Japan Protein Water Market Size, Share, By Product Type (Whey Protein Water, Casein Protein Water), By Source (Animal-Based, Plant-Based), By Packaging Type (Bottles, Cans), Japan Protein Water Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesJapan Protein Water Market Size Insights Forecasts to 2035

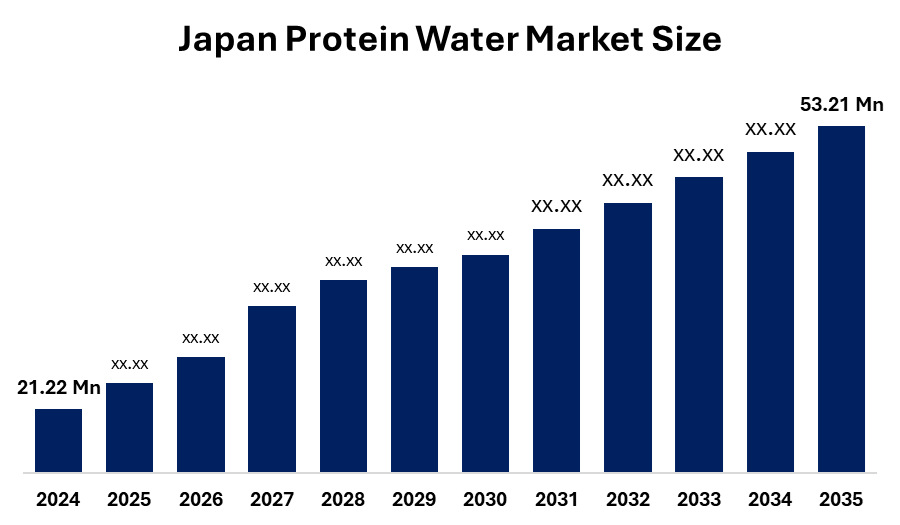

- Japan Protein Water Market Size 2024: USD 21.33 Mn

- Japan Protein Water Market Size 2035: USD 53.21 Mn

- Japan Protein Water Market Size CAGR: 8.67%

- Japan Protein Water Market Size Segments: Product Type, Source, Packaging Type

Get more details on this report -

The Japan Protein Water Market Size is made up of functional ready-to-drink beverages that are enriched with protein and are meant for the purposes of hydration, muscle recovery, weight management, and general wellness support. The market's growth is being powered by the factors of rising health consciousness, increasing rate of adoption of active lifestyles, growing demand for low-calorie functional beverages, and a strong consumer preference for convenient nutrition solutions, especially among Japan's urban population. Protein water is a functional beverage that offers a low-sugar and low-calorie alternative to traditional protein shakes since it combines the two processes of hydration and protein supplementation. Protein water in Japan is considered an entirely new category of beverages with features such as clean-label, light flavors, high bioavailability, and easy digestibility that make it suitable for athletes, working professionals, and the aging population. Among the major trends in the market are the increasing demand for plant-based protein water, minimalist ingredient lists, and the development of products that target fitness, beauty, and healthy aging.

In Japan, government and private-sector initiatives are working hand in hand by conducting Food Science research, promoting health, and providing a regulatory framework based on Foods with Function Claims (FFC) for the support of functional food innovation. Japanese drink companies and health-care supplement manufacturers are making significant investments in protein-based hydration solutions that are consistent with healthier populations and preventive healthcare policies at the national level.

The processing of proteins, microfiltration, masking flavors, and cold bottling have been technological advancements that have greatly impacted protein water by improving its taste, clarity, and stability. Hydrolyzed proteins, plant-protein solubilization technologies, and eco-friendly packaging are some of the innovations that are making products more attractive and prolonging their shelf life, thus speeding up the growth of the market.

Japan Protein Water Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 21.33 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.67% |

| 2035 Value Projection: | 53.21 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Source |

| Companies covered:: | Suntory Holdings Limited, Asahi Group Holdings, Ltd., Kirin Holdings Company, Limited, Meiji Holdings Co., Ltd., Morinaga Milk Industry Co., Ltd., Ajinomoto Co., Inc., Otsuka Pharmaceutical Co., Ltd., Yakult Honsha Co., Ltd., House Foods Group Inc., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Protein Water Market

The Japan Protein Water Market Size is driven by health awareness, fitness and sports activity participation, and the need for convenient nutrition on the go are all factors that contribute to market expansion. The trend of consumers preferring low-sugar functional drinks that are beneficial to their health and provide hydration is on the rise. The elderly population, along with working professionals, is also driving the demand for muscle maintenance and recovery solutions, which in turn is a positive factor for market growth. Besides, the development of new plant-based protein formulations and premium beverage positioning still keeps the demand alive across various consumer segments.

The Japan Protein Water Market Size is restrained by the high costs of production linked to premium protein ingredients, difficulties in flavor formulation, lack of consumer awareness compared to conventional protein drinks, and stringent food labeling regulations, which are the major reasons restricting the market's rapid penetration. Furthermore, price sensitivity among the mass market and competition from alternative functional drinks also hinder the market's quick acceptance.

The Japan Protein Water Market's Size future is very bright. The main reasons for that are the growing demand for plant-based protein, the trend of personalized functional drinks, sports nutrition becoming part of the main lifestyle, and the beauty-from-within approach. Furthermore, the increase in online shopping, the rise of high-priced products, and the partnerships between drinks manufacturers and fitness apps are likely to create new areas for the companies to grow in the cities and the suburbs.

Market Segmentation

The Japan Protein Water Market share is classified into product type, source, and packaging type.

By Product Type

The Japan Protein Water Market Size is segmented by product type into whey protein water and casein protein water. Among these, the whey protein water segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This dominance is driven by the swift intake of whey protein, its elevated biological value, and the great taste for those in athletics and fitness areas. Besides, the transparency of its formulation and compatibility with flavored hydration products have made it stronger in adoption.

By Source

The Japan Protein Water Market Size is segmented by source into animal-based and plant-based. Among these, the animal-based segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. the segment is driven by consumer trust, quality amino acid profiles, and the extensive application of whey-derived proteins, which have made this sector the utmost among others. Meanwhile, the plant-based segment is projected to grow more rapidly because of the rise of veganism, an increase in lactose intolerance awareness, and eco-friendly buying habits.

By Packaging Type

The Japan Protein Water Market Size is segmented by packaging type into bottles and cans. Among these, the bottles segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment is driven by portability, resealability, and convenience for fitness and on-the-go consumption. Bottled protein water products are the most commonly bought ones in gyms, convenience stores, and vending machines in Japan.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Protein Water Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Protein Water Market

- Suntory Holdings Limited

- Asahi Group Holdings, Ltd.

- Kirin Holdings Company, Limited

- Meiji Holdings Co., Ltd.

- Morinaga Milk Industry Co., Ltd.

- Ajinomoto Co., Inc.

- Otsuka Pharmaceutical Co., Ltd.

- Yakult Honsha Co., Ltd.

- House Foods Group Inc.

- Others

Recent Developments in Japan Protein Water Market

In March 2024, Suntory Holdings Limited expanded its functional beverage portfolio by introducing a protein-enriched hydration drink targeting fitness conscious consumers in Japan.

In July 2024, Asahi Group Holdings launched a low calorie whey protein water under its health beverage segment, focusing on post workout recovery.

In October 2024, Meiji Holdings enhanced its protein beverage R&D capabilities to improve flavor clarity and shelf stability for protein water formulations.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firms

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Protein Water Market based on the below-mentioned segments:

Japan Protein Water Market, By Product Type

- Whey Protein Water

- Casein Protein Water

Japan Protein Water Market, By Source

- Animal-Based

- Plant-Based

Japan Protein Water Market, By Packaging Type

- Bottles

- Cans

Frequently Asked Questions (FAQ)

-

What is the Japan protein water market size?Japan Protein Water Market is expected to grow from USD 21.33 million in 2024 to USD 53.21 million by 2035, growing at a CAGR of 8.67% during the forecast period 2025–2035.

-

What are the key growth drivers of the market?Growth is driven by rising health awareness, increasing demand for functional beverages, active lifestyles, low-sugar nutrition preferences, and innovation in protein formulation technologies.

-

What factors restrain the Japan protein water market?High production costs, regulatory compliance requirements, limited consumer awareness, and competition from alternative functional drinks restrain market growth.

-

How is the market segmented?The market is segmented by product type, source, and packaging type.

-

Who are the key players in the Japan protein water market?Key companies include Suntory Holdings, Asahi Group Holdings, Kirin Holdings, Meiji Holdings, Morinaga Milk Industry, Ajinomoto, and others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?