Japan IP-driven Merchandise & Content Market Size, Share, By Type (Merchandise, Content), By Age (Aged between 10 and 16 years, aged above 16 years), By Gender (Male, Female), By Distribution (Online, Offline), Japan IP-driven Merchandise & Content Market Insights, Industry Trend, Forecasts to 2035

Industry: Electronics, ICT & MediaJapan IP-driven Merchandise & Content Market Insights Forecasts to 2035

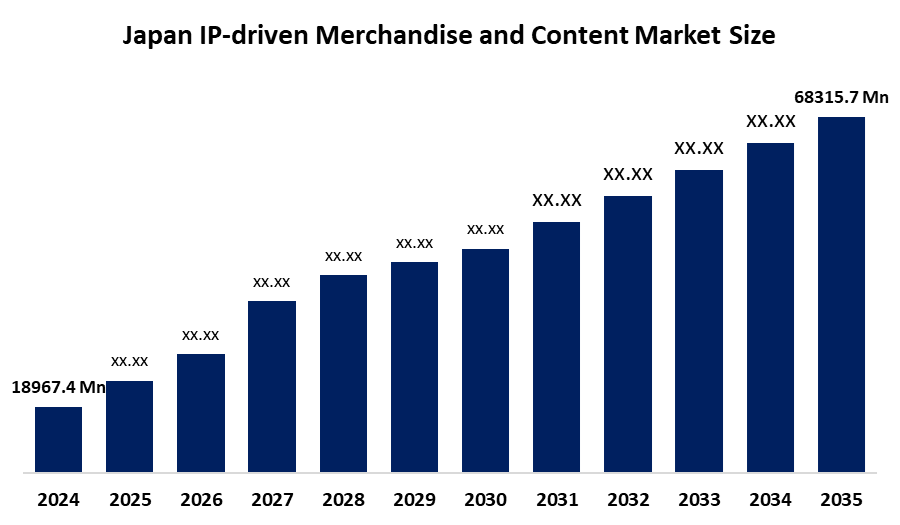

- Japan IP-driven Merchandise & Content Market Size 2024: USD 18967.4 Mn

- Japan IP-driven Merchandise & Content Market Size 2035: USD 68315.7 Mn

- Japan IP-driven Merchandise & Content Market CAGR 2024: 12.35%

- Japan IP-driven Merchandise & Content Market Segments: Type, Age Group, Gender, Distribution Channel

Get more details on this report -

The Japan IP driven merchandise and content market is essentially composed of products and experiences derived from intellectual properties such as anime, manga, games, and character brands. This range covers character goods, clothing, collectibles, digital content, and various collaborations that tie the media content with tangible products. The market serves to be a platform for consumer engagement and the spread of global fandom culture, with major IPs like Pokémon, Hello Kitty, and Demon Slayer leading the way in demand. The scope of the market includes licensed merchandise, apparel tie, ins, toys, digital content partnerships, themed cafes, exhibitions, and interactive experiences.

The increasing regional and global appeal of Japanese IP is stimulating retail, e, commerce, and experiential sectors, produced stable incomes across different consumer categories. With technological advancements like AR/VR, fans are given new ways to interact with merchandise, while AI, powered personalization, digital collectibles, and omnichannel platforms further annihilate the barriers in fan interaction and global outreach. The government, through initiatives like the New Cool Japan Strategy, aims to facilitate the global expansion of creative industries by providing support for licensing, merchandising, and cultural exports. It is anticipated that there will be future possibilities for worldwide IP partnerships, creation of immersive retail experiences, digital, physical integration, and more extensive international licensing, thus still keeping Japan at the forefront of IP, driven merchandise and content.

Market Dynamics of the Japan IP-driven Merchandise & Content Market:

The market is fueled by the increasing trend of anime, gaming, and entertainment IPs. The partnership of IPs with global brands and the evolution of omnichannel retail and digital platforms further spur market development. New developments in immersive experiences such as AR and VR, AI-powered personalization, and collectibles further complement and engage consumers.

The market is held back by challenges in the licensing complexities, high costs of production of high-end products, and the potential for counterfeit merchandise impacting the brand. Furthermore, the markets in the IP spaces are getting saturated and are depending on the support of loyal fans.

Future prospects include promising international collaborations, convergence of offline and online experiences, global development in e-commerce, and exploitation of opportunities in digital collectibles. Additionally, growth will come from collaborations, development of intellectual properties, and integration with government initiatives in Japan, such as "New Cool Japan Strategy."

Japan IP-driven Merchandise and Content Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 18967.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 12.35% |

| 2035 Value Projection: | USD 68315.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type |

| Companies covered:: | Akita Publishing Co., Ltd., Alter Co., Ltd., Aniplex Inc. (Sony Pictures Entertainment Inc.), Bioworld Merchandising, Inc., Bones, Inc., Crunchyroll (Sony Pictures Entertainment Inc.), Good Smile Company Inc., Kadokawa Corporation, Kodansha Ltd., Kyoto Animation Co., Ltd., MADHOUSE, Inc., MAX FACTORY, Inc., Medicom Toy Co., Ltd., MegaHouse Corporation (Bandai Namco Filmworks Inc.), Pierrot Co., Ltd., Production I.G, Inc., Sentai Holdings, LLC (AMC Networks), Shogakukan Inc., Shueisha Inc., Studio Ghibli, Inc., Sunrise, and Inc. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan IP-driven Merchandise & Content Market share is classified into type, age group, gender, distribution channel

By Type:

The Japan IP-driven merchandise & content market is divided by type into merchandise and content. Among these, the merchandise segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Merchant leads are influenced by their strong brand, their appeal to collectors, and anime, gaming, and character merchandise, resulting in higher expenditures on tangible items in the Japanese market.

By Age:

The Japan IP-driven merchandise & content market is divided by age into 10-16 years and above 16 years. Among these, the above 16 years segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This segment leads because the seniors in this generation have disposable income and are avid collectors who are willing to shell out money to own popular intellectual property content and merchandise.

By Gender:

The Japan IP-driven merchandise & content market is divided by gender into male and female. Among these, the male segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Male buyers also contribute significantly, given their heavy involvement in gaming, anime, and hobby merch.

By Distribution:

The Japan IP-driven merchandise & content market is divided by distribution into online and offline. Among these, online dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Online platforms lead based on convenience, product offerings, and advertising through online shopping and social media platforms in Japan.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan IP-driven merchandise & content market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan IP-driven Merchandise & Content Market:

- Akita Publishing Co., Ltd.

- Alter Co., Ltd.

- Aniplex Inc. (Sony Pictures Entertainment Inc.)

- Bioworld Merchandising, Inc.

- Bones, Inc.

- Crunchyroll (Sony Pictures Entertainment Inc.)

- Good Smile Company Inc.

- Kadokawa Corporation

- Kodansha Ltd.

- Kyoto Animation Co., Ltd.

- MADHOUSE, Inc.

- MAX FACTORY, Inc.

- Medicom Toy Co., Ltd.

- MegaHouse Corporation (Bandai Namco Filmworks Inc.)

- Pierrot Co., Ltd.

- Production I.G, Inc.

- Sentai Holdings, LLC (AMC Networks)

- Shogakukan Inc.

- Shueisha Inc.

- Studio Ghibli, Inc.

- Sunrise, Inc.

- Toei Animation Co., Ltd.

- Ufotable Co., Ltd.

- VIZ Media, LLC

- Yen Press LLC

Recent Developments in Japan IP-driven Merchandise & Content Market:

In July 2025, Toppan Group established the Cross Media UK to support Japanese anime and manga Intellectual Property holders in the distribution of licensed merchandise within the UK market, including items like Nendoroid and figma figures.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan IP-driven merchandise & content market based on the below-mentioned segments:

Japan IP-driven Merchandise & Content Market, By Type

- Merchandise

- Content

Japan IP-driven Merchandise & Content Market, By Age

- Aged between 10 and 16 years

- Aged above 16 years

Japan IP-driven Merchandise & Content Market, By Gender

- Male

- Female

Japan IP-driven Merchandise & Content Market, By Distribution

- Online

- Offline

Frequently Asked Questions (FAQ)

-

What is the Japan IP-driven merchandise & content market size?Japan IP-driven merchandise & content market is expected to grow from USD 18967.4 million in 2024 to USD 68315.7 million by 2035, growing at a CAGR of 12.35% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the increasing trend of anime, gaming, and entertainment IPs. The partnership of IPs with global brands and the evolution of omnichannel retail and digital platforms further spur market development. New developments in immersive experiences such as AR and VR, AI-powered personalization, and collectibles further complement and engage consumers.

-

What factors restrain the Japan IP-driven merchandise & content market?Constraints include the challenges in the licensing complexities, high costs of production of high-end products, and the potential for counterfeit merchandise impacting the brand. Furthermore, the markets in the IP spaces are getting saturated and are depending on the support of loyal fans.

-

How is the market segmented by type?The market is segmented into merchandise and content.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?