Japan Pet Insurance Market Size, Share, By Coverage (Accident & Illness, Accident Only, and Others), By Animal (Dogs, Cats, and Others), Japan Pet Insurance Market Insights, Industry Trend, Forecasts to 2035.

Industry: Consumer GoodsJapan Pet Insurance Market Insights Forecasts to 2035

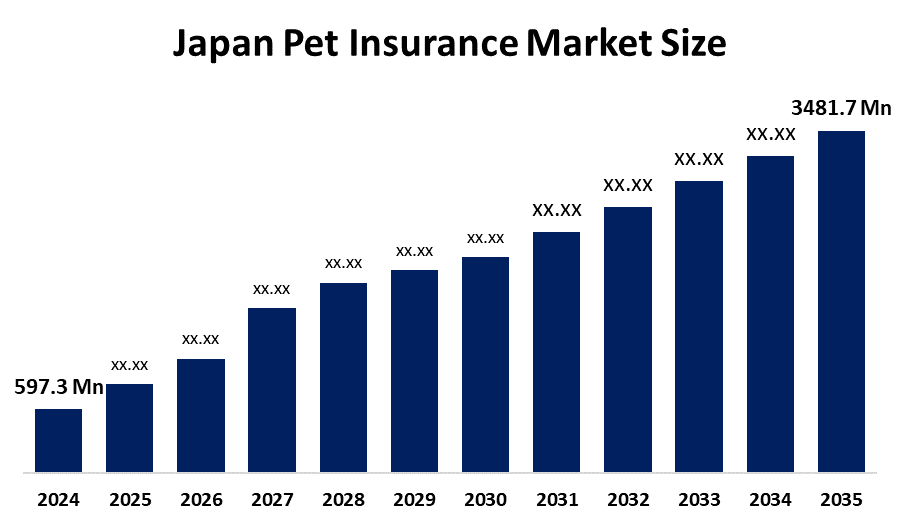

- Japan Pet Insurance Market Size 2024: USD 597.3 Mn

- Japan Pet Insurance Market Size 2035: USD 3481.7 Mn

- Japan Pet Insurance Market CAGR 2024: 17.38%

- Japan Pet Insurance Market Segments: Coverage and Animal

Get more details on this report -

The Japan pet insurance market consists of policies that insure the veterinary care, medical treatments, accidents, and diseases of pets (mainly dogs and cats), besides offering financial reimbursement or credit. It is similar to human health insurance, where owners can still get veterinary help for their pets in spite of the very high costs, by the simple means of paying premiums for reimbursement or direct payment of the covered expenses. The market for Japan pet insurance is growing very quickly because of factors such as more and more people keeping pets, higher vet fees, more fenced-off pet health awareness, and the launching of a variety of insurance plans that are dog, cat, and even exotic pet specific.Japan's Animal Welfare Act mandates that pet owners should provide animal health and safety; thus, veterinary care and pet insurance demand will be supported. The regulatory reforms are said to increase the transparency as well as the protection of consumers when it comes to insurance products. Nationally, there are no pet insurance subsidies, but local administrations are offering help by way of reimbursement for microchipping up to ¥7,500 and subsidizing shelter care and veterinary expenses, which act indirectly as encouragements for responsible pet ownership and thus, adoption of insurance products.Some of the recent changes in the pet insurance market in Japan are Anicom's uplift of the digital and wellness-focused services like microbiome testing, along with preventive care programs, and the partnership of Tokio Marine with vet clinics to improve the integration of insurance. The increasing adoption of AI, telehealth, and data analytics is resulting in more efficient claims processing, better pet health monitoring, and enhanced customer experience.

Japan Pet Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 597.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 17.38% |

| 2035 Value Projection: | USD 3481.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 132 |

| Segments covered: | By Coverage By Animal |

| Companies covered:: | Anicom Insurance, ipet Insurance, Nihon Pet, Aflac Pet Insurance, HS Insurance, Rakuten General Insurance, au Insurance, Tsubaki Small Amount & Short-Term Insurance, Pet Medical Support Insurance, FPC Small Amount & Short-Term Insurance, SBI Prism Small Amount & Short-Term Insurance,and Others key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Pet Insurance Market:

The Japan pet insurance market is driven by the rise in pet ownership, mainly in urban families, and the overall tendency of considering pets as family members. The increasing costs of veterinary treatments, better knowledge of preventive and advanced animal healthcare, and the pet longevity that is considered a factor for insurance usage are the main contributors. The government's animal welfare policy, along with the improved transparency in insurance products, has also gained consumers' trust. Besides that, the digital innovation, wellness-based insurance plans, and collaborations with vet clinics are among the causes for the rapid expansion of the market throughout the nation.

The Japan pet insurance market is restrained by the general unawareness of pet insurance among certain pet owners, high premiums for older pets, limited coverage and exclusions, complicated policy wording, and some households preferring to pay out of pocket or save rather than purchase insurance.

The future of Japan's pet insurance market will be characterized by AI-powered underwriting, telehealth veterinary services, and health monitoring devices for pets. The new ideas are the wellness-based insurance plans that have preventive care rewards and data-linked premium discounts, which not only make the health of pets better but also increase the interaction with the customers. Going into exotic pet insurance and working closely with vet clinics will make the market even larger.

Market Segmentation

The Japan Pet Insurance Market share is classified into coverage and animal.

By Coverage:

The Japan pet insurance market is divided by coverage into accident & illness, accident only, and others. Among these, the accident & illness segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Comprehensive coverage for veterinary care, growing medical expenses, growing awareness of preventative care, and pet owners' inclination for insurance that guards against both unforeseen mishaps and chronic illnesses are the main factors driving this dominance.

By Animal:

The Japan pet insurance market is divided by animal into dogs, cats, and others. Among these, the dogs segment accounted for the largest share in 2024 and is projected to grow at a significant CAGR during the forecast period. Higher dog ownership rates, more frequent and expensive veterinary care, the availability of dog-specific insurance plans, and owners' increased willingness to ensure dogs due to their higher treatment costs relative to other pets are the main factors contributing to this dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan pet insurance market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Pet Insurance Market:

- Anicom Insurance

- ipet Insurance

- Nihon Pet

- Aflac Pet Insurance

- HS Insurance

- Rakuten General Insurance

- au Insurance

- Tsubaki Small Amount & Short-Term Insurance

- Pet Medical Support Insurance

- FPC Small Amount & Short-Term Insurance

- SBI Prism Small Amount & Short-Term Insurance

- Others

Recent Developments in Japan Pet Insurance Market:

In July 2025, Anicom Insurance triumphed in two categories at the 2025 Insurance Asia Awards for its product innovation and digital insurance initiatives, which were mainly exemplified by the Animal Wellness Program and Animal Health Insurance Card.

In June 2025, The Beisia Group's acquisition of Japan Pet Small Amount & Short-Term Insurance signaled a significant entry into the market by a large retail group.

In May 2025, Tokio Marine Well Design introduced a group purchasing service aimed at veterinary clinics as a measure to ensure the provision of pet medical services stably and efficiently.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan pet insurance market based on the below-mentioned segments:

Japan Pet Insurance Market, By Coverage

- Accident & Illness

- Accident Only

- Others

Japan Pet Insurance Market, By Animal

- Dogs

- Cats

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Japan pet insurance market size?A: Japan Pet Insurance Market is expected to grow from USD 597.3 million in 2024 to USD 3481.7 million by 2035, growing at a CAGR of 17.38% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rise in pet ownership, mainly in urban families, and the overall tendency of considering pets as family members. The increasing costs of veterinary treatments, better knowledge of preventive and advanced animal healthcare, and the pet longevity that is considered a factor for insurance usage are the main contributors. The government's animal welfare policy, along with the improved transparency in insurance products, has also gained consumers' trust.

-

Q: What factors restrain the Japan pet insurance market?A: Constraints include the general unawareness of pet insurance among certain pet owners, high premiums for older pets, limited coverage and exclusions, complicated policy wording, and some households preferring to pay out of pocket or save rather than purchase insurance.

-

Q: How is the market segmented by coverage?A: The market is segmented into accident & illness, accident only, and others.

-

Q: Who are the key players in the Japan pet insurance market?A: Key companies include Anicom Insurance, ipet Insurance, Nihon Pet, Aflac Pet Insurance, HS Insurance, Rakuten General Insurance, au Insurance, Tsubaki Small Amount & Short-Term Insurance, Pet Medical Support Insurance, FPC Small Amount & Short-Term Insurance, SBI Prism Small Amount & Short-Term Insurance, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?