Japan Heavy-Duty Electric Trucks Market Size, Share, By Vehicle Class (Class 7 and Class 8), By Application (Logistics and Delivery, Construction, Waste Management, and Others), Japan Heavy-Duty Electric Trucks Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationJapan Heavy-Duty Electric Trucks Market Insights Forecasts to 2035

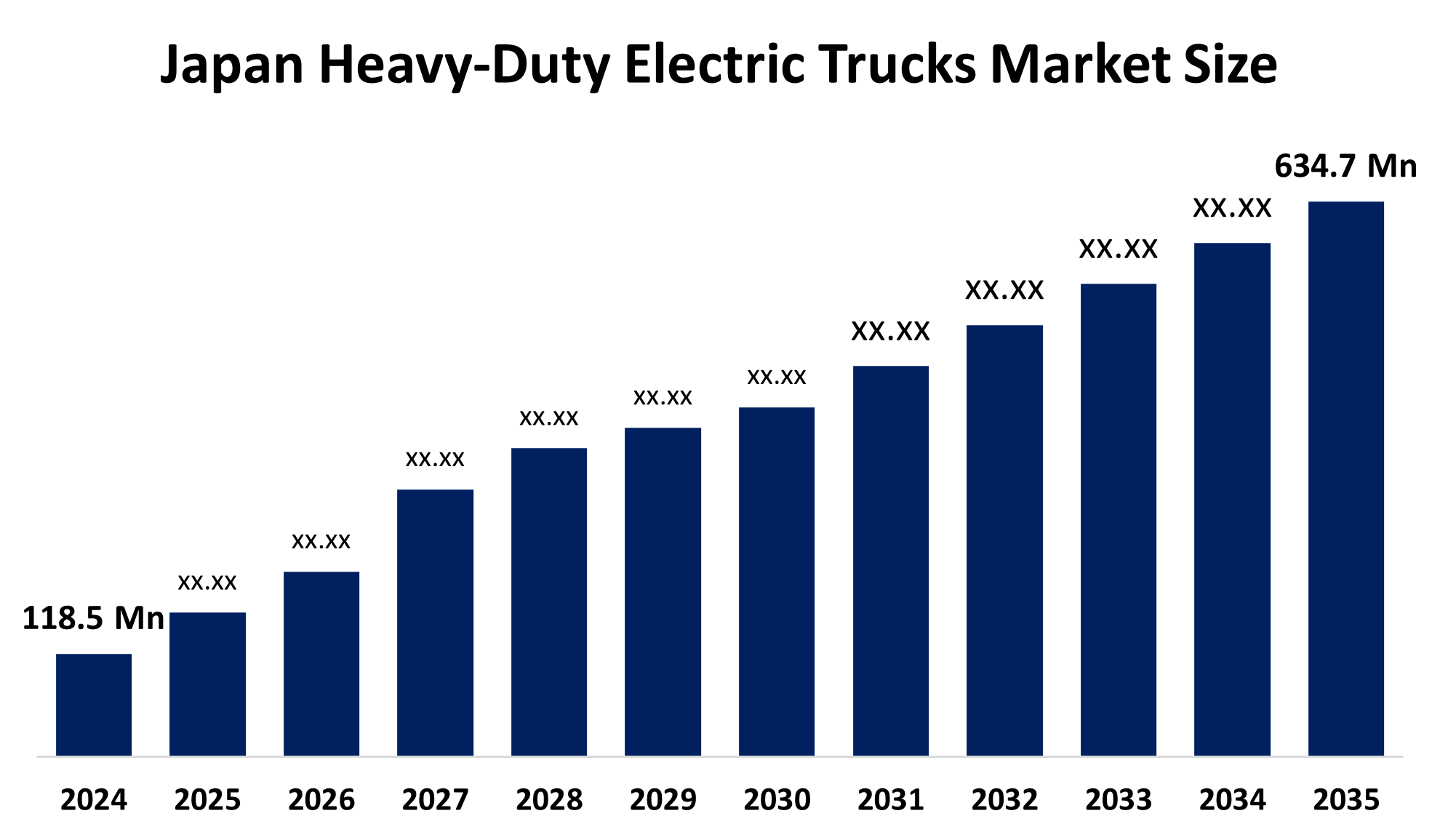

- Japan Heavy-Duty Electric Trucks Market Size 2024: USD 118.5 Million

- Japan Heavy-Duty Electric Trucks Market Size 2035: USD 634.7 Million

- Japan Heavy-Duty Electric Trucks Market CAGR 2024: 16.48%

- Japan Heavy-Duty Electric Trucks Market Segments: Vehicle Class and Application.

Get more details on this report -

In Japan, the Heavy-Duty Electric Trucks Market has emerged as a separate segment with a primary focus on the development, distribution, and usage of high-capacity commercial vehicles equipped with electric power systems. Such vehicles are designed to haul things that exceed their weight capabilities, so they produce no tailpipe emissions and generally use either fuel cell or larger capacity lithium-ion batteries as a power source. The Japanese heavy-duty electric truck market also includes greater use and development of telematics technology for optimizing fleet utilization, and a general shift towards improved battery powering solutions due to greater energy density and increased ranges offered by newer, solid-state battery technologies.

The Japanese government's involvement in the expansion of the Japan Heavy-Duty Electric Trucks Market Size stems from its "Green Growth Strategy," which sets a goal for all new vehicle sales in Japan to be fully electrified by 2035. On the private sector front, there are strong collaborations amongst manufacturers building hydrogen, hybrid electric, and rapid charging infrastructure within Japan.

The logistics industry is leveraging technological advancements to further improve the operational efficiencies of long-haul transportation. The use of regenerative braking and improved traction motor control algorithms is becoming increasingly common in maximizing battery performance. In addition, advances in non-contact sensor technology and continuous level monitoring of fuel cell fluids and battery temperature have enabled more precise thermal management of batteries and provide improved safety and reliability in heavy-duty applications.

Market Dynamics of the Japan Heavy-Duty Electric Trucks Market:

The Japan Heavy-Duty Electric Trucks Market Size is driven by stringent emission regulations, government incentives for zero-emission vehicles, rising fuel costs, and logistics companies’ decarbonization goals. Additionally, advancements in battery technology, expanding charging infrastructure, and growing adoption of electric fleets for urban and regional freight further support market growth.

The main challenges of the heavy-duty electric trucks market in Japan will take longer to grow than other electric vehicles because it is constrained by high upfront capital expense, restricted driving range while operating under a full load, lack of fast-charging stations, prolonged charge times, and uncertainties surrounding the durability of batteries in harsh operating environments. Additionally, the time required for regulatory complexity and the slow transition of fleets to electrification slows the growth of this segment of the market.

The evolution of hydrogen fuel cell technology is providing a unique opportunity for heavy-duty truck makers due to the speed of refuelling and higher payload capacity compared to battery electric vehicle systems. Additionally, flexible leasing options and modular charging solutions also provide an opportunity for small-scale fleet adoption.

Japan Heavy-Duty Electric Trucks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 118.5 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 16.48% |

| 2035 Value Projection: | USD 634.7 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Vehicle Class, By Application |

| Companies covered:: | Toyota Motor Corporation, Isuzu Motors Ltd., Hino Motors, Ltd., Mitsubishi Fuso Truck and Bus Corporation, Nissan Motor Co., Ltd., Honda Motor Co., Ltd., UD Trucks Corporation, Panasonic Corporation, Toshiba Corporation, Mitsubishi Motors Corporation, and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The Japan heavy-duty electric trucks market share is classified into vehicle class and application.

By Vehicle Class:

The Japan Heavy-Duty Electric Trucks Market Size is divided by vehicle class into class 7 and class 8. Among these, the class 7 segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Class 7 heavy-duty electric trucks have a gross vehicle weight rating (GVWR) of 26,001 to 33,000 pounds. Also, rising government attempts to promote the use of class 7 electric vehicles can contribute to the segment's expansion.

By Application:

The Japan Heavy-Duty Electric Trucks Market Size is divided by application into logistics and delivery, construction, waste management, and others. Among these, the logistics and delivery segment dominated the market in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The shift to electric trucks in the transportation industry is intended to improve the efficiency of goods deliveries. Advances in battery technology and the advent of next-generation motors are expected to increase the use of electric cars in urban logistics.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Heavy-Duty Electric Trucks Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Heavy-Duty Electric Trucks Market:

- Toyota Motor Corporation

- Isuzu Motors Ltd.

- Hino Motors, Ltd.

- Mitsubishi Fuso Truck and Bus Corporation

- Nissan Motor Co., Ltd.

- Honda Motor Co., Ltd.

- UD Trucks Corporation

- Panasonic Corporation

- Toshiba Corporation

- Mitsubishi Motors Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical insights has segmented the Japan Heavy-Duty Electric Trucks Market Size based on the below-mentioned segments:

Japan Heavy-Duty Electric Trucks Market, By Vehicle Class

- Class 7

- Class 8

Japan Heavy-Duty Electric Trucks Market, By Application

- Logistics and Delivery

- Construction

- Waste Management

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the current size of the Japan heavy-duty electric trucks market?A: The Japan heavy-duty electric trucks market was valued at USD 118.5 million in 2024 and is projected to reach USD 634.7 million by 2035, growing at a CAGR of 16.48% during the forecast period.

-

Q: What are the key factors driving the growth of the market in Japan?A: Market growth is driven by stringent emission regulations, strong government incentives, rising fuel costs, logistics sector decarbonization goals, advancements in battery technology, and expansion of charging and hydrogen refueling infrastructure.

-

Q: Which vehicle class dominates the Japan heavy-duty electric trucks market?A: Class 7 heavy-duty electric trucks dominated the market in 2024 due to their suitability for urban and regional transport and increased government initiatives supporting their adoption.

-

Q: Which application segment holds the largest market share?A: The logistics and delivery segment holds the largest share, supported by the growing demand for efficient, low-emission urban freight transportation and advancements in battery and motor technologies.

-

Q: What are the major challenges faced by the Japan heavy-duty electric trucks market?A: Key challenges include high upfront costs, limited driving range under full load, lack of fast-charging infrastructure, long charging times, battery durability concerns, and slow fleet electrification.

-

Q: What opportunities exist in the Japan heavy-duty electric trucks market?A: Opportunities include the development of hydrogen fuel cell trucks, modular and flexible charging solutions, leasing models for fleet operators, and advancements in solid-state battery technologies.

-

Q: Who are the key players operating in the Japan heavy-duty electric trucks market?A: Major players include Toyota Motor Corporation, Isuzu Motors Ltd., Hino Motors, Mitsubishi Fuso Truck and Bus Corporation, Nissan Motor Co., Honda Motor Co., UD Trucks Corporation, Panasonic Corporation, Toshiba Corporation, and others.

Need help to buy this report?