Japan Health Supplements Market Size, Share, By Type (Dietary supplement, Body building supplements, Eye health supplements, Speciality supplements, and Others), By Application (Cardiology, Rheumatic disorders, Allergy and Others), and By End-Use (Hospitals, Clinics, Research centres and Others). Japan Health Supplements Market Size Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Health Supplements Market Size Insights Forecasts to 2035

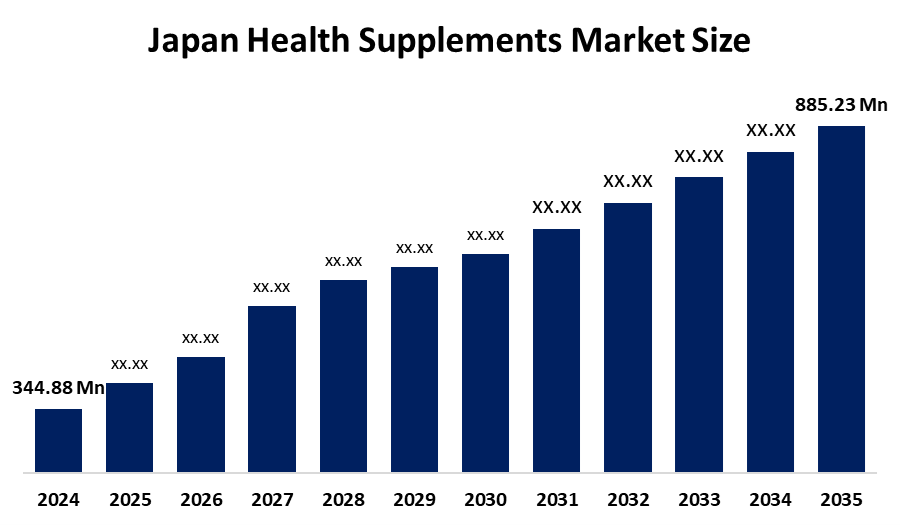

- Japan Health Supplements Market Size 2024: USD 334.88 Million

- Japan Health Supplements Market Size 2035: USD 885.23 Million

- Japan Health Supplements Market Size CAGR 2024: 9.24%

- Japan Health Supplements Market Size Segments: Types, Applications, and End Use.

Get more details on this report -

Japan Health Supplements Market Size refers to the industry that creates and distributes products such as vitamins, minerals, herbs, probiotics, protein powder, etc., that are used for a healthy lifestyle. These products are popular among the Japanese for boosting immunity, digestion, energy levels, and overall health issues related to ageing. Furthermore, Japan Health Supplements Market Size is growing due to increasing preventive healthcare practices and higher disposable incomes. Consumers prefer supplements to maintain immunity, heart health, and bone strength. Busy lifestyles also encourage demand for convenient nutrition solutions. Expansion of e-commerce platforms and growing interest in natural and organic ingredients further support steady market growth across different age groups.

The health supplements are regulated in Japan by the government through the ‘Food with Health Claims’ system. Under this system, the country regulates foshu products, as well as foods with ‘function claims.’ These regulations are successful in protecting the Japanese consumer. Government regulation of advertisement claims also promotes consumer health. The support of preventive health measures promotes the production of health supplements and thus indirectly affects business.

The Japan Health Supplements Market Size trends in the Japan Health Supplements Market Size comprise increasing demand for immunity boosters, collagen supplements, probiotics, and plant-based supplements. Personalised nutrition and scientific-ingredient products are increasing in demand, while online supplement marketplaces are growing significantly. Clean-label products, the absence of additives, and natural products are also trending in the market. Supplements with beauty-from-within and de-ageing effects are popular in Japan due to the growing elderly population, as well as the younger generation.

Japan Health Supplements Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 334.88 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 9.24 % |

| 2035 Value Projection: | USD 885.23 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Otsuka Pharmaceutical Co., Ltd., DHC Corporation, Meiji Holdings Co., Ltd., Suntory Wellness / Suntory Holdings, FANCL Corporation, Yakult Honsha Co., Ltd., Takeda Pharmaceutical Company, Eisai Co., Ltd., Amway Japan GK, Reckitt Benckiser Group Plc, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Health Supplements Market Size:

The Japan Health Supplements Market Size is drivers like increased life expectancy rate, strong preventive health culture of Japanese people, fitness awareness, convenience requirements of supplements, and technological advancements in the Health Supplements Market Size, which are significantly impacting the Health Supplements Market Size in Japan. Marketing through digital media and the influence of influencers are other key factors that are influencing the Japanese Health Supplements Market Size significantly.

The Japan Health Supplements Market Size is facing several restraining factors include strict regulations imposed by approving authorities, licensing costs, and higher levels of competition among domestic as well as international brands. Scepticism among buyers regarding unverifiable enhanced well-being and market saturation among certain segments, like vitamins, hinders the market’s overall progression. Market dynamics in terms of raw material price volatility, geographical supply restraints, coupled with declining population growth pose risks to market expansion.

The Japan Health Supplements Market Size provides growth opportunities in the areas of personal nutrition, AI-driven health check-ups, and condition-specific supplements such as cognitive health and joint health. Organic and plant-based supplements provide additional opportunities. A supplement company can explore the use of digital technologies such as e-commerce and international trade to increase its market reach.

Market Segmentation

The Japan Health Supplements Market Size share is classified into types, applications, and end use.

By Types:

The Japan Health Supplements Market Size is divided by types into dietary supplements, body building supplements, eye health supplements, speciality supplements, and others. Among these, the dietary supplements segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The dietary supplements segment dominates due to strong daily consumption of vitamins, minerals, and probiotics for preventive healthcare. Japan’s ageing population prioritises immunity, bone, and heart health support. These products are affordable, widely available, and supported by government-approved health claim systems, increasing consumer trust and consistent long-term usage across all age groups.

By Application:

The Japan Health Supplements Market Size is divided by application into cardiology, rheumatic disorders, allergy and others. Among these, the cardiology segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The wearable devices segment dominates because of the ageing population and high prevalence of heart-related conditions. Preventive care drives demand for supplements supporting blood pressure, cholesterol, and cardiovascular health, making them more widely used than other application segments.

By End Use:

The Japan Health Supplements Market Size is divided by end use into hospitals, clinics, research centres and others. Among these, the hospital segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The hospital segment dominates because hospitals actively incorporate supplements into patient care for immunity, bone, and cardiovascular health. Their role in preventive healthcare, chronic disease management, and post-treatment recovery drives consistent demand, making hospitals the primary institutional consumers compared to clinics, research centres, or other end-use segments.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Health Supplements Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Health Supplements Market Size:

- Otsuka Pharmaceutical Co., Ltd.

- DHC Corporation

- Meiji Holdings Co., Ltd.

- Suntory Wellness / Suntory Holdings

- FANCL Corporation

- Yakult Honsha Co., Ltd.

- Takeda Pharmaceutical Company

- Eisai Co., Ltd.

- Amway Japan GK

- Reckitt Benckiser Group Plc

- Others

Recent Developments in Japan Health Supplements Market Size:

- In September 2025, Taiyo Kagaku launched a water-dispersible rutin antioxidant, designed for use in functional beverages and jellies. This ingredient supports the growing clean-label trend, offering an easy-to-use, health-focused solution for manufacturers seeking natural, transparent, and consumer-friendly product formulations

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Health Supplements Market Size based on the below-mentioned segments:

Japan Health Supplements Market Size, By Types.

- Dietary supplement

- Bodybuilding supplements

- Eye health supplements

- Speciality supplements

- Others

Japan Health Supplements Market Size, By Application

- Cardiology

- Rheumatic disorders

- Allergy

- Others

Japan Health Supplements Market Size, By End Use.

- Hospitals

- Clinics

- Research centres

- Other

Frequently Asked Questions (FAQ)

-

What is the Japan Health Supplements Market Size?Japan Health Supplements Market Size is expected to grow from USD 334.88 million in 2024 to USD 885.23 million by 2035, growing at a CAGR of 9.24 % during the forecast period 2025-2035.

-

What are the key growth drivers of the Japan Health Supplements Market Size?Japan Health Supplements Market Size is a growth drivers include aging population, rising health awareness, preventive healthcare, higher disposable income, and increasing demand for immunity and wellness supplements.

-

What factors restrain the Japan Health Supplements Market Size?The Japan Health Supplements Market Size is facing several restraining include high costs, strict regulations, consumer scepticism, market saturation, limited clinical evidence, and supply chain challenges.

-

How is the Japan Health Supplements Market Size segmented by application?The Japan Health Supplements Market Size is segmented into cardiology, rheumatic disorders, allergy, and others.

-

Who are the key players in the Japan Health Supplements Market Size?Key companies operating in the Japan Health Supplements Market Size include Otsuka Pharmaceutical Co., Ltd., DHC Corporation, Meiji Holdings Co., Ltd., Suntory Wellness/Suntory Holdings, FANCL Corporation, Yakult Honsha Co., Ltd., Takeda Pharmaceutical Company, Eisai Co., Ltd., Amway Japan GK, Reckitt Benckiser Group Plc, and several other regional and international players.

Need help to buy this report?