Japan Organic Beverages Market Size, Share, By Product (Non-Dairy Beverages, Fruit Beverages, Coffee & Tea, Beer & Wine, and Others), By Distribution Channel (Offline and Online), Japan Organic Beverages Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesJapan Organic Beverages Market Size Insights Forecasts to 2035

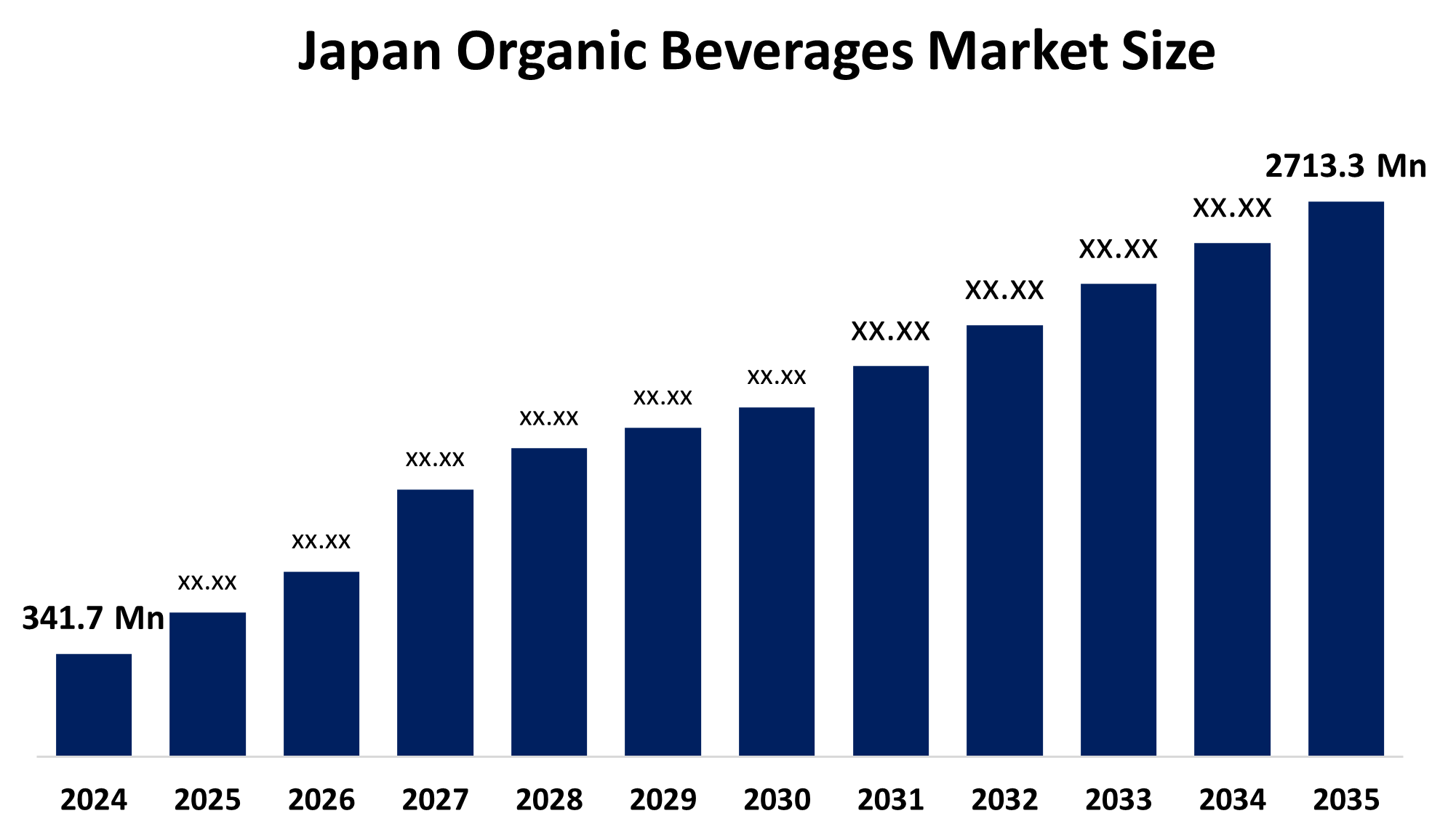

- Japan Organic Beverages Market Size 2024: USD 341.7 Million

- Japan Organic Beverages Market Size 2035: USD 2713.3 Million

- Japan Organic Beverages Market CAGR 2024: 20.73%

- Japan Organic Beverages Market Segments: Product and Distribution Channel.

Get more details on this report -

Japan is an organic beverage manufacturer that meets the criteria established under the Japanese Agricultural Standards for organic products by using only ingredients grown without using synthetic pesticides or fertilizers or using genetically modified organisms. These products can be found within the tea, coffee, and fruit juice categories. Along with the increased demand for high-quality edible products, there is an increase in products with clean labels and significant health-related claims. While increased availability has driven these trends, there has also been a growing popularity of functional organic beverages, such as kombucha and plant milks, as customers increasingly focus on building immunity and improving their digestive health as part of their daily diet.

Government and private sector initiatives are playing a critical role in shaping the future of organic drinks in Japan. The Ministry of Agriculture, Forestry, and Fisheries (MAFF) has implemented the "Midori Strategy," which aims to expand organic farming to 1 million hectares by 2050, thereby securing a stable domestic supply of organic raw materials. On the private side, major retailers like Aeon and Seven & Holdings are launching dedicated organic private-label brands and expanding shelf space in urban convenience stores to make organic beverages more accessible to the mass market.

Technological advancements are driving efficiency and trust across the organic beverage value chain in Japan. Manufacturers are integrating blockchain technology to provide "farm-to-bottle" traceability, allowing consumers to verify organic certifications via QR codes on packaging. Additionally, innovations in high-pressure processing (HPP) are enabling brands to extend the shelf life of organic juices without the use of artificial preservatives or high-heat pasteurization, preserving the natural flavor and nutrient profile of the ingredients.

Market Dynamics of the Japan Organic Beverages Market:

The Japan Organic Beverages Market Size is primarily driven by rising health consciousness among an aging population seeking products free from synthetic additives and chemicals. Additionally, the growing "clean label" trend encourages consumers to scrutinize ingredient lists, favoring beverages with simple, recognizable organic components.

The Japan Organic Beverages Market Size is restrained by restrained by the premium pricing of organic drinks compared to conventional options, which can deter price-sensitive consumers. Furthermore, the complex and time-intensive JAS certification process poses a barrier for small-scale producers.

There are substantial opportunities in the development of organic functional waters and ready-to-drink (RTD) organic teas that cater to the "on-the-go" lifestyle. Expanding into subscription-based delivery services for organic health drinks also offers high growth potential.

Japan Organic Beverages Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 341.7 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 20.73% |

| 2035 Value Projection: | USD 2713.3 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product, By Distribution Channel |

| Companies covered:: | Suntory Holdings Limited, Kirin Holdings Company, Limited, Asahi Group Holdings, Ltd., Pokka Sapporo Food & Beverage Co., Ltd., Meiji Holdings Co., Ltd., Ito En, Ltd., Kagome Co., Ltd. and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The Japan organic beverages market share is classified into product and distribution channel.

By Product:

The Japan Organic Beverages Market Size is divided by product into non-dairy beverages, fruit beverages, coffee & tea, beer & wine, and others. Among these, the non-dairy beverages segment dominated the market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. These products are made from legumes, plant materials, nuts, and cereals, and hence serve as functional beverages. Plant-based beverages, such as milk and smoothies, are predicted to expand fast due to their nutritional value and health advantages.

By Distribution Channel:

The Japan Organic Beverages Market Size is divided by distribution channel into offline and online. Among these, the offline segment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period. This is due to the growing number of supermarket and hypermarket chains, as well as the changing retail landscape, especially in developing nations, drive greater product sales through offline channels.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Organic Beverages Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Organic Beverages Market:

- Suntory Holdings Limited

- Kirin Holdings Company, Limited

- Asahi Group Holdings, Ltd.

- Pokka Sapporo Food & Beverage Co., Ltd.

- Meiji Holdings Co., Ltd.

- Ito En, Ltd.

- Kagome Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Organic Beverages Market Size based on the below-mentioned segments:

Japan Organic Beverages Market, By Product

- Non-dairy Beverages

- Fruit Beverages

- Coffee & Tea

- Beer & Wine

- Others

Japan Organic Beverages Market, By Distribution Channel

- Offline

- Online

Frequently Asked Questions (FAQ)

-

Q: What is the Japan organic beverages market?A: The Japan organic beverages market includes beverages produced using organically certified ingredients under Japanese Agricultural Standards (JAS), free from synthetic pesticides, fertilizers, and GMOs, covering products like organic tea, coffee, juices, and plant-based drinks.

-

Q: What is the market size and growth outlook of the Japan organic beverages market?A: The market was valued at USD 341.7 million in 2024 and is projected to reach USD 2713.3 million by 2035, growing at a strong CAGR of 20.73% during 2025–2035.

-

Q: Which product segment dominates the Japan organic beverages market?A: The non-dairy beverages segment dominated the market in 2024, driven by rising demand for plant-based, functional drinks such as organic plant milks and smoothies.

-

Q: Which distribution channel holds the largest market share?A: The offline segment held the largest share in 2024 due to the strong presence of supermarkets, hypermarkets, and convenience stores offering wider accessibility to organic beverages.

-

Q: What are the key drivers of the Japan organic beverages market?A: Key drivers include increasing health consciousness, demand for clean-label products, rising preference for functional beverages, and government support for organic farming.

-

Q: Who are the major players in the Japanese organic beverages market?A: Major players include Suntory Holdings Limited, Kirin Holdings Company, Asahi Group Holdings, Pokka Sapporo Food & Beverage, Meiji Holdings, Ito En, Kagome Co., Ltd., and other emerging brands.

Need help to buy this report?