Japan Retail Vending Machine Market Size, Share, By Product (Beverage Vending Machines, Snacks Vending Machines, and Food Vending Machines), By Location (Manufacturing, Offices, Colleges & Universities, Hospitals & Nursing Homes, Restaurants, Bars & Clubs, Public Places, and Others), Japan Retail Vending Machine Market Insights, Industry Trend, Forecasts to 2035

Industry: Machinery & EquipmentJapan Retail Vending Machine Market Insights Forecasts to 2035

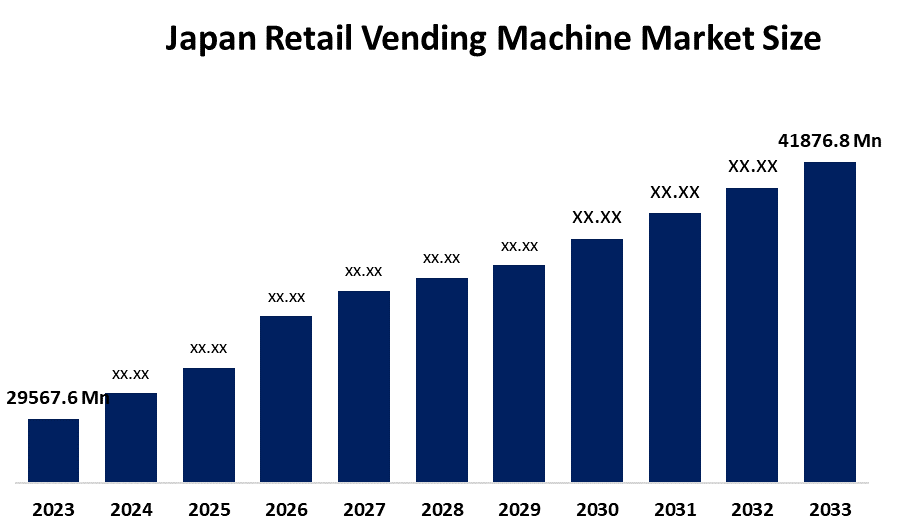

- Japan Retail Vending Machine Market Size 2024: USD 29567.6 Mn

- Japan Retail Vending Machine Market Size 2035: USD 41876.8 Mn

- Japan Retail Vending Machine Market CAGR 2024: 3.21%

- Japan Retail Vending Machine Market Segments: Product and Location.

Get more details on this report -

The Japanese retail market for vending machines includes the development and operation of automated machines that deliver drinks, food, and other products directly to customers. There is a very sophisticated infrastructure that supports the development of vending machines in this country, therefore, there is a great urban demand for these products. Vending machines are an excellent retail option for people who want easy access to their desired products 24 hours a day, seven days a week, in a small space, and expect to receive the same product each time. The stocking of the machines will be determined by the demand of the customers, a selection of premium products for customers, and the installation of energy saving equipment that incorporates real time monitoring capability.

Through policies supporting work efficiency, smart city building, and energy-efficient devices, both public and private activities are supporting the growth of Japan's vending machine ecosystem. Partnerships are being developed between vending machine owners, food & drink manufacturers, and tech firms to create clean, automated, and AI-driven retail solutions. The use of vending machines is increasing among retailers as they extend their presence into locations such as transport hubs, offices, hospitals/doctors' offices, and residential buildings.

The Japanese vending machine industry has been changed by technological improvements such as Internet of Things (IoT) sensor integration, remote level measurement technology, artificial intelligence (AI) based demand prediction, and inventory management systems that are connected to the internet by Cloud-based services. By implementing these technologies, the efficiency of operations has been increased. Today’s advanced vending machines are equipped with advanced predictive maintenance, remote monitoring, adaptive pricing, and improved user interfaces. These innovations allow for increased uptime of machines, decreased operational expenses, and enhanced customer satisfaction.

Market Dynamics of the Japan Retail Vending Machine Market:

The Japanese retail vending machine market is driven by the fact that, as Japan's population becomes more urbanized and less able to work, there is an increasing need for automated retail solutions via vending machines. Additionally, the high level of acceptance of vending machines by consumers in Japan has led to an increase in vending machine purchases supported by cashless payment systems. In addition, the availability of innovative IoT-based products and services that provide monitoring and increase energy savings provides operational enhancement and increased scalability among the various retail venues.

The Japanese retail vending machine market is restrained by the installation of vending machines, including high costs related to machine installation and maintenance, and the fact that there are many locations without an appropriate amount of space available for vending machine installations. Additionally, machine vandalism and regulatory compliance issues may restrict the industry from expanding its walls.

There are many growth opportunities that can arise from the increasing implementation of AI-based solutions, expansion into the healthcare sector, integration into smart city projects, and the continued growth of Personalized Retail Experiences using data.

Japan Retail Vending Machine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 29567.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 3.21% |

| 2035 Value Projection: | USD 41876.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product, By Location |

| Companies covered:: | Fuji Electric Co., Ltd,Sanden Retail Systems orporation,Asahi Soft Drinks Co., Ltd,Coca-Cola Bottlers Japan Inc,DyDo Group Holdings, Inc,Otsuka Pharmaceutical Co., Ltd,Panasonic Holdings Corporation And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan retail vending machine market share is classified into product and location.

By Product:

The Japanese retail vending machine market is divided by product into beverage vending machines, snack vending machines, and food vending machines. Among these, the beverage segment held the largest market revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is due to the rising customer demand for handy, on-the-go refreshment alternatives, as well as developments in vending technology. Furthermore, the need for healthier beverage options, such as cold-pressed juices, functional drinks, and premium coffee, has prompted the spread of vending machines beyond traditional soft drinks.

By Location:

The Japanese retail vending machine market is divided by location into manufacturing, offices, colleges universities, hospitals & nursing homes, restaurants, bars & clubs, public places, and others. Among these, the manufacturing segment held the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The demand for vending machines in manufacturing is growing as businesses strive to improve workplace productivity and employee convenience. These devices allow quick access to snacks, refreshments, and necessary equipment or PPE, lowering downtime and increasing productivity.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Retail Vending Machine market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Retail Vending Machine Market:

- Fuji Electric Co., Ltd.

- Sanden Retail Systems Corporation

- Asahi Soft Drinks Co., Ltd.

- Coca-Cola Bottlers Japan Inc.

- DyDo Group Holdings, Inc.

- Otsuka Pharmaceutical Co., Ltd.

- Panasonic Holdings Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan retail vending machine market based on the below-mentioned segments:

Japan Retail Vending Machine Market, By Product

- Beverage Vending Machines

- Snacks Vending Machines

- Food Vending Machines

Japan Retail Vending Machine Market, By Location

- Manufacturing, Offices

- Colleges & Universities

- Hospitals & Nursing Homes

- Restaurants, Bars & Clubs

- Public Places

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the current size of the Japan retail vending machine market?A: The Japan retail vending machine market was valued at USD 29,567.6 million in 2024 and represents a well-established automated retail ecosystem supported by advanced infrastructure and high consumer acceptance.

-

Q: What is the projected growth rate of the Japan retail vending machine market?A: The market is expected to grow at a CAGR of 3.21% during the forecast period 2025–2035, reaching an estimated value of USD 41,876.8 million by 2035.

-

Q: What factors are driving the growth of the Japan retail vending machine market?A: Market growth is driven by increasing urbanization, labor shortages, strong consumer preference for convenient retail solutions, widespread adoption of cashless payment systems, and integration of IoT-based monitoring and energy-efficient vending technologies.

-

Q: Which product segment dominates the Japan retail vending machine market?A: The beverage vending machines segment dominated the market in 2024 due to high demand for on-the-go refreshments, expansion of premium beverage offerings, and continuous technological advancements in vending solutions.

-

Q: Which location segment holds the largest market share in Japan?A: The manufacturing segment held the largest market share in 2024, driven by the growing need for convenient access to food, beverages, and essential items to improve workforce productivity and reduce operational downtime.

-

Q: Who are the key players operating in the Japan retail vending machine market?A: Key companies in the market include Fuji Electric Co., Ltd., Sanden Retail Systems Corporation, Asahi Soft Drinks Co., Ltd., Coca-Cola Bottlers Japan Inc., DyDo Group Holdings, Inc., Otsuka Pharmaceutical Co., Ltd., Panasonic Holdings Corporation, and other regional players.

-

Q: Who are the target audiences for the Japan retail vending machine market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?