Japan Lighting Fixture Market Size, Share & Trends Analysis Report, By Source (Fluorescent, LED and OLED), By Distribution Channel (Online and Offline), and Japan Lighting Fixture Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsJapan Lighting Fixture Market Insights Forecasts to 2035

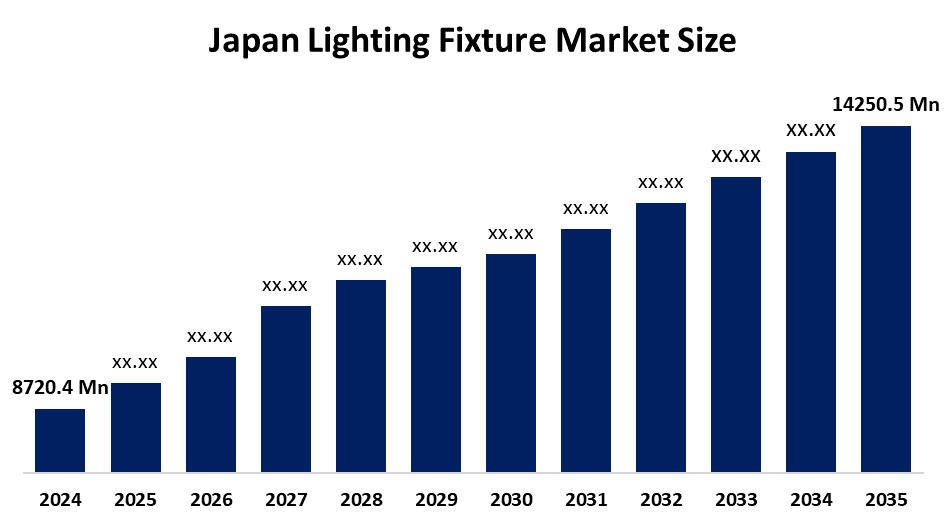

- The Japan Lighting Fixture Market Size Was Estimated at USD 8720.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.57% from 2025 to 2035

- The Japan Lighting Fixture Market Size is Expected to Reach USD 14250.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Lighting Fixture Market size is anticipated to reach USD 14250.5 Million by 2035, growing at a CAGR of 4.57% from 2025 to 2035. The Japan lighting fixture market refers to the industry involved in the design, production, and distribution of lighting products used for residential, commercial, industrial, and public infrastructure applications. It includes a wide range of lighting solutions such as LED lamps, luminaires, ceiling lights, wall-mounted fixtures, and outdoor lighting systems. The market encompasses both conventional lighting technologies and advanced energy-efficient systems integrated with smart controls.

Market Overview

Japan’s lighting fixture market is one of the most mature and technologically advanced in the world, driven by innovation, energy efficiency policies, and a strong focus on design and quality. The widespread adoption of LED technology has significantly transformed the market, replacing traditional fluorescent and incandescent lighting. LEDs now dominate due to their longer lifespan, low power consumption, and reduced environmental impact. The market’s growth is further supported by Japan’s commitment to sustainability and smart infrastructure development. Government initiatives promoting energy conservation and carbon neutrality encourage the use of eco-friendly lighting solutions in public spaces, transportation systems, and commercial buildings. The increasing adoption of smart lighting systems integrated with sensors, IoT, and automation enhances energy management, safety, and convenience. In the residential segment, rising urbanisation and demand for modern interior design have increased the use of stylish and customizable lighting fixtures. Meanwhile, in the industrial and commercial sectors, efficient lighting systems contribute to operational cost reduction and improved workplace environments. Despite its maturity, the market faces challenges such as high installation costs for advanced systems and competition from low-priced imported products. However, continued innovation, miniaturisation, and integration of lighting with smart home and building technologies are expected to sustain steady growth. Overall, the Japan lighting fixture market is evolving toward intelligent, energy-efficient, and design-oriented solutions that align with the country’s sustainability and modernisation goals.

Report Coverage

This research report categorizes the market for the Japan lighting fixture market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan lighting fixture market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan lighting fixture market.

Japan Lighting Fixture Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8720.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.57% |

| 2035 Value Projection: | USD 14250.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Source, By Distribution Channel |

| Companies covered:: | Panasonic Holdings Corporation, Toshiba Lighting and Technology Corporation, Sharp Corporation, Nichia Corporation, Koito Manufacturing Co., Ltd., Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The lighting fixture market is driven by the government, aggressive smart city projects integrating IoT lighting, and consistent consumer demand for energy efficiency and aesthetic, human-centric lighting solutions. This transition is amplified by the retrofit boom in commercial and residential buildings seeking to minimize electricity costs. Furthermore, the push for smart cities and IoT integration is driving demand for advanced, connected, and human-centric lighting systems.

Restraining Factors

The lighting fixture market is restrained by high upfront cost of replacing older, incompatible fixtures (especially in residential retrofits) and intense margin squeeze from fierce competition with lower-cost imported LED products from other Asian manufacturers.

Market Segmentation

The Japan lighting fixture market share is classified into source and distribution channel.

- The fluorescent segment held the largest market revenue share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The Japan lighting fixture market is segmented by source into fluorescent, LED and OLED. Among these, the fluorescent segment held the largest market revenue share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. This is due to better characteristics than incandescent lamps. Incandescent bulbs are outdated as they use a metallic filament to produce light. However, fluorescent lamps use gas to produce light, thus resulting in less power consumption.

- The online channel is projected to grow at the fastest CAGR during the forecast period.

The Japan lighting fixture market is segmented by distribution channel into online and offline. Among these, the online channel is projected to grow at the fastest CAGR during the forecast period. This is due to due to the availability of several offers on products and growing e-commerce. In addition, the availability of a wide range of products and the increasing penetration of smart devices are likely to proliferate the sales of lighting fixtures on the online portal in the forthcoming years.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the Japan lighting fixture market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Panasonic Holdings Corporation

- Toshiba Lighting and Technology Corporation

- Sharp Corporation

- Nichia Corporation

- Koito Manufacturing Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan lighting fixture market based on the below-mentioned segments:

Japan Lighting Fixture Market, By Source

- Fluorescent

- LED

- OLED

Japan Lighting Fixture Market, By Distribution Channel

- Online

- Offline

Frequently Asked Questions (FAQ)

-

Q: What is the current market valuation and expected growth rate of the Japanese lighting market?A: The broader Japan Lighting Market was valued at approximately USD 8.9 billion in 2024. It is projected to show robust growth, with some forecasts predicting an 11.2% CAGR through 2033, driven largely by the mandatory switch to LED technology.

-

Q: How are government regulations impacting market growth?A: The market is significantly driven by regulations, notably the Minamata Convention, which mandates the phase-out of most fluorescent lamps by 2027. This forces mass replacements (the "retrofit boom") and accelerates the transition to mercury-free, energy-efficient LED fixtures.

-

Q: Which Japanese companies are the key leaders in the lighting fixture market?A: Key market leaders include major electronics conglomerates like Panasonic and Toshiba Lighting, renowned for comprehensive residential and commercial solutions. Specialized component manufacturers like Nichia (LED chips) and automotive suppliers like Koito and Stanley Electric are also highly influential.

-

Q: What is the primary restraining factor limiting faster adoption in the Japanese residential sector?A: The main restraint is the high upfront cost of replacing older, non-standard fixtures. While the long-term energy savings are significant, the initial out-of-pocket expenditure often delays the widespread replacement of residential lighting, despite government incentives.

-

Q: Which segments are showing the fastest growth rates?A: Beyond general LED adoption, specific high-growth segments include Smart Lighting systems (integrated with IoT for centralized control), Outdoor deployments (driven by smart-pole rollouts), and niche applications like UV-C disinfection luminaires for hospitals.

Need help to buy this report?