Japan Plastic Recycling Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Polyethylene, Polyethylene Terephthalate, Polypropylene, Polyvinyl Chloride, Polystyrene & Others), By Application (Building & Construction, Packaging, Electrical & Electronics, Textiles, Automotive & Others), and Japan Plastic Recycling Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Plastic Recycling Market Insights Forecasts to 2035

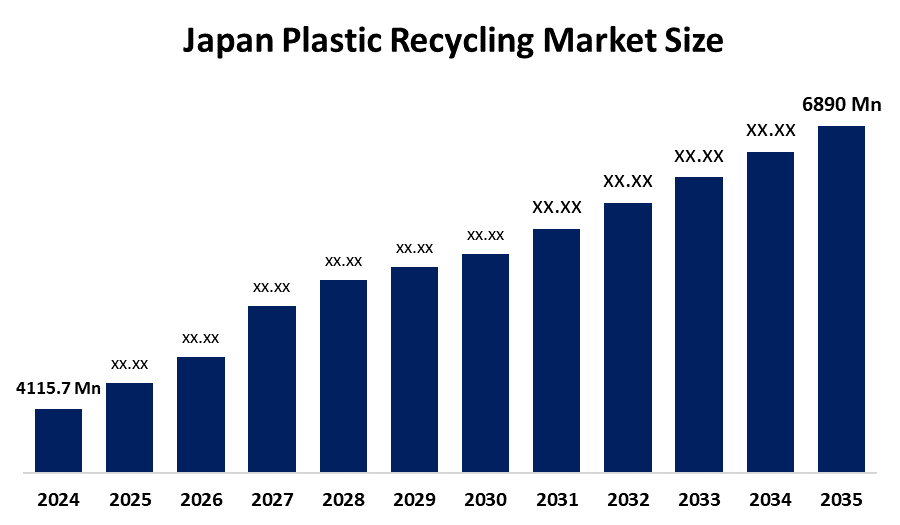

- The Japan Plastic Recycling Market Size Was Estimated at USD 4115.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.8% from 2025 to 2035

- The Japan Plastic Recycling Market Size is Expected to Reach USD 6890 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Plastic Recycling Market Size Is Anticipated To Reach USD 6890 Million By 2035, Growing At A CAGR Of 4.8% From 2025 to 2035. Japan’s plastic recycling market is driven by strict government regulations, rising environmental awareness, circular economy initiatives, advanced recycling technologies, corporate sustainability commitments, and increasing demand for recycled plastics from the packaging, automotive, and electronics industries.

Market Overview

Japan’s Plastic Recycling Market Size involves the systematic collection, sorting, processing, and reuse of plastic waste to produce recycled raw materials for various industries. The market is witnessing steady growth due to strict environmental regulations, rising public awareness about plastic pollution, and Japan’s strong commitment to a circular economy. Government initiatives such as the Plastic Resource Circulation Act, along with targets to reduce single-use plastics, are encouraging higher recycling rates. In addition, increasing demand for recycled plastics from packaging, automotive, electronics, and construction sectors is supporting market expansion and long-term growth.

Several key trends are shaping the market. First, the use of recycled plastics in packaging is rising as brand owners respond to consumer demand for sustainable and eco-friendly products. Second, corporate sustainability strategies are becoming more prominent, with companies setting clear targets for recycled content and waste reduction. Third, collaboration between local governments, recycling companies, and manufacturers is improving collection systems and recycling efficiency across regions. Fourth, export-oriented recycling and international partnerships are emerging, allowing Japan to optimize material recovery and manage plastic waste more effectively within global recycling networks.

Technological innovation plays a critical role in the advancement of Japan’s plastic recycling market. Mechanical recycling technologies are improving through better sorting, washing, and processing systems, enabling higher-quality recycled plastics. At the same time, chemical recycling technologies such as depolymerization and pyrolysis are gaining attention for their ability to handle mixed or contaminated plastics. Automation, robotics, and artificial intelligence are increasingly used in sorting facilities to enhance accuracy, reduce labor dependency, and increase recycling yields. These advancements are strengthening Japan’s ability to achieve sustainable plastic resource circulation.

Report Coverage

This research report categorizes the market for the Japan Plastic Recycling Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan plastic recycling market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan plastic recycling market.

Japan Plastic Recycling Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4115.7 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 4.8% |

| 2035 Value Projection: | USD 6890 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | , Yoshin Co., Ltd., Toyobo Co., Ltd., Toppan Printing Co., Ltd., Siu Japan Co., Ltd., G-Place Corporation, Green max Recycling, Rengo Co., Ltd., Hokan Holdings Ltd, Teijin Limited, Dai Nippon Printing Co., Ltd, and Other Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan Plastic Recycling Market Size is driven by strict environmental regulations aimed at reducing plastic waste and promoting a circular economy. Strong government initiatives, such as mandatory recycling targets and restrictions on single-use plastics, support market growth. Rising environmental awareness among consumers encourages higher waste segregation and recycling participation. Additionally, increasing demand for recycled plastics from packaging, automotive, and electronics industries, along with corporate sustainability commitments and investments in advanced recycling technologies, further accelerate the expansion of Japan’s plastic recycling market.

Restraining Factors

Japan’s Plastic Recycling Market Size faces restraints from high operational and technology costs, particularly for advanced and chemical recycling processes. Limited profitability due to fluctuating recycled plastic prices and competition from low-cost virgin plastics also hinder growth. Additionally, complex waste segregation requirements and contamination issues reduce recycling efficiency and increase processing challenges for recyclers.

Market Segmentation

The Japan plastic recycling market share is classified into product type and application.

- The polyethylene terephthalate segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan Plastic Recycling Market Size is segmented by product type into polyethylene, polyethylene terephthalate, polypropylene, polyvinyl chloride, polystyrene & others. Among these, the polyethylene terephthalate segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Polyethylene terephthalate dominates the market because the country has a well-established PET bottle collection and deposit system that ensures high recovery rates. PET is easier to sort and recycle compared to other plastics, resulting in better material quality. Strong government regulations on beverage containers, along with rising demand for recycled PET in packaging, textiles, and consumer goods, further support its dominance and consistent market growth.

- The packaging segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan Plastic Recycling Market Size is segmented by application into building & construction, packaging, electrical & electronics, textiles, automotive & others. Among these, the packaging segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The packaging segment dominates the market because it generates the largest volume of recyclable plastic waste, particularly from PET bottles and food containers. Government regulations and initiatives promote the use of recycled materials in packaging, encouraging manufacturers to adopt eco-friendly solutions. High consumer demand for sustainable packaging further drives this trend. Advanced collection, sorting, and recycling systems in Japan are specifically designed to efficiently process packaging plastics, ensuring a steady supply of recycled material for the industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Plastic Recycling Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

• Yoshin Co., Ltd.

• Toyobo Co., Ltd.

• Toppan Printing Co., Ltd.

• Siu Japan Co., Ltd.

• G-Place Corporation

• Green max Recycling

• Rengo Co., Ltd.

• Hokan Holdings Ltd

• Teijin Limited

• Dai Nippon Printing Co., Ltd

• Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan plastic recycling market based on the below-mentioned segments:

Japan Plastic Recycling Market, By Product Type

- Polyethylene

- Polyethylene Terephthalate

- Polypropylene

- Polyvinyl Chloride

- Polystyrene

- Others

Japan Plastic Recycling Market, By Application

- Building & Construction

- Packaging

- Electrical & Electronics

- Textiles

- Automotive

- Others

Frequently Asked Questions (FAQ)

-

What is the main purpose of plastic recycling in Japan?To reduce environmental pollution, conserve resources, and support a circular economy by converting plastic waste into reusable materials.

-

Which plastic type is most commonly recycled?Polyethylene terephthalate (PET) dominates due to its high recovery rate from bottles and ease of processing.

-

What industries use recycled plastics the most?Packaging, automotive, textiles, electronics, and construction industries are the primary consumers of recycled plastics.

-

How does Japan manage plastic waste collection?Through municipal collection programs, deposit-return schemes for PET bottles, and collaborations with private recyclers

-

Are chemical recycling methods used in Japan?processes like pyrolysis and depolymerization are used for mixed or contaminated plastics that cannot be mechanically recycled.

-

What role do government policies play in recycling?Policies such as the Plastic Resource Circulation Act mandate recycling targets, encourage recycled content, and promote sustainable waste management.

Need help to buy this report?