Japan Seeds Market Size, Share, By Category (Organic and Conventional), By Crop Type (Cereals & Grain, Fruits & Vegetables, Oilseeds & Pulses, and Others), Japan Seeds Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureJapan Seeds Market Insights Forecasts to 2035

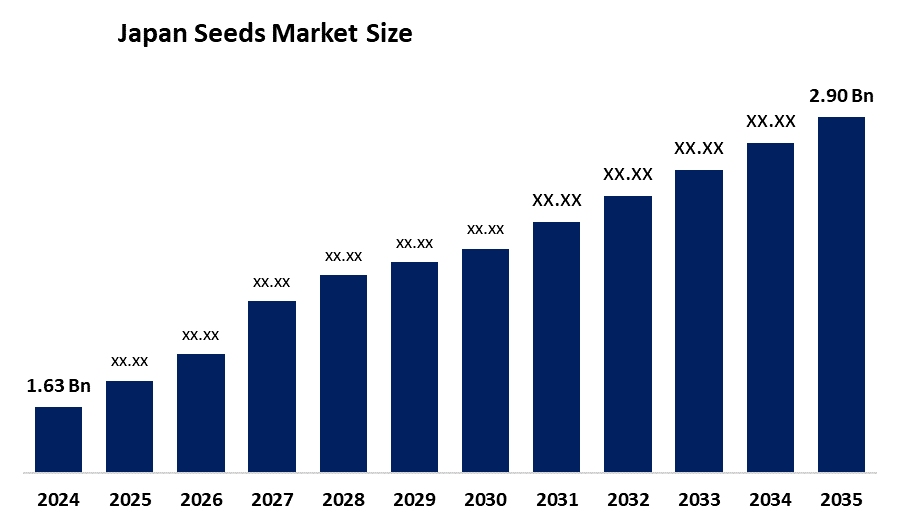

- Japan Seeds Market Size 2024: USD 1.63 Bn

- Japan Seeds Market Size 2035: USD 2.90 Bn

- Japan Seeds Market CAGR 2024: 5.38%

- Japan Seeds Market Segments: Category and Crop Type.

Get more details on this report -

The seed market in Japan is comprised of businesses that produce, develop, and distribute high-quality seeds that can be used in agriculture, horticulture, and commerce. The qualities that distinguish these seeds are genetic purity, high germination rate, and specific traits such as disease resistance and adaptability to climatic challenges, allowing for maximum yield in the limited space of Japan's agricultural land. Significant trends in this market include an increasing consumer preference for organic and non-GMO seed options, as health consciousness continues to grow amongst Japanese consumers. Another trend is the growing popularity of "functional" seeds such as flaxseed and hemp seeds, used as ingredients in nutraceuticals and cosmetics.

In Japan, the government is working diligently to grow domestic markets through the use of sustainability-oriented policy and legislation focused on food security. A new law focused on national food security was recently passed in May 2024. An eco-labeling system has also been introduced, measuring the reduction of greenhouse gas emissions in 23 types of agricultural products, and providing incentives to produce high-quality certified seeds. There are also private sector initiatives being taken to promote climate-smart agricultural practices, such as AI and IoT-based initiatives being developed in partnership with major companies, including BASF Digital Farming and ZEN-NOH, which will allow farmers to digitize their seed production process.

Advancements in seed treatment technology have contributed to the impact that technology has had on seed market evolution. With the help of these technological innovations, a greater variety of products can now be developed using genetic engineering, CRISPR, and biotechnology-based methods to develop resistant crops to not only insects but also weather variations. Advancements in seed coating technology have resulted in microencapsulation and multilayer seed coatings to supply nutrients to seedlings while providing a protective shield at the same time, which again helps to reduce the need for large-scale application of chemicals and enhance the productivity capabilities across the board.

Market Dynamics of the Japan Seeds Market:

The seed market in Japan is mainly driven by an increase in the need for food security and the desire for better-performing seed types to achieve maximum crop yield on limited land availability. With an ageing farmer population, we see more precision and smart farming adopting new seed types that have been optimised to be made with technology for automating cultivation. The consumer demand for high-quality seeds that allow for healthier and more functional products will encourage farmers to continue investing in better-quality seed types.

The main challenges of the seeds market in Japan are the rising research costs paired with strict biosafety regulations, which slow down the research and introduction of new traits to market, limit the Japan seeds marketplace. The environmental impact of the utilization of chemical seed treatments, coupled with a declining number of individuals working in agriculture due to an aging population, presents obstacles to the growth of the seeds marketplace.

An opportunity exists in the creation of new, climate-resilient or disease-resistant seed varieties to reduce the impact of severe weather and the increasing pressure for crop protection from pests. Moreover, vertical and urban farming and growing consumer interest in organic and "functional" seeds provide tremendous opportunities for growth for specialized seed companies.

Japan Seeds Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.63 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.38% |

| 2035 Value Projection: | USD 2.90 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Sakata Seed Corporation, Takii & Co., Ltd., Kaneko Seeds Co., Ltd., Snow Brand Seed Co., Ltd., Sanatech Seed Co., Ltd., Kobayashi Seed Co., Ltd., Tokita Seed Co., Ltd., Musashino Seed Co., Ltd., Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan seeds market share is classified into category and crop type.

By Category:

The Japan seed market is divided by category into organic and conventional. Among these, the organic segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is because of their adherence to stringent laws and natural growth methods, organic seeds are respected and have been able to capture a sizable piece of the market. They develop a strong market position by drawing in ecologically conscientious farmers and health-sensitive consumers.

By Crop Type:

The Japan seed market is divided by crop type into cereals & grain, fruits & vegetables, oilseeds & pulses, and others. Among these, the cereals & grain segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is due to their common use in a variety of agricultural techniques and dietary staples, cereals and grains constitute the foundation of the seed industry. They profit from well-established farming infrastructures as well as large investments in innovation and hybrid technologies that boost resilience and yields.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan seeds market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Seeds Market:

- Sakata Seed Corporation

- Takii & Co., Ltd.

- Kaneko Seeds Co., Ltd.

- Snow Brand Seed Co., Ltd.

- Sanatech Seed Co., Ltd.

- Kobayashi Seed Co., Ltd.

- Tokita Seed Co., Ltd.

- Musashino Seed Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan seeds market based on the below-mentioned segments:

Japan Seeds Market, By Category

- Organic

- Conventional

Japan Seeds Market, By Crop Type

- Cereals & Grain

- Fruits & Vegetables

- Oilseeds & Pulses

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the projected market size of the Japan seeds market by 2035?A: The Japan seeds market is expected to grow from USD 1.63 billion in 2024 to USD 2.90 billion by 2035.

-

Q: What is the expected CAGR of the Japan seeds market during the forecast period?A: The market is projected to grow at a CAGR of 5.38% during the forecast period from 2025 to 2035.

-

Q: Which category dominated the Japan seeds market in 2024?A: The organic seeds segment dominated the market in 2024 due to rising demand for sustainable, chemical-free, and high-quality agricultural inputs.

-

Q: Which crop type holds the largest market share in the Japanese seeds market?A: The cereals & grain segment held the largest market share in 2024, driven by their role as dietary staples and strong investments in hybrid and resilient seed technologies.

-

Q: What are the key growth drivers of the Japan seeds market?A: Key growth drivers include increasing focus on food security, limited arable land, adoption of precision farming, and rising demand for organic and functional seeds.

-

Q: Who are the major players in the Japan seeds market?A: Major players include Sakata Seed Corporation, Takii & Co., Ltd., Kaneko Seeds Co., Ltd., Snow Brand Seed Co., Ltd., and Sanatech Seed Co., Ltd.

Need help to buy this report?