Japan Precision Fermentation Market Size, Share, By Microbe (Yeast, Algae, Fungi, and Bacteria), By End Use (Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics, and Other), Japan Precision Fermentation Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesJapan Precision Fermentation Market Insights Forecasts to 2035

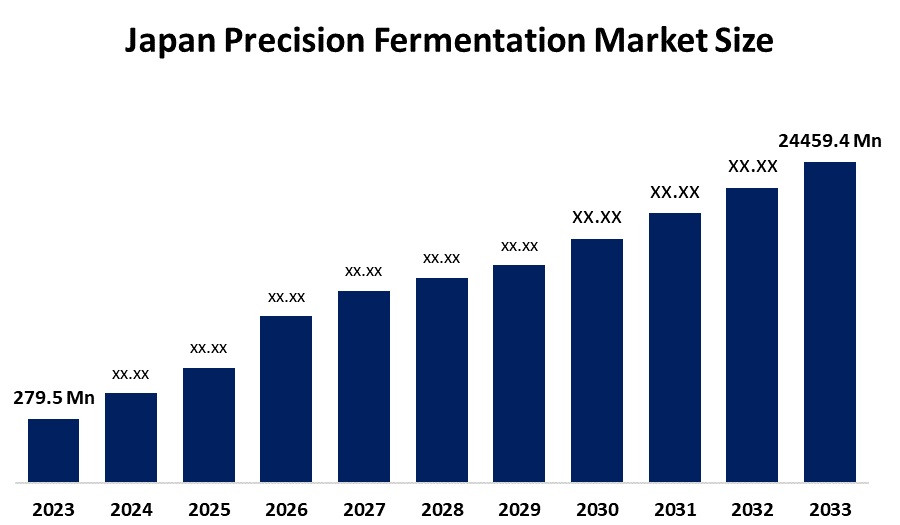

- Japan Precision Fermentation Market Size 2024: USD 279.5 Mn

- Japan Precision Fermentation Market Size 2035: USD 24459.4 Mn

- Japan Precision Fermentation Market CAGR 2024: 50.16%

- Japan Precision Fermentation Market Segments: Microbe and End Use.

Get more details on this report -

The Japanese precision fermentation market involves advanced biotechnology methods that rely on the use of genetically modified organisms such as yeasts, fungi, and bacteria to produce targeted functional ingredients through a form of fermentation known as cellular manufacturing. Traditional fermentation utilizes the capability of Microorganisms to change bulk organic materials. Whereas traditional fermentation transforms bulk organic materials into final products, the microbes used in precision fermentation have been programmed to produce specific compounds in addition to their ability to transmit genetic information from one generation of organisms to the next. This rapid scale-up of the industry allows for tremendous levels of efficiency in terms of resource usage and the potential to produce ingredients identical to those produced through traditional means, rather than necessitating high volumes of livestock production.

Japan's government has made the bio-manufacturing sector one of its main priorities and established a "Bioeconomy Strategy" to encourage new ideas and establish early-stage projects through large investments. In the private sector, significant private companies have invested heavily in biomanufacturing. All of these initiatives and new technologies will allow Japan to be the world leader in building the infrastructure needed to produce precision fermentation materials on an industrial scale, as pilot plants are constructed in conjunction with leading universities and bio-manufacturing companies such as Ajinomoto and Kirin Holdings.

Technological advancement in Japan has focused on the synergy between artificial intelligence (AI) and synthetic biology. Companies in Japan are using AI systems that automatically monitor and optimise fermentation cycles, resulting in significant increases in protein production efficiency, in some cases doubling the efficiency of production. Improved strain engineering and metabolic modelling provides the ability to develop strong microbial hosts that are capable of producing large quantities of product from concentrated batches. Additionally, newly developed Bioreactor technologies with integrated real-time sensors provide for production with greater yield and purity, aiding in creating a path from lab-production to mass-production.

Market Dynamics of the Japan Precision Fermentation Market:

The Japanese precision fermentation market is driven by the country importing almost 40% of its dairy products and needs to achieve food self-sufficiency through local production of essential proteins using precision fermentation technology. The increased demand from consumers for sustainable, ethically produced, and "clean-label" products has opened up a huge new market for precision fermentation, and the support of national bio-manufacturing policy and large investment in research and development (R&D) in the private and public sectors has laid a solid foundation on which to expand the market and develop technology leadership.

The Japanese precision fermentation market is restrained by the high start-up capital investment required to construct specialised bioreactor facilities, the lengthy and complex food safety regulations impacting registration of new food technologies, and the lack of widespread consumer awareness and potential scepticism around the "unnatural" nature of produced fermented proteins.

Opportunities for high-purity fermented ingredients, such as bio-collagen, from expansion into the pharmaceutical and cosmetic industries are substantial. The increased use of artificial intelligence (AI)-driven automated process optimisation will significantly lower the production costs associated with precision fermentation and make these products more price-competitive than conventionally produced animal-derived products in the Japanese retail market.

Japan Precision Fermentation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 279.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 50.16% |

| 2035 Value Projection: | USD 24459.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Microbe, By End Use |

| Companies covered:: | Ajinomoto Co., Inc,Kirin Holdings Company, Limited,Amano Enzyme Inc,Kyowa Hakko Bio Co., Ltd,Fermelanta, Spiber Inc,Morinaga Milk Industry Co., Ltd,Suntory Holdings Limited,Chitose Bio Evolution Pte. Ltd And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan precision fermentation market share is classified into microbe and end use.

By Microbe:

The Japanese precision fermentation market is divided by microbe into yeast, algae, fungi, and bacteria. Among these, the yeast segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is due to its long-standing industrial scalability, regulatory acceptance, and excellent protein expression efficiency. Yeast strains, notably Saccharomyces cerevisiae and Pichia pastoris, provide quicker fermentation cycles, high yield consistency, and compatibility with large-scale bioreactor systems.

By End Use:

The Japanese precision fermentation market is divided by end use into food & beverages, pharmaceuticals, personal care & cosmetics, and other. Among these, the food & beverages segment dominated the market in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is due to the rapid commercialization of animal-free proteins and enzymes across mainstream food applications. Also, Strong consumer demand for sustainable, clean-label, and allergen-free food items, combined with increased plant-based and hybrid food penetration, has hastened food producers' adoption.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Precision Fermentation market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Precision Fermentation Market:

- Ajinomoto Co., Inc.

- Kirin Holdings Company, Limited

- Amano Enzyme Inc.

- Kyowa Hakko Bio Co., Ltd.

- Fermelanta

- Spiber Inc.

- Morinaga Milk Industry Co., Ltd.

- Suntory Holdings Limited

- Chitose Bio Evolution Pte. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan precision fermentation market based on the below-mentioned segments:

Japan Precision Fermentation Market, By Microbe

- Yeast

- Algae

- Fungi

- Bacteria

Frequently Asked Questions (FAQ)

-

Q: What is the current size of the Japan precision fermentation market?A: The Japan precision fermentation market was valued at USD 279.5 million in 2024 and represents a rapidly emerging segment within Japan’s bio-manufacturing and food technology ecosystem

-

Q: What is the expected growth rate of the Japan precision fermentation market?A: The market is projected to grow at a CAGR of 50.16% during the forecast period 2025–2035, reaching an estimated value of USD 24,459.4 million by 2035

-

Q: What factors are driving the growth of the Japan precision fermentation market?A: Growth is driven by Japan’s need to improve food self-sufficiency, high dependence on imported dairy proteins, rising demand for sustainable and clean-label products, and strong government support through bioeconomy strategies and R&D investments.

-

Q: Which microbe segment dominates the Japan precision fermentation market?A: The yeast segment dominated the market in 2024 due to its industrial scalability, regulatory acceptance, high protein expression efficiency, and compatibility with large-scale bioreactor systems.

-

Q: Which end-use segment holds the largest market share in Japan?A: The food and beverages segment accounted for the largest market share in 2024, driven by rapid commercialization of animal-free proteins, enzymes, and growing consumer preference for sustainable and allergen-free food products.

-

Q: Who are the key players operating in the Japan precision fermentation market?A: Key companies include Ajinomoto Co., Inc., Kirin Holdings Company, Limited, Amano Enzyme Inc., Kyowa Hakko Bio Co., Ltd., Fermelanta, Spiber Inc., Morinaga Milk Industry Co., Ltd., Suntory Holdings Limited, Chitose Bio Evolution Pte. Ltd., and other emerging players.

-

Q: Who are the target audiences for the Japan precision fermentation market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?