Japan Orthopaedic Devices Market Size, Share, By Type (Trauma Fixation, Spinal Devices, Joint Replacement, Consumables Disposables and Bone Repair), By Application (Spine, Trauma and Extremities, Knee, Hip, Foot and Ankle) and By End Use (Ambulatory Surgery Centers, Hospitals and Medical Research Center), Japan Orthopaedic Devices Market Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Orthopaedic Devices Market Insights Forecasts to 2035

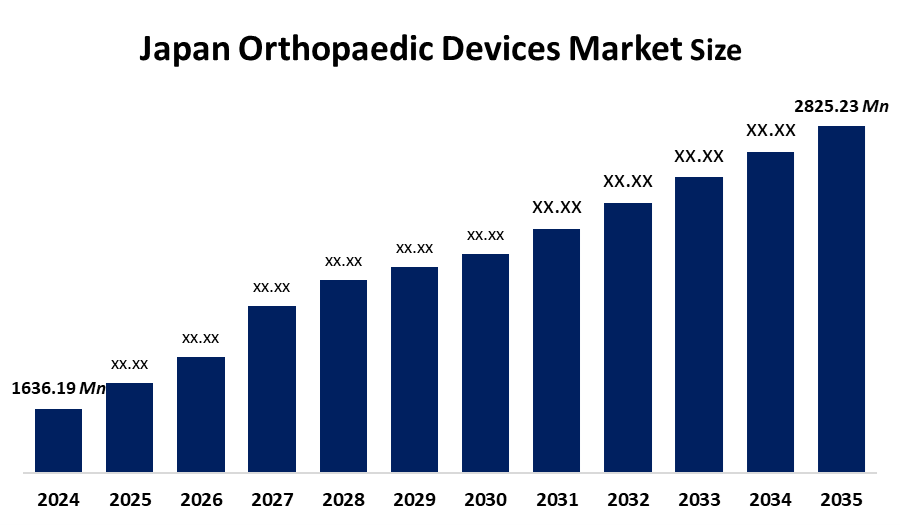

- Japan Orthopaedic Devices Market Size 2024: USD 1636.19 Million

- Japan Orthopaedic Devices Market Size 2035: USD 2825.23 Million

- Japan Orthopaedic Devices Market CAGR 2024: 5.09%

- Japan Orthopaedic Devices Market Segments, Types, Application, and End Use.

Get more details on this report -

The Japan orthopaedic devices market includes medical equipment and implants used to treat bone, joint, and musculoskeletal conditions. These devices include joint replacement implants, trauma fixation devices, spinal implants, and orthopaedic braces. The market serves hospitals, clinics, and surgical centres, supporting treatment for fractures, arthritis, osteoporosis, and sports injuries, particularly among Japan’s rapidly ageing population. Furthermore, The Japan orthopaedic devices market is growing due to the country’s rapidly ageing population and rising cases of osteoporosis, arthritis, and joint disorders. Increasing demand for knee and hip replacement surgeries supports expansion. Technological advancements in minimally invasive procedures and durable implant materials improve outcomes. Higher healthcare spending, strong insurance coverage, and growing awareness about mobility treatments further accelerate market growth.

The Japan government supports the orthopaedic devices market through universal healthcare coverage and reimbursement policies for essential surgical procedures. Regulatory oversight by the Pharmaceuticals and Medical Devices Agency (PMDA) ensures product safety and quality standards. Policies encouraging medical innovation, faster device approvals, and healthcare modernisation also promote domestic manufacturing and adoption of advanced orthopaedic technologies.

Japan's orthopaedic devices market trends include rising adoption of minimally invasive surgeries, robotic-assisted orthopaedic procedures, and 3D-printed implants. Demand for customised joint replacements and biologic-based treatments is increasing. Smart implants with monitoring capabilities are emerging. Additionally, outpatient surgical procedures are becoming more common, improving efficiency and reducing hospital stays while maintaining high-quality patient outcomes.

Market Dynamics of the Japan Orthopaedic Devices Market:

The Japan orthopaedic devices market is driven by factors including increasing life expectancy, growing prevalence of degenerative bone diseases, and expanding sports-related injuries. Improved diagnostic capabilities and patient preference for mobility restoration also boost demand. Technological advancements in implant durability and surgical precision further strengthen adoption. Strong healthcare infrastructure and insurance coverage make advanced orthopaedic treatments accessible in Japan.

The Japan orthopaedic devices market faces restraints such as high costs of advanced implants and surgical procedures, which may limit patient access. Strict regulatory approval processes can delay product launches. Government price control and reimbursement revisions reduce profit margins for manufacturers. Additionally, surgical risks, implant failures, and postoperative complications may discourage some patients from undergoing orthopaedic procedures.

The Japan orthopaedic devices market offers opportunities in developing innovative biomaterials, robotic-assisted surgery systems, and patient-specific implants. Expansion of home rehabilitation technologies and telemedicine services offers growth potential. Increasing investment in research and development supports advanced treatment options. Japan’s ageing society creates long-term demand for joint replacements and spinal devices, presenting sustained opportunities for manufacturers and healthcare provider

Japan Orthopaedic Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1636.19 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 5.09 % |

| 2035 Value Projection: | USD 2825.23 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Segments covered: | By Type |

| Companies covered:: | Mizushima Seiki, Nippon Sigmax, Teijin Nakashima Medical Co., Ltd., Kyocera Corporation, Olympus Corporation, HOYA Technosurgica / HOYA Group, and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan orthopaedic devices market share is classified into types, applications, and end use.

By Types:

The Japan orthopaedic devices market is divided by types into trauma fixation, spinal devices, joint replacement, consumables, disposables and bone repair. Among these, the joint replacement segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The Joint Replacement systems segment dominates because Japan rapidly ageing population and high prevalence of osteoarthritis. Increasing demand for knee and hip replacement surgeries, strong insurance reimbursement coverage, advanced surgical technologies, and improved implant durability collectively drive higher procedure volumes and revenue compared to other orthopaedic device segments.

By Application:

The Japan orthopaedic devices market is divided by application into spine, trauma and extremities, knee, hip, foot and ankle. Among these, the knee segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The knee segment dominates due to the high incidence of osteoarthritis among Japan’s ageing population. Elderly patients commonly require knee replacement to restore mobility and reduce pain. Strong health insurance coverage, advanced surgical techniques, improved implant longevity, and increasing awareness about quality-of-life improvements further drive higher procedure volumes in the knee category.

By End Use:

The Japan orthopaedic devices market is divided by end use into ambulatory surgery centres, hospitals and medical research centres. Among these, the hospitals segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The hospitals dominate because most orthopaedic procedures, especially joint replacements and spinal surgeries, require advanced operating facilities and postoperative care. They have specialised surgeons, diagnostic equipment, and emergency services for trauma cases. Strong insurance reimbursement and patient trust in hospital-based treatment further increase procedure volumes, supporting their leading position.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan orthopaedic devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Orthopaedic Devices Market:

- Mizushima Seiki

- Nippon Sigmax

- Teijin Nakashima Medical Co., Ltd.

- Kyocera Corporation

- Olympus Corporation

- HOYA Technosurgica / HOYA Group

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan orthopaedic devices market based on the below-mentioned segments:

Japan Orthopaedic Devices Market, By Types.

- Trauma Fixation

- Spinal Devices

- Joint Replacement

- Consumables Disposables

- Bone Repair

Japan Orthopaedic Devices Market, By Application

- Spine

- Trauma and Extremities

- Knee

- Hip

- Foot and Ankle

Japan Orthopaedic Devices Market, By End Use.

- Ambulatory Surgery Centres

- Hospitals

- Medical Research Centre

Frequently Asked Questions (FAQ)

-

What is the Japan orthopaedic devices market size? Japan orthopaedic devices market is expected to grow from USD 1636.19 million in 2024 to USD 2825.23 million by 2035, growing at a CAGR of 5.09 % during the forecast period 2025-2035.

-

What are the key growth drivers of the Japan orthopaedic devices market? Japan’s orthopaedic devices market growth is driven by ageing demographics, increasing osteoarthritis cases, technological advancements, sports injuries, higher healthcare spending, and rising demand for minimally invasive surgeries.

-

What factors restrain the Japan orthopaedic devices market? The Japan ORTHOPAEDIC DEVICES MARKET is restraining Japan’s extended reality marke High device costs, stringent regulatory approvals, reimbursement limitations, pricing pressures, declining population growth, and hospital budget constraints restrain market expansion

-

How is the Japan orthopaedic devices market segmented by application? The Japan orthopaedic devices market is segmented into spine, trauma and extremities, knee, hip, foot and ankle.

-

Who are the key players in the Japan orthopaedic devices market? Key companies operating in the Japan orthopaedic devices market include Mizushima Seiki, Nippon Sigmax, Teijin Nakashima Medical Co., Ltd., Kyocera Corporation, Olympus Corporation, HOYA Technosurgica (HOYA Group), and other prominent market participants

Need help to buy this report?