Japan Smart Grid Market Size, Share, By Components (Hardware, Software, and Services), By End-User (Residential, Corporate, and Government), Japan Smart Grid Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerJapan Smart Grid Market Insights Forecasts to 2035

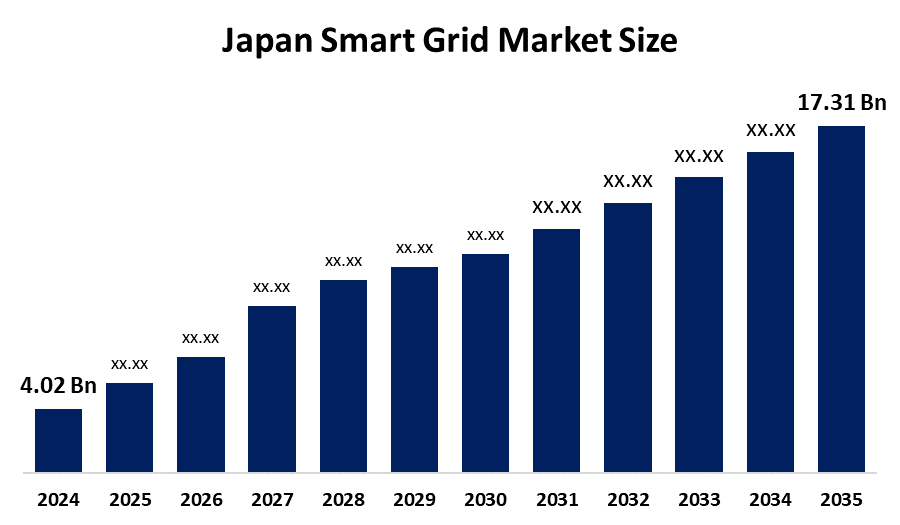

- Japan Smart Grid Market Size 2024: USD 4.02 Bn

- Japan Smart Grid Market Size 2035: USD 17.31 Bn

- Japan Smart Grid Market CAGR 2024: 14.19%

- Japan Smart Grid Market Segments: Components and End-User.

Get more details on this report -

Japan's smart grid market comprises advanced electric power networks that leverage digital communication technologies, automatic transmission of electricity, advanced automation and control to optimise the generation, transmission, distribution and consumption of electric power. As Japan progresses toward low-carbon energy, smart grids are instrumental in providing solutions to several energy-related problems, including energy security, an ageing electric grid, disaster readiness and management, along with the integration of renewable energy resources.

The Japanese government has consistently supported the development of smart grid technology through long-term energy and digital transformation strategy policies. The Ministry of Economy, Trade, and Industry has played a key role in promoting smart grids as a prominent objective within Japan's Strategic Energy Plan, which emphasises the integration of renewable energies into existing electric grids, ensuring the stability of electric grids, the efficiency of electricity, and making sure all sectors of the Japanese economy can benefit from smart grids. in addition, initiatives to achieve a commitment of carbon neutrality by 2050 have accelerated the investment in smart grid technology, enabling more incorporation of solar and wind energy sources into the electric grid.

The technological advancement of the Japanese smart grid focuses on the implementation of advanced metering infrastructure (AMI), artificial intelligence (AI), internet of things (IoT), and energy management systems (EMS). Also, Utility Companies have begun installing smart meters, which will allow the collection of readings in real-time, dynamic price settings, and demand-side management. Additionally, there are grid management platforms that use AI and Data Analysis to improve load forecasting & fault detection, and grid optimisation. Finally, Japan has also developed its Vehicle-to-Grid (V2G) technology, which enables Electric Vehicles (EVs) to act as a mobile energy storage unit.

Japan Smart Grid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.02 Bn |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 14.19% |

| 2035 Value Projection: | USD 17.31 Bn |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Components, By End-User |

| Companies covered:: | Tokyo Electric Power Company (TEPCO), Kansai Electric Power Co., Inc., Chubu Electric Power Co., Inc., Hokkaido Electric Power, Kyushu Electric Power, Chugoku Electric Power, Hitachi Ltd., Mitsubishi Electric Corporation, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Smart Grid Market:

The Japanese smart grid market is driven by the integration of renewable energy sources into the national grid through solar and wind resources, which requires maintaining stability and reliability. The governments’ commitment to carbon neutrality by 2050, the burgeoning electricity demand, and the ageing infrastructure modernisation will significantly increase the pace of advanced smart grid rollouts. Growth in the electric vehicle, energy storage, and disaster-resilient power networks will create opportunities for further smart grid market growth.

the Japan smart grid market is restrained by high initial investment required for smart grid infrastructure development, concerns related to cybersecurity, and the complexity of integrating new technologies into an old-style infrastructure system. Also, regulatory barriers and interoperability challenges associated with a network of utilities and technology suppliers are likely to continue to delay the adoption of smart grid technology.

Growth opportunities of the Japanese smart grid market include expansion of advanced metering infrastructure, AI-based grid management, microgrids for remote or disaster-prone areas, and increased investment in energy storage and digital energy management solutions.

Market Segmentation

The Japan Smart Grid Market share is classified into components and end-users.

By Components:

The Japanese smart grid market is divided by components into hardware, software, and services. Among these, the hardware segment held the largest market share in 2024 and is anticipated to grow at the highest CAGR during the predicted timeframe. This is due to the extensive infrastructure required for smart grid deployment, including physical components such as sensors, meters, and storage systems.

By End-User:

The Japan smart grid market is divided by end-user into residential, corporate, and government. Among these, the residential segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is due to rising emphasis on energy efficiency and demand response systems. Residential users play an important role in the general adoption of smart grid capabilities by using home automation systems and smart meters.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan smart grid market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Smart Grid Market:

- Tokyo Electric Power Company (TEPCO)

- Kansai Electric Power Co., Inc.

- Chubu Electric Power Co., Inc.

- Hokkaido Electric Power

- Kyushu Electric Power

- Chugoku Electric Power

- Hitachi Ltd.

- Mitsubishi Electric Corporation

- Others

Recent Developments in Japan Smart Grid Market

In March 2025, Hitachi announced the expansion of its AI-based energy management and grid optimisation solutions for domestic utilities, focusing on improving renewable energy integration and grid stability using real-time data analytics.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan smart grid market based on the following segments:

Japan Smart Grid Market, By Components

- Hardware

- Software

- Services

Japan Smart Grid Market, End-User

- Residential

- Corporate

- Government

Frequently Asked Questions (FAQ)

-

Q: What is the market size and growth outlook for Japan’s smart grid market?A: The market was valued at USD 4.02 Billion in 2024 and is expected to reach USD 17.31 Billion by 2035, growing at a strong CAGR of 14.19% during the forecast period 2025–2035.

-

Q: Which component segment dominates the Japanese smart grid market?A: The hardware segment held the largest market share in 2024, driven by high demand for smart meters, sensors, communication devices, and energy storage systems required for large-scale smart grid deployment.

-

Q: Which end-user segment leads the Japan smart grid market?A: The residential segment leads the market in 2024 due to increasing adoption of smart meters, home energy management systems, and demand-response programs focused on improving household energy efficiency.

-

Q: What are the key drivers of the Japan smart grid market?A: Major drivers include renewable energy integration, government commitment to carbon neutrality by 2050, modernisation of ageing power infrastructure, growing electricity demand, and rising adoption of electric vehicles and energy storage systems.

-

Q: What challenges restrain the growth of the Japanese smart grid market?A: High initial investment costs, cybersecurity risks, complexity of integrating smart technologies with legacy grid systems, regulatory barriers, and interoperability issues among utilities and technology providers restrain market growth.

-

Q: Who are the key players in the Japanese smart grid market?A: Key players include Tokyo Electric Power Company (TEPCO), Kansai Electric Power Co., Chubu Electric Power Co., Hokkaido Electric Power, Kyushu Electric Power, Chugoku Electric Power, Hitachi Ltd., and Mitsubishi Electric Corporation.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?