Japan Natural Gas-Fired Electricity Market Size, Share, and COVID-19 Impact Analysis, By Technology (Open Cycle and Combined Cycle), By Application (Power & Utility and Industrial), and Japan Natural Gas-Fired Electricity Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerJapan Natural Gas-Fired Electricity Market Insights Forecasts to 2035

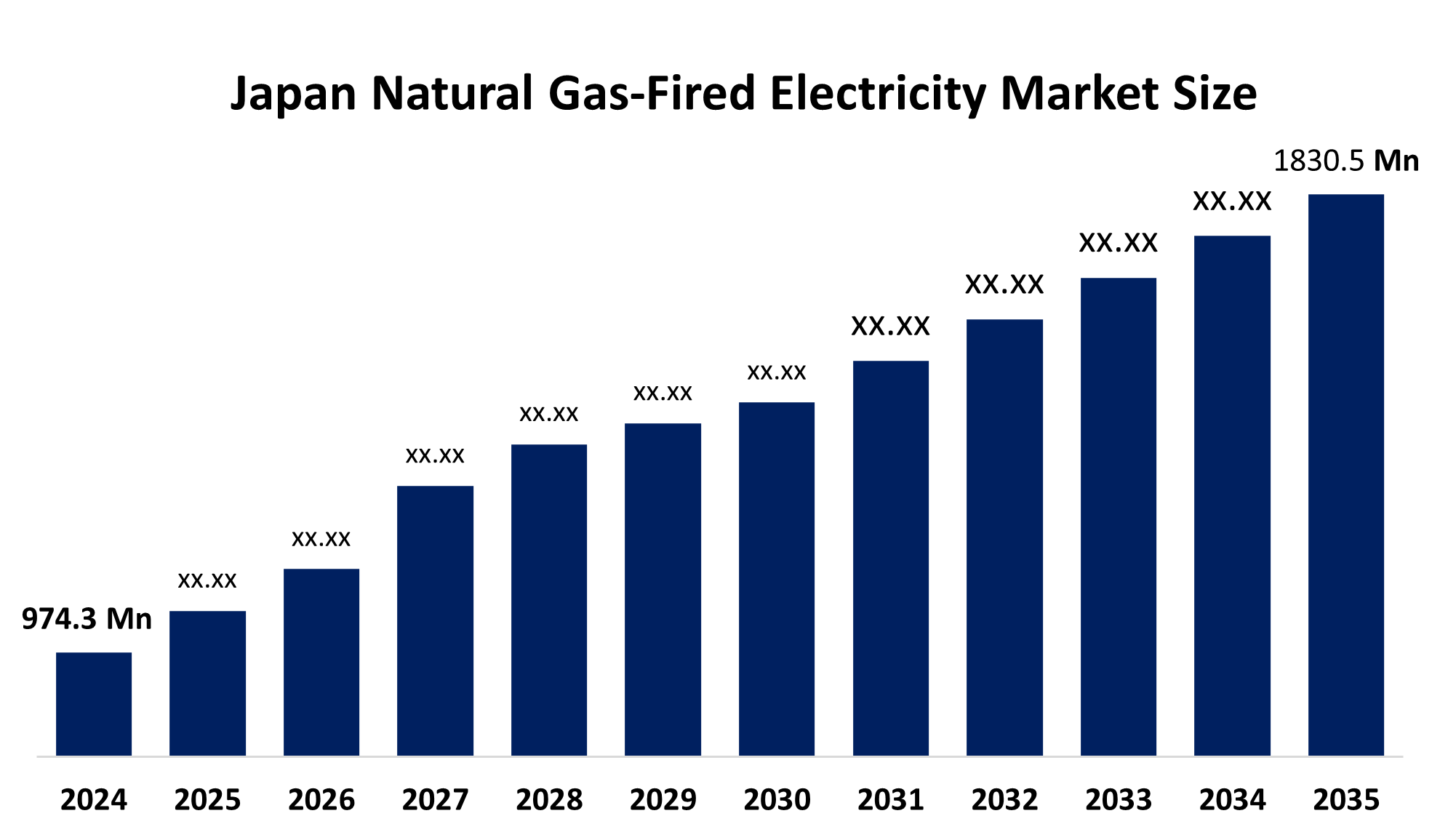

- The Japan Natural Gas-Fired Electricity Market Size Was Estimated at USD 974.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.9% from 2025 to 2035

- The Japan Natural Gas-Fired Electricity Market Size is Expected to Reach USD 1830.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Natural Gas-Fired Electricity Market Size is anticipated to reach USD 1830.5 million by 2035, growing at a CAGR of 5.9% from 2025 to 2035. The natural gas-fired electricity market in Japan is driven by the fact that natural gas is less damaging to the environment than coal or oil, and lowering carbon emissions has hastened the transition even further. Additionally, another significant factor is the rise in energy demand brought on by industrialization and population development.

Market Overview

Natural gas-fired electricity generation is the process of using natural gas as a major fuel in power plants to generate energy. Most methane, natural gas burns cleaner than coal and oil as it releases low particulate matter, sulfur dioxide, carbon dioxide, and nitrogen oxides. Therefore, it is a commonly used energy source in changes to green energy systems. The two main technologies used in power generation from natural gas are joint-cycle gas turbines (JCCGTs) and open-cycle gas turbines (OCGTS). Natural gas combustion powers an open-cycle gas turbine, which functions similarly to the jet engine. Due to their rapid start time, open-cycle gas turbines are often used to meet peak load demands. There are some benefits of high efficiency, operational flexibility, comparatively low emissions, and the ability to complement sporadic renewable energy sources such as solar and air. This flexibility is necessary to maintain grid stability in markets where renewable energy is increasing. In addition, a comprehensive fuel supply is made possible by natural gas infrastructure, such as pipelines and LNG terminals. Japan is one of the world’s largest importers of liquefied natural gas, and it heavily relies on natural gas-fired power plants for electricity generation. Natural gas-fired plants in Japan are dominated by combined-cycle gas turbines, which offer high efficiency and lower emissions compared to coal. These plants play a central role in balancing renewable integration, especially solar and wind.

Report Coverage

This research report categorizes the market for the Japan natural gas-fired electricity market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan natural gas-fired electricity market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan natural gas-fired electricity market.

Driving Factors

The natural gas-fired electricity market is driven by increased demand for power, combined-cycle gas turbine (CCGT) plant efficiency, and reduced carbon emissions in comparison to coal. Additionally, government programs encouraging cleaner fuels, hydrogen blending, and ammonia co-firing enhance natural gas's position as a dependable transitional energy source in power generation, it also offers flexibility for balancing intermittent renewable energy.

Restraining Factors

The natural gas-fired electricity market is mostly constrained by fluctuating LNG costs and carbon neutrality pledges. Long-term reliance on natural gas is dubious since the competitiveness of gas-fired power in Japan's changing energy landscape is diminished by tighter pollution rules, the growth of renewable energy, and investments in alternative technologies.

Market Segmentation

The Japan natural gas-fired electricity market share is classified into technology and application.

- The combined cycle segment accounted for the largest revenue share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The Japan natural gas-fired electricity market is segmented by technology into open cycle and combined cycle. Among these, the combined cycle segment accounted for the largest revenue share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. This is due to its combined cycle plants, which may produce a lot more energy from the same quantity of fuel by using both gas and steam turbines. Furthermore, this technology is an environmentally responsible choice because it cuts emissions in addition to fuel usage.

- The power & utility segment dominated in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan natural gas-fired electricity market is segmented by application into power & utility and industrial. Among these, the power & utility segment dominated in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is due to the growing need for cleaner and more dependable energy sources. Natural gas is becoming more popular than coal for baseload power generation as nations seek to lower their carbon emissions. Furthermore, the creation of large-capacity power projects and encouraging laws from the government improve the market in Japan.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan natural gas-fired electricity market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsubishi Hitachi Power Systems, Ltd

- Kawasaki Heavy Industries, Ltd.

- Tokyo Electric Power Company Holdings, Inc. (TEPCO)

- Showa Shell

- Chubu Electric Power Co., Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Natural Gas-Fired Electricity market based on the below-mentioned segments:

Japan Natural Gas-Fired Electricity Market, By Technology

- Open Cycle

- Combined Cycle

Japan Natural Gas-Fired Electricity Market, By Application

- Power & Utility

- Industrial

Frequently Asked Questions (FAQ)

-

1.What is the size of the Japan natural gas-fired electricity market in 2024?The market size was estimated at USD 974.3 million in 2024.

-

2. What is the projected market size by 2035?The market is expected to reach USD 1830.5 million by 2035.

-

3. What is the expected CAGR during 2025–2035?The market is forecasted to grow at a CAGR of 5.9%.

-

4. Which technology segment dominates the market?The combined cycle segment accounted for the largest share in 2024 and will continue to grow significantly due to higher efficiency and lower emissions.

-

5. What are the main applications of natural gas-fired electricity in Japan?The market is segmented into Power & Utility and Industrial.

-

6. What role does natural gas play in Japan’s transition to clean energy?Natural gas acts as a transitional energy source, offering lower emissions than coal, while complementing intermittent renewables like solar and wind.

-

7. Who are the key players in the Japan natural gas-fired electricity market?Major companies include Mitsubishi Hitachi Power Systems, Ltd., Kawasaki Heavy Industries, Ltd., Tokyo Electric Power Company Holdings, Inc. (TEPCO), Showa Shell, and Chubu Electric Power Co., Inc., and Others.

-

8. Who are the target stakeholders of this market?The target audience includes market players & investors, end-users & utilities, government authorities, consulting & research firms, venture capitalists & vars (value-added resellers).

Need help to buy this report?