Japan Polyurethane Market Size, Share, and COVID-19 Impact Analysis, By Raw Material (Toluene Di-isocyanate, Methylene Diphenyl Di-isocyanate, and Polyols), By Application (Furniture and Interiors, Construction, Electronics & Appliances, Automotive, Footwear, Packaging, and Others) and Japan Polyurethane Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Polyurethane Market Size Insights Forecasts to 2035

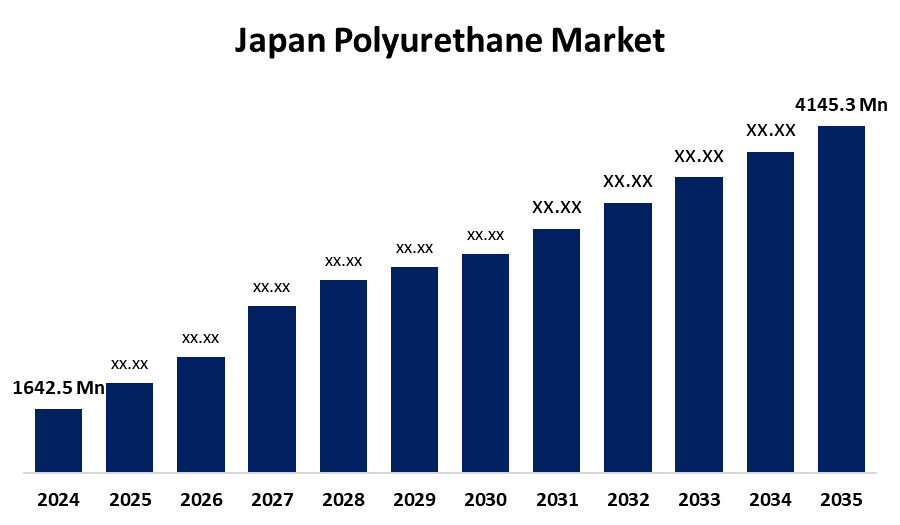

- The Japan Polyurethane Market Size Was Estimated at USD 1642.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.78% from 2025 to 2035

- The Japan Polyurethane Market Size is Expected to Reach USD 4145.3 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Polyurethane Market Size is anticipated to Reach USD 4145.3 Million by 2035, Growing at a CAGR of 8.78% from 2025 to 2035. The polyurethane market in Japan is driven by increasing demand for building insulation in light of sustainability concerns is expected to escalate the demand for polyurethane over the forecast period.

Market Overview

Polyurethane (PU) is a versatile polymer composed of organic units connected by urthane lyncage. With the help of catalysts, flying agents, or other additives, a polyol is a molecule with several hydroxyl groups, and an isocyanate undergoes a chemical process to make it. Instead of having a single material like many plastics, polyurethane is a family of polymers that can be made for a variety of physical characteristics, including flexible foam to rigid solids. Polyurethane is used extensively due to its durability and versatility. Depending on the formulation, they can be produced as elastomers, coatings, adhesives, sealants, flexible foams, and rigid foams. Flexible polyurethane foam, which provides comfort and durability, is an essential part of beds, furniture, and car seats. Due to their better insulating properties, rigid foam is often used for thermal insulation in refrigeration systems, equipment, and building construction. Because polyurethane depends on petrochemicals and it is difficult to recycle, its manufacture and disposal reduce environmental difficulties. To increase stability, however, current development is focused on energy-efficient production, chemical recycling, and bio-based raw materials.

Report Coverage

This research report categorizes the market for the Japan polyurethane market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan polyurethane market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan polyurethane market.

Japan Polyurethane Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1642.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.78% |

| 2035 Value Projection: | USD 4145.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Raw Material, By Application and COVID-19 Impact Analysis |

| Companies covered:: | ArcelorMittal S.A., thyssenkrupp AG, The Dow Chemical Company, Huntsman Corporation, Lanxess AG, Mitsui Chemicals, Inc., Tosoh Corporation, and Eastman Chemical Company |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Polyurethane market in Japan is driven by the growing versatility and wide industrial use. Rising demand in construction for insulation, growth in automotive and furniture sectors for foams, and increasing applications in footwear, coatings, and adhesives fuel expansion. Additionally, technological advancements and the shift toward lightweight, durable materials further accelerate polyurethane adoption across multiple industries.

Restraining Factors

The polyurethane market in Japan is mostly constrained by high reliance on raw materials derived from petrochemicals, environmental issues brought on by non-biodegradability, and intricate recycling procedures. Furthermore, fluctuating raw material costs and strict environmental laws pertaining to production-related emissions

Market Segmentation

The Japan polyurethane market share is classified into raw material and application.

- The polyols segment accounted for the largest share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The Japan polyurethane market is segmented by raw material into toluene di-isocyanate, methylene diphenyl di-isocyanate, and polyols. Among these, the polyols segment accounted for the largest share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. Polyols utilized in the production of a number of polymers, such as polyurethane, which is used in the furniture, automotive, and construction sectors, among others. The polyurethane market based on polyols is driven by a number of factors that affect its expansion and advancement.

- The construction segment dominates the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan Polyurethane market is segmented by application into furniture and interiors, construction, electronics & appliances, automotive, footwear, packaging, and others. Among these, the construction segment dominates the market in 2024 and is expected to grow at a significant CAGR during the forecast period. widespread adoption of polyurethane resins in a variety of applications that are essential to infrastructure and building projects. Because of their exceptional durability, fire resistance, and weather resistance, polyurethanes are frequently used in the production of architectural panels, exterior cladding, and flooring materials.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the Japan polyurethane market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ArcelorMittal S.A.

- thyssenkrupp AG

- The Dow Chemical Company

- Huntsman Corporation

- Lanxess AG

- Mitsui Chemicals, Inc.

- Tosoh Corporation

- Eastman Chemical Company

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan polyurethane market based on the below-mentioned segments:

Japan Polyurethane Market, By Raw Material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

Japan Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the base year considered for the Japan Polyurethane Market analysis?A: The base year considered is 2024, with historical data from 2020–2023.

-

Q: What is the market size of the Japan Polyurethane Market in 2024?A: The market size is estimated at USD 1642.5 million in 2024.

-

Q: What is the projected market size of the Japan Polyurethane Market by 2035?A: The market is expected to reach USD 4145.3 million by 2035.

-

Q: What is the CAGR of the Japan Polyurethane Market during the forecast period 2025–2035?A: The market is projected to grow at a CAGR of 8.78%.

-

Q: Which raw material segment dominated the market in 2024?A: The polyols segment accounted for the largest share in 2024 and is expected to continue growing significantly.

-

Q: Which application segment held the largest share of the market in 2024?A: The construction segment dominated in 2024 due to widespread use of polyurethane resins in building and infrastructure projects.

-

Q: What are the major driving factors of the Japan Polyurethane Market?A: Key drivers include growing demand for building insulation, expanding automotive and furniture sectors, technological innovations, and the need for lightweight, durable materials.

Need help to buy this report?