Japan Psoriasis Drugs Market Size, Share, By Drug Type (Biologic Drugs, Small Molecule Systemic Drugs, And Topical Therapies), By Distribution Channel (Retail and E-commerce), and Japan Psoriasis Drugs Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareJapan Psoriasis Drugs Market Insights Forecasts to 2035

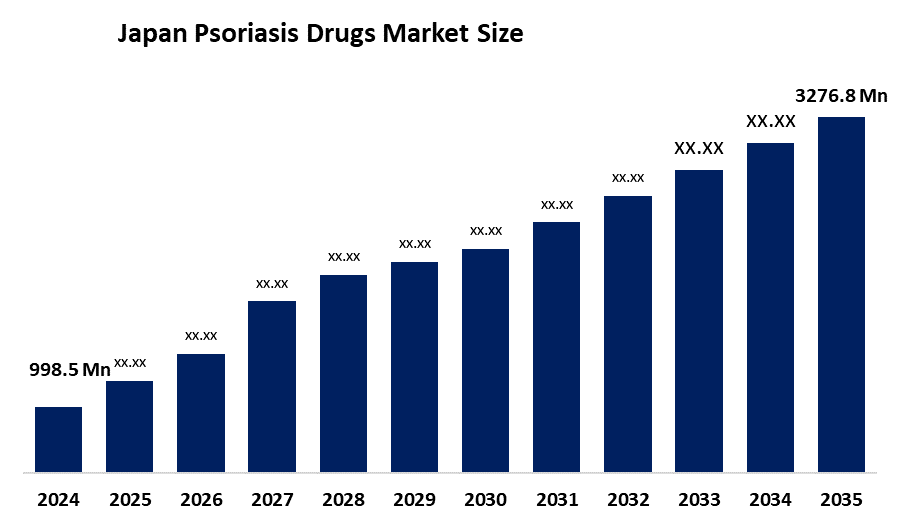

- Japan Psoriasis Drugs Market Size 2024: USD 998.5 Mn

- Japan Psoriasis Drugs Market Size 2035: USD 3276.8 Mn

- Japan Psoriasis Drugs Market CAGR: 11.41%

- Japan Psoriasis Drugs Market Segments: Drug Type and Distribution Channel

Get more details on this report -

The Japanese psoriasis drug market comprises pharmaceuticals that can aid patients in treating their psoriasis, which is a chronic autoimmune disease that affects the skin of patients by causing inflammation and scale formation. The market includes biologics, small-molecule systemic drugs, as well as topical drugs that are effective for treating patients suffering from mild to severe psoriasis. The driving factors for the market growth include increasing awareness of the disease, enhancing diagnostic rates, and increasing acceptance of targeted biologic drugs like IL-17/IL-23 inhibitors. The well-established healthcare system of Japan also fuels market growth.

The Japanese government, through the MHLW and PMDA, also plays an important role in supporting the market. Regulatory measures supporting faster access to novel therapies include priority review pathways, early consultation programs, and innovation-focused approval systems. Finally, Japan's universal health insurance provides wide reimbursement for treatments for psoriasis, including high-cost biologics, significantly improving patient affordability and uptake.

The factors driving the market are technological advances in the modalities that next-generation biologics, oral small-molecule inhibitors, and biosimilars are presenting for the growing circle of treatments. Japan is also embracing AI-assisted drug discovery, precision medicine, and advanced drug-delivery systems, enhancing treatment efficacy, safety, and patient convenience. Digital health tools and improved clinical research capabilities continue to strengthen Japan's psoriasis drug development landscape.

The factors driving the market are technological advances in the modalities that next-generation biologics, oral small-molecule inhibitors, and biosimilars are presenting for the growing circle of treatments. Japan is also embracing AI-assisted drug discovery, precision medicine, and advanced drug-delivery systems, enhancing treatment efficacy, safety, and patient convenience. Digital health tools and improved clinical research capabilities continue to strengthen Japan's psoriasis drug development landscape.

Market Dynamics of the Japan Psoriasis Drugs Market:

The Japanese market for psoriasis drugs is being driven by a mix of clinical, demographic, and healthcare system factors. One of the leading factors is the rise in awareness and diagnosis of psoriasis, which is helped by better dermatological services and patient education. The increasing use of novel biologics and targeted therapies, for example, IL, 17 and IL-23 inhibitors, has resulted in a significant improvement in treatment outcomes, thus fostering greater adoption. The universal health insurance system in Japan guarantees that most treatments for psoriasis, including expensive biologics, will be reimbursed, thereby facilitating patient access and further supporting market growth.

Healthcare budgets are still under pressure due to high treatment costs, especially for novel systemic therapies and biologics, which may restrict the use of treatments in certain patient groups. Long-term safety, immunosuppression, and adverse effects of systemic drugs are concerns that can also influence doctors’ prescribing habits. In addition, the rigorous regulatory and approval procedures in Japan may delay the launch of new treatments.

The market is full of growth opportunities. One of the major reasons is the launch of biosimilars, which are cheaper alternatives to branded biologics, thus increasing the number of patients who can get treated. Besides, the application of AI in the discovery of new drugs, personalization of treatments, and better drug dispensing methods is expected to give more effective results and keep the patients faithful to the treatment. Moreover, growing telemedicine and digital health platforms could greatly help in controlling diseases and also in bringing care to patients who have not been served before.

Japan Psoriasis Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 998.5 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 11.4% |

| 2035 Value Projection: | USD 3276.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Eli Lilly & Company, Pfizer Inc., Janssen Pharmaceuticals, Inc. (Johnson & Johnson), Bristol Myers Squibb Company, Takeda Pharmaceutical Company Limited, Novartis AG, Amgen Inc., AbbVie Inc., AstraZeneca, and Others Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

Japan's Psoriasis Drugs Market share is classified into drug type and distribution channel.

By Drug Type:

The Japan psoriasis drugs market is categorised by drug type into biologic drugs, small-molecule systemic drugs, and topical therapies. Among these, the biological drugs segment dominated the market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The reason for this dominance is the treatment of moderate to severe psoriasis with biologic therapy like TNF-α, IL-17, and IL-23 inhibitors, which have a very effective, specific, and long-lasting mechanism of action.

By Distribution Channel:

The Japan psoriasis drugs market is classified by distribution channel into retail and e-commerce. Among these, the retail segment held the majority market share in 2024 and is predicted to grow at a notable rate in the future. This dominance is primarily driven by the strong presence of hospital and retail pharmacies, which serve as the main point of dispensing for prescription-based psoriasis therapies, particularly biologics and systemic drugs.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan psoriasis drugs market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the Japan Psoriasis Drugs Market:

-

Eli Lilly & Company

-

Pfizer Inc.

-

Janssen Pharmaceuticals, Inc. (Johnson & Johnson)

-

Bristol Myers Squibb Company

-

Takeda Pharmaceutical Company Limited

-

Novartis AG

-

Amgen Inc.

-

AbbVie Inc.

-

AstraZeneca

-

Others

Recent Developments in Japan Psoriasis Drugs Market:

- In December 2024, Japan’s Pharmaceutical and Medical Devices Agency (PMDA) approved a biosimilar version of ustekinumab. This launch increases competition and affordability in the high-cost biologics segment.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japanese psoriasis drugs market based on the following segments:

Japan Psoriasis Drugs Market, By Drug Type

- Biologic Drugs

- Small-molecule systemic drugs

- Topical Therapies

Japan Psoriasis Drugs Market, By Distribution Channel

- Retail pharmacies

- E-commerce

Frequently Asked Questions (FAQ)

-

1.What is the base year and forecast period for the Japan Psoriasis Drugs Market?The base year is 2024, with historical data covering 2020–2023. The forecast period spans from 2025 to 2035.

-

2.What is the current and projected market size of the Japan Psoriasis Drugs Market?The market was valued at USD 998.5 million in 2024 and is expected to reach USD 3,276.8 million by 2035, growing at a CAGR of 11.41% during the forecast period.

-

3.What factors are driving the growth of the Japan Psoriasis Drugs Market?Key drivers include rising awareness and diagnosis of psoriasis, increased adoption of biologic and targeted therapies, strong reimbursement support under Japan’s universal healthcare system, and continuous technological advancements in drug development.

-

4.How is the Japanese Psoriasis Drugs Market segmented?The market is segmented by drug type (biologic drugs, small-molecule systemic drugs, and topical therapies) and by distribution channel (retail pharmacies and e-commerce).

-

5.Which distribution channel holds the largest market share?The retail segment held the majority market share in 2024, driven by the strong presence of hospital and retail pharmacies and the need for professional supervision in prescription-based therapies.

Need help to buy this report?