Japan Smokeless Tobacco Market Size, Share, By Product Type (Chewing Tobacco, Moist Snuff, US-Style Moist Snuff, Swedish Style Snus), By Distribution Channel (Supermarkets/Hypermarkets, Convenience/Grocery Stores, Online Retail Stores, Other Distribution Channels), Japan Smokeless Tobacco Market Insights, Industry Trend, Forecasts to 2035.

Industry: Consumer GoodsJapan Smokeless Tobacco Market Insights Forecasts to 2035

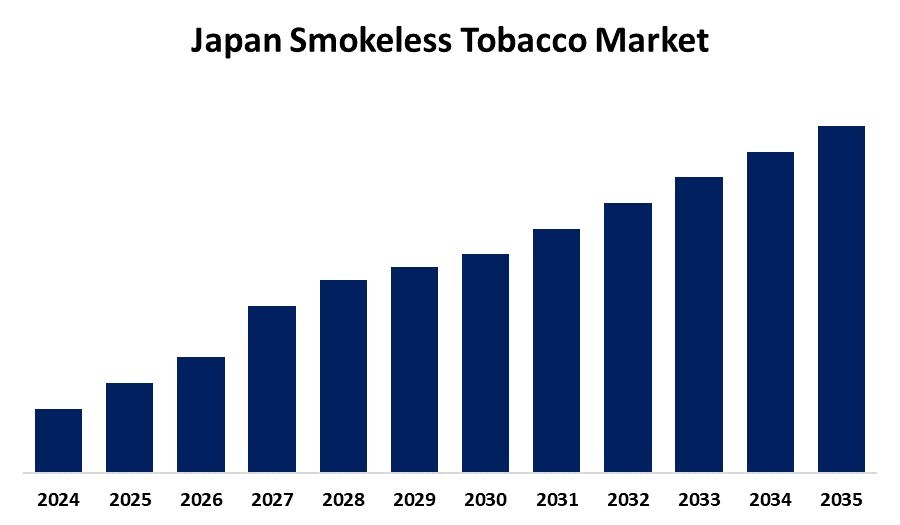

- Japan Smokeless Tobacco Market CAGR 2024: 8.87%

- Japan Smokeless Tobacco Market Segments: Product Type and Distribution Channel

Get more details on this report -

The Japan smokeless tobacco market operates through products which include chewing tobacco moist snuff US-style moist snuff dip and Swedish-style snus as tobacco alternatives that do not require burning. Adult consumers use these products because they want to find safer tobacco products which supply nicotine and match their personal usage patterns. The market grows because more people become health-conscious and governments implement anti-smoking programs and more adults choose smoke-free tobacco products.

Advanced manufacturing technologies use improved flavor formulations and nicotine content standardization and portion-controlled packaging to create better product quality and enhance consumer experience. The Ministry of Health Labour and Welfare performs regulatory oversight to ensure products meet safety requirements and their labeling contains accurate information and they meet quality standards. Online retail channel expansion and flavored product development and product customization for niche market consumers will create future growth opportunities. Japan experiences rapid growth in its smokeless tobacco market because urbanization increases and disposable income rises and consumers prefer tobacco products with reduced health risks.

Market Dynamics of the Japan Smokeless Tobacco Market:

The Japan smokeless tobacco market is driven by increasing consumer preference for smoke-free alternatives, rising health awareness about the harmful effects of conventional smoking, and government campaigns promoting reduced-risk tobacco products. Growth is also supported by innovations in flavored and portion-controlled products and the expansion of convenient retail and e-commerce channels.

The market is restrained by strict regulatory compliance, high excise taxes on tobacco products, and societal stigma against tobacco use. Limited consumer awareness of smokeless tobacco options, potential health concerns related to nicotine consumption, and competition from conventional cigarettes and heated tobacco products further limit adoption. Operational costs for product development, quality control, and compliance also pose barriers to market entry.

The Japan smokeless tobacco market presents opportunities through product innovation, including flavored, reduced-nicotine, and personalized offerings, as well as expansion via online sales and subscription models. Collaboration between manufacturers and retail platforms, increased focus on harm reduction, and growing urbanization are expected to drive long-term adoption and revenue growth.

Japan Smokeless Tobacco Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.87% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 87 |

| Segments covered: | By Product Type, By Distribution Channel |

| Companies covered:: | Japan Tobacco Inc. (JT), Philip Morris International (PMI), British American Tobacco (BAT), KT&G Corporation, and Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan smokeless tobacco market share is classified into product type and distribution channel.

By Product Type:

The Japan smokeless tobacco market is divided by product type into chewing tobacco, moist snuff, US-style moist snuff (dip), and Swedish style snus. Among these, the chewing tobacco segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Chewing tobacco dominates due to strong cultural preference, established consumption habits, easy availability in retail outlets, growing product variety, and increasing adoption among adult male consumers seeking alternatives to smoking in Japan.

By Distribution Channel:

The Japan smokeless tobacco market is divided by distribution channel into supermarkets/hypermarkets, convenience/grocery stores, online retail stores, and other distribution channels. Among these, the convenience/grocery stores segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Convenience/grocery stores dominate because of widespread geographic presence, easy accessibility, frequent consumer visits, promotional discounts, and impulse purchases driving higher sales compared to other retail channels in Japan.

Top Key Companies in Japan Smokeless Tobacco Market:

- Japan Tobacco Inc. (JT)

- Philip Morris International (PMI)

- British American Tobacco (BAT)

- KT&G Corporation

- Others

Recent Developments in Japan Smokeless Tobacco Market:

In May 2025, Japan Tobacco Inc. (JT) announced the launch of Ploom AURA and EVO heated tobacco sticks in Japan, initially available through Ploom stores and the CLUB JT online shop, with a nationwide convenience store rollout scheduled from July 1, 2025.

In June 2025, British American Tobacco (BAT) launched glo Hilo, a new premium heated tobacco device featuring TurboStart technology, across Japan, targeting advanced user convenience and enhanced tobacco experience.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan smokeless tobacco market based on the below-mentioned segments:

Japan Smokeless Tobacco Market, By Product Type

- Chewing Tobacco

- Moist Snuff

- US-Style Moist Snuff (Dip)

- Swedish Style Snus

Japan Smokeless Tobacco Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience/Grocery Stores

- Online Retail Stores

- Other Distribution Channels

Frequently Asked Questions (FAQ)

-

What is the Japan smokeless tobacco market size?Japan smokeless tobacco market is expected to grow at a CAGR of 8.87% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by increasing consumer preference for smoke-free alternatives, rising health awareness about harmful effects of conventional smoking, innovations in flavored and portion-controlled products, and expansion of convenient retail and e-commerce channels.

-

What factors restrain the Japan smokeless tobacco market?Constraints include strict regulatory compliance, high excise taxes on tobacco products, societal stigma against tobacco use, limited consumer awareness of smokeless tobacco options, potential health concerns, and competition from conventional cigarettes and heated tobacco products.

-

Who are the key players in the Japan smokeless tobacco market?Key companies include Japan Tobacco Inc. (JT), Philip Morris International (PMI), British American Tobacco (BAT), KT&G Corporation, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?