Japan Plywood Market Size, Share, By Wood Type (Softwood and Hardwood), By End-use (Residential and Commercial), Japan Plywood Market Insights, Industry Trend, Forecasts to 2035.

Industry: Construction & ManufacturingJapan Plywood Market Insights Forecasts to 2035

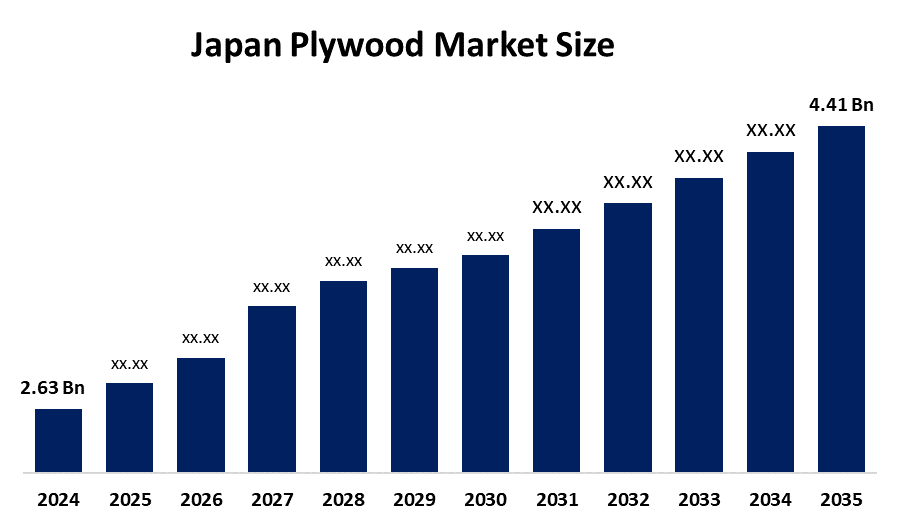

- Japan Plywood Market Size 2024: USD 2.63 Bn

- Japan Plywood Market Size 2035: USD 4.41 Bn

- Japan Plywood Market CAGR 2024: 4.81%

- Japan Plywood Market Segments: Wood Type and End-Use.

Get more details on this report -

In Japan, Plywood Products Typically consist of many thin layers called plies and are bonded together using a high-strength adhesive under heat and pressure. Cross-graining is the unique feature of plywood, each layer has the grain direction rotated 90° from the previous layer, thus giving it high dimensional stability and greatly reducing the chance of splitting, while also providing consistent strength throughout the panel. The current trends in the Japanese plywood market are an increasing demand for high-performance or specialty plywood, as well as an increased use of smart logistics in the packaging of export-quality products.

The Japanese plywood industry & the future of domestic plywood use, the Japanese government has focused many initiatives to try and return the domestic plywood industry to prominence and to increase the sustainable use of plywood in the building process with the introduction of policies aimed at increasing plywood use with better sustainable building practices. The introduction of legislation encouraging the use of wood in the construction of medium and upper structures of wooden design has encouraged more companies and individuals to construct buildings from plywood. To meet the demand for timber, many of those companies are starting to develop "timber industrial complexes" with a stable supply of timber from Japan, including Japanese cedar and cyprus to increase the ratio of timber used in housing material to decrease reliance on foreign plywood as an imported material.

In the area of technological development, the primary area of focus for the Japanese plywood industry is on improving manufacturing efficiencies and on being more environmentally friendly in the manufacturing of products by introducing new processes & products. Innovative products such as "Ultra Thick" plywood (CLP), which can vary from 200–300 mm for large commercial structures, are being manufactured as a potential structural alternative to steel & concrete construction. Additionally, manufacturers are beginning to invest in biomass boilers and to use automated digital transformation tools (DX) to help reduce material cost by increasing efficiencies and cleaning up their environment from greenhouse gases emitted by the industry, labour shortages, and reducing the amount of wood waste through robotic handling systems in the assembly line process.

Market Dynamics of the Japan Plywood Market:

The Japanese plywood market is driven by the construction industry's recovery as well as a strong interest in green construction materials. Urbanization and demand for disaster-resistant homes and businesses are driving up the use of plywood in roofs, floors, and walls. In addition, the Japanese government is promoting wood-based decarbonization, and home renovations and do-it-yourself (DIY) projects are becoming increasingly popular, both contributing to market expansion. Plywood is also viewed as a good option for today's modular building industry due to its strength-to-weight ratio and cost-effectiveness compared to solid wood.

The Japanese plywood market is restrained by the volatility of raw material sources, and fluctuating costs of plywood are inhibiting the growth of this market. International trade agreements and environmental laws will continue to pressure this sector. Competition from other products engineered from wood, such as MDF and OSB, further complicates matters for the industry. Increasing production costs due to labor shortages and rising wages in the areas where most manufacturers are located will also pose challenges to the industry.

The creation of novel, high-performance goods, such as fire-resistant and waterproof plywood, offers enormous growth prospects. In addition, expanding applications in modular housing and aerospace create new opportunities for market expansion.

Japan Plywood Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.41 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 4.81% |

| 2035 Value Projection: | USD 4.41 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Nippon Plywood Industry Co., Ltd., Hanwa Co., Ltd., SMB Kenzai Co., Ltd., Sumitomo Forestry Co., Ltd., Daiken Corporation, Mori Kougei, Seihoku Corporation, Marubeni Corporation, Mitsui & Co., Ltd., Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan plywood market share is classified into wood type and end-use.

By Wood Type:

The Japanese plywood market is divided by wood type into softwood and hardwood. Among these, the hardwood plywood segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is due to its durability and aesthetic appeal make it a popular choice for high-end applications like furniture and cabinetry.

By End-Use:

The Japanese plywood market is divided by end-use into residential and commercial. Among these, the residential segment held the highest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is due to the wide use in housing construction, interior design, and furniture production. Plywood is commonly used in flooring, roofing, wall panels, cabinets, and doors due to its strength, durability, and cost-effectiveness. Additionally, rapid urbanization and rising demand for affordable housing have greatly increased residential plywood usage.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Plywood market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Plywood Market:

- Nippon Plywood Industry Co., Ltd.

- Hanwa Co., Ltd.

- SMB Kenzai Co., Ltd.

- Sumitomo Forestry Co., Ltd.

- Daiken Corporation

- Mori Kougei

- Seihoku Corporation

- Marubeni Corporation

- Mitsui & Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan plywood market based on the below-mentioned segments:

Japan Plywood Market, By Wood Type

- Softwood

- Hardwood

Japan Plywood Market, By End-Use

- Residential

- Commercial

Frequently Asked Questions (FAQ)

-

Q:What is the current and forecasted size of the Japan plywood market?A:The market was valued at USD 2.63 billion in 2024 and is projected to reach USD 4.41 billion by 2035. This growth reflects a CAGR of 4.81% during 2025–2035.

-

Q:What are the key factors driving growth in the Japanese plywood market?A:Growth is driven by recovery in construction, rising demand for green building materials, and urbanization. Also, Government policies promoting wood-based construction further support market expansion.

-

Q:Which wood type holds the largest share in the Japanese plywood market?A:Hardwood plywood dominated the market in 2024 due to its durability and aesthetic appeal. It is widely used in furniture, cabinetry, and premium interior applications.

-

Q:Which end-use segment leads the Japanese plywood market?A:The residential segment held the highest market share in 2024, due to extensive use in housing construction, flooring, roofing, and interior applications.

-

Q:What technological trends are shaping the Japanese plywood market?A:Manufacturers are adopting automation, digital transformation (DX), and biomass energy solutions. Innovations such as ultra-thick plywood (CLP) are gaining attention as alternatives to steel and concrete.

-

Q:Who are the major players in the Japanese plywood market?A:Key companies include Nippon Plywood Industry, Sumitomo Forestry, Daiken Corporation, and Seihoku Corporation. Marubeni and Mitsui & Co. also play a significant role in the market.

-

Q:Who are the target audiences for the Japan plywood market report?A:The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?