Japan Leak Detection and Repair Market Size, Share, By Product (Handheld Gas Detectors, UAV-Based Detectors, Vehicle-based Detectors, and Manned Aircraft Detectors), By Technology (Volatile Organic Compounds (VOC) Analyzer, Optical Gas Imaging (OGI), Laser Absorption Spectroscopy, Ambient/Mobile Leak Monitoring, Acoustic Leak Detection, Audio-Visual-Olfactory Inspection), Japan Leak Detection and Repair Market Insights, Industry Trend, Forecasts to 2035.

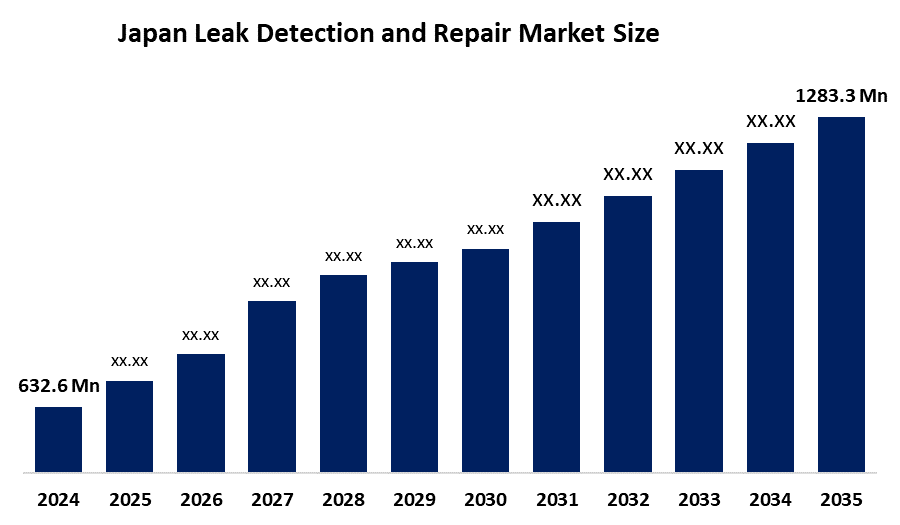

Industry: Semiconductors & Electronics- Japan Leak Detection and Repair Market Size 2024: USD 632.6 Mn

- Japan Leak Detection and Repair Market Size 2035: USD 1283.3 Mn

- Japan Leak Detection and Repair Market CAGR 2024: 6.64%

- Japan Leak Detection and Repair Market Segments: Product and Technology.

Get more details on this report -

Japan's leak detection and repair (LDAR) sector includes methods and equipment utilized to detect, locate and repair unintentional leaks from industrial, municipal, and commercial infrastructure, but is primarily characterized by an emphasis on ensuring safety in operations, preventing environmental contamination, conserving natural resources and addressing the common issues of non-business as usual, and to improve product/services quality. Recent developments within this sector include a movement away from traditional techniques of control in favor of increased automation and integration with sensors that are embedded with Internet of Things (IoT) capability for the purpose of providing immediate data feedback to allow quick response to critical repairs, thus reducing time spent recovering valuable products.

The Japanese Government has supported efforts of the private sector through numerous environmental regulations, such as required environmental impact assessments, as well as several safety regulations developed to help promote industries' use of very testing and monitoring processes and approaches to reduce greenhouse gases and exposure to hazardous materials using LDAR methodologies. Similarly, the private sector is continuing to invest an increasing amount of resources into upgrading its existing infrastructure to meet and comply with the stringent National Government safety regulations related to energy and water utility systems.

Advances in technology are also causing significant change with respect to leak detection and repair (LDAR) in Japan. The use of advanced technologies, including high-resolution and high-precision contact/non-contact technologies have facilitated the ability to monitor and detect extremely small changes in pressure and/or volume of material to determine possible leaks. Additionally, and very importantly, continuous monitoring and detection systems that leverage the use of highly sophisticated data analytics and artificial intelligence to effectively detect and alert operators to possible leak conditions are now in use across many sectors. Predictive maintenance is now possible based upon such monitoring and alert systems as opposed to the traditional approach of wait and see if the maintenance will be needed.

Market Dynamics of the Japan Leak Detection and Repair Market:

The Japanese leak detection and repair market is driven by the oil and gas sectors, for example, their extensive mature pipeline, water distribution system, and industrial lifelines are being monitored on an ongoing basis to help mitigate the loss of products due to leaks, as well as ensure the safety of employees who work in these facilities. This has created increased demand for advancements in leak detection technology because of the need to meet extremely high standards for minimizing water loss through building infrastructure, the ever-increasing automation of industrial facilities, and the desire to minimize downtime from operationally disrupted service.

The Japanese leak detection and repair market's primary barriers to the adoption of advanced leak detection and response (LDAR) technologies include the cost of installation and maintenance, both of which are high. Technical complexity and skill requirements associated with these new technologies, as well as the challenges associated with integrating them with current legacy infrastructures, also create barriers. Finally, in some instances, false alarms and inaccurate data can erode confidence in automated systems and thus impede their adoption in conservative industries.

The application of artificial intelligence (AI), machine learning, and predictive analytics is providing consumers with reduced costs associated with proactive maintenance. The programmatic growth of smart cities, digital water management, and hydrogen infrastructure development has led to the increasing need for advanced LDAR technologies. The increasing number of investments focused on renewable energy, LNG terminals, and the decarbonization of industry will also create avenues to expand the use of innovative and real-time LDAR technologies.

Japan Leak Detection and Repair Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 632.6 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.64% |

| 2035 Value Projection: | USD 1283.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Technology, By Application, By Region, COVID-19 Impact Analysis |

| Companies covered:: | Yokogawa Electric Corporation, NEC Corporation, Tenchijin Inc., OMRON Corporation, JGC Holdings Corporation, Idemitsu Kosan Co., Ltd., Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan leak detection and repair market share is classified into product and technology.

By Product

The Japanese leak detection and repair market is divided by product into handheld gas detectors, UAV-based detectors, vehicle-based detectors, and manned aircraft detectors. Among these, the handheld gas detectors segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Handheld gas detectors are becoming increasingly popular among the oil and gas industries due to their advantages, such as quick and reliable detection, compact and lightweight construction, and ease of use. These detectors are used to detect several gases, including methanol, carbon dioxide, ammonia, and methane.

By Technology:

The Japan leak detection and repair market is divided by technology into volatile organic compounds (VOC) analyzer, optical gas imaging (OGI), laser absorption spectroscopy, ambient/mobile leak monitoring, acoustic leak detection, and audio-visual-olfactory inspection. Among these, the volatile organic compounds (VOC) analyzer segment dominated the market in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The concentration of a VOC is higher indoors than outdoors. Cleaning supplies, paints, glues, and printing equipment are among the most common sources of VOC emissions within a facility. VOC detectors are primarily utilized for the quick and precise detection of volatile organic compounds.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan leak detection and repair market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Leak Detection and Repair Market:

- Yokogawa Electric Corporation

- NEC Corporation

- Tenchijin Inc.

- OMRON Corporation

- JGC Holdings Corporation

- Idemitsu Kosan Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan leak detection and repair market based on the below-mentioned segments:

Japan Leak Detection and Repair Market, By Product

- Handheld Gas Detectors

- UAV-Based Detectors

- Vehicle-based Detectors

- Manned Aircraft Detectors

Japan Leak Detection and Repair Market, By Technology

- Volatile Organic Compounds (VOC) Analyzer

- Optical Gas Imaging (OGI)

- Laser Absorption Spectroscopy

- Ambient/Mobile Leak Monitoring

- Acoustic Leak Detection

- Audio-Visual-Olfactory Inspection

Frequently Asked Questions (FAQ)

-

Q: What is the market size of Japan's LDAR in 2024 and 2035?A: The market was valued at USD 632.6 million in 2024 and is projected to reach USD 1,283.3 million by 2035.

-

Q: What is the expected CAGR of the Japan LDAR market?A: The market is expected to grow at a CAGR of 6.64% during the forecast period 2025–2035.

-

Q: Which product segment dominates the Japan LDAR market?A: Handheld gas detectors dominated the market in 2024 due to their portability, ease of use, and quick detection capabilities across multiple gases.

-

Q: What are the key technologies used in the Japanese LDAR market?A: Major technologies include VOC analyzers, optical gas imaging (OGI), laser absorption spectroscopy, ambient/mobile leak monitoring, acoustic leak detection, and audio-visual-olfactory inspection.

-

Q: Which technology segment held the largest market share in 2024?A: The volatile organic compounds (VOC) analyzer segment dominated the market in 2024 owing to its accuracy and widespread use in industrial facilities.

-

Q: What are the major drivers of the Japan LDAR market?A: Key drivers include stringent environmental regulations, aging infrastructure, safety concerns, industrial automation, and the need to reduce water and gas losses.

-

Q: Who are the leading companies in the Japanese LDAR market?A: Major players include Yokogawa Electric Corporation, NEC Corporation, Tenchijin Inc., OMRON Corporation, JGC Holdings Corporation, and Idemitsu Kosan Co., Ltd.

-

Q: Who are the target audiences for the Japan Leak Detection and Repair market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?