Japan Healthy Snacks Market Size, Share, By Product (Frozen & Refrigerated, Fruit, Nuts & Seeds, Bakery, Savory, Bars & Confectionery, Dairy, and Others), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online, and Others), Japan Healthy Snacks Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesJapan Healthy Snacks Market Insights Forecasts to 2035

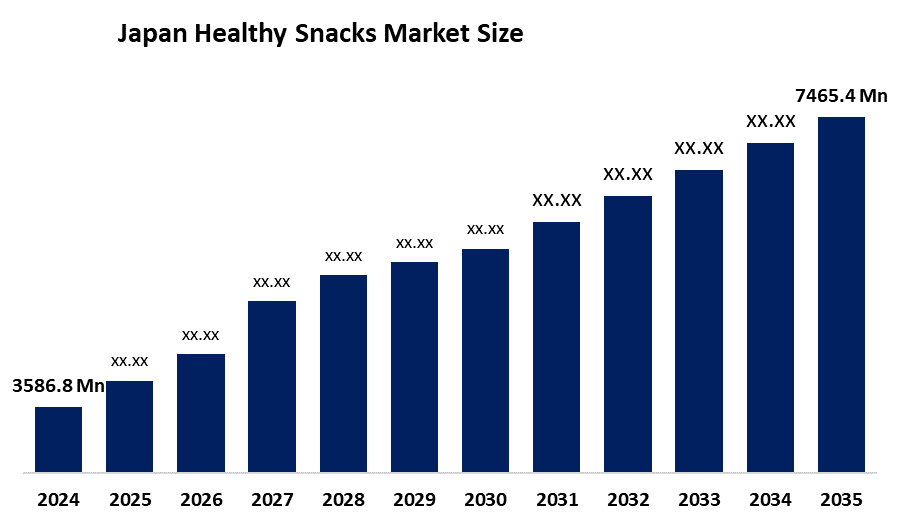

- Japan Healthy Snacks Market Size 2024: USD 3586.8 Mn

- Japan Healthy Snacks Market Size 2035: USD 7465.4 Mn

- Japan Healthy Snacks Market CAGR 2024: 6.89%

- Japan Healthy Snacks Market Segments: Product and Distribution Channel.

Get more details on this report -

The healthy snacks market in Japan is a small sub-sector of the larger food and beverage sector that deals specifically with producing and distributing foods that are high in nutrition, low in calories, and function as an easy snack. The healthy snacks market can be classified into two categories by technology: contact-level sensors and non-contact-level sensors. The healthy snacks market can also be classified by the type of monitoring done on each product. Point-level monitoring and continuous level monitoring are both types of monitoring available to the manufacturer. Features of this industry include a focus on portion control, transparent labeling for consumers, and functional benefits such as better digestion, improved immune systems, and weight loss, etc.

The Japanese government has put into place proactive strategies to encourage the public to adopt healthier eating habits through programmes such as "Health Japan 21" and the "Basic Act Regarding Food and Nutrition Education. These strategies address issues such as the increasing prevalence of lifestyle-related diseases in Japan and the management of a steadily growing elderly population. A strong example of this is the recent collaboration between Calbee and Pegasus Tech Ventures, where the two companies are creating innovative products that fall into the functional food category. These collaborative efforts will help to promote the "FFC" (Food with Function Claims) initiative and increase standardized nutrition labelling, thus providing companies with an opportunity to communicate the specific health benefits of their products effectively.

Japanese companies are changing the way that healthy snacks are manufactured and stored through technological advancements. There has been an increase in processing methods, such as freeze-drying, at lower temperatures in order to keep the vitamin content and freshness of natural ingredients, like natto and various types of vegetables, as high as possible, as well as many other types of foods. Furthermore, food science has developed innovative ingredients that have helped reduce waste and increase the fibre content of the final product. The use of AI in food production has allowed for better supply chain efficiency, allowing for the optimal freshness of food that does not contain any additives, and the use of smart passive technology has provided a way to effectively preserve both natural and artificial foods by providing shelf-life extension capabilities, without the need for synthetic preservatives.

Market Dynamics of the Japan Healthy Snacks Market:

The Japanese healthy snacks market is driven by the trend toward rising health awareness among a more senior population, and busy urban professionals stems from this. Consumers are making the switch to snacks high in protein, fibre, and vitamins due to the increased prevalence of lifestyle-related diseases such as obesity and diabetes. The long-standing appreciation of Japan's cultural heritage for functional ingredients like matcha and fermented soy, along with the convenience of Japan's extensive retail network, also creates a conducive environment to produce more nutrient-dense, grab-and-go food options.

The Japanese healthy snacks market is restrained by the high cost of raw materials, and fluctuating global supply chains can prove detrimental to the production of snack items. Add to this the fact that many natural, preservative-free snacks have shorter shelf lives than their traditional counterparts; this leads to increased logistical complexity and waste due to the higher likelihood of product spoilage, leaving manufacturers with both a financial liability and the deterrent of making more premium products accessible across the country.

The explosion in growth of e-commerce and subscription-based snack boxes creates numerous opportunities to provide consumers with personalised nutrition. Developing plant-based, allergen-free snacks tailored to the "wellness-from-within" trend stands to benefit brands via access to a lucrative youth-and-beauty market seeking health benefits from functional, targeted foods.

Japan Healthy Snacks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3586.8 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.89% |

| 2035 Value Projection: | USD 7465.4 |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Calbee, Inc., Meiji Holdings Co., Ltd., Morinaga & Co., Ltd., Ezaki Glico Co., Ltd., Otsuka Pharmaceutical Co., Ltd., Kameda Seika Co., Ltd., Bourbon Corporation, Asahi Group Holdings, Ltd., Nissui Corporation, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan healthy snacks market share is classified into product and distribution channel.

By Product:

The Japanese healthy snacks market is divided by product into frozen & refrigerated, fruit, nuts & seeds, bakery, savory, bars & confectionery, dairy, and others. Among these, the fruit, nuts, and seeds segment held the largest market revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Healthy snacks, such as fruits, nuts, and seeds, are becoming increasingly popular as consumers seek accessible, enjoyable, and nutritious snack options.

By Distribution Channel:

The Japanese healthy snacks market is divided by distribution channel into supermarkets & hypermarkets, convenience stores, online, and others. Among these, the supermarkets & hypermarkets accounted for the largest market share in 2024 and are anticipated to grow at a remarkable CAGR during the forecast period. Consumers show a preference for supermarkets and hypermarkets while purchasing healthy snacks, and this inclination is attributed to several factors. These retail locations offer a wide variety of nutritious snack options, such as roasted nuts, seeds, and fruits, effectively satisfying the growing need for convenient and healthy snack alternatives.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan healthy snacks market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Healthy Snacks Market:

- Calbee, Inc.

- Meiji Holdings Co., Ltd.

- Morinaga & Co., Ltd.

- Ezaki Glico Co., Ltd.

- Otsuka Pharmaceutical Co., Ltd.

- Kameda Seika Co., Ltd.

- Bourbon Corporation

- Asahi Group Holdings, Ltd.

- Nissui Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan healthy snacks market based on the below-mentioned segments:

Japan Healthy Snacks Market, By Product

- Frozen & Refrigerated

- Fruit, Nuts & Seeds

- Bakery

- Savory

- Bars & Confectionery

- Dairy

- Others

Japan Healthy Snacks Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the current size of the Japanese healthy snacks market?A: The Japan healthy snacks market was valued at USD 3,586.8 million in 2024, supported by rising demand for nutritious, low-calorie, and functional snack options across diverse consumer groups.

-

Q: What is the expected growth rate of the Japanese healthy snacks market?A: The market is projected to grow at a CAGR of 6.89% during the forecast period 2025–2035, reaching an estimated value of USD 7,465.4 million by 2035.

-

Q: What factors are driving the growth of the Japan healthy snacks market?A: Growth is driven by increasing health awareness among aging populations and urban professionals, rising prevalence of lifestyle-related diseases, preference for functional ingredients, and strong retail and convenience store penetration across Japan.

-

Q: Which product segment dominates the Japan healthy snacks market?A: The fruit, nuts, and seeds segment dominated the market in 2024 due to strong consumer preference for natural, nutrient-dense, and convenient snack options.

-

Q: Which distribution channel holds the largest market share in Japan?A: Supermarkets and hypermarkets accounted for the largest market share in 2024, as they offer a wide variety of healthy snack options and enable easy comparison of nutritional labels.

-

Q: Who are the key players operating in the Japan healthy snacks market?A: Key companies include Calbee, Inc., Meiji Holdings Co., Ltd., Morinaga & Co., Ltd., Ezaki Glico Co., Ltd., Otsuka Pharmaceutical Co., Ltd., Kameda Seika Co., Ltd., Bourbon Corporation, Asahi Group Holdings, Ltd., Nissui Corporation, and other regional players.

-

Q: Who are the target audiences for the Japan healthy snacks market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?