Japan Organic Food & Beverages Market Size, Share, By Product (Organic Food and Organic Beverages), By Distribution Channel (Supermarket/Hypermarket, Specialty Stores, Convenience Stores, Online Sales Channel, and Others), Japan Organic Food & Beverages Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesJapan Organic Food & Beverages Market Insights Forecasts to 2035

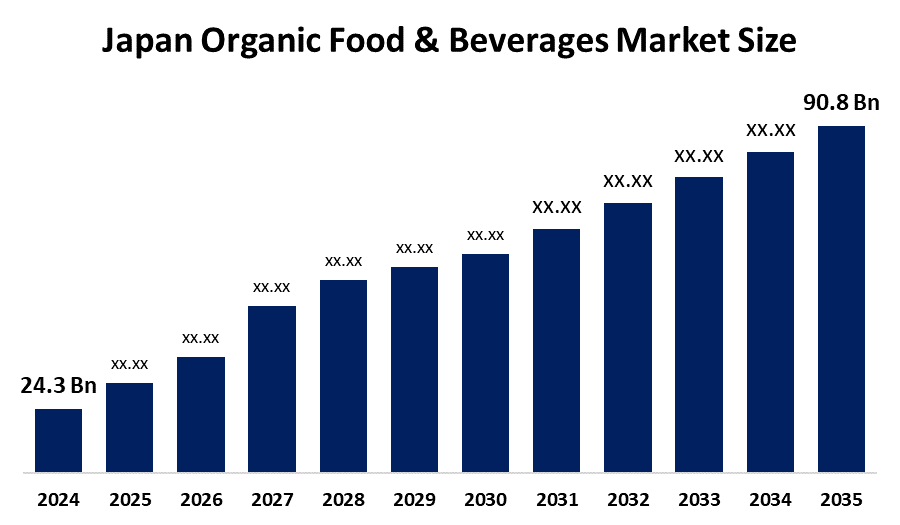

- Japan Organic Food & Beverages Market Size 2024: USD 24.3 Bn

- Japan Organic Food & Beverages Market Size 2035: USD 90.8 Bn

- Japan Organic Food & Beverages Market Size CAGR 2024: 12.73%

- Japan Organic Food & Beverages Market Size Segments: Product And Distribution Channel.

Get more details on this report -

The Japanese Organic Food And Beverages Market Size Includes Products That Are Produced Organically, Without The Use Of Chemical Fertilisers, Pesticides, Genetically Modified Organisms, Artificial Ingredients, Or Growth Hormones. There are many types of organic food and drink products available in Japan, including organic fruits and vegetables, cereals, dairy products, meat, beverages, packaged foods, and baby food. Organic food production in Japan is tightly controlled in accordance with the requirements of the Japanese Agricultural Standards (JAS) certification system. The organic food and beverages market has expanded steadily due to increasing consumer awareness of health, food safety, and environmental sustainability.

The Japanese Government's Efforts To Promote Organic Agriculture Are Part Of The Country's Overall Sustainability Agenda. Under the Green Food System Strategy, the Japanese Ministry of Agriculture, Forestry and Fisheries (MAFF) expect to increase organic farming areas while significantly decreasing the number of chemical pesticides and fertilisers used on farms by the year 2050. In addition, MAFF is involved in some programs designed to promote the JAS organic certification system; improve transparency in the organic supply chain; and develop more opportunities for organic producers to sell their products internationally.

Technological Development Is Critical To The Continued Advancement Of Japan's Organic Food And Beverage Industry, And Many Advancements Have Been Made In This Area. For example, some farmers in Japan are using smart agriculture tech such as IoT-enabled soil sensors, drones, and artificial intelligence-based crop monitoring systems. To optimise yields while still meeting the requirements of organic farming. In addition, innovations in plant-based ingredients, fermentation technology, and clean-label processing space are supporting the development of innovative new products in both organic beverages and functional foods.

Japan Organic Food & Beverages Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 24.3 Billion |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 12.73% |

| 2023 Value Projection: | 90.8 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product By Distribution Channel |

| Companies covered:: | Ohsawa Japan Co. Ltd., Sokensha Co., Ltd., Yakult Honsha, Seikatsu Club Consumers’ Co-operative Union, Asahi Group Holdings, Suntory Holdings, and Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Organic Food & Beverages Market:

The Japanese Organic Food & Beverages Market Size Is Driven By Rising Consumer Awareness About Health, food safety, and the environmental impacts of traditional farming, which has contributed to increased demand for organic food products. Additional demand factors include an ageing population, increasing disposable incomes, and a strong preference for clean-label products. In addition, many supportive government programs have been created around sustainability initiatives, which support the growth of organic food products.

The Japanese Organic Food & Beverages Market Size Is Restrained By The High Cost Of Producing And Selling Organic Foods, Which, Relative To Traditional Foods, Will Hinder Widespread Consumer Acceptance Of Organic Foods. Limited domestic supply, higher certification costs, and price sensitivity are all major impediments to widespread organic food acceptance. Additionally, the limited shelf life of organic foods presents logistical difficulties.

Organic Packaged Goods, On-The-Go Meals, And Functional Beverages Represent Key Categories With Growth Opportunities. The rapid growth of e-commerce, the emergence of speciality organic retail channels, and an increase in exports, in conjunction with innovation related to sustainable packaging and advances in smart farming technologies, will accelerate market growth for organic foods.

Market Segmentation

The Japan Organic Food & Beverages Market share is classified into product and distribution channel.

By Product:

The Japanese Organic Food & Beverages Market Size Is Divided By Product Into Organic Food And Organic Beverages. Among these, the organic food segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is due to strong consumer emphasis on daily dietary health, increased consumption of organic staples including rice, vegetables, fruits, and packaged meals, and growing concerns about food safety and chemical residues.

By Distribution Channel:

The Japanese Organic Food & Beverages Market Size Is Divided By Distribution Channel Into Supermarket/Hypermarket, Speciality Stores, Convenience Stores, Online Sales Channel, And Others. Among these, the supermarket/hypermarket segment accounted for the largest market size revenue share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is due to the growing number of supermarket and hypermarket chains, as well as changes in the retail landscape, which are driving up product sales through this channel.

Competitive Analysis:

The Report Offers The Appropriate Analysis Of The Key Organisations/Companies Involved Within The Japan Organic Food & Beverages Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Organic Food & Beverages Market:

- Ohsawa Japan Co. Ltd.

- Sokensha Co., Ltd.

- Yakult Honsha

- Seikatsu Club Consumers’ Co-operative Union

- Asahi Group Holdings

- Suntory Holdings

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Organic Food & Beverages Market based on the below-mentioned segments:

Japan Organic Food & Beverages Market, By Product

- Organic Food

- Organic Beverages

Japan Organic Food & Beverages Market, By Distribution Channel

- Supermarket/Hypermarket

- Speciality Stores

- Convenience Stores

- Online Sales Channel

- Others

Frequently Asked Questions (FAQ)

-

What is the market size and growth outlook of the Japan organic food & beverages market?The market was valued at USD 24.3 billion in 2024 and is projected to reach USD 90.8 billion by 2035, growing at a CAGR of 12.73% during 2025–2035.

-

Which product segment dominates the Japan organic food & beverages market market?The organic food segment held the largest market share in 2024 due to higher consumption of organic staples such as rice, fruits, vegetables, and packaged foods.

-

Which distribution channel leads the market in Japan?Supermarkets and hypermarkets dominate the market, supported by wide product availability, consumer trust, and expanding retail chains across urban and suburban areas.

-

What challenges does the Japan organic food & beverages market face?High product prices limited domestic organic supply, certification costs, price-sensitive consumers, and shorter shelf life of organic products restrain market growth.

-

Who are the major players in the Japan Organic Food & Beverages Market?Key players include Ohsawa Japan Co. Ltd., Sokensha Co., Ltd., Yakult Honsha, Seikatsu Club Consumers’ Co-operative Union, Asahi Group Holdings, and Suntory Holdings.

-

Who are the target audiences for the Japan Organic Food & Beverages market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?