Japan Precision Machining Market Size, Share, By Operation (Manual Operation and CNC Operation), By Type (Milling Machining, Laser Machining, Electric Discharge Machining (EDM), Turning, Grinding, and Others), By End Use (Automotive, Aerospace & Defense, Construction Equipment, Power & Energy, Industrial, and Others), Japan Precision Machining Market Insights, Industry Trends, and Forecasts to 2035.

Industry: Machinery & EquipmentJapan Precision Machining Market Insights Forecasts to 2035

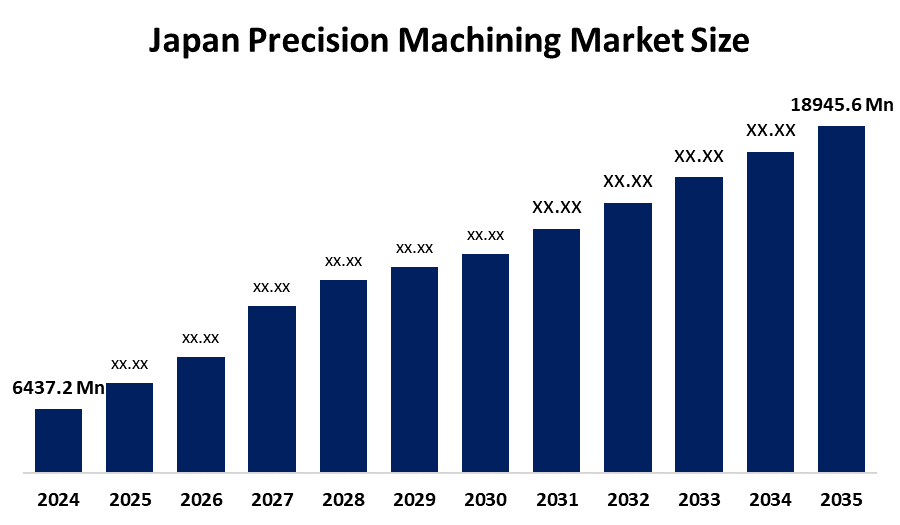

- Japan Precision Machining Market Size 2024: USD 6437.2 Mn

- Japan Precision Machining Market Size 2035: USD 18945.6 Mn

- Japan Precision Machining Market CAGR 2024: 10.31%

- Japan Precision Machining Market Segments: Operation, Type, and End Use

Get more details on this report -

The precision machining market in Japan signifies titanium, level manufacturing processes through which intricate metal and engineered components with super tight tolerances are produced. Such services are a must across automotive, aerospace & defense, industrial machinery, construction equipment, power & energy, and semiconductor manufacturing sectors which require dimensional precision and surface quality. Demand all over the world is the consequence of the advanced manufacturing requirements, miniaturization of components, and a strong industrial base of Japan. Technological innovation is a key ingredient of the market development recipe as the wide scale adoption of CNC machining, multi, axis systems, laser machining, EDM, digital twins, AI, enabled process control, and smart factory integration has resulted in better productivity, accuracy, and repeatability.

Government interventions are instrumental in the development of the market. The Ministry of Economy, Trade and Industry, led (METI) programs including the Monozukuri Subsidy, Society 5.0, and Connected Industries initiatives are facilitating automation, robotics, IoT integration, and capital investment in advanced machine tools. Besides that, tax benefits and equipment modernization policies are enabling faster adoption not only among SMEs but also large manufacturers. The future is bright for machinery with which the production of EV parts, aircraft platforms, semiconductor devices, robotics, and high, value export manufacturing will be done, making Japan one of the most equipped countries globally in precision engineering.

Japan Precision Machining Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6437.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 10.31% |

| 2035 Value Projection: | USD 18945.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 196 |

| Tables, Charts & Figures: | 165 |

| Segments covered: | By Operation,By Type |

| Companies covered:: | DMG Mori Co., Ltd. Yamazaki Mazak Corporation Okuma Corporation Makino Milling Machine Co., Ltd. Fanuc Corporation Amada Co., Ltd. Sodick Co., Ltd. Mitsubishi Electric Corporation Brother Industries, Ltd. Tsugami Corporation Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Precision Machining Market:

The Japan precision machining market is primarily driven by a surging demand for highly accurate and quality consistent machined products in the automotive, aerospace & defense, electronics, and industrial machinery sectors. These sectors require high dimensional accuracy and tight tolerances. The continuous growth of the market is facilitated by the increasing use of CNC machining, multi, axis systems, and automation along with Japan’s focus on high, value manufacturing and export, oriented production.

The market is limited by the stringent capital investment requirements for advanced machining equipment, increasing costs of labor and energy, and the shortage of skilled machinists. Furthermore, the intense competition, pressure on pricing, and strict quality and compliance standards lead to increased operational complexity, especially for small and mid, sized machining service providers.

Opportunities are arising from the adoption of Industry 4.0, the integration of smart factories, and the application of AI-based process optimization and predictive maintenance. The increasing demand for lightweight components, electric vehicle components, semiconductor manufacturing equipment, and precision components for renewable energy systems also improves market potential. Manufacturing modernization initiatives launched by the government and the ongoing trend of reshoring high-precision manufacturing are expected to provide continued opportunities over the forecast period.

Market Segmentation

The Japan precision machining market share is classified into operation, type, and end use.

By Operation:

The Japan precision machining market is divided by operation into manual operation and CNC operation. Among these, the CNC operation segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. CNC operations rule the market due to a long list of factors such as high accuracy requirement, consistency, automation, less human errors, faster production cycles, continuity with Industry 4.0 type systems, and booming adoption by automotive, aerospace, and industrial manufacturing sectors.

By Type:

The Japan precision machining market is divided by type into milling machining, laser machining, electric discharge machining (EDM), turning, grinding, and others. Among these, milling machining dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The lead in Milling machining is explained by its general utility, high rate of material removal, ability to produce very complex parts, extensive CNC integration, heavy demand from the automotive and industrial sectors, and constant progress in multi, axis machining technology.

By End Use:

The Japan precision machining market is divided by end use into automotive, aerospace & defense, construction equipment, power & energy, industrial, and others. Among these, the automotive segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Automotive industry holds the majority of the market mainly because of the mass productions, the requirement for high, precision components, the trend towards electrification, the use of lightweight materials, the strict quality standards, and the constant investments in the manufacturing and machining technologies in Japan.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan precision machining market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Precision Machining Market:

- DMG Mori Co., Ltd.

- Yamazaki Mazak Corporation

- Okuma Corporation

- Makino Milling Machine Co., Ltd.

- Fanuc Corporation

- Amada Co., Ltd.

- Sodick Co., Ltd.

- Mitsubishi Electric Corporation

- Brother Industries, Ltd.

- Tsugami Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan precision machining market based on the below-mentioned segments:

Japan Precision Machining Market, By Operation

- Manual Operation

- CNC Operation

Japan Precision Machining Market, By Type

- Milling Machining

- Laser Machining

- Electric Discharge Machining (EDM)

- Turning

- Grinding

- Others

Japan Precision Machining Market, By End Use

- Automotive

- Aerospace & Defense

- Construction Equipment

- Power & Energy

- Industrial

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Japan precision machining market size?A: Japan precision machining market is expected to grow from USD 6,437.2 million in 2024 to USD 18,945.6 million by 2035, growing at a CAGR of 10.31% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by rising demand for high-precision components across automotive, aerospace & defense, industrial machinery, semiconductor manufacturing, and energy sectors. Increasing adoption of CNC machining, multi-axis systems, automation, and smart manufacturing technologies further supports market expansion.

-

Q: What factors restrain the Japan precision machining market?A: Key restraints include high capital investment requirements for advanced machining equipment, rising labor and energy costs, shortage of skilled machinists, and intense price competition. Strict quality standards and compliance requirements also increase operational complexity for small and mid-sized manufacturers.

-

Q: How is the market segmented by type?A: The market is segmented into milling machining, laser machining, electric discharge machining (EDM), turning, grinding, and others.

-

Q: Who are the key players in the Japan precision machining market?A: Key companies include DMG Mori Co., Ltd., Yamazaki Mazak Corporation, Okuma Corporation, Makino Milling Machine Co., Ltd., Fanuc Corporation, Amada Co., Ltd., Sodick Co., Ltd., Mitsubishi Electric Corporation, Brother Industries, Ltd., Tsugami Corporation, and others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?