Japan Plastic Resin Market Size, Share, and COVID-19 Impact Analysis, By Product (Crystalline Resin, Non-crystalline Resin, and Engineering Plastic), By Application (Packaging, Automotive, and Construction), and Japan Plastic Resin Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Plastic Resin Market Insights Forecasts To 2035

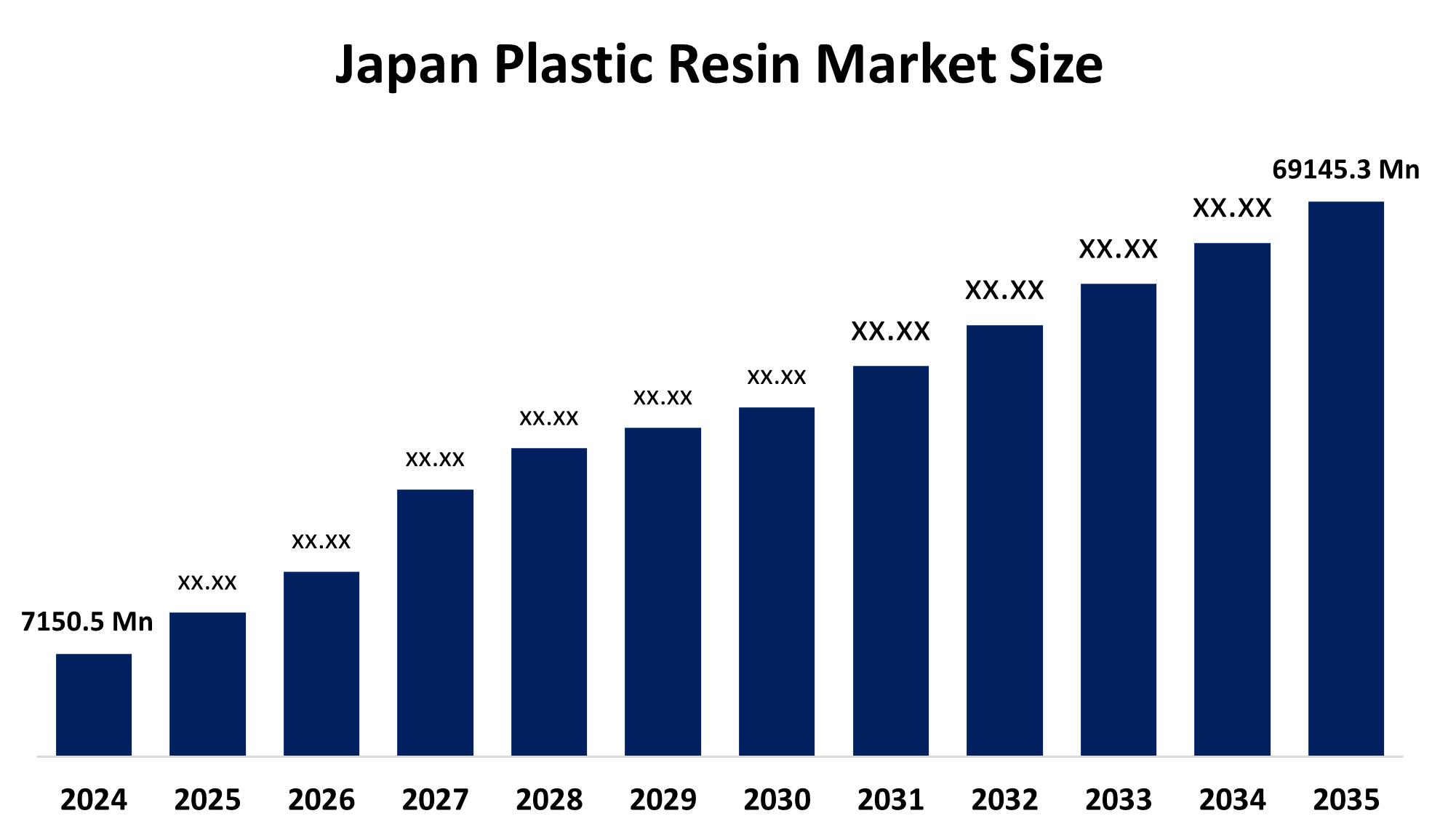

- The Japan Plastic Resin Market Size Was Estimated at USD 7150.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 22.91% from 2025 to 2035

- The Japan Plastic Resin Market Size is Expected to Reach USD 69145.3 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Plastic Resin Market Size is Anticipated to Reach USD 69145.3 Million by 2035, Growing at a CAGR of 22.91% from 2025 to 2035. The plastic resin market in Japan is driven by rising product demand from the construction, automotive, and electrical and electronics industries, which is driving market expansion in Japan.

Market Overview

Plastic resin refers to the raw, unprocessed form of plastic that serves as the foundation of the production of a wide range of plastic products. It is usually supplied in small, solid pills or beads, which can be melted, molded, and extruded in various shapes depending on the desired application. Plastic resins are formed through polymerization processes, with monomers bonded to make polymers. The properties of these resins such as strength, flexibility, transparency, and resistance to heat or chemicals depend on the types of polymer and additives used during manufacturing. Plastic resins are roughly classified into two categories: thermoplastic and thermosetting plastics. Thermoplastics, such as polyethylene (PE), polypropylene (PP), polystyrene (PS), and polyvinyl chloride (PVC), can be repeatedly melted and can be re-shaped, which can make them highly multifaceted for packaging, containers, automotive parts, and consumer goods. Thermosetting resins, such as epoxy, phenolic, and melamine resins, undergo a treatment process that makes them ideal for rigid and heat-resistant coatings, adhesives, electrical components, and construction materials. Plastic resin also presents environmental challenges, mainly due to dependence on issues with petrochemical feedstock and plastic waste and recycling. To overcome these concerns, ongoing research is focusing on bio-based resins, biodegradable plastics, and advanced recycling technologies.

Report Coverage

This research report categorizes the market for the Japan plastic resin market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan plastic resin market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan plastic resin market.

Japan Plastic Resin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024 : | USD 7150.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 22.91% |

| 2035 Value Projection: | USD 69145.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Sumitomo Chemical Co., Ltd., Toray Industries, Inc., Mitsui & Co., Ltd., Teijin Limited, Others, and |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The plastic resin market in Japan is driven by its affordability, scalability, and applicability in a variety of industries. Growth is accelerated by growing demand in the automotive, electronics, construction, and packaging industries. Resins are crucial for replacing conventional materials because of their chemical resistance, durability, and lightweight nature. In addition, continuous advancements in recyclable and bio-based resins facilitate market growth in response to sustainability and legal mandates.

Restraining Factors

The plastic resin market in Japan is mostly constrained by environmental issues related to plastic waste, dependency on petrochemical feedstocks, and inadequate recycling infrastructure. Strict government rules, volatile crude oil prices, and growing demand for sustainable substitutes all hinder market expansion and drive businesses into more environmentally friendly inventions and circular economy strategies.

Market Segmentation

The Japan plastic resin market share is classified into product and application.

- The crystalline resin segment dominated the market in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The Japan plastic resin market is segmented by product into crystalline resin, non-crystalline resin, and engineering plastic. Among these, the crystalline resin segment dominated the market in 2024 and is expected to grow at a remarkable CAGR during the forecast period. Crystalline resin thrives under conditions involving structural stresses, wear, and bearings. Due to the growing e-commerce industry and the packaging of consumer goods, crystalline resins are frequently used in packaging due to their durability and barrier properties.

- The packaging segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan plastic resin market is segmented by application into packaging, automotive, and construction. Among these, the packaging segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the growing demand for packaged goods and beverages. Additionally, a number of government organizations have set strict guidelines for the safe use of plastic materials in food and beverage applications, which should encourage market growth in Japan.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the Japan plastic resin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sumitomo Chemical Co., Ltd.

- Toray Industries, Inc.

- Mitsui & Co., Ltd.

- Teijin Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan plastic resin market based on the below-mentioned segments:

Japan Plastic Resin Market, By Product

- Crystalline Resin

- Non-crystalline Resin

- Engineering Plastic

Japan Plastic Resin Market, By Application

- Packaging

- Automotive

- Construction

Frequently Asked Questions (FAQ)

-

1. What is the base year considered for the Japan Plastic Resin Market analysis?The base year is 2024, with historical data from 2020–2023.

-

2. What was the market size of the Japan Plastic Resin Market in 2024?The market size was valued at USD 7150.5 million in 2024.

-

3. What is the projected size of the Japan Plastic Resin Market by 2035?The market is expected to reach USD 69145.3 million by 2035.

-

4. What is the growth rate (CAGR) of the Japan Plastic Resin Market during 2025–2035?The market is forecasted to grow at a CAGR of 22.91%.

-

5. Which application segment held the largest share in 2024?The packaging segment led the market in 2024 due to increasing demand for packaged goods and beverages.

-

6. What are the main driving factors of the Japan Plastic Resin Market?Key drivers include affordability, scalability, rising demand in packaging, automotive, electronics, and construction industries, and innovations in recyclable and bio-based resins.

-

7. What are the key restraining factors for the market?Environmental concerns, reliance on petrochemical feedstocks, inadequate recycling infrastructure, and volatile crude oil prices hinder market growth.

-

8. Who are the major companies operating in the Japan Plastic Resin Market?Key players include Sumitomo Chemical Co., Ltd., Toray Industries, Inc., Mitsui & Co., Ltd., and Teijin Limited.

-

9. Key players include Sumitomo Chemical Co., Ltd., Toray Industries, Inc., Mitsui & Co., Ltd., and Teijin Limited.The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?