Japan Pipeline Integrity Management Market Size, Share, and COVID-19 Impact Analysis, By Location (Onshore and Offshore), By Service (Inspection Service, Cleaning Service, and Repairs & Refurbishment), and Japan Pipeline Integrity Management Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerJapan Pipeline Integrity Management Market Insights Forecasts To 2035

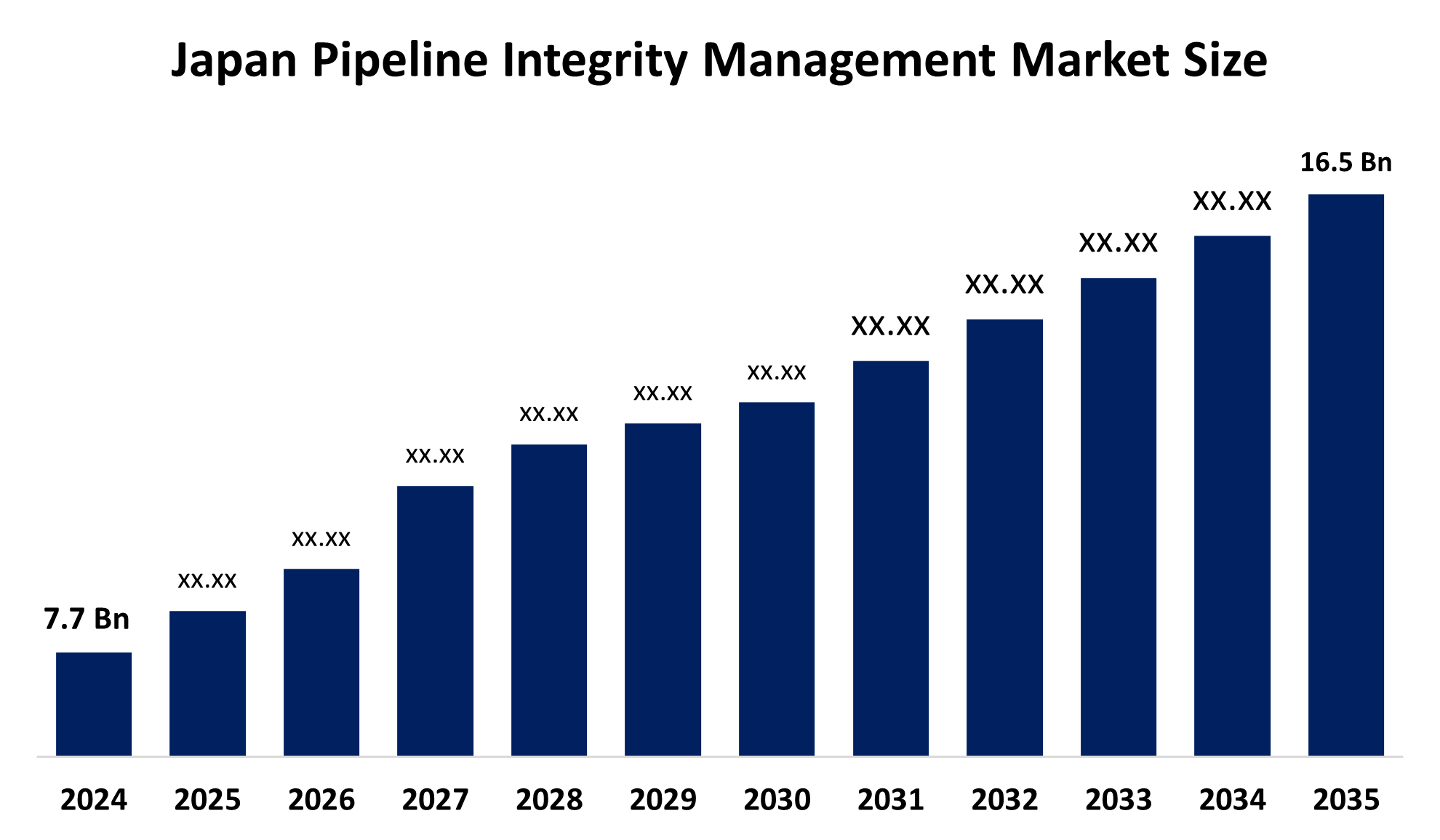

- The Japan Pipeline Integrity Management Market Size Was Estimated at USD 7.7 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.17% from 2025 to 2035

- The Japan Pipeline Integrity Management Market Size is Expected to Reach USD 16.5 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Pipeline Integrity Management Market Size is Anticipated To Reach USD 16.5 Billion by 2035, Growing at a CAGR of 7.17% from 2025 to 2035. The pipeline integrity management market in Japan is driven by accelerating industrialization, building out the infrastructure for gas and oil pipelines, and investing more in cutting-edge monitoring and inspection technology to guarantee pipeline dependability and safety.

Market Overview

The pipeline integrity management refers to the methodical, organized, and all-targeted strategy used to guarantee the safety, dependability, and effectiveness of pipelines during their operating life. Oil, gas, water, and chemical pipeline failures, leaks, and operational risks are reduced by implementing engineering concepts, data management, inspection, monitoring, risk evaluation, and preventive maintenance processes. Protecting people, the environment, and property while maintaining operational continuity and regulatory compliance is the main goal of pipeline integrity management. Maintaining the integrity of pipelines is important to prevent events such as bursting, rolling failures, or third-party losses as they often cross a large distance, different types of areas, and communities. There are all the benefits of cost-saving pipeline integrity management through better security, low downtime, prolonged asset life, low environmental impact, and preventive maintenance. In addition, the inclusion of technologies such as drones, AI-operated future-fed maintenance, and digital twins is changing pipeline monitoring and management as the energy sector undergoes an acceleration of digital changes.

Report Coverage

This research report categorizes the market for the Japan pipeline integrity management market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan pipeline integrity management market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan pipeline integrity management market.

Japan Pipeline Integrity Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7.7 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.17% |

| 2035 Value Projection: | USD 16.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Location, By Service |

| Companies covered:: | Applus+, DNV AS (formerly DNV GL, Baker Hughes Company, Schlumberger, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The primary driving factor for Japan's pipeline integrity management market is aging infrastructure, growing energy and LNG imports, and stringent government laws that prioritize environmental and safety preservation. Efficiency is increased by the use of AI, IoT-based solutions, digital monitoring, and predictive maintenance. Additionally, the need for sophisticated integrity management technology is being further accelerated by rising investments in pipelines for renewable energy and hydrogen.

Restraining Factors

The Japan pipeline integrity management market is restrained by high installation costs of sophisticated monitoring systems and complicated regulatory compliance. Furthermore, pipeline inspection and maintenance are made more difficult by Japan's dense metropolitan infrastructure, and local innovation in integrity management solutions is slowed down, resulting in increased reliance on foreign technologies.

Market Segmentation

The Japan pipeline integrity management market share is classified into location and service.

- The onshore segment held the largest market revenue share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The Japan pipeline integrity management market is segmented by location into onshore and offshore. Among these, the onshore segment held the largest market revenue share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The onshore segment focuses on pipelines that follow land for the transportation of gas, oil, and other materials. Environmental circumstances, land use conflicts, and the requirement for careful monitoring and maintenance to stop leaks or ruptures that might have serious effects on the environment and public safety are some of the particular difficulties this segment faces.

- The inspection services segment held the largest market revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan pipeline integrity management market is segmented by service into inspection service, cleaning service, and repairs & refurbishment. Among these, the inspection services segment held the largest market revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the identification and assessment of any dangers and harm to pipeline infrastructure. Due to the necessity of routine inspections to guarantee adherence to safety regulations and prolong the life of pipeline assets, it has experienced tremendous expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan pipeline integrity management market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Applus+

- DNV AS (formerly DNV GL

- Baker Hughes Company

- Schlumberger

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Pipeline Integrity Management market based on the below-mentioned segments:

Japan Pipeline Integrity Management Market, By Location

- Onshore

- Offshore

Japan Pipeline Integrity Management Market, By Service

- Inspection Service

- Cleaning Service

- Repairs & Refurbishment

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Japan pipeline integrity management market in 2024?The market size was valued at USD 7.7 billion in 2024.

-

2. What is the forecasted the Japan pipeline integrity management market size by 2035?The market is projected to reach USD 16.5 billion by 2035.

-

3. What is the CAGR of the Japan pipeline integrity management market during 2025–2035?The market is expected to grow at a CAGR of 7.17% during the forecast period.

-

4. What factors restrain the Japan pipeline integrity management market?High costs of advanced monitoring systems, complex regulatory compliance, and urban infrastructure challenges.

-

5. Which segment held the largest market share by location in 2024?The onshore segment held the largest revenue share in 2024.

-

6. Which service segment dominates the Japan pipeline integrity management market?Inspection services held the largest revenue share due to the rising need for routine inspections.

-

7. Who are the key players in the Japan pipeline integrity management market?Key companies include Applus+, DNV AS, Baker Hughes, Schlumberger, and others.

Need help to buy this report?