Japan Online Grocery Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Vegetables & Fruits, Staples & Cooking Essentials, Snacks, Dairy Products, Meat & Seafood, Others), By Business Model (Pure Marketplace, Hybrid Marketplace, and Others), and Japan Online Grocery Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsJapan Online Grocery Market Size Insights Forecasts to 2035

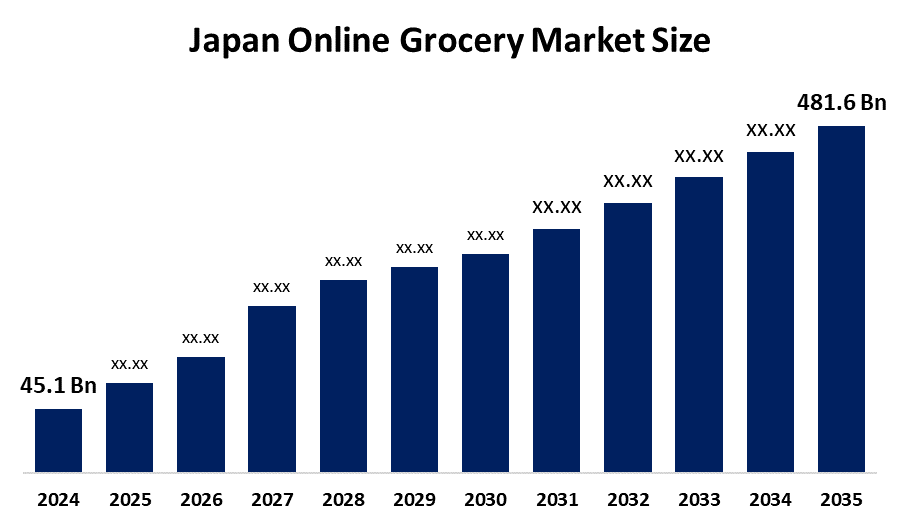

- The Japan Online Grocery Market Size Was Estimated at USD 45.1 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 24.02% from 2025 to 2035

- The Japan Online Grocery Market Size is Expected to Reach USD 481.6 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Online Grocery Market Size is anticipated to Reach USD 481.6 Billion by 2035, Growing at a CAGR of 24.02% from 2025 to 2035. The online grocery market in Japan is driven by growing technological improvements that have produced mobile applications and user-friendly interfaces that make it simpler for consumers to shop and navigate online grocery platforms.

Market Overview

The online grocery market is the digital marketplace of food, beverages, and household staples that consumers purchase through internet-based solutions. Orders are made online through an order fulfillment website or mobile app, with the items then delivered to customers' homes or prepared for in-store/curbside specialists to take to the consumer. The online grocery market comprises retailers, e-commerce players, and delivery service providers that carry grocery items along with packaged and personal consumables, including fresh items. The Japan online grocery market is expanding rapidly, with increasing consumer preference for distinct, oversized, contactless purchasing of food, drinks, and household goods through online platforms. Main drivers of this growth are busy lifestyles common in Japan's cities, increased use of e-commerce since COVID-19, and a robust and aging population willing to spend on home delivery services. Government initiatives supporting digital transformation, innovative logistics, and automation help bring operational efficiencies to grocery operations. Strict laws are enforced by the Japanese government to guarantee the security of groceries purchased online. These consist of specifications for appropriate labeling, temperature-controlled storage, and packaging. More than 80% of online grocery stores complied with these rules in full in 2023, which reflects excellent industry standards but also places a heavy burden on newcomers in terms of compliance costs. Technology is advancing quickly with AI-based personalized grocery offerings, micro-fulfillment, and autonomous delivery, adding speed and service. Fast-growing opportunities are evident in quick-commerce, retailer-partner platforms, subscription services, and rural delivery services.

Report Coverage

This research report categorizes the market for the Japan online grocery market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan online grocery market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan online grocery market.

Japan Online Grocery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 45.1 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 24.02% |

| 2035 Value Projection: | USD 481.6 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 186 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Business Model and COVID-19 Impact Analysis |

| Companies covered:: | Rakuten SEIYU, Aeon Supermarket, Ito-Yokado Net Supermarket, Maruetsu Net Super, Life Supermarket Online, Tokyu Store Online, Daiei Online Supermarket, Okuwa Online Store, Coop Deli, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The online grocery market in Japan is driven by a surge in consumer demand for convenience, especially with busy urban households. Japan’s aging population also increases the demand for home delivery and simplified digital shopping experiences. The increase in comfort with e-commerce during COVID-19 has changed the flow of these purchases more toward online. There is a high level of competition among the large retailers and platforms like AEON, Rakuten, and Seiyu, resulting in enhancements to service, a greater variety of products available for delivery, and faster delivery services like same-day delivery. Advances in technology, such as AI personalization, automated fulfillment solutions, and trials of autonomous delivery, continue to be employed to enhance efficiency and adoption.

Restraining Factors

The online grocery market in Japan is mostly constrained by logistics and delivery costs, underdeveloped or limited cold-chain infrastructure, and issues with last-mile labor. Additionally, many consumers continue to prefer to shop for fresh produce in the store, limiting the overall online grocery market. Furthermore, for small retailers, digital transformation and technology adoption are slow, preventing the online grocery sector from fully exploiting existing demand.

Market Segmentation

The Japan online grocery market share is classified into product type and business model.

- The staples & cooking essentials segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan online grocery market is segmented by product type into vegetables & fruits, staples & cooking essentials, snacks, dairy products, meat & seafood, and others. Among these, the staples & cooking essentials segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Japanese consumers tend to be frequent online shoppers for the regular consumption of rice, noodles, condiments, soy sauce, cooking oil, and other pantry staples, due to their low perishability, necessity of reliable shelf-life, and ease of shipping. These regular purchases are less perishable than other items, such as fresh produce. Therefore, there are good reasons for the Japanese to value pantry staples at a reasonable price.

- The hybrid marketplace segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan online grocery market is segmented by business model into pure marketplace, hybrid marketplace, and others. Among these, the hybrid marketplace segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The hybrid model will be more trustworthy and scalable because it is able to provide quality control during expanding product choice and delivery options, and this will lead to its dominance and strong expected growth over the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan online grocery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Rakuten SEIYU

- Aeon Supermarket

- Ito-Yokado Net Supermarket

- Maruetsu Net Super

- Life Supermarket Online

- Tokyu Store Online

- Daiei Online Supermarket

- Okuwa Online Store

- Coop Deli

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In April 2024, the Japanese retailer Ito-Yokado entered into a collaborative effort with delivery service OniGO for 20-minute grocery delivery, first at 80 stores and growing to 120 stores by February 2025. The service will be in the Tokyo metropolitan, Chubu, and Kansai areas.

- In October 2023, Daiei opened Japan's first totally checkout-free supermarket in CeeU mall, Yokohama. With ceiling cameras, weight-sensing shelves, and app-based payment, customers can walk in, pick items up, and leave the store while charges are automatically processed in the background. The project was developed with the company NTT Data Corporation and shows Daiei's intention of entering a new innovative space within retail.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan online grocery market based on the below-mentioned segments:

Japan Online Grocery Market, By Product Type

- Vegetables & Fruits

- Staples & Cooking Essentials

- Snacks

- Dairy Products

- Meat & Seafood

- Others

Japan Online Grocery Market, By Business Model

- Pure Marketplace

- Hybrid Marketplace

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Japan online grocery market size?A: Japan online grocery market size is expected to grow from USD 45.1 billion in 2024 to USD 481.6 billion by 2035, growing at a CAGR of 24.02% during the forecast period 2025-2035

-

Q: What are the key growth drivers of the market?A: Market growth is driven by a surge in consumer demand for convenience, especially with busy urban households. Japan’s aging population also increases the demand for home delivery and simplified digital shopping experiences. The increase in comfort with e-commerce during COVID-19 has changed the flow of these purchases more toward online.

-

Q: What factors restrain the Japan online grocery market?A: Constraints include logistics and delivery costs, underdeveloped or limited cold-chain infrastructure, and issues with last-mile labor.

-

Q: How is the market segmented by product type?A: The market is segmented into vegetables & fruits, staples & cooking essentials, snacks, dairy products, meat & seafood, and others.

-

Q: Who are the key players in the Japan online grocery market?A: Key companies include Rakuten SEIYU, Aeon Supermarket, Ito-Yokado Net Supermarket, Maruetsu Net Super, Life Supermarket Online, Tokyu Store Online, Daiei Online Supermarket, Okuwa Online Store, and Coop Deli.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?