Japan Smart Homes Market Size, Share, and COVID-19 Impact Analysis, By Product (Security & Access Control Devices, Energy & Electrical Controls, Climate & Environmental Controls, Smart Appliances, Smart Speakers & Voice Interfaces, Other Devices), By Technology (wireless Communication, Cellular Technologies, Mobile App Platforms), By Construction (New construction, Retrofit) and Japan Smart Homes Market Insights, Industry Trend, Forecasts to 2035

Industry: Semiconductors & ElectronicsJapan Smart Home Market Insights Forecasts to 2035

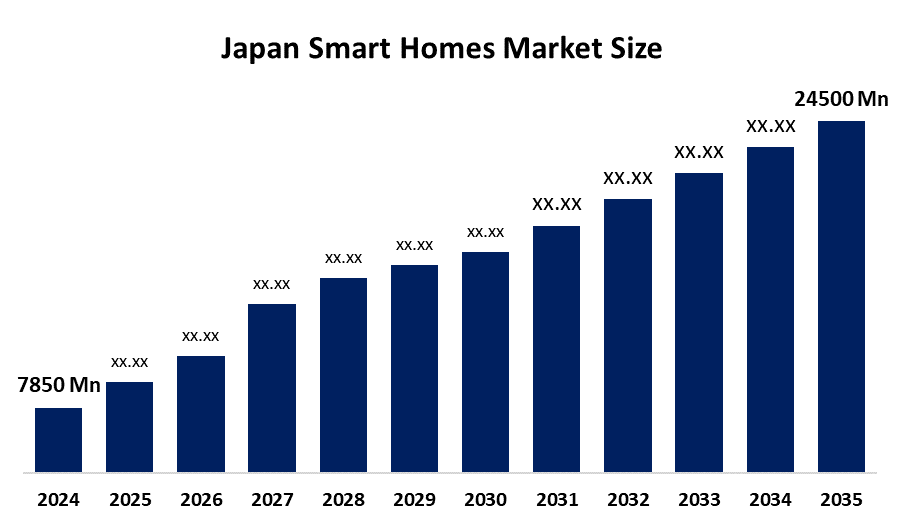

- The Japan Smart Homes Market Size Was Estimated at USD 7850 Million in 2024.

- The Market Size is expected to grow at a CAGR of around 10.9% from 2025 to 2035.

- The Japan Smart Homes Market Size is expected to reach USD 24500 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Smart Homes Market Size is Expected to Grow from USD 7,850 Million in 2024 to USD 24500 Million by 2035, Growing at a CAGR of 10.9% During the Forecast Period 2025-2035. The market is driven by several key factors, including the rapid adoption of IoT & connected technologies, aging population & assisted living needs, and government support.

Market Overview

The Japan Smart Homes Market Size refers to the market for connected residential technologies and systems that enable automation, remote control, monitoring, and integration of household functions such as lighting, security, heating and cooling, appliances, entertainment, and energy management. These systems operate through Internet of Things (IoT) platforms, artificial intelligence (AI), and networked devices.Smart homes allow homeowners to control and optimize multiple household systems via smartphones, central hubs, voice assistants, or dedicated applications, significantly enhancing convenience, safety, energy efficiency, and overall lifestyle comfort. In Japan, the market is characterized by rising demand for energy-efficient housing, increasing adoption of IoT-enabled devices, and growing consumer preference for smart solutions that offer both convenience and security.The Japanese government plays an active role in promoting the smart homes sector through a wide range of initiatives and policies focused on energy efficiency, sustainability, and digital infrastructure development. These efforts include the implementation of energy-efficient housing standards, financial incentives and grants for smart and energy-saving home technologies, and strong support for smart city and connected living projects. Collectively, these initiatives are steadily driving the growth and maturity of the smart homes market in Japan.

Report Coverage

This research report categorizes the market for Japan Smart Homes Market Size based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan smart homes market. Recent market developments and competitive strategies, including expansion, product launches, developments, partnerships, mergers, and acquisitions, have been incorporated to illustrate the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan smart homes market.

Japan Smart Homes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7850 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 10.9% |

| 2035 Value Projection: | USD 24500 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Product, By Technology |

| Companies covered:: | Sony Corporation, Panasonic Corporation, Toshiba Corporation, Hitachi, Ltd., Mitsubishi Electric Corporation, NEC Corporation, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan Smart Homes Market Size is driven by several key factors, including the rapid adoption of Internet of Things (IoT) and artificial intelligence (AI) technologies, the growing demand for energy-efficient and environmentally friendly homes, and the increasing focus on residential security and convenience.Additionally, Japan’s aging population is accelerating the need for assisted-living and smart healthcare solutions within homes. A well-developed digital infrastructure, high smartphone penetration, and strong government support for smart city initiatives and energy-efficient housing further contribute to market expansion and sustained growth.

Restraining Factors

Market growth is restrained by the high initial installation costs of smart home systems, concerns related to data privacy and cybersecurity, interoperability issues among devices from different manufacturers, and limited consumer awareness across certain segments. Additionally, complex system integration requirements and resistance from traditional households continue to hinder the rapid adoption and expansion of the market.

Market Segmentation

The Japan Smart Home Market share is classified into product, technology, and construction.

- The security & access control devices accounted for the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Security and access control devices accounted for the largest revenue share in 2024 and are expected to grow at a significant CAGR during the forecast period. The market is segmented into security and access control devices, energy and electrical controls, climate and environmental controls, smart appliances, smart speakers and voice interfaces, and other smart devices.

Among these, the security and access control segment dominated the market in 2024, driven by the increasing adoption of smart cameras, video doorbells, smart locks, and motion sensors. Growing awareness of real-time monitoring and surveillance through smartphones has further strengthened demand. Additionally, security devices often serve as the entry point for smart home adoption, contributing to their higher revenue share.

- The wireless communication segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Wireless communication held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Based on technology, the market is segmented into wireless communication, cellular technologies, and mobile application platforms. The dominance of wireless communication is attributed to its wide accessibility, high-speed connectivity, and compatibility with a broad range of smart home devices, making it the preferred technology choice among consumers.

- The retrofit driving segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The retrofit segment accounted for the largest share in 2024 and is projected to grow at a significant CAGR during the forecast period. The Japan Smart Home Market Size is segmented by construction into new construction and retrofit. The dominance of the retrofit segment is driven by Japan’s extensive base of existing residential buildings, where homeowners prefer gradual, device-by-device adoption rather than full smart system integration during construction. Cost-effective retrofit solutions are easy to install, compatible with existing infrastructure, and more appealing than smart systems designed exclusively for new housing projects.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Smart Home Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market

List of Key Companies

- Sony Corporation

- Panasonic Corporation

- Toshiba Corporation

- Hitachi, Ltd.

- Mitsubishi Electric Corporation

- NEC Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japanese smart homes market based on the following segments:

Japan Smart Homes Market, By Product

- Security & Access Control Devices

- Energy & Electrical Controls

- Climate & Environmental Controls

- Smart Appliances

- Smart Speakers & Voice Interface

- Other Devices

Japan Smart Homes Market, By Technology

- Wireless Communication

- Cellular Technologies

- Mobile App Platforms

Japan Smart Homes Market, By Construction

- New Construction

- Retrofit

Frequently Asked Questions (FAQ)

-

1. What is the base year for the Japan Smart Homes Market study?The base year for the Japan Smart Homes Market study is 2024, which serves as the reference point for market sizing and forecasting.

-

2. What is the market size of the Japan Smart Homes Market in 2024?The Japan Smart Homes Market was valued at USD 7,850 million in 2024.

-

3. What is the expected market size by 2035?The market is expected to reach approximately USD 24500 million by 2025.

-

4. What is the projected CAGR of the Japan Smart Homes Market?The market is projected to grow at a CAGR of 10.9% during the forecast period 2025–2035.

-

5. Which product segment dominated the market in 2024?The security & access control devices segment dominated the market in 2024.

Need help to buy this report?