Japan Liquefied Petroleum Gas Market Size, Share, By Source (Refinery, Natural Gas Processing), By Application (Residential, Commercial, Industrial, Chemical & Petrochemical, Autogas), By Supply Mode (Cylinders, Bulk Supply), By End-Use Sector (Households, Hospitality & Retail, Manufacturing, Transportation), Japan Liquefied Petroleum Gas Market Insights, Industry Trends, Forecasts to 2035

Industry: Energy & PowerJapan Liquefied Petroleum Gas Market Insights Forecasts to 2035

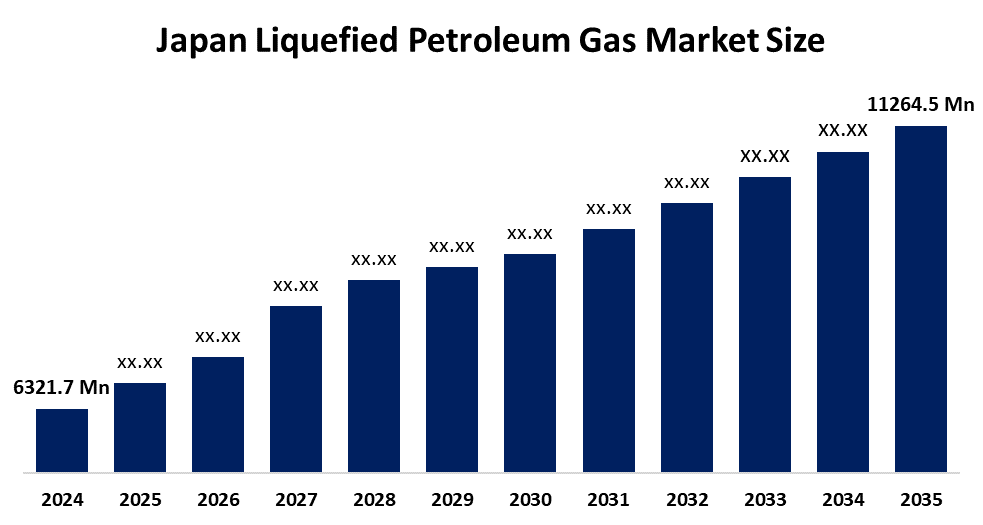

- Japan Liquefied Petroleum Gas Market Size 2024: USD 6321.7 Million

- Japan Liquefied Petroleum Gas Market Size 2035: USD 11264.5 Million

- Japan Liquefied Petroleum Gas Market CAGR 2024: 5.39%

- Japan Liquefied Petroleum Gas Market Segments: Source, Application, Supply Mode, and End Use Sector

Get more details on this report -

Liquefied Petroleum Gas (LPG) refers to clean-burning hydrocarbon fuel which consists mainly of propane and butane. The people of Japan use LPG through various applications which include heating systems and cooking equipment and industrial operations and petrochemical production processes. The energy mix of Japan depends on LPG as a vital component because the country lacks sufficient fossil fuel reserves to meet its energy security demands. The main uses of this product include cooking and space heating in homes and hotel operations and industrial activities and chemical production and disaster backup power generation. Households maintain their regular consumption patterns which creates a stable market need for industrial fuel use and substitution.

Japan depends on imports to fulfil its LPG requirements because the country imports about 9.8 to 10.0 million metric tons every year while domestic output falls short at 3 million metric tons and exports remain insignificant. The primary driving forces behind this market include the requirement for energy diversification and the dependable fuel needs of residential customers and industrial operations. The field of technology has progressed through the development of LPG-based cogeneration systems and the creation of high-efficiency burners and the establishment of smart metering systems and the development of storage and safety technologies. The Japanese government through METI requires national LPG stockpiling to reach 50 days of total consumption which helps improve supply security. The development of industrial efficiency improvements and rural energy systems and disaster-proof fuel systems and low-carbon transition solutions presents future business possibilities.

Japan Liquefied Petroleum Gas Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6321.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.39% |

| 2035 Value Projection: | USD 11264.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Source, By Application, By Supply Mode, By End-Use Sector |

| Companies covered:: | Astomos Energy Corporation, ENEOS GLOBE Corporation, ITOCHU ENEX Co., Ltd., Mitsuuroko Group Holdings Co., Ltd., Japan Gas Energy Corporation, Cosmo Oil Marketing Co., Ltd., TOHO Gas Co., Ltd., Shikoku Gas Co., Ltd., Saibu Gas Energy Co., Ltd., Nippon Sanso Holdings Corporation. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Liquefied Petroleum Gas Market:

The Japan LPG market operates through two main forces which include the country's need to import energy and the constant need for residential and commercial energy consumption. The market for liquefied petroleum gas (LPG) exists because customers value its ability to burn cleanly and its dependable performance during blackouts and its industrial and chemical usage. The industrial sector and commercial sector both continue to use LPG because natural gas pipelines do not exist in their operational areas. LPG remains necessary for residential purposes because people need to heat their homes and prepare food in multifamily houses and rural locations. The energy transition process generates new drivers which maintain constant energy consumption levels through its entire course.

The market faces two major restrictions because urban areas present competition between liquefied natural gas (LNG) and electricity which decreases LPG usage in sectors that need pipeline gas and renewable energy sources. The global LPG feedstock markets experience price fluctuations and international supply chain disruptions which impede investment in large infrastructure projects and reduce projections for volume growth. The current policy framework emphasizes decarbonization which compels organizations to reduce their fossil fuel use thus creating challenges for long-term growth in LPG consumption.

The future of advanced LPG technologies presents major growth opportunities through high-efficiency burners and hybrid LPG-electric systems and distributed cogeneration systems which improve energy efficiency. Japan needs disaster-resilient energy solutions which use LPG to provide backup power and emergency heating because of its climate danger circumstances. The potential for growth exists through two specific areas: niche industrial applications and rural electrification where LPG functions as a transitional low-carbon fuel until the energy network develops further.

Market Segmentation

The Japan liquefied petroleum gas market share is classified into source, application, supply mode, and end use sector.

By Source:

The Japan liquefied petroleum gas market is divided by source into refinery and natural gas processing. Among these, the refinery segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment dominates because Japan relies heavily on imported crude oil for its refining operations which use existing refinery infrastructure while maintaining steady LPG recovery rates and delivering dependable supply and petrochemical operations and sustaining demand from residential and industrial and commercial markets.

By Application:

The Japan liquefied petroleum gas market is divided by application into residential, commercial, industrial, chemical & petrochemical, and autogas. Among these, the residential segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The growth of the organization receives support from two energy sources which include off-grid systems and household usage of LPG systems and operational strength of cylinder distribution networks and heating needs and cooking requirements and disaster-resistant fuel choices and ongoing usage of LPG systems in rural and semi-urban areas of Japan.

By Supply Mode:

The Japan liquefied petroleum gas market is divided by supply mode into cylinders and bulk supply. Among these, the cylinders segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The system maintains its leading position because it has reached all residential areas while providing distribution partnerships which enable quick delivery of products because the system permits customers to store products at their homes and use the product during emergencies and the system maintains its appeal to residential users and business owners in isolated areas.

By End-Use Sector:

The Japan liquefied petroleum gas market is divided by end-use sector into households, hospitality & retail, manufacturing, and transportation. Among these, the households segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The primary fuel for domestic use in households stays as LPG gas because people need to cook and heat their homes but they cannot access pipeline gas services and they must use safety-approved cylinder systems which follow safety regulations and their energy needs depend on where they live and their energy security needs and their dependency on LPG as their primary home fuel source.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan liquefied petroleum gas market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Liquefied Petroleum Gas Market:

- Astomos Energy Corporation

- ENEOS GLOBE Corporation

- ITOCHU ENEX Co., Ltd.

- Mitsuuroko Group Holdings Co., Ltd.

- Japan Gas Energy Corporation

- Cosmo Oil Marketing Co., Ltd.

- TOHO Gas Co., Ltd.

- Shikoku Gas Co., Ltd.

- Saibu Gas Energy Co., Ltd.

- Nippon Sanso Holdings Corporation

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan liquefied petroleum gas market based on the below-mentioned segments:

Japan Liquefied Petroleum Gas Market, By Source

- Refinery

- Natural Gas Processing

Japan Liquefied Petroleum Gas Market, By Application

- Residential

- Commercial

- Industrial

- Chemical & Petrochemical

- Autogas

Japan Liquefied Petroleum Gas Market, By Supply Mode

- Cylinders

- Bulk Supply

Japan Liquefied Petroleum Gas Market, By End-Use Sector

- Households

- Hospitality & Retail

- Manufacturing

- Transportation

Frequently Asked Questions (FAQ)

-

Q: What is the Japan liquefied petroleum gas market size?A: Japan liquefied petroleum gas market is expected to grow from USD 6,321.7 million in 2024 to USD 11,264.5 million by 2035, growing at a CAGR of 5.39% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the Japan liquefied petroleum gas market?A: Market growth is driven by steady residential consumption, energy diversification requirements, continued industrial fuel demand, limited natural gas pipeline coverage, and the role of LPG as a reliable energy source during power outages and natural disasters.

-

Q: What factors restrain the Japan liquefied petroleum gas market?A: Key restraints include competition from LNG and electricity in urban areas, global LPG price volatility, import dependency risks, infrastructure investment challenges, and long-term decarbonization policies limiting fossil fuel expansion.

-

Q: How is the Japan liquefied petroleum gas market segmented?A: The market is segmented by source, application, supply mode, and end-use sector.

-

Q: What are the major applications of LPG in Japan?A: Major applications include residential cooking and heating, commercial hospitality operations, industrial fuel use, chemical and petrochemical processes, and transportation fuel in the form of autogas.

-

Q: Who are the key players in the Japan liquefied petroleum gas market?A: Key companies include Astomos Energy Corporation, ENEOS GLOBE Corporation, ITOCHU ENEX Co., Ltd., Mitsuuroko Group Holdings Co., Ltd., Japan Gas Energy Corporation, Cosmo Oil Marketing Co., Ltd., TOHO Gas Co., Ltd., Shikoku Gas Co., Ltd., Saibu Gas Energy Co., Ltd., and Nippon Sanso Holdings Corporation.

-

Q: Who are the target audiences for the Japan liquefied petroleum gas market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?