Japan Potash Market Size, Share, By Product (Potassium Chloride, Potassium Nitrate, Potassium Sulphate, and Others), By End Use (Agriculture and Others), Japan Potash Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureJapan Potash Market Insights Forecasts to 2035

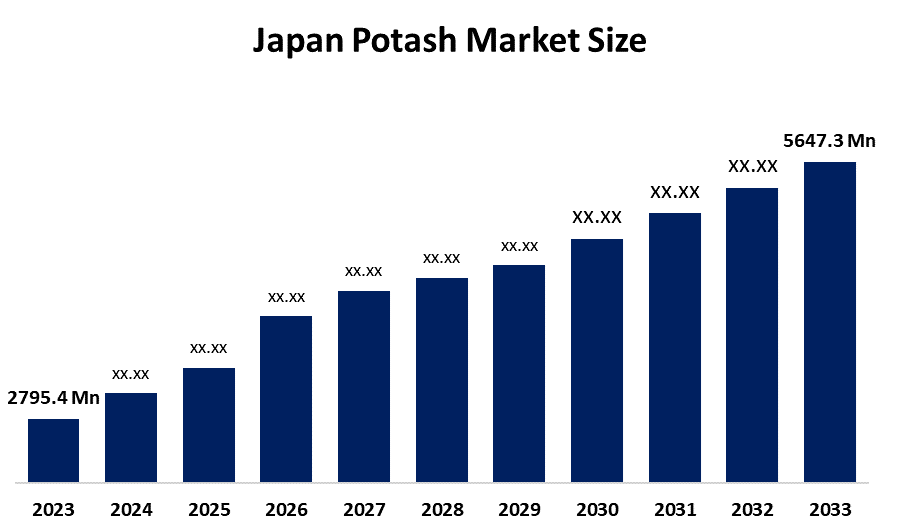

- Japan Potash Market Size 2024: USD 2795.4 Mn

- Japan Potash Market Size 2035: USD 5647.3 Mn

- Japan Potash Market CAGR 2024: 6.6%

- Japan Potash Market Segments: Product and End Use

Get more details on this report -

Potash refers to the mineral fertilizer compound compounds of potassium-based, such as potassium chloride and potassium sulphate, which serve as rich potassium nutrients essential for improving agricultural output and soil fertility, along with enhancing plant strength and stamina. The potash fertilizer products are widely used in Japanese farming to have a balanced source of potassium fertilizer for cereals, vegetables, fruits, and other produce of agriculture to have adequate supplies of potassium nutrients for intensive farming and to have limited arable land available for farming.

Since Japan does not have major domestic resources of potash, its fertilizers are largely imported. In 2023, imports of potassic fertilizers HS 3104 into Japan were worth around USD 260 million, while exports were small at around USD 1.49 million. RD is presently underway for controlled release fertilizers, highly pure potash formulations, and precision application equipment to increase efficiency. The future will bring innovations related to fertilizers, precision agriculture, and stable supply chains for long-term agricultural productivity and, consequently, food security.

Market Dynamics of the Japan Potash Market:

The Japan potash markets is mainly driven by a number of factors such as the increasing requirement for soil fertility improvement, the need to produce more food from less land, and the rising adoption of premium fertilizers in modern agriculture. The country's reliance on nutrient, balanced cultivation along with the conversion to precision agriculture necessitates pretty much all farmers to use potash, based products. Besides the government programs aimed at encouraging sustainable farming, the increased application of controlled, release formulations, water, soluble potash products, and smart nutrient, management technologies are the elements that will keep propelling the market forward.

The Japan potash markets is restrained by the high import dependency, increased costs of logistics and procurement, and the exposure to the global price fluctuations, all of which add to the farmers' monetary burden. The small degree of domestic farmland, stringent environmental rules, and the aging farmers are the factors that limit the market size. Moreover, supply chain issues and currency fluctuations make it difficult to get fertilizers and increase the overall cost of production, which results in a slower pace of the market expansion.

The Japan potash markets future offers a lot of bright and attractive opportunities coming from the use of precision nutrient application, specialty potash products, and sustainable farming practices. In addition, the adoption of innovative technologies like sensor, based fertilization, data, driven soil management, and smart farming platforms will lead to the optimized use of nutrients and hence the maximized crop yields while minimizing the environmental footprint.

Japan Potash Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2795.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.6% |

| 2035 Value Projection: | USD 5647.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product, By End Use |

| Companies covered:: | ITOCHU Corporation,Mitsui & Co., Ltd, Marubeni Corporation,Sumitomo Corporation, Kanematsu Corporation,ZEN NOH, JCAM AGRI Co., Ltd. And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan potash market share is classified into product and end use.

By Product:

The Japan potash market is divided by product into potassium chloride, potassium nitrate, potassium sulphate, and others. Among these, the potassium chloride segment dominated the market share in 2024 and is expected to continue expanding at a notable CAGR during the forecast period. The reason for its dominance is because of its effectiveness in meeting the demands of major crops, its cost efficiency, its widespread availability, and its utility in upgrading the fertility of the soil in different agricultural uses in Japan. The widespread use of potassium chloride as the major source of potash fertilizer, in addition to its adoption in precision farming, further cements its leading market position.

By End Use:

The Japan potash market is divided by end use into agriculture and others. Among these, the agriculture segment held the largest share in 2024 and is projected to grow significantly over the coming years. This is because its dominance is linked to its country's requirement to improve crop yields per acre of arable land, as well as a shift in nutrient management practices and a broader application of potash in rice, vegetable, and orchard production. Rising support for efficient fertilizer and better soil health practices is also a driving force behind its contribution in Japan's agricultural sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan potash market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Potash Market:

- ITOCHU Corporation

- Mitsui & Co., Ltd.

- Marubeni Corporation

- Sumitomo Corporation

- Kanematsu Corporation

- ZEN NOH

- JCAM AGRI Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan potash market based on the below-mentioned segments:

Japan Potash Market, By Product

- Potassium Chloride

- Potassium Nitrate

- Potassium Sulphate

- Others

Japan Potash Market, By End Use

- Agriculture

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Japan potash market size?A: Japan Potash Market is expected to grow from USD 2795.4 million in 2024 to USD 5647.3 million by 2035, growing at a CAGR of 6.6% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by a number of factors such as the increasing requirement for soil fertility improvement, the need to produce more food from less land, and the rising adoption of premium fertilizers in modern agriculture

-

Q: What factors restrain the Japan potash market?A: Constraints include the high import dependency, increased costs of logistics and procurement, and the exposure to the global price fluctuations, all of which add to the farmers' monetary burden. The small degree of domestic farmland, stringent environmental rules, and the aging farmers are the factors that limit the market size.

-

Q: How is the market segmented by product?A: The market is segmented into potassium chloride, potassium nitrate, potassium sulphate, and others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?