Japan Modern Oral Nicotine Products Market Size, Share, By Product Type (Nicotine Gum and Nicotine Lozenges), By Distribution Channel (Online Sales and Pharmacy Stores), Japan Modern Oral Nicotine Products Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Modern Oral Nicotine Products Market Insights Forecasts to 2035

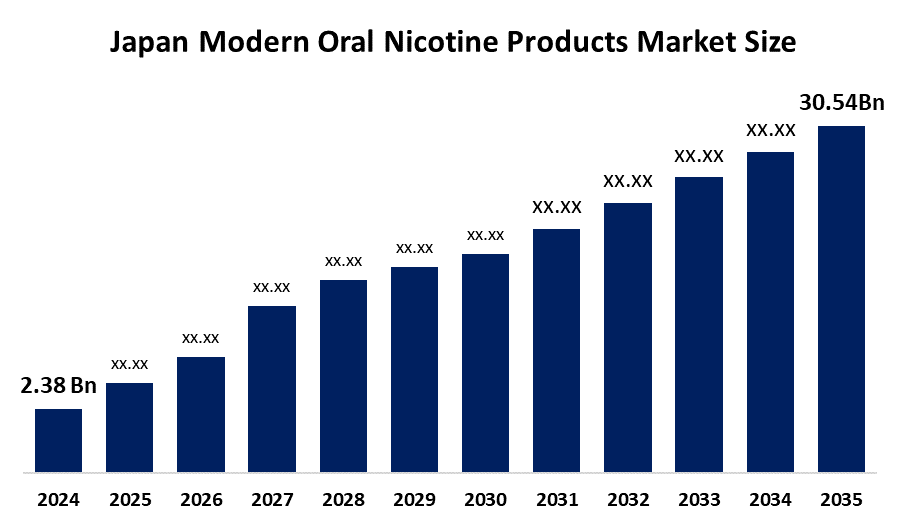

- Japan Modern Oral Nicotine Products Market Size 2024: USD 2.38 Bn

- Japan Modern Oral Nicotine Products Market Size 2035: USD 30.54 Bn

- Japan Modern Oral Nicotine Products Market CAGR 2024: 26.11%

- Japan Modern Oral Nicotine Products Market Segments: Product Type and Distribution Channel

Get more details on this report -

The modern oral nicotine products market in Japan comprises various forms of smokeless, tobacco-free or low-tobacco nicotine, such as nicotine pouches and lozenges. The products are consumed in a discreet manner similar to smoking, wherein the delivery of nicotine is done through no burning, smoke or vapour.

The oral nicotine pouch segment is not only diversifying in flavour but also improving in delivery (e.g. different strengths and formats), which is a strong reason for adult users who are seeking smoking alternatives to try the product.

The Japanese government places nicotine-containing pouches and similar goods under the Pharmaceutical and Medical Device Act for regulation, which means that the respective products must have pharmaceutical approval to be marketed and sold legally. Hence, a large part of the modern oral nicotine products, like nicotine pouches made from tobacco leaf without restrictions, are still being denied general sale approval and are under tight pharmaceutical control.

Possible relaxation of regulations, increasing demand for smoke-free alternatives, harm-reduction awareness, product innovations, and adult consumers' switch from burning cigarettes altogether, are factors that create a long-term growth opportunity in Japan market.

Market Dynamics of the Japan Modern Oral Nicotine Products Market:

The Japan modern oral nicotine products market is driven by the falling smoking rates, the strong demand for smoking-free and discrete nicotine alternatives, the growing awareness of harm-reduction among adult consumers, the innovative activities of the tobacco companies, and the cultural preference of Japan for low-odour, socially acceptable nicotine products.

The Japan modern oral nicotine products market is restrained by the stringent regulations on nicotine products, the requirements of pharmaceutical classification, the limited number of approved products, marketing restrictions, and high compliance costs that delay product launches and limit the adoption of products by the market.

The future of Japan's modern oral nicotine products market is bright and promising, with the potential for regulatory clarity, the increase in harm-reduction awareness, the innovation in nicotine delivery formats, the shift in adult consumer preferences, and the gradual expansion of smoke-free alternatives all contributing to the long-term growth of the market.

Japan Modern Oral Nicotine Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.38 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 26.11% |

| 2035 Value Projection: | USD 30.54 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type, By Distribution Channel |

| Companies covered:: | Japan Tobacco Inc,Nippon Calmic,Nippon Kayaku,Nippon Shinyaku And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan modern oral nicotine products market share is classified into product type and distribution channel

By Product Type:

The Japan modern oral nicotine products market is divided by product type into nicotine gum and nicotine lozenges. Among these, the nicotine gum segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. In Japan, nicotine gum outperformed nicotine lozenges, especially due to factors such as long regulatory approval, strong consumer awareness, wider availability as an OTC cessation aid and higher repeat usage.

By Distribution Channel:

The Japan modern oral nicotine products market is divided by distribution channel into online sales and pharmacy stores. Among these, the pharmacy stores segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Regulatory controls, OTC medicine classification, consumer trust in pharmacists, wider physical availability, and stricter limitations on online sales of nicotine-containing products are the major reasons pharmacy stores dominate in Japan.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan modern oral nicotine products market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Modern Oral Nicotine Products Market:

- Japan Tobacco Inc.

- Nippon Calmic

- Nippon Kayaku

- Nippon Shinyaku

- Others

Recent Developments in Japan Modern Oral Nicotine Products Market:

In July 2025, Philip Morris Japan announced the limited release of ZYN BY IQOS, a new oral tobacco pouch product containing nicotine extracted from tobacco, available initially in select stores and online.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan modern oral nicotine products market based on the below-mentioned segments:

Japan Modern Oral Nicotine Products Market, By Product Type

- Nicotine Gum

- Nicotine Lozenges

Japan Modern Oral Nicotine Products Market, By Distribution Channel

- Online Sales

- Pharmacy Stores

Frequently Asked Questions (FAQ)

-

Q: What is the Japan modern oral nicotine products market size?A: Japan modern oral nicotine products market is expected to grow from USD 2.38 billion in 2024 to USD 30.54 billion by 2035, growing at a CAGR of 26.11% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the falling smoking rates, the strong demand for smoking-free and discrete nicotine alternatives, the growing awareness of harm-reduction among adult consumers, the innovative activities of the tobacco companies, and the cultural preference of Japan for low-odour, socially acceptable nicotine products.

-

Q: What factors restrain the Japan modern oral nicotine products market?A: Constraints include the stringent regulations on nicotine products, the requirements of pharmaceutical classification, the limited number of approved products, marketing restrictions, and high compliance costs that delay product launches and limit the adoption of products by the market.

-

Q: How is the market segmented by product type?A: The market is segmented into nicotine gum and nicotine lozenges.

-

Q: Who are the key players in the Japan modern oral nicotine products market?A: Key companies include Japan Tobacco, Nippon Calmic, Nippon Kayaku, Nippon Shinyaku and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?