Japan Metal Cans Market Size, Share, and COVID-19 Impact Analysis, By Material (Aluminium and Steel), By Application (Food, Beverages, and Others), and Japan Metal Cans Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesJapan Metal Cans Market Insights Forecasts to 2035

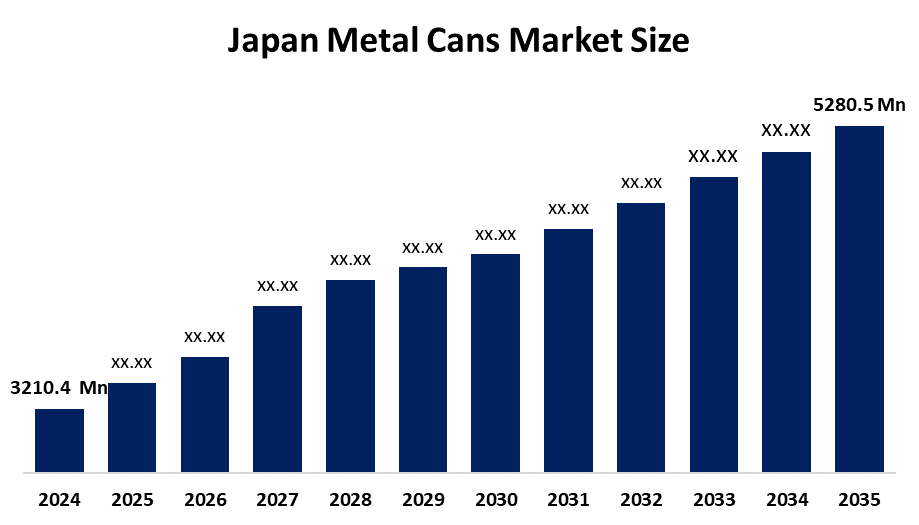

- The Japan Metal Cans Market Size Was Estimated at USD 3210.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.63% from 2025 to 2035

- The Japan Metal Cans Market Size is Expected to Reach USD 5280.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights Consulting, the Japan metal cans market size is anticipated to reach USD 5280.5 million by 2035, growing at a CAGR of 4.63% from 2025 to 2035. The metal can market in Japan is driven by rapid urbanisation, a growing middle class, and increasing demand for packaged food and beverages. Additionally, sustainability concerns are pushing manufacturers toward recyclable metal cans.

Market Overview

Metal cans are rigid containers primarily made from aluminium, steel, or tin-plated steel, designed for the safe packaging, storage, and transportation of a wide range of products, including food, beverages, chemicals, and pharmaceuticals. They provide an airtight and durable barrier that protects contents from contamination, light, moisture, and oxygen, thereby extending shelf life and preserving product quality. Metal cans are widely used in the packaging industry due to their strength, recyclability, and ability to maintain product integrity over long periods. Aluminium cans are commonly used for beverages such as soft drinks, beer, and energy drinks because they are lightweight, corrosion-resistant, and highly recyclable. Steel and tin-plated cans are preferred for food products like soups, vegetables, and pet food, as they offer superior protection and heat resistance during sterilisation processes. The manufacturing process of metal cans involves forming sheets of aluminium or steel into cylindrical shapes, sealing them with ends or lids, and coating the interior with protective linings to prevent metal product interaction. Advances in manufacturing technology have led to the development of lightweight and easy-to-open designs, improving convenience and reducing material and sustainable packaging solutions has further strengthened their market position. Additionally, metal cans offer superior branding opportunities through printing and embossing, enhancing shelf appeal.

Report Coverage

This research report categorizes the market for the Japanese metal cans market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan metal cans market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan metal cans market.

Japan Metal Cans Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3210.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.63% |

| 2035 Value Projection: | USD 5280.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Material, By Application |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The metal cans market in Japan is driven by the increasing demand for sustainable and recyclable packaging, rising consumption of canned food and beverages, and growing awareness of food safety and shelf life. Additionally, technological advancements in lightweight can design, convenience features like easy-open lids, and expanding applications across food, beverage, and pharmaceutical industries further boost market growth.

Restraining Factors

The metal can market in Japan is restrained by fluctuating raw material prices of aluminium and steel, competition from alternative packaging materials like plastics and glass, and high energy consumption during manufacturing, which increases production costs and affects overall market profitability.

Market Segmentation

The Japan metal cans market share is classified into material and applications.

- The aluminium segment held the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan metal cans market is segmented by material into aluminium and steel. Among these, the aluminium segment held the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Aluminium is the most widely used material for beverage cans due to its lightweight, corrosion resistance, and excellent barrier properties. Aluminium cans are primarily used for carbonated soft drinks, energy drinks, and beer, offering excellent shelf life and sustainability credentials.

- The beverages segment held the largest market share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Japan metal cans market is segmented by application into tilapia, catfish, sea bass, and groupers. Among these, the beverages segment held the largest market share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The beverage segment is the largest application segment for metal cans and includes both alcoholic and non-alcoholic drinks such as beer, carbonated soft drinks, energy drinks, juices, and sparkling water. Additionally, Beverage brands often favor metal cans for their aesthetic appeal and ability to retain carbonation and freshness over extended periods.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the Japan metal cans market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan metal cans market based on the below-mentioned segments:

Japan Metal Cans Market, By Material

- Aluminium

- Steel

Japan Metal Cans Market, By Application

- Food

- Beverages

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the base year and historical period considered in this market study?A: The base year is 2024, with historical data from 2020 to 2023.

-

Q: What is the forecast period for the Japan Metal can market?A: The forecast period is 2025–2035.

-

Q: What is the base year considered for the Japan Metal can Market report?A: The base year considered for the Japan Metal can Market report is 2024, with historical data from 2020 to 2023 and forecasts from 2025 to 2035.

-

Q: What is the expected growth rate of the Japan metal cans market during 2025–2035?A: The Japan metal cans market is expected to grow at a CAGR of 4.63% from 2025 to 2035, increasing from USD 3,210.4 million in 2024 to USD 5,280.5 million by 2035.

-

Q: What factors are driving the growth of the Japan metal cans market?A: Growth is driven by rising demand for sustainable and recyclable packaging, increasing consumption of canned food and beverages, technological advancements in lightweight can design, and expanding applications in the food and beverage industries.

-

Q: Which application segment accounted for the largest market share in 2024?A: The beverages segment held the largest market share in 2024, driven by the high consumption of beer, carbonated soft drinks, energy drinks, and juices, as well as growing preference for metal cans’ aesthetic and functional advantages.

-

Q: What are the key restraints affecting market growth?A: The market faces challenges such as fluctuating prices of aluminum and steel, competition from plastic and glass packaging, and high energy consumption during can manufacturing, which increases overall production costs.

-

Q: Who is the target audience for this market report?A: The report is targeted at market players, investors, government authority es, end-users, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?