Japan Popcorn Market Size, Share, By Type (Ready-to-Eat Popcorn and Microwave Popcorn), By Distribution Channel (B2B and B2C), Japan Popcorn Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesJapan Popcorn Market Size Insights Forecasts to 2035

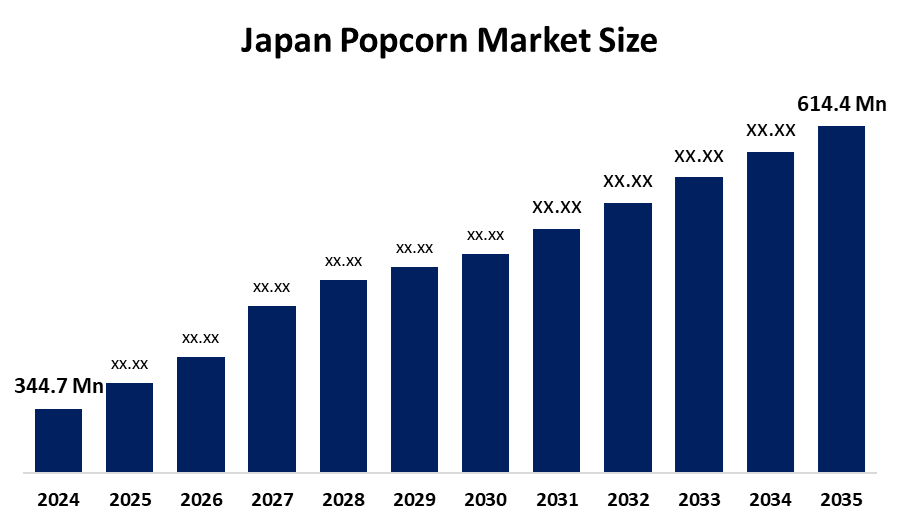

- Japan Popcorn Market Size 2024: USD 344.7 Mn

- Japan Popcorn Market Size 2035: USD 614.4 Mn

- Japan Popcorn Market Size CAGR 2024: 5.39%

- Japan Popcorn Market Size Segments: Type and Distribution Channel.

Get more details on this report -

The Popcorn Market Size in Japan encompasses the production, processing, and distribution of both popcorn kernels and ready-to-eat popcorn. It is predominantly based on specific corn varieties that "pop" when heated. When consumers in Japan look for an easy-to-eat and light snacking option, popcorn fits both of those criteria. Popcorn also has a variety of localized flavors available to Japanese consumers. Presently, the industry is showing a trend toward more premium and gourmet varieties, as well as healthier options that are non-GMO and organic. This has occurred in response to Japanese consumers' growing desire to find healthier snacking options in place of traditional fried snacks.

The government of Japan and private companies are actively working together to help grow the popcorn industry. The Japanese government, through MHLW, offers dietary guidelines, recommending reduced fat and sodium intake. These guidelines indirectly increase demand for air-popped or low-sodium popcorn as a healthier alternative to traditional fried snacks. Private companies have started initiatives to improve their supply chains' transparency and increase the sustainable sourcing of corn kernels. International franchises partnering with local retailers have created brand-new retail concepts that cater to urban consumers.

Popcorn technology has evolved significantly as companies develop new manufacturing processes to improve how efficiently they produce popcorn and apply flavor to the finished product. Today's manufacturers use advanced air-popping and infrared heating systems within their processes that aid in greatly reducing the amount of oil needed while still producing crunchy popcorn. New ways of using microencapsulation to encapsulate flavor are being utilized for a more even distribution of flavor on popcorn, as well as giving longer shelf life to packaged, ready-to-eat popcorns. Packaging improvements like the use of high-barrier films and resealable pouches created to preserve freshness have supported the increase in on-the-go consumption habits in Japan.

Japan Popcorn Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 344.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.39% |

| 2035 Value Projection: | 614.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Distribution Channel |

| Companies covered:: | Frito-Lay Japan, Koike-ya Inc., Calbee, Inc., KuKuRuZa Gourmet Popcorn Japan, Doc Popcorn Japan, MD Holdings Co., Ltd., Bourbon Corporation, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Popcorn Market Size:

The Japanese popcorn market is driven by the urban population seems to have a growing need for tasty and convenient snack options that are good sources of nutrition. As consumers become more aware of their diets, many are switching from calorie-dense products to healthy popcorn products due to high fiber content and the benefits of whole grains. The development of the entertainment industry has also contributed to increased consumption of traditional and gourmet popcorn products in cinemas and via streaming services. The introduction of innovative flavors and premium package designs has helped to draw the interest of young consumers, which continues to drive steady growth in the region's market.

The Japanese popcorn market is restrained by high prices associated with premium raw materials used to make popcorn, as well as the costs associated with developing specialty flavoring ingredients, which often make it very difficult for local manufacturers to produce these products. In addition, maintaining consistency in taste and texture over long shelf lives and getting past strict regulations regarding labeling and food safety standards can also lead to decreased consumer acceptance and increased complexity of producing these products.

There are many opportunities to develop natural, clean-label popcorn products within the plant-based and vegan diet trend. Additionally, the development of new technologies for oil-free popping and the subsequent rise of e-commerce sites allow brands to more effectively connect directly with health-conscious consumers and offer them a truly customized popcorn experience.

Market Segmentation

The Japan Popcorn Market Size share is classified into type and distribution channel.

By Type:

The Japan Popcorn Market Size is divided by type into ready-to-eat popcorn and microwave popcorn. Among these, the ready-to-eat popcorn segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is due to the increasing number of people consuming ready-to-eat popcorn in their homes and at theatres, and the increasing purchasing power of consumers. The introduction of new flavour combinations and the provision of various product types, through ongoing product development and innovation, also entice people to purchase ready-to-eat popcorn.

By Distribution Channel:

The Japan Popcorn Market Size is divided by distribution channel into B2B and B2C. Among these, the B2C segment held the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is due to the growth of internet distribution channels and diverse product assortments available at supermarkets or hypermarkets, consumers can now access, purchase, and receive products from many different locations. Consumers benefit from extra services provided by these distribution channels, such as home delivery, simplified payment mechanisms, cost savings, and a wide selection of products to choose from, all available from one source.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Popcorn Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Popcorn Market Size:

- Frito-Lay Japan

- Koike-ya Inc.

- Calbee, Inc.

- KuKuRuZa Gourmet Popcorn Japan

- Doc Popcorn Japan

- MD Holdings Co., Ltd.

- Bourbon Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Popcorn Market Size based on the below-mentioned segments:

Japan Popcorn Market Size, By Type

- Ready-to-Eat Popcorn

- Microwave Popcorn

Japan Popcorn Market Size, By Distribution Channel

- B2B

- B2C

Frequently Asked Questions (FAQ)

-

What is the market size of the Japan Popcorn Market Size in 2024?In 2024, the Japan Popcorn Market Size was valued at USD 344.7 million.

-

What is the expected growth rate of the Japan Popcorn Market Size?The market is expected to grow at a CAGR of 5.39% during the forecast period from 2025 to 2035.

-

Which type segment dominates the Japan Popcorn Market Size?The ready-to-eat popcorn segment dominates due to its convenience, wide flavor variety, and increasing consumption at homes, cinemas, and entertainment venues.

-

Which distribution channel holds the largest share in the market?The B2C segment holds the largest share, supported by strong supermarket presence, e-commerce growth, home delivery services, and diverse product availability.

-

What are the key drivers of the Japan Popcorn Market Size?Key drivers include rising health awareness, demand for convenient snacks, growth of the entertainment industry, innovative flavors, and premium packaging trends.

-

Who are the major players in the Japan Popcorn Market Size?Major players include Frito-Lay Japan, Koike-ya Inc., Calbee, Inc., KuKuRuZa Gourmet Popcorn Japan, Doc Popcorn Japan, MD Holdings Co., Ltd., and Bourbon Corporation.

Need help to buy this report?