Japan Isopropyl Alcohol Market Size, Share, By Application (Antiseptic & Astringent Solvent, Chemical Intermediate, Other Application, and Cleaning Agent), By End Use (Cosmetics and Personal Care, Pharmaceutical, Food and Beverages, Paints and Coatings, Chemical, and Other), and Japan Isopropyl Alcohol Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Isopropyl Alcohol Market Insights Forecasts to 2035

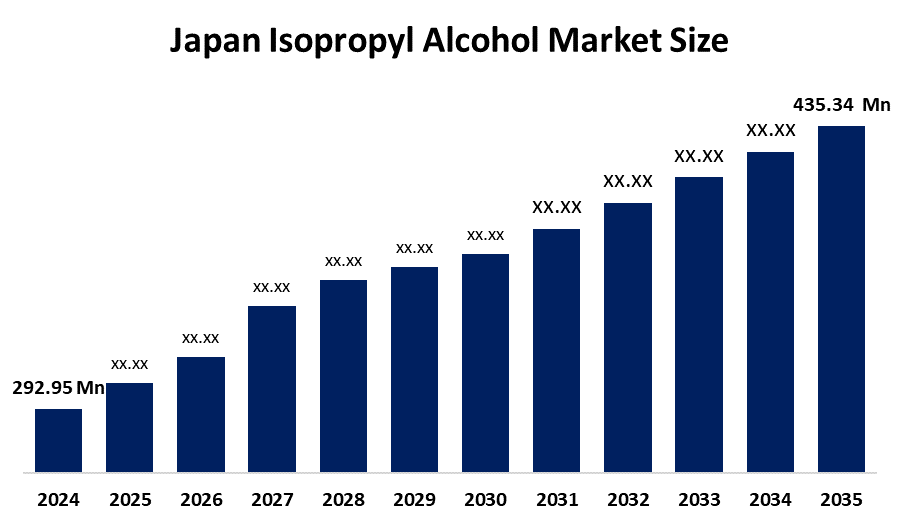

- Japan Isopropyl Alcohol Market Size 2024: USD 292.95 Million

- Japan Isopropyl Alcohol Market Size 2035: USD 435.34 Million

- Japan Isopropyl Alcohol Market CAGR 2024: 3.67%

- Japan Isopropyl Alcohol Market Segments, Application and End Use.

Get more details on this report -

The Japan Isopropyl Alcohol industry describes the process of production, distribution, and consumption of Isopropyl Alcohol, a colourless, volatile solvent used for disinfection, cleaning, electronic manufacturing, pharmaceuticals, and other industrial purposes. It contributes to the hygiene products, semiconductor, and industrial cleaning requirements of the chemical industry in Japan, measured by revenue and volume growth during the forecast period. Furthermore, the growth of the Japan isopropyl alcohol industry in Japan is driven by the increasing hygiene and disinfection awareness, strong demand in the healthcare and pharmaceutical industries, and extensive use in the electronics and semiconductor industries for precision cleaning. The strong and advanced industries of Japan, increasing hygiene and purity requirements of the electronic and semiconductor industries, and the use of Isopropyl Alcohol in the personal care and cosmetics industry are driving the growth of the Isopropyl Alcohol Industry in Japan.

The chemical regulation of Japan focuses on the safe handling of chemicals, protection of the environment, and the control of VOC emissions under the Air Pollution Control Act. Industry initiatives and voluntary programs are implemented to reduce the emission of organic solvents into the atmosphere and the safe use of chemicals, as well as the implementation of safety and environmental.

trends in the Japan Isopropyl Alcohol Market Size include increasing production of high-purity isopropyl alcohol, as it is required for semiconductor and pharmaceutical applications, and increasing demand for isopropyl alcohol in cosmetics and precision manufacturing. There is also increasing interest in green alternatives, as well as optimising the supply chain for consistent quality and performance in high-tech and healthcare applications.

Japan Isopropyl Alcohol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 292.95 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.67 % |

| 2035 Value Projection: | USD 435.34 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Application, By Industry |

| Companies covered:: | Okayama Corporation., Mitsui Chemicals, Inc., ENEOS Corporation., Nishi Tokyo Chemix Corporation, Tokyo Chemical Industry Co., Ltd., Mitsubishi Chemical Corporation, Sumitomo Chemical Co., Ltd., Tosoh Corporation, Idemitsu Kosan Co., Ltd., Kao Corporation., and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Isopropyl Alcohol Market:

The Japan Isopropyl Alcohol Market Size is driven by increasing demand for isopropyl alcohol in pharmaceutical synthesis and sterilization, as well as in overall electronic manufacturing, which requires isopropyl alcohol for cleaning electronic components, and increasing hygiene concerns of consumers. The emphasis of Japan on quality and safety standards will also help in increasing demand for isopropyl alcohol, as it is required by various sectors of the industry, which require its solvent and disinfectant properties, and a stable industrial and manufacturing sector, which will also help in increasing demand for isopropyl alcohol.

The restraints in the Japan Isopropyl Alcohol Market Size are the fluctuations in the price of raw materials, environmental and health safety regulations, the flammability of IPA, and the competition from alternative or bio-based solvents. All these restraints create operational hurdles in the Japan isopropyl alcohol market, hindering the expansion of the market in terms of scale without improvements in efficiency or the introduction of innovative environmental solutions.

The Japan Isopropyl Alcohol Market Size has opportunities in the Japan IPA market are the expansion in the market for high-purity IPA in advanced electronics and semiconductor manufacturing, the expansion in the market for sustainable and alternative or bio-based solvents, and the expansion in the market for medical/healthcare products. These Opportunities in the Japan IPA market could be explored through the export market and the introduction of innovative manufacturing processes.

Market Segmentation

The Japan Isopropyl Alcohol Market share is classified into technology, applications, and end use.

By Application:

The Japan Isopropyl Alcohol Market Size is divided by application into antiseptic & astringent solvent, chemical intermediate, other application, and cleaning agent. Among these, the cleaning agent segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The cleaning agent segment dominates due to high demand in healthcare, electronics, and industrial cleaning. Isopropyl alcohol’s quick evaporation, strong disinfectant properties, residue-free performance, and cost-effectiveness make it ideal for precision cleaning and hygiene applications, driving higher consumption than other segments.

By End Use:

The Japan Isopropyl Alcohol Market Size is divided by end use into healthcare facilities, pharmaceuticals, the food industry, laboratories, home care and other. Among these, the healthcare facilities segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The healthcare facilities dominate because of strict sterilisation requirements, infection control standards, and continuous demand for disinfectants and solvents. Isopropyl alcohol’s proven antimicrobial effectiveness, rapid evaporation, and compatibility with medical equipment make it essential for maintaining hygiene, safety, and regulatory compliance in these sectors.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Isopropyl Alcohol Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Isopropyl Alcohol Market:

- Okayama Corporation.

- Mitsui Chemicals, Inc.

- ENEOS Corporation.

- Nishi Tokyo Chemix Corporation

- Tokyo Chemical Industry Co., Ltd.

- Mitsubishi Chemical Corporation

- Sumitomo Chemical Co., Ltd.

- Tosoh Corporation

- Idemitsu Kosan Co., Ltd.

- Kao Corporation.

- Other

Recent Developments in Japan Isopropyl Alcohol Market

- In February 2025, a new line of bio-based IPA derived from renewable sources, targeting the Japanese and global cosmetics and healthcare sectors

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Isopropyl Alcohol Market Size based on the below-mentioned segments

Japan Isopropyl Alcohol Market, By Application

- Antiseptic &Amp

- Astringent Solvent

- Chemical Intermediate

- Other Application

- Cleaning Agent

Japan Isopropyl Alcohol Market, by End Use.

- Cosmetics and Personal Care

- Pharmaceutical

- Food and Beverages

- Paints and Coatings

- Chemical

- Other

Frequently Asked Questions (FAQ)

-

Q: What is the Japan isopropyl alcohol (IPA) market size?A: Japan isopropyl alcohol (IPA) Market is expected to grow from USD 281.6 million in 2024 to USD 436.2 million by 2035, growing at a CAGR of 4.06% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the electronics and semiconductor industry, which is the major consumer of the high-purity IPA that is used for precision cleaning. The growth of the IPA-using industries like pharmaceuticals, healthcare, and medical device manufacturing is due to the disinfectant properties of IPA. Moreover, IPA is a necessary drug for industrial manufacturing, automotive maintenance, and cosmetics production. The continuous increase of hygiene standards, advanced manufacturing processes, and domestic chemical production capabilities is keeping the Japan market's upward trend in the world.

-

Q: What factors restrain the Japan isopropyl alcohol (IPA) market?A: Constraints include the volatile prices of raw materials, stringent environmental and safety regulations, flammability issues, and a rising shift towards alternative or bio-based solvents. These factors increase the cost of compliance and limit the widespread industrial adoption of the product.

-

Q: How is the market segmented by application?A: The market is segmented into process solvent, cleaning agent, coating solvent, intermediate, and others.

-

Q: Who are the key players in the Japan isopropyl alcohol (IPA) market?A: Key companies include Tokuyama Corporation, Mitsui Chemicals, Inc., ENEOS Corporation, Nishi Tokyo Chemix Corporation, Tokyo Chemical Industry Co., Ltd. (TCI), Mitsubishi Chemical Corporation, Sumitomo Chemical Co., Ltd., Tosoh Corporation, Idemitsu Kosan Co., Ltd., Kao Corporation, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?