Japan Preparative and Process Chromatography Market Size, Share, By Product (Process Chromatography and Preparative Chromatography), By System (Batch Chromatography Systems and Continuous Chromatography Systems), By Consumables (Resins, Columns, and Reagents), By Type (Liquid Chromatography, Gas Chromatography, HPLC, and Other Chromatography Techniques), By End Use (Pharmaceutical, Biotechnology, Food & Nutraceutical, and Others), Japan Preparative and Process Chromatography Market Insights, Industry Trends, Forecasts to 2035

Industry: HealthcareJapan Preparative and Process Chromatography Market Insights Forecasts to 2035

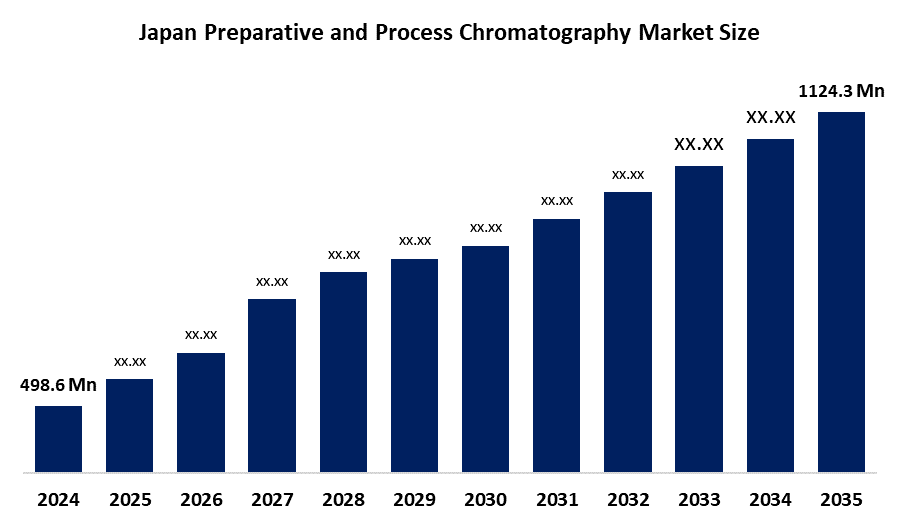

- Japan Preparative and Process Chromatography Market Size 2024: USD 498.6 Mn

- Japan Preparative and Process Chromatography Market Size 2035: USD 1124.3 Mn

- Japan Preparative and Process Chromatography Market CAGR 2024: 7.67%

- Japan Preparative and Process Chromatography Market Segments: Product, System, Consumables, Type, and End Use

Get more details on this report -

The Japan Preparative and Process Chromatography Market Size deals with large-scale, as well as laboratory-scale, separation tools designed for the purification of various Active Pharmaceutical Ingredients, Biologics, Vaccines, Food Ingredients, as well as Nutraceutical Compounds. The Japan market, which deals with preparative chromatographic techniques, has prominent applications in the pharmaceutical and biotechnology industries. It also has prominent applications in the area of food ingredient purification, as well as the purification of various Nutraceutical Compounds.

Technological innovations in the market primarily emphasize continuous chromatography systems, high-performance resins, one-touch chromatography, and high-performance HPLC products, which are designed to improve yield, scalability, and operational efficiency in the process. Government support addresses requirements from PMDA’s quality standard, self-sufficiency of biopharmaceuticals, promotion of advanced manufacturing technology, and other related areas as discussed previously. Future scope in the market will continue to provide a broad opportunity, including growth in continuous bioprocessing, continued growth in biologics/vaccine production, growth in biosimilars, and growth in automation-enabled chromatography solutions in the pharmaceutical, biotech, life science, and nutraceutical industries.

Japan Preparative and Process Chromatography Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 498.6 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.67% |

| 2035 Value Projection: | USD 1124.3 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product ,By Consumables |

| Companies covered:: | Shimadzu Corporation, Tosoh Corporation, YMC Co., Ltd., Novasep, Merck KGaA, Thermo Fisher Scientific, Agilent Technologies, Waters Corporation, Bio-Rad Laboratories, Danaher Corporation, GE HealthCare, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Preparative and Process Chromatography Market:

The Japan Preparative and Process Chromatography Market Size is being driven primarily due to the increasing pharmaceutical manufacturing industry, particularly in the production of pharmaceuticals and biotechnology medicines such as biologics, biosimilars, and vaccines. This market is further increasing due to the increasing R&D spending in the region along with the quality standards set by the PMDA.

The key factors restricting the development of the market are the high costs associated with the procurement of instruments, resins, and other materials, along with the complexity involved in validating these instruments, as well as the need to possess high expertise to operate these instruments. Also, the need to rely on overseas technology in the form of high-performance resins to carry out these operations increase procurement expenses.

Opportunities for the future will also be backed by rising adoption rates for continuous chromatography, single-use purification systems, and automation-enabled technology, which facilitates faster process times and greater overall yield. Moreover, expansion of bio-manufacturing, biosimilar development, and nutraceuticals production in Japan is likely to fuel demand for chromatography systems globally.

Market Segmentation

The Japan Preparative and Process Chromatography Market share is classified into product, system, consumables, type, and end use.

By Product

The Japan Preparative and Process Chromatography Market Size is segmented by product into process chromatography and preparative chromatography. Among these, the process chromatography segment dominated the market in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This dominance is driven by key factors such as increasing large-scale production of biologics, greater demand for continuous purification workflows, higher throughput, and increased efficiency in processes, coupled with strong adoption across commercial pharmaceutical manufacturing facilities needing consistent quality, scalability, regulatory compliance, and cost optimization.

By System

The Japan Preparative and Process Chromatography Market Size is segmented by system into batch chromatography systems and continuous chromatography systems. Among these, the batch chromatography systems segment dominated the market in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Batch systems prevail because of the accumulated operational reliability, better regulatory familiarity, flexible batch sizing, lower capital investment requirements, easier validation processes, and wide usage in pharmaceutical and biotechnology facilities processing varied production volumes and product portfolios in Japan.

By Consumables

Based on consumables, the Japan Preparative and Process Chromatography Market Size is divided into resins, columns, and reagents. Among these, the resins segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Resins lead the market because of the recurring replacement cycles, critical role in separation selectivity, expanding biologics pipelines, rising monoclonal antibody production, and continuous demand for high-performance affinity, ion-exchange, and mixed-mode resins across the purification stages.

By Type

The Japan Preparative and Process Chromatography Market Size is segmented by type into liquid chromatography, gas chromatography, HPLC, and other chromatography techniques. Among these, the liquid chromatography segment dominated the market in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Liquid chromatography is the dominant mode due to the widespread use of the technique in protein purification, vaccines, peptides, biologics, scale-up ability, compatibility with downstream processing, resolution, and regulatory acceptability in the pharmaceutical as well as biotechnology industries in Japan.

By End Use

By end use, the Japan Preparative and Process Chromatography Market Size is segmented into pharmaceutical, biotechnology, food & nutraceutical, and others. Among these, the pharmaceutical segment held the dominant market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Pharmaceutical dominance is enabled by the rise in volumes of drugs produced, an increase in the emerging space of drugs classified as biologics, the high standards set for the purified end product, growth in capacity, ongoing investments in research and development, and the consistent need for validated high-efficiency separation technologies used in the regulated landscape of Japanese drugs.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Preparative and Process Chromatography Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Preparative and Process Chromatography Market:

- Shimadzu Corporation

- Tosoh Corporation

- YMC Co., Ltd.

- Novasep

- Merck KGaA

- Thermo Fisher Scientific

- Agilent Technologies

- Waters Corporation

- Bio-Rad Laboratories

- Danaher Corporation

- GE HealthCare

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan Preparative and Process Chromatography Market Size based on the below-mentioned segments:

Japan Preparative and Process Chromatography Market, By Product

- Process Chromatography

- Preparative Chromatography

Japan Preparative and Process Chromatography Market, By System

- Batch Chromatography Systems

- Continuous Chromatography Systems

Japan Preparative and Process Chromatography Market, By Consumables

- Resins

- Columns

- Reagents

Japan Preparative and Process Chromatography Market, By Type

- Liquid Chromatography

- Gas Chromatography

- HPLC

- Other Chromatography Techniques

Japan Preparative and Process Chromatography Market, By End Use

- Pharmaceutical

- Biotechnology

- Food & Nutraceutical

- Others

Frequently Asked Questions (FAQ)

-

What is the Japan preparative and process chromatography market size?The Japan preparative and process chromatography market is expected to grow from USD 498.6 million in 2024 to USD 1124.3 million by 2035, registering a CAGR of 7.67% during the forecast period 2025–2035.

-

What are the key growth drivers of the market?Growth is driven by rising pharmaceutical and biotechnology manufacturing, increasing biologics and vaccine production, expanding R&D investments, strict PMDA quality standards, and growing demand for high-purity separation technologies

-

What factors restrain the Japan preparative and process chromatography market?Market growth is restrained by high equipment and consumable costs, complex validation requirements, dependence on imported high-performance resins, operational complexity, and the need for skilled technical expertise.

-

How is the market segmented by consumables?The market is segmented into resins, columns, and reagents

-

How is the market segmented by end use?The market is segmented into pharmaceutical, biotechnology, food & nutraceutical, and others.

-

What technological innovations are shaping the market?Key innovations include continuous chromatography systems, high-performance resins, automation-enabled purification, one-touch chromatography solutions, and advanced HPLC systems improving scalability and operational efficiency.

-

Who are the key players in the Japan preparative and process chromatography market?Key players include Shimadzu Corporation, Tosoh Corporation, YMC Co., Ltd., Novasep, Merck KGaA, Thermo Fisher Scientific, Agilent Technologies, Waters Corporation, Bio-Rad Laboratories, Danaher Corporation, GE HealthCare, and others.

-

Who are the target audiences for this market report?Target audiences include market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?