Japan Hub Motor Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Geared Hub Motor, Gearless Hub Motor), By Motor Type (Brushless DC Motor (BLDC), Brushed DC Motor), and Japan Hub Motor Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationJapan Hub Motor Market Insights Forecasts to 2035

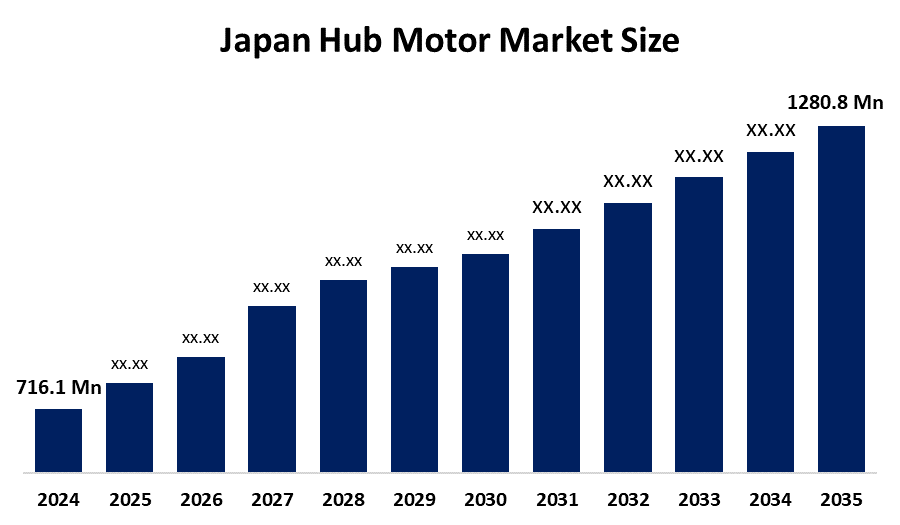

- The Japan Hub Motor Market Size was estimated at USD 716.1 Million in 2024

- The Market Size is expected to grow at a CAGR of around 5.43% from 2025 to 2035

- The Japan Hub Motor Market Size is expected to Reach USD 1280.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Hub Motor Market Size is Expected to Grow from USD 716.1 Million in 2024 to USD 1280.8 Million by 2035, Growing at a CAGR of 5.43% During the Forecast Period 2025-2035. The hub motor market is driven by the fact that electric vehicles are continue to evolve, there is a rising emphasis on improving their efficiency, power, and overall performance. Hub motors, with their direct power delivery to the wheels, offer various advantages, including providing instant torque and enabling quick acceleration

Market Overview

The Japanese Market Size for hub motors refers to an industry built around producing, using, and selling hub motors (electric motors that are built directly into the wheel of vehicles). Hub motors remove the need to use traditional drive systems (like chains and gears) and provide compact and efficient propulsion for electric bicycles, electric scooters, motorcycles, and light electric vehicles. There is significant growth potential within Japan’s hub motor market due to several converging trends. The first trend is a significant increase in demand from urban commuters and older individuals who want assisted mobility for electric two-wheelers and micromobility solutions. The majority of e-bikes depend on hub motors for their padded feeling of power delivery, which helps to make them attractive to consumers. The second trend is the movement toward a more sustainable method of transportation, which includes reducing carbon emissions. To achieve this goal, both consumers and fleet operators are choosing to purchase electric vehicles that have hub motors, particularly when used to deliver goods at the last mile or in conjunction with shared mobility services. The Japanese Government is promoting the adoption of electric vehicles through various electric mobility initiatives rather than specifically focusing on hub motors. National policies are focused on reducing carbon emissions and encouraging electrified vehicles through subsidies and tax incentives offered under the Clean Energy Vehicle (CEV) Promotion Subsidy program for EVs, plug-in hybrids, and technology associated with these vehicles.

Report Coverage

This research report categorizes the market for the Japan Hub Motor Market Size based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing hub motor market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan hub motor market.

Japan Hub Motor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 716.1 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 5.43% |

| 2035 Value Projection: | USD 1280.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Product Type, By Motor Type |

| Companies covered:: | Nidec Corporation, Panasonic, Hitachi Astemo, Tajima Motor Corporation, Yamaha Motor Co., Ltd, and Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japanese Hub Motor Market Size is experiencing strong growth, which is inspired by factors such as environmental rules, growing e-bikes and electric vehicles, and government incentives. Motor efficiency and technological progress in compact designs also contribute to the expansion of the market.

Restraining Factors

The Japanese Hub Motor Market Size leads to several preventive factors, including high early and maintenance costs of electric vehicles, complex manufacturing processes, and limited infrastructure for electric vehicles in developing economies. In addition, some hub motors may have an operating speed and a more complex structure, which potentially hinders market growth.

Market Segmentation

The Japan hub motor market share is classified into product type and motor type.

- The geared hub motor segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan Hub Motor Market Size is segmented by product type into geared hub motor and gearless hub motor. Among these, the geared hub motor segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is due to their efficiency, durability, and ability to provide higher torque, making them suitable for applications where performance and power usage are crucial, such as electric motorcycles and lightweight vehicles.

- The brushless DC motor (BLDC) segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan Hub Motor Market is segmented by motor type into brushless DC motor (BLDC), brushed DC motor. Among these, the brushless DC motor (BLDC) segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. BLDC motors are known for their efficiency, reliability, and precise control, making them a popular choice for a variety of applications, including electric vehicles, e-bikes, and scooters.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan hub motor market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nidec Corporation

- Panasonic

- Hitachi Astemo

- Tajima Motor Corporation

- Yamaha Motor Co., Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Japan Hub Motor Market, By Product Type

- Geared Hub Motor

- Gearless Hub Motor

Japan Hub Motor Market, By Motor Type

- Brushless DC Motor (BLDC)

- Brushed DC Motor

Frequently Asked Questions (FAQ)

-

What is the base year and forecast period for the Japan Hub Motor Market?The base year for the market is 2024, with historical data from 2020–2023. The forecast period spans from 2025 to 2035.

-

What is the current and projected market size of the Japan Hub Motor Market?The market was valued at USD 716.1 million in 2024 and is expected to reach USD 1,280.8 million by 2035, growing at a CAGR of 5.43% during the forecast period.

-

What factors are driving the growth of the Japan Hub Motor Market?Key growth drivers include rising adoption of electric vehicles and e-bikes, stringent environmental regulations, government incentives for clean mobility, and technological advancements improving motor efficiency, power delivery, and compact design.

-

What are the major restraining factor in the Japan Hub Motor Market?Market growth is restrained by high initial and maintenance costs of electric vehicles, complex manufacturing processes, limited charging infrastructure in certain regions, and performance limitations such as speed constraints in some hub motor designs.

-

Which product type segment dominates the Japan Hub Motor Market?The geared hub motor segment dominated the market in 2024 due to its higher torque output, durability, and efficiency, making it suitable for electric motorcycles and lightweight electric vehicles.

-

Who are the key players operating in the Japan Hub Motor Market?Major companies in the market include Nidec Corporation, Panasonic, Hitachi Astemo, Tajima Motor Corporation, Yamaha Motor Co., Ltd., along with other domestic and international manufacturers.

Need help to buy this report?