubber. Additionally, TPVs have unique processing requirements, and the lack of knowledge among many small manufacturers about their usage and processing methods.

There will continue to be growth opportunities with the ongoing development of bio-based and recycled thermoplastic vulcanizates, increased use in the healthcare and medical fields as well as increased demand from the infrastructure and electronics industries, supported by Japan's circular economy initiatives and material innovations.

Market Segmentation

The Japan Thermoplastic Vulcanizates Market Size share is classified into grade and application.

By Grade:

The Japan Thermoplastic Vulcanizates Market Size is divided by grade into natural, standard black, pre-colored, and others. Among these, the natural segment held the largest share in 2024 and is anticipated to grow at the highest CAGR during the predicted timeframe. Natural grade thermoplastic vulcanizates are uncoloured or naturally colored variations of thermoplastic vulcanizates that are valued for their versatility and ease of customisation. These materials are widely employed in a variety of industries because of their inherent qualities, which include flexibility, durability, and resistance to chemicals and extreme temperatures.

By Application:

The Japan Thermoplastic Vulcanizates Market Size is divided by application into automotive, construction & architecture, consumer goods, electric & electronics, medical & healthcare, and others. Among these, the automotive segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is due to the growing demand for lightweight and high-performance materials in the automotive industry, which is projected to boost the demand for thermoplastic vulcanizates (TPV).

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Thermoplastic Vulcanizates Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Thermoplastic Vulcanizates Market Size:

- Mitsui Chemicals, Inc.

- Sumitomo Chemical Co., Ltd.

- JSR Corporation

- Kuraray Co., Ltd.

- Toray Industries, Inc.

- Asahi Kasei Corporation

- Others

Recent Developments in Japan Thermoplastic Vulcanizates Market Size:

In May 2025, Mitsui Chemicals, Inc. and Hagihara Industries collaborated to develop a new technique to homogenise the viscosity of recovered plastics, thereby enhancing recycled material quality and supporting circular economy goals related to TPV recycling and sustainability.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Thermoplastic Vulcanizates Market Size based on the below-mentioned segments:

Japan Thermoplastic Vulcanizates Market Size, By Grade

- Natural

- Standard Black

- Pre-Colored

- Others

Japan Thermoplastic Vulcanizates Market Size, Application

- Automotive

- Construction & Architecture

- Consumer goods

- Electric & Electronics

- Medical & Healthcare

- Others

Frequently Asked Questions (FAQ)

-

What is the Japan thermoplastic vulcanizates (TPV) Market?The Japan TPV market refers to the segment of the polymer industry that produces elastomeric materials combining the elasticity of vulcanised rubber with the processing flexibility and recyclability of thermoplastics. TPVs are widely used in automotive, consumer goods, electronics, construction, and medical applications due to their durability, chemical resistance, and ease of moulding.

-

What is the market size and growth outlook for Japan thermoplastic vulcanizates?The Japan Thermoplastic Vulcanizates Market Size was valued at USD 107.3 million in 2024 and is projected to reach USD 276.6 million by 2035, growing at a CAGR of 8.99% during the forecast period 2025–2035.

-

Which grade segment held the largest share of the Japanese thermoplastic vulcanizates market?The natural grade segment held the largest market share in 2024. Its versatility, ease of customisation, and strong mechanical and thermal properties make it widely preferred across multiple applications.

-

What are the key drivers of the Japan Thermoplastic Vulcanizates Market Size?Major drivers include strong automotive manufacturing, rising electric vehicle production, demand for lightweight and fuel-efficient materials, and Japan’s emphasis on sustainable and recyclable polymer solutions.

-

Who are the key players in the Japan Thermoplastic Vulcanizates Market Size?Key companies include Mitsui Chemicals, Inc., Sumitomo Chemical Co., Ltd., JSR Corporation, Kuraray Co., Ltd., Toray Industries, Inc., and Asahi Kasei Corporation, along with other regional and global players.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?