Japan Oat Milk Market Size, Share, By Source (Organic and Conventional), By Product (Plain and Flavored), By Packaging (Cartons, Bottles, and Others), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online Retail, and Others), Japan Oat Milk Market Insights, Industry Trends, Forecasts to 2035

Industry: Food & BeveragesJapan Oat Milk Market Size Insights Forecasts to 2035

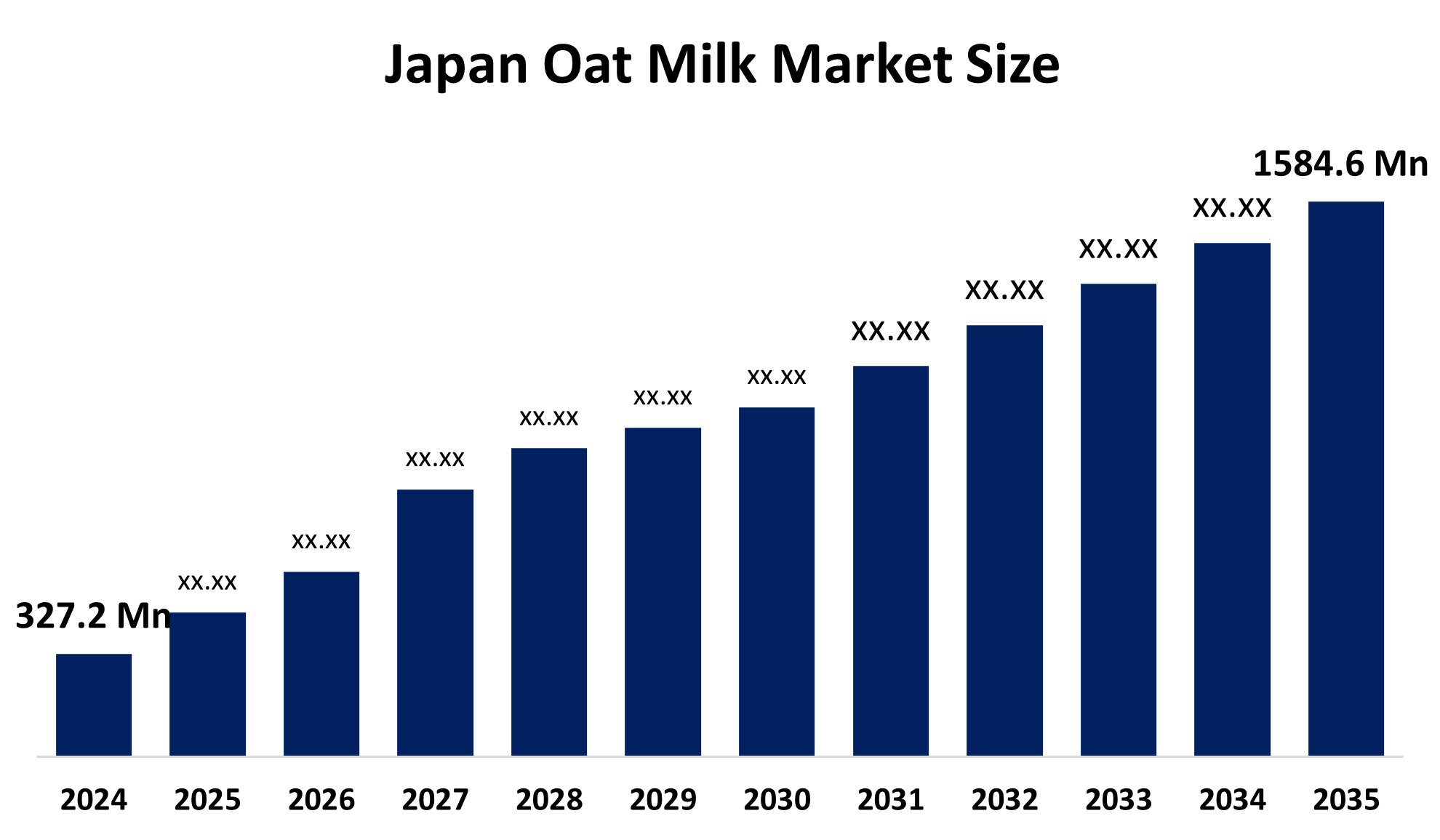

- Japan Oat Milk Market Size 2024: USD 327.2 Million

- Japan Oat Milk Market Size 2035: USD 1584.6 Million

- Japan Oat Milk Market CAGR 2024: 15.42%

- Japan Oat Milk Market Segments: Source, Product, Packaging, and Distribution Channel

Get more details on this report -

Oat milk is defined as an environmentally friendly plant-based dairy drink that is prepared through milling oats and blending them in water to produce an oat drink that is filtered to give an oat milk drink that is drinkable, useable as a coffee and tea creamer, and applicable in cooking and preparing meals from dairy-free meals. Oat milk has gained widespread acclaim and is used across different sectors due to its unique flavour, oat drink consistency, and non-dairy functionality, coupled with positive drivers of market expansion including increased health and wellness concerns, preference for plant-based beverages, and increased focus on sustainable living among consumers.

Technological advancements involve barista-grade formula development, fortified varieties, and increased processing techniques to improve texture, stability, and nutritional function. Though there were no policies regarding oat milk in particular, there were sufficient regulations regarding food safety and vegan products in the Japanese industry to create long-term stability. Oat milk’s long-term growth in the Japanese market could result from functional value propositions in the industry and beverages.

Market Dynamics of the Japan Oat Milk Market:

The major drivers of the Japan oat milk market are increased awareness of lactose intolerance among consumers, increased demand for flexitarianism and other plant-based diet options, and increasing demand for health and environmentally conscious beverages. Market expansion of cafes and coffee-based oat milk-based beverages also positively influences the development of this market. Additionally, with increased innovation and awareness of oat milk as a healthy and environment-friendly option, this trend is reported to be increasing in both urban and semi-urban areas of Japan.

Japan Oat Milk Market Size is restrained by prices of the product compared to dairy milk products, lack of awareness in consumers belonging to the older and rural population, and cultural acceptance of dairy milk products. Reliance on imported ingredients and the difficulty of matching dairy milk with respect to taste rates pose another restraint.

The future of the Japan Oat Milk Market Size appears promising in terms of opportunities provided through the development of fortified oat milk, development in the barista industry, online sales channels, convenience stores, steady interest in sustainable packaging, clean nutrition, plant-based innovation, and future opportunities that will be generated to enhance the long-term standing in this industry.

Japan Oat Milk Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 327.2 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 15.42% |

| 2035 Value Projection: | USD 1584.6 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product, By Distribution Channel |

| Companies covered:: | Marusan-ai Co., Ltd., Oatly Group AB, Danone S.A., Kikkoman Corporation, Minor Figures Ltd. and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The Japan oat milk market share is classified into source, product, packaging, and distribution channel.

By Source:

The Japan Oat Milk Market Size is divided by source into organic and conventional. Among these, the conventional segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Cost competitiveness, wide retail availability, well-established supply chains, high café and foodservice usage, consistent taste profiles, and wider consumer acceptance compared to premium-priced organic variants all support higher sales volumes and continued dominance throughout Japan’s mass-market oat milk consumption.

By Product:

The Japan Oat Milk Market Size is divided by product into plain and flavored. Among these, the plain segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Health-oriented consumption, as well as flavour versatility, usability for making coffee, cooking, cereals, lower sugar perception, and superior adoption among lactose-intolerant and vegan individuals compared to other Flavors, are important factors behind loyal consumption and market dominance in Japan.

By Packaging:

The Japan Oat Milk Market Size is divided by packaging into cartons, bottles, and others. Among these, the cartons segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The preponderance of cartons results from better shelf life, cost-effectiveness, lightweight transportation, perception of recyclability, aseptic processing, display optimization, and linkage with sustainability, therefore creating a starting point for businesses seeking a way to effectively increase reach while maintaining product quality in Japan.

By Distribution Channel:

The Japan Oat Milk Market Size is divided by distribution channel into supermarkets & hypermarkets, convenience stores, online retail, and others. Among these, supermarkets & hypermarkets dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Supermarkets and hypermarkets dominate, owing to wide product ranges, reasonable pricing, visibility of promotion displays, private-label product level, one-stop shopping convenience, and higher trust among consumers, which lead to footfall, higher numbers of unplanned purchases, and consistent sales performance levels.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Oat Milk Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Oat Milk Market:

- Marusan-ai Co., Ltd.

- Oatly Group AB

- Danone S.A.

- Kikkoman Corporation

- Minor Figures Ltd.

- Others

Recent Developments in Japan Oat Milk Market:

- In July 2024, Misola Foods announced the launch of "Delicious oat milk made by Mr. Tsukagoshi," a domestically produced oat milk tailored for Japanese taste preferences, focusing on palatability, natural sweetness, and acceptance by a wider range of consumers across households and families in Japan.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Oat Milk Market Size based on the below-mentioned segments:

Oat Milk Market, By Source

- Organic

- Conventional

Oat Milk Market, By Product

- Plain

- Flavored

Oat Milk Market, By Packaging

- Cartons

- Bottles

- Others

Oat Milk Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Japan oat milk market size?A: Japan oat milk market is expected to grow from USD 327.2 million in 2024 to USD 1584.6 million by 2035, growing at a CAGR of 15.42% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the Japan oat milk market?A: Market growth is driven by rising awareness of lactose intolerance, increasing adoption of plant-based and flexitarian diets, growing café and coffee culture, demand for sustainable beverages, and expanding availability of oat milk across retail and foodservice channels in Japan.

-

Q: What factors restrain the Japan oat milk market?A: Market restraints include higher prices compared to conventional dairy milk, limited awareness among older and rural consumers, strong cultural preference for dairy products, dependence on imported raw materials, and challenges in achieving taste parity with traditional milk.

-

Q: What are the key packaging formats in the Japan oat milk market?A: The market is segmented into cartons, bottles, and other packaging formats.

-

Q: Which distribution channels are covered in the Japan oat milk market?A: The market is segmented into supermarkets & hypermarkets, convenience stores, online retail, and other distribution channels.

-

Q: Who are the key players in the Japan oat milk market?A: Key companies operating in the market include Marusan-ai Co., Ltd., Oatly Group AB, Danone S.A., Kikkoman Corporation, Minor Figures Ltd., and others.

-

Q: Who are the target audiences for the Japan oat milk market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?