Japan Nicotine Gum Market Size, Share, By Product (2 mg and 4 mg), By Distribution Channel (Supermarkets, Convenience Stores, Pharmacies, and Online), Japan Nicotine Gum Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsJapan Nicotine Gum Market Insights Forecasts to 2035

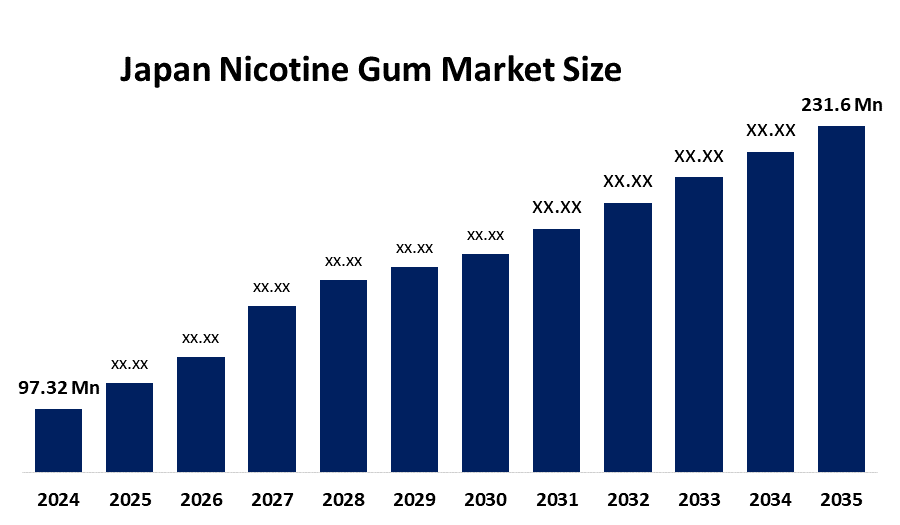

- Japan Nicotine Gum Market Size 2024: USD 97.32 Million

- Japan Nicotine Gum Market Size 2035: USD 231.6 Million

- Japan Nicotine Gum Market CAGR 2024: 8.2%

- Japan Nicotine Gum Market Segments: Product and Distribution Channel

Get more details on this report -

Nicotine-containing medicated chewing gums in controlled doses are designed to help smokers quit the habit and manage withdrawal symptoms among adult consumers. These are over-the-counter products that are very popular in self-managed quit attempts, physician-driven therapy courses, workplace wellness initiatives, and pharmacy-driven nicotine replacement schedules that need discreet, portable, and easy-use delivery formats. Growing awareness related to health risks from tobacco and increasing adoption of structured programs for quitting continue to support consistent consumer demand across Japan's urban and aging populations.

Technology innovation targets the development of better flavor masking systems, sugar-free products, quick nicotine release systems, and better chewing bases designed for increased comfort, compliance, and retention over long cessation periods. The opportunities to be faced in the future are related to digital cessation products such as apps, therapy products, personalized dosing guidance, pharmacy-led counselling development, and the growth of online channels that help improve the availability of the product. With the growth of low-irritation formulations, herbal flavor developments, and the use of combination nicotine replacement methodologies, there could be an improvement in the degrees of adherence that could attract the segment of quitters looking for convenient solutions to deal with tobacco dependency issues.

Market Dynamics of the Japan Nicotine Gum Market:

The driving factors for the Japan market of nicotine gums include the growth of smoking cessation awareness, heightened government-endorsed anti-smoking campaigns, pharmacist counselling programs, and the demand for discreet products that help users reduce their dependencies on the smoke without any social inconvenience.

The market growth is hampered by stringent pharmaceutical regulations imposed on nicotine products, a lack of consumer awareness among rural populations, product-related problems such as irritation, competition from other therapy products, and a declining smoking population, thus slowing down the demand growth rate.

The key opportunities that would be realized going forward would be flavored low irritation formulations, linkage with digital programs for cessation tracking, expansion of online pharmacy distribution, personalized recommendations on nicotine potency, and increasing wellness initiatives that advocate for structured quitting programs with easy access to over-the-counter nicotine replacement therapy products in Japan.

Japan Nicotine Gum Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 97.32 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.2% |

| 2035 Value Projection: | USD 231.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product, By Distribution Channel |

| Companies covered:: | Kenvue, GlaxoSmithKline, Perrigo Company plc, Takeda Pharmaceutical Company Limited, Fertin Pharma A/S, Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan nicotine gum market share is classified into product and distribution channel.

By Product:

The Japan nicotine gum market is divided by product into 2 mg and 4 mg. Among these, the 2 mg segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The 2mg gum leads because of high adoption rates amongst first-time quitters, its suitability for light to moderate smokers, pharmacist endorsement, relatively fewer perceived side effects, tendency for repeat purchases, and overall acceptability for gradual nicotine reduction schemes across Japan.

By Distribution Channel:

The Japan nicotine gum market is divided by distribution channel into supermarkets, convenience stores, pharmacies, and online. Among these, the pharmacies segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The dominance of the pharmacies is fueled by controlled measures of OTC sales practices, the faith placed in the advice offered by pharmacists, the necessity for cessation advice, the availability of medically approved nicotine replacement therapies, the credibility of the product, and the continued purchase patterns among health-conscious consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan nicotine gum market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Nicotine Gum Market:

- Kenvue

- GlaxoSmithKline

- Perrigo Company plc

- Takeda Pharmaceutical Company Limited

- Fertin Pharma A/S

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan nicotine gum market based on the below-mentioned segments:

Japan Nicotine Gum Market, By Product

- 2 mg

- 4 mg

Japan Nicotine Gum Market, By Distribution Channel

- Supermarkets

- Convenience Stores

- Pharmacies

- Online

Frequently Asked Questions (FAQ)

-

Q: What is the Japan nicotine gum market size?A: Japan nicotine gum market is expected to grow from USD 97.32 million in 2024 to USD 231.6 million by 2035, growing at a CAGR of 8.2% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by rising smoking cessation awareness, government anti-smoking initiatives, increasing demand for over-the-counter nicotine replacement therapy, pharmacist-guided quitting programs, growing health consciousness, and preference for discreet, portable solutions supporting structured tobacco dependency reduction in Japan.

-

Q: What factors restrain the Japan nicotine gum market?A: Constraints include strict pharmaceutical regulations on nicotine products, declining smoking population, limited awareness in certain demographics, competition from alternative cessation therapies such as patches and lozenges, product-related side effects, and consumer hesitation toward medicated chewing formats.

-

Q: Who are the key players in the Japan nicotine gum market?A: Key companies include Kenvue, GlaxoSmithKline, Perrigo Company plc, Takeda Pharmaceutical Company Limited, Fertin Pharma A/S, and others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?