Japan Industrial Gases Market Size, Share, By Product (Nitrogen, Oxygen, Hydrogen, Carbon Dioxide, and Others), By Application (Healthcare, Manufacturing, Retail, Metallurgy & Glass, Food & Beverages, and Others), Japan Industrial Gases Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsJapan Industrial Gases Market Insights Forecasts to 2035

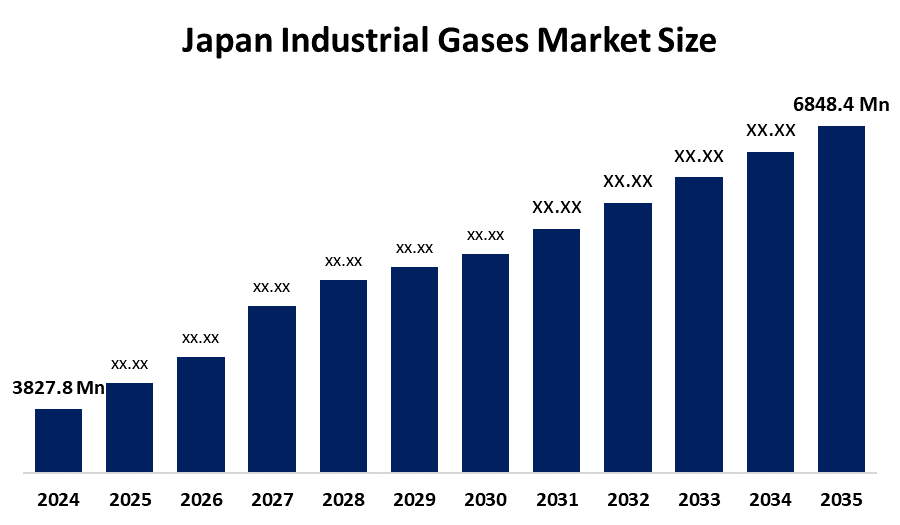

- Japan Industrial Gases Market Size 2024: USD 3827.8 Mn

- Japan Industrial Gases Market Size 2035: USD 6848.4 Mn

- Japan Industrial Gases Market CAGR 2024: 5.43%

- Japan Industrial Gases Market Segments: Product and Application.

Get more details on this report -

The Japan Industrial Gases Market Size refers to the large-scale production and distribution of high-purity gases such as nitrogen, oxygen, argon, hydrogen, and carbon dioxide for diverse industrial applications. These gases are characterized by their specialized properties essential for critical processes in manufacturing, semiconductor fabrication, healthcare, and chemical production. Current trends indicate a significant shift toward the adoption of green hydrogen and low-carbon gas solutions as Japan accelerates its transition toward a carbon-neutral economy. Additionally, the rising demand for ultra-high-purity specialty gases in the advanced electronics and biotechnology sectors is shaping the market's technological landscape.

The Japanese government has implemented robust initiatives, including the "Green Growth Strategy," which targets carbon neutrality by 2050 and provides substantial subsidies for hydrogen infrastructure and city gas to mitigate energy price inflation. Furthermore, the Petroleum Association of Japan is collaborating with the Ministry of Economy, Trade, and Industry (METI) to develop "transition finance" roadmaps that encourage private investment in carbon capture and hydrogen fueling stations.

Technological progress is centered on the integration of AI and IoT to optimize gas production, storage, and real-time monitoring, leading to efficiency improvements of 10–30% in facilities like the Fukushima FH2R. Advancements in cryogenic separation and membrane technologies have enhanced gas purity levels, while AI-driven predictive modeling is increasingly used to ensure the structural integrity of hydrogen refueling networks. Moreover, innovations in Carbon Capture, Utilization, and Storage (CCUS) are enabling industries to capture emissions from hard-to-abate sectors, turning carbon into a recyclable feedstock for petrochemical products.

Market Dynamics of the Japan Industrial Gases Market

The Japan Industrial Gases Market Size is primarily driven by the robust expansion of the semiconductor and electronics industries, which require massive quantities of ultra-high-purity nitrogen and argon for wafer manufacturing. Additionally, Japan’s aggressive pursuit of a hydrogen-based society and green energy transition is fueling demand for hydrogen fuel cells and clean energy technologies. The healthcare sector also serves as a critical driver, with an aging population increasing the need for medical-grade oxygen and specialty therapeutic gases.

The industrial gases market in Japan is constrained by high production and infrastructure costs, particularly for cryogenic storage and pipeline distribution, which pose significant financial barriers. Furthermore, stringent safety and environmental regulations concerning the handling of hazardous, flammable, or toxic gases like hydrogen and acetylene increase compliance costs and operational complexities for manufacturers.

Significant opportunities exist in the development of functional organic snacks and the integration of nuts and seeds into the expanding vegan and plant-based sectors. Additionally, the growing popularity of urban vertical farming and direct-to-consumer digital platforms provides new avenues for specialty growers to reach health-conscious urban demographics.

Japan Industrial Gases Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3827.8 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 5.43% |

| 2035 Value Projection: | USD 6848.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Taiyo Nippon Sanso Corporation Air Water Inc. Iwatani Corporation Air Liquide Japan G.K. Showa Denko Gas Products Co., Ltd. Tomoe Shokai Co., Ltd. Kanto Denka Kogyo Co., Ltd. Nikkiso Co., Ltd. Others Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan industrial gases market share is classified into product and application.

By Product:

The Japan Industrial Gases Market Size is divided by product into nitrogen, oxygen, hydrogen, carbon dioxide, and others. Among these, the oxygen segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Oxygen is used in a variety of processes, including fabrication, steel melting, medical uses, and copper smelting. Oxygen is known to increase the thermal efficiency of fuel. Thus, oxygen can be employed as a means to extract more energy from fuel.

By Application:

The Japan Industrial Gases Market Size is divided by application into healthcare, manufacturing, retail, metallurgy & glass, food & beverages, and others. Among these, the manufacturing segment is anticipated to grow at the fastest CAGR during the forecast period. This is due to a variety of applications, the demand for industrial gases in the manufacturing industry is expected to increase rapidly. Carbon dioxide is commonly used in the rubber sector as dry ice to clean rubber molds without abrasion.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Industrial Gases Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Industrial Gases Market:

- Taiyo Nippon Sanso Corporation

- Air Water Inc.

- Iwatani Corporation

- Air Liquide Japan G.K.

- Showa Denko Gas Products Co., Ltd.

- Tomoe Shokai Co., Ltd.

- Kanto Denka Kogyo Co., Ltd.

- Nikkiso Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan industrial gases market based on the below-mentioned segments:

Japan Industrial Gases Market, By Product

- Nitrogen

- Oxygen

- Hydrogen

- Carbon Dioxide

- Others

Japan Industrial Gases Market, By Application

- Healthcare

- Manufacturing

- Retail

- Metallurgy & Glass

- Food & Beverages

- Others

Frequently Asked Questions (FAQ)

-

What is the projected market size of the Japan industrial gases market by 2035?The market is expected to grow from USD 3,827.8 million in 2024 to USD 6,848.4 million by 2035.

-

What is the expected CAGR of the Japan industrial gases market during the forecast period?The Japan industrial gases market is projected to grow at a CAGR of 5.43% during the forecast period from 2025 to 2035

-

Which product segment dominated the Japan industrial gases market in 2024?The oxygen segment dominated the market in 2024 due to its extensive use in healthcare, metal fabrication, steelmaking, and energy-efficient combustion processes

-

Which application segment is expected to grow at the fastest rate?The manufacturing segment is expected to grow at the fastest CAGR, driven by rising demand from electronics, automotive, rubber processing, and precision manufacturing industries

-

What are the key drivers of growth in the Japan industrial gases market?Key drivers include expansion of the semiconductor and electronics sectors, increasing adoption of hydrogen for clean energy, and rising healthcare demand from Japan’s aging population.

-

Who are the major players in the Japan industrial gases market?Major players include Taiyo Nippon Sanso Corporation, Air Water Inc., Iwatani Corporation, Air Liquide Japan G.K., Showa Denko Gas Products Co., Ltd., and Nikkiso Co., Ltd

Need help to buy this report?