Japan Polydextrose Market Size, Share, By Product (Powder and Liquid), By Application (Beverages, Cultured Dairy, Nutritional Food, Ready-to-Eat Meals, and Bakery & Confectionery), Japan Polydextrose Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesJapan Polydextrose Market Insights Forecasts to 2035

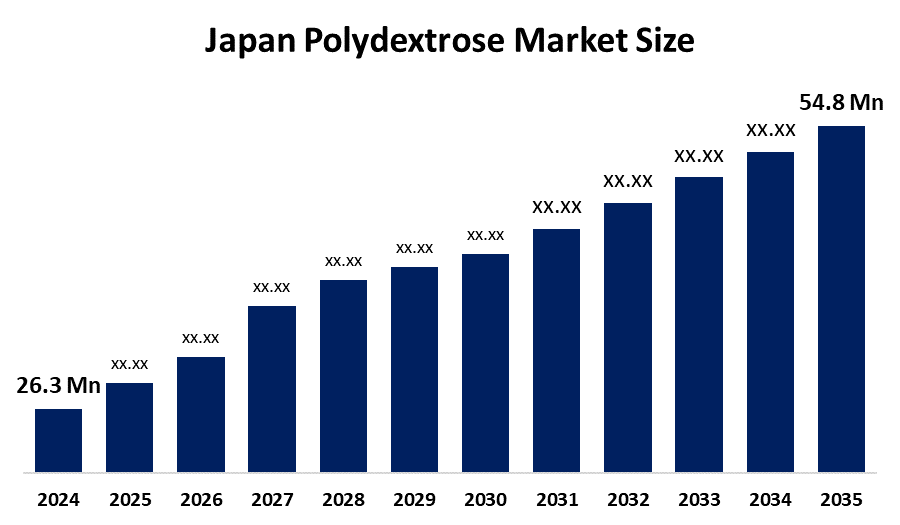

- Japan Polydextrose Market Size 2024: USD 26.3 Mn

- Japan Polydextrose Market Size 2035: USD 54.8 Mn

- Japan Polydextrose Market CAGR 2024: 6.9%

- Japan Polydextrose Market Segments: Product and Application.

Get more details on this report -

The Japanese polydextrose market is a synthetic polymer that contains a lot of branches and is made from glucose. Sorbitol and citric acid are added to polydextrose during its creation. The unique characteristics of polydextrose are its ability to dissolve in water, high thermal stability, and low caloric value of about 1kcal/g. It can therefore be used as a bulking material and sugar substitute for food products. In Japan, the market for polydextrose is experiencing a movement to "Food with Function Claim" (FFC) products, due to the prebiotic benefits polydextrose has on the gut while maintaining the sensory characteristics of the product. Additionally, Japanese consumers are increasingly demanding that polydextrose products be clean-label and non-GMO.

The Japanese government provides strong support through its CAA and MHLW, and as a result of this government support, many Japanese food companies will develop products containing functional fibers. The "Health Japan 21" program promotes increased fiber intake and decreased sugar intake. These programs are particularly beneficial to the polydextrose industry. Many Japanese food manufacturers work with their ingredient suppliers to develop products with both the probiotic and prebiotic benefits associated with polydextrose through the use of synbiotics to meet the needs of the growing aging population that desires enhanced digestive longevity.

Innovation in polydextrose technology is focused on the increased purity and molecular weight control so that consumers can receive the maximum physiological benefits from polydextrose. Japanese manufacturers are now using advanced microencapsulation techniques to incorporate polydextrose into high moisture products without compromising their stability and shelf-life. Additionally, many Japanese manufacturers are implementing "Green Chemistry" practices in manufacturing polydextrose, including sustainable catalysts and energy-saving methods of dehydration to comply with international standards for environmental sustainability. The combination of these advances and innovations in polydextrose technology will allow for much broader applications than ever before, from carbonated functional beverages through to high-temperature baked sugar confectionery.

Japan Polydextrose Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 26.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.9% |

| 2035 Value Projection: | USD 54.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 221 |

| Tables, Charts & Figures: | 164 |

| Segments covered: | By Product,By Application, |

| Companies covered:: | Otsuka Pharmaceutical Co., Ltd. Tate & Lyle Japan Danisco Japan (IFF) Matsutani Chemical Industry Co., Ltd. Cargill Japan Taiyo Kagaku Co., Ltd. Samyang Japan Corporation Ingredion Japan Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Polydextrose Market:

The Japanese polydextrose market is driven by the lifestyle diseases such as diabetes and obesity have become more prevalent as a result of an increasing demand for low glycemic index and low-calorie foods. The growing elderly population in Japan is also seeking a functionally beneficial source of "anti-aging" nutrition thus, the importance of polydextrose as a prebiotic to support gut health is being realised by many in Japan. Additionally, polydextrose has become widely used as a fat and sugar substitute in traditional Japanese confections and prepared meals, facilitating its wide adoption within the commercial food manufacturing industries.

The Japanese polydextrose market is restrained by cost of producing polydextrose in compliance with Japanese regulations is relatively high due to the high level of purity required. The lower cost of comparable fibres, such as inulin and indigestible dextrin will continue to increase price competition, which may result in decreased profit margins for polydextrose manufacturers located in Japan.

There are significant opportunities included in the Japanese polydextrose has the potential to expand into the pharmaceutical industry as an excipient for drug delivery. Additionally, the growing popularity of vegan and plant-based diets in urban areas such as Tokyo has opened a niche for plant-based dairy alternatives fortified with polydextrose as a source of both fibre and allergen-free.

Market Segmentation

The Japan polydextrose market share is classified into product and application.

By Product:

The Japanese polydextrose market is divided by product into powder and liquid. Among these, the powder segment held the largest market revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Powdered polydextrose has numerous nutritional benefits, including a low-calorie formulation, fiber enrichment, enhanced texture, and prebiotic properties. The powdered form has a higher concentration of polydextrose than the liquid form.

By Application:

The Japanese polydextrose market is divided by application into beverages, cultured dairy, nutritional food, ready-to-eat meals, and bakery & confectionery. Among these, the beverages segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is due to the growing consumption of nutritional and functional beverages, which has created a significant opportunity for companies that manufacture polydextrose.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan polydextrose market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Polydextrose Market:

- Otsuka Pharmaceutical Co., Ltd.

- Tate & Lyle Japan

- Danisco Japan (IFF)

- Matsutani Chemical Industry Co., Ltd.

- Cargill Japan

- Taiyo Kagaku Co., Ltd.

- Samyang Japan Corporation

- Ingredion Japan

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan polydextrose market based on the below-mentioned segments:

Japan Polydextrose Market, By Product

- Powder

- Liquid

Japan Polydextrose Market, By Application

- Beverages

- Cultured Dairy

- Nutritional Food

- Ready-to-Eat Meals

- Bakery & Confectionery

Frequently Asked Questions (FAQ)

-

Q: What is the current size of the Japan polydextrose market?A: The Japan polydextrose market was valued at USD 26.3 million in 2024, reflecting growing adoption of functional dietary fibers in food and beverage applications.

-

Q: What is the expected growth rate of the Japan polydextrose market?A: The market is projected to grow at a CAGR of 6.9% during the forecast period 2025–2035, reaching an estimated value of USD 54.8 million by 2035.

-

Q: What are the key factors driving the growth of the Japan polydextrose market?A: Growth is driven by rising prevalence of lifestyle-related diseases, increasing demand for low-calorie and low-glycemic foods, growing awareness of gut health benefits, and expanding use of polydextrose as a sugar and fat substitute in processed foods.

-

Q: Which product segment dominates the Japan polydextrose market?A: The powder segment dominated the market in 2024 due to its higher polydextrose concentration, better stability, ease of handling, and broad applicability across food and beverage formulations.

-

Q: Which application segment holds the largest market share in Japan?A: The beverages segment accounted for the largest market share in 2024, supported by strong demand for functional and nutritional drinks enriched with dietary fiber.

-

Q: What are the major challenges faced by the Japan polydextrose market?A: Key challenges include high production costs required to meet strict Japanese purity standards and strong price competition from alternative fibers such as inulin and indigestible dextrin.

-

Q7: Who are the key players operating in the Japan polydextrose market?A: Major companies include Otsuka Pharmaceutical Co., Ltd., Tate & Lyle Japan, Danisco Japan (IFF), Matsutani Chemical Industry Co., Ltd., Cargill Japan, Taiyo Kagaku Co., Ltd., Samyang Japan Corporation, Ingredion Japan, and other regional players.

Need help to buy this report?